In this era where technology continues to rapidly transform every industry, debt collection is no exception. Artificial Intelligence (AI) in Debt Collections is reshaping how companies approach debt recovery by optimizing processes, enhancing customer engagements, and boosting operational efficiency. As debt recovery continues to evolve, understanding the real applications, benefits, and emerging trends of AI in this field is essential for organizations aiming to modernize their collection efforts and improve customer satisfaction.

Why AI in Debt Collections Matters

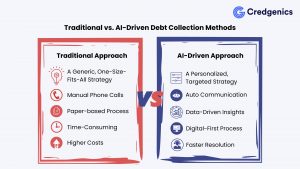

Debt collection has traditionally been associated with bulk applied, complex and often inefficient processes, comprising repetitive tasks and huge administrative cost. As customer expectations shift and regulations become stricter, lenders need more effective methods to manage collections. Artificial Intelligence (AI) and Machine Learning (ML) in debt collections offer solutions that streamline workflows, personalize debtor interactions, and enhance decision-making. These technologies are not only improving connect and collection rates but also facilitating a more empathetic approach to collections.

How AI Transforms Debt Collections: Key Applications

AI is enhancing debt collections in various areas, from predicting borrower payment patterns to automating customer communications. Let’s look at some real-world applications.

1. Predictive Analytics for Better Targeting

AI algorithms analyze historical data and past borrower behavior to predict the likelihood of repayment. This allows collectors to prioritize high-risk accounts, focusing efforts where they are most likely to succeed. By scoring customers based on risk, AI helps allocate collection resources more effectively.

2. Personalized Communication Strategies

Not all borrowers respond to the same communication style. AI-driven insights enable debt collections agencies to tailor their communication approaches based on customer profiles. Some customers might respond better to gentle reminders, while others may need more direct follow-ups. Personalized communication increases engagement rates and can lead to faster payments.

3. Automated Payment Reminders

AI-powered systems can automatically send reminders via SMS, email, WhatsApp, IVR or other channels at optimal times. These reminders can be customized in tone and timing to fit the customer’s profile, making them more effective at encouraging action automatically.

4. Chatbots and Virtual Assistants

AI-powered chatbots and virtual assistants provide immediate support to customers, answering questions and guiding them through repayment options. These tools enhance customer experience by providing 24/7 assistance, which improves customer satisfaction and increases the chances of timely repayment.

5. Sentiment Analysis and Emotional AI

Advanced AI models can analyze the sentiment behind a customer’s response, allowing agents to adjust their approach in real time. For example, if a customer seems frustrated, the system can recommend more empathetic language, leading to a more positive outcome.

Benefits of AI in Debt Collections

Integrating AI into debt collections offers substantial benefits, and improves outcomes for lenders and customers.

a) Increased Efficiency and Reduced Costs

AI handles repetitive tasks such as data entry, analysis, and customer follow-ups. Automating these functions allows debt collection teams to focus on complex cases, reducing operational costs and enhancing productivity.

b) Improved Collection Rates

Predictive analytics and personalized communication strategies significantly improve collection rates. By targeting high-risk accounts and approaching them with the right messaging, collection teams see a notable increase in recovery success.

c) Enhanced Compliance and Reduced Risk

AI-driven systems are designed to comply with industry regulations, minimizing legal risks associated with debt collections. Automated systems ensure consistent adherence to compliance protocols, reducing the chances of regulatory fines.

d) Better Customer Experience

AI personalizes the experience for each debtor, which is critical in an industry where empathy is increasingly valued. Through tailored communication and emotional intelligence, AI helps make the collections process less stressful for customers.

Related Read | AI and ML in debt collections: Shaping the future of debt recovery

Emerging Trends Shaping AI-driven Debt Collections

As AI technology advances, let’s talk about some new trends that are influencing how debt collections will operate in the future.

1. Integration of Generative AI for Empathetic Conversations

Generative AI enables debt collection agencies to craft more empathetic responses, providing agents with conversational scripts that balance sensitivity and effectiveness. These scripts can help agents handle difficult conversations with compassion, reducing conflict and improving resolution rates.

2. Increased Focus on Data Security and Privacy

As AI relies heavily on customer data, ensuring robust data security and privacy practices is essential. Companies are investing in advanced encryption and secure data storage solutions to protect sensitive information.

