AI-powered Contact Center for Debt Collections: Swara Voicebot & DialNext Dialer Integration

Reading Time: 5 minutesIn debt collection, every borrower conversation is unique and needs to be handled with utmost importance and care. A…

How digital debt collection delivers faster recovery rates for banks, NBFCs & fintech lenders

Reading Time: 7 minutesIs your collections strategy costing more than it recovers? Lenders that modernize debt recoveries with digital debt collection are…

Reading Time: 9 minutesNBFCs in India have emerged as one of the most dynamic forces shaping the nation’s financial ecosystem. Operating alongside…

Popular Blogs

All Blogs

AI-powered Contact Center for Debt Collections: Swara Voicebot & DialNext Dialer Integration

In debt collection, every borrower conversation is unique and needs to be handled with utmost importance and care. A simple reminder call may trigger an instant repayment, a clarification conversation, or a support request. Managing these diverse debt collection-related interactions at scale across millions of borrowers, different loan products, varying delinquency stages, multiple languages, and unique repayment behaviors has always been complex.

This is where Swara – Credgenics’ GenAI voicebot for debt collections and DialNext – predictive dialer for collections are transforming the communication approach for debt recovery.

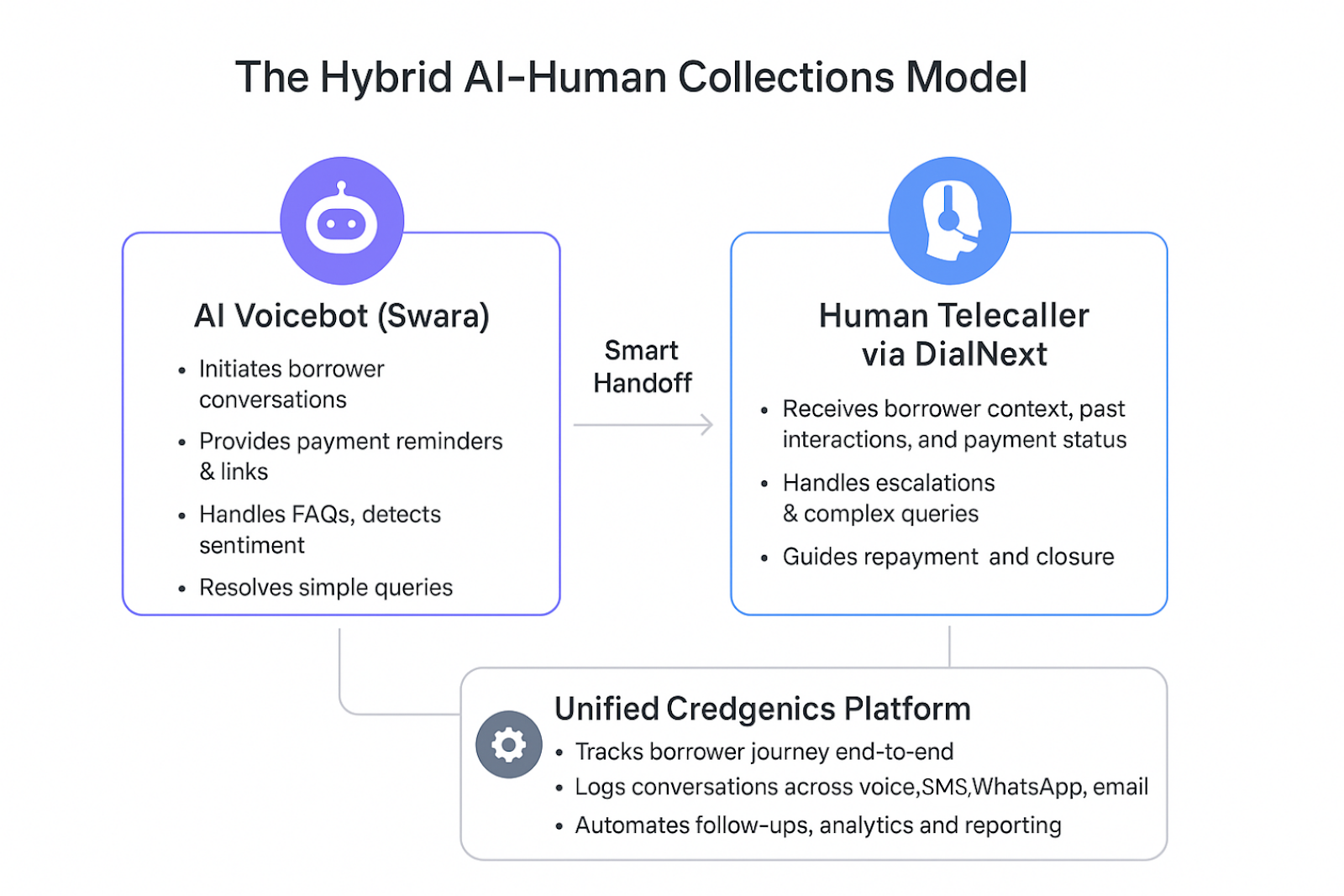

Together, they power an intelligent AI-powered contact center for debt collections that delivers a hybrid model where smarter automation handles professional calls at scale with human-like empathy, while human telecallers step in at the right moment to provide quick resolution for complex situations or escalations.

The Borrower’s Journey: From Voicebot to Telecaller

Let’s take a simple repayment reminder scenario.

Step 1: The Voicebot Makes the Call

A credit customer receives a call from Swara, the Credgenics AI voicebot for debt collections. The conversation is natural in tone, in the customer’s preferred language, personalized, and empathetic. Swara reminds the customer of a missed due date, the possible impact of delay, shares the outstanding amount, and even provides an instant UPI link for payment.

For many customers, this is enough—they understand the situation and complete the payment within minutes.

Step 2: A Query Arises

But sometimes, the customer has a question. Maybe they are facing a technical issue, want to confirm whether a partial payment is acceptable, or they are unsure about late fee calculations. These are queries where empathy, flexibility, and context are essential.

Here, Swara does something smart: it uses proprietary LLM, TTS, and STT models to interpret the query, uses voice analytics to analyze borrower sentiments, and provides the best solution based on pre-approved scenarios, customer engagement history on the platform. This can be a penalty waiver offer on late payments, a partial payment acceptance procedure, or even educating the borrower on the impact of late payments on their credit score.

Step 3: Escalation to DialNext

Let’s say the borrower is not satisfied with the solution shared or with the voicebot call and still wants to talk to a human telecaller. The query is instantly passed on to DialNext – the AI Predictive Dialer for collections. DialNext instantly connects the borrower to an available expert telecaller. But this isn’t just a blind transfer—the telecaller has full visibility of the borrower’s interaction history, including:

- What Swara voicebot has already discussed

- Payment reminders sent earlier via digital communications

- Borrower’s response patterns and preferences

Empowered with this context, the telecaller doesn’t need to further repeat the questions or waste more time. They step in directly into the borrower’s journey, build trust, and resolve the query faster.

Step 4: Resolution and Payment

The telecaller explains the repayment options, answers the query, and guides the borrower to complete the payment, often within the same call. The result? A smoother borrower experience and a higher likelihood of resolution.

Why this matters for BFSI companies

The AI-powered contact center for debt collections with hybrid and smarter automation addresses the three biggest challenges that lenders face in debt collections:

- Rapid Scalability at Low Cost

Swara AI voicebot for debt collections can handle thousands of calls simultaneously in 8+ languages, which reduces the need for having huge human calling teams. - Seamless Addressing of Escalations

DialNext predictive dialer for collections ensures that no borrower query falls through the cracks as it routes them to telecallers only when necessary – resulting in reduced cost and faster resolutions while improving customer experience. - Context-driven Conversations

With full visibility into past interactions, telecallers skip redundant questions that help build trust in the conversation and lead to faster repayments.

Fig 1: A sample flow with Swara and DialNext integrated into the contact center journey

End-to-End Automation: When Voicebots Close the Loop

| For Borrowers | For Lenders |

|

|

The entire customer engagement journey is handled end-to-end by Swara Voicebot, with no human telecaller intervention required. This frees telecallers to focus on complex/sensitive cases and escalations.