3. Omnichannel Communication for Seamless Customer Engagement

AI-powered debt collection tools now support omnichannel communication, allowing collectors to reach customers across multiple platforms, including SMS, email, social media, and phone calls. This approach ensures customers are engaged on their preferred channels, increasing the chances of timely repayment.

4. Real-time Reporting and Analytics Dashboards

AI enables real-time tracking of debt collections performance through dynamic dashboards. Collections teams can assess KPIs instantly, making informed decisions and adjusting strategies based on live data.

5. Rise of Ethical AI in Debt Collections

Ethical AI principles are becoming increasingly relevant as debt collection agencies strive to treat customers with dignity and respect. Ethical AI focuses on fair practices, ensuring that automated processes are transparent, unbiased, and respectful of customers’ rights.

Challenges and Future Outlook for AI in Debt Collections

While artificial intelligence in debt collections offers substantial benefits, it also presents challenges that organizations must navigate.

a) Data Privacy Concerns

AI relies on vast amounts of customer data, making data privacy a top concern. Companies need to adopt strict data protection policies and ensure compliance to maintain customer trust.

b) High Initial Investment

Implementing AI solutions can be expensive, and not all businesses can afford these technologies. However, the long-term ROI in terms of efficiency and improved collections often justifies the initial cost.

c) Resistance to Change

Adopting new technologies can encounter resistance from staff accustomed to traditional methods. Proper training and change management strategies are crucial to ensuring smooth adoption.

Despite these challenges, the future of AI in debt collections looks promising. With continuous advancements in AI capabilities and a growing emphasis on ethical practices, AI is set to become an indispensable tool in debt recovery.

Conclusion

AI in Debt Collections is reshaping the industry, enabling significant advancements across debt recovery processes. By leveraging predictive analytics, automation, and personalized communication, AI in debt collections empowers collection teams to navigate complex challenges with improved efficiency while maintaining compliance and enhancing the customer experience. Organizations that embrace AI in loan collections gain a competitive edge, positioning themselves as leaders in a rapidly evolving market. With AI, loan collections become effective, ethical, and customer-centric, creating a win-win scenario for both lenders and borrowers.

FAQs

1. How does AI improve the debt collection process?

AI enhances debt collections by automating repetitive tasks, predicting payment behaviors, and personalizing communication. These improvements streamline workflows, reduce costs, and increase collection rates by targeting high-risk accounts more effectively and interacting with debtors in a more tailored manner.

2. What are the key benefits of using artificial intelligence in debt collections?

Key benefits include increased efficiency, reduced operational costs, improved collection rates, better compliance with regulations, and enhanced customer experience. AI allows for more empathetic and personalized debtor interactions, which leads to more favorable outcomes for both the debtor and the collection agency.

3. Can AI help debt collection agencies comply with industry regulations?

Yes, AI-driven systems are designed to comply with debt collection regulations by automating compliance checks and ensuring consistent adherence to protocols. This minimizes the risk of legal issues and reduces the chance of regulatory fines by maintaining strict compliance standards.

4. What emerging trends are shaping AI-driven debt collections?

Key trends include the use of generative AI for empathetic customer interactions, a focus on data security and privacy, omnichannel communication strategies, real-time performance analytics, and a rising emphasis on ethical AI practices. These trends make debt collections more efficient, secure, and respectful of customers’ rights.

5. Is implementing AI in debt collections costly?

While initial investment in AI technology can be high, the long-term return on investment often justifies the cost. AI significantly boosts efficiency, improves collection rates, and reduces operational expenses, offering substantial savings and benefits over time.

6. How does AI handle sensitive customer data in debt collections?

AI systems used in debt collections are designed with stringent data security protocols to protect sensitive information. This includes advanced encryption, secure data storage, and adherence to data privacy regulations, ensuring that customer data is handled responsibly and securely.

7. How can AI be used in collections?

AI is transforming debt collections by enhancing efficiency and personalizing customer interactions. Through predictive analytics, AI prioritizes high-risk accounts, enabling better resource allocation. Automated reminders are timed optimally, improving repayment rates, while AI-driven personalization tailors communication styles to each debtor, increasing engagement. Chatbots provide 24/7 support, answering questions and guiding customers through repayment options. Together, these applications make debt collections faster, more effective, and customer-friendly.