DialNext: AI-Powered Predictive Dialer for Collections Edge

When escalations to human telecallers are needed, DialNext ensures maximum efficiency with:

- Smart Dialing: Predictive algorithms reduce the telecaller’s idle time and maximize connect rates

- Compliance First: Built-in safeguards for Do-Not-Call lists and call-window rules

- Integrated journeys: Telecallers receive borrower details and history before the call connects

- Real-Time Monitoring: Supervisors track telecaller productivity and campaign outcomes instantly. Telecaller live interaction monitoring also ensures policy control

- Real Time Agent Assist: The system supports live chats and videos with screen sharing. Instant recommendations and knowledge prompts help to resolve queries faster

By intelligently routing escalations and managing outbound campaigns, DialNext reduces costs while keeping compliance airtight.

Swara: Empathy and Efficiency at Scale

Unlike the basic IVR systems and voicebots, GenAI-powered Swara uses natural language processing to hold real human-like conversations, tailored for debt collections.

- Multilingual Reach with real-time language switch: 8+ languages supported to ensure that borrowers can engage freely.

- Adaptive Dialogue: Handles interruptions, clarifies doubts, and adjusts tone / context in real time.

- Payment Integration: Shares personalized payment links instantly and confirms status updates to close the collection loop.

- Behavioral Learning: Learns from borrower interactions to adjust frequency and style of outreach.

- Follow-up actions: Automatically follows up for next actions across digital, calling, field, and legal engagements.

This makes Swara an empathetic front line collection AI assistant , fatigue-free, and always compliant.

A Future-Ready Solution for Smarter Contact Centers

Collection calls don’t have to feel combative or inefficient. With Swara’s Conversational AI and DialNext finesse, lenders get the best of both worlds: AI-powered automation for scale, and human empathy where it matters most.

Whether it’s a credit customer making a repayment with a voicebot call, or a query escalated seamlessly to an informed human telecaller, the result is the same—higher recoveries, stronger compliance, and better customer experiences.

The hybrid model of GenAI Voicebot + Predictive Dialer is more than just a tech upgrade. It represents a fundamental shift in how BFSI AI-powered contact centers for debt collections operate:

- From manual to automated conversation

- From generic to personalized discussions

- From reactive to proactive follow-up

- From error-prone to error-free communications

- From basic to advanced systems

- From broken to integrated platforms

At Credgenics, we’re enabling the transformation of AI-powered contact centers for debt collections with Swara and DialNext AI Predictive Dialer. We are powering an ecosystem — where AI and humans don’t compete, but collaborate to deliver benchmark outcomes that matter.

Frequently Asked Questions (FAQs)

1. How is an AI Voicebot for collections like Swara different from traditional IVR systems?

Unlike IVR systems that rely on fixed menus and keypad inputs, Swara uses Generative AI and Natural Language Processing (NLP) to hold human-like, two-way conversations in multiple languages. It understands borrower intent, adjusts tone, and provides personalized responses — creating a far more empathetic and efficient experience.

2. What role does DialNext play in the hybrid model?

DialNext is an AI-powered Predictive Dialer for collections that optimizes outbound campaigns, connects telecallers to borrowers instantly, and ensures faster resolutions and higher productivity.

3. How do Swara and DialNext together improve borrower experience?

The hybrid model ensures the best of both worlds, AI for scale and humans for empathy. Swara handles routine calls with automation and accuracy, while DialNext routes complex or sensitive cases to trained telecallers with full visibility, creating seamless, context-rich borrower interactions.

4. Can lenders customize and integrate these solutions easily?

Yes. Both Swara and DialNext are part of the Credgenics AI full-stack collections platform, designed for easy integration with existing LOS and LMS systems. They support multilingual, compliance-ready workflows and can be customized to reflect each lender’s process, communication tone, borrower profile, and operational goals.

How digital debt collection delivers faster recovery rates for banks, NBFCs & fintech lenders

Is your collections strategy costing more than it recovers?

Lenders that modernize debt recoveries with digital debt collection are seeing great results in their digital debt collection recovery rates. For example, a private sector bank achieved a 92% increase in resolutions, an 80% reduction in calling costs, and a 45% uplift in response rates after shifting to an integrated and data-driven omnichannel digital collections strategy. This is a strong illustration of how digital debt collection improves recovery rates in the real world.

Traditional collections, calling-based or field-based, struggle with limited reach, manual errors, poor compliance tracking, and inconsistent borrower experiences. They cannot scale efficiently or optimize engagement at speed.

This guide explains how digital debt collection improves recovery rates and how banks, NBFCs, and fintech lenders can modernize debt recovery through digital collections to boost resolutions, efficiency, and borrower experience. It covers digital debt collection for banks and NBFCs as well as digital debt collection for fintech lenders, helping them design faster debt recovery with digital collection strategies across portfolios.

What is digital debt collection?

Digital debt collection refers to the use of technology, data, and automation to recover overdue payments through digital channels. It leverages AI/ML capabilities, analytics, and integrated process workflows to personalize outreach, provide flexible payment options, and optimize collection outcomes while enhancing loan customer experience and ensuring compliance.

By replacing fragmented processes with automated, compliant journeys, digital debt collections improve efficiency, transparency, and reach while respecting borrower preferences and regulatory requirements. This unified, data-driven approach is at the core of stronger digital debt collection recovery rates.

Core building blocks in digital debt collections

Omnichannel Communication: Use multiple digital channels (WhatsApp, SMS, email, IVR, chatbots, app notifications) to reach customers on channels wherever they’re most active.

AI & Machine Learning: Apply algorithms to predict customer behavior, analyze sentiment to adjust messaging tone, identify default risk, and automate customer service through chatbots and voicebots.

Data & Analytics: Analyze customer segments and payment patterns to optimize collection strategies and improve recovery rates. This is one of the most direct levers in how digital debt collection improves recovery rates across buckets.

Self-Service Portals: Provide online platforms where customers can manage accounts, set up payment plans, and pay on their own schedule—giving them control and privacy.

Personalized Payment Links: Send secure links with multiple payment options (cards, transfers, digital wallets) to make repayment quick and easy.

Together, these capabilities enable faster debt recovery with digital collection, regardless of whether the lender is a large bank, an NBFC, or an agile fintech.

Traditional vs. digital debt collections: A quick analysis

Key differentiators from traditional methods

Proactive rather than reactive: Instead of waiting for accounts to become severely delinquent, digital systems identify early warning signals and intervene before defaults escalate. This proactive approach is a key reason digital debt collection recovery rates outperform traditional models.

Personalization at scale: While traditional methods apply one-size-fits-all strategies, digital platforms analyze individual borrower data to customize communication, timing, messaging, and channels for each case.

Continuous optimization: Digital systems learn from every interaction, continuously refining their strategies based on what works and what doesn’t, creating a self-improving collection process that sustains faster debt recovery with digital collection over time.

How digital debt collection works (end-to-end)

Understanding the digital debt collection workflow reveals how technology prevents defaults before they happen and optimizes recovery at every stage, from prediction to resolution.

1) Predictive Risk Detection & Pre-Due Intervention

Before accounts become overdue, AI continuously monitors spending patterns, repayment behavior, credit score performance, income volatility, and engagement history to identify borrowers likely to miss upcoming EMIs. Early warning systems trigger personalized pre-due nudges, flexible reminders, awareness campaigns and alternative repayment options—preventing slippages before they start and directly improving digital debt collection recovery rates in early buckets.

2) Smart Risk Classification

When accounts enter soft or hard delinquency buckets, AI evaluates risk parameters and classifies borrowers into three distinct paths:

- Self-cure borrowers: Minimal, optimized reminders

- Digital-assisted support needed: Guided payment options and flexible EMI restructuring

- High-risk requiring escalation: Human agents, field collectors, or legal workflows

This segmentation is central to how digital debt collection improves recovery rates, by matching the right effort to each borrower’s risk profile.

3) Intelligent, Multi-Channel Outreach

AI identifies the optimal channel, timing, language, and message format for each borrower based on their profile. Outreach is delivered via WhatsApp, SMS, email, voicebots, chatbots — with personalized content that reflects exact amounts due, available options, and tone calibrated to borrower intent and past engagement.

For digital debt collection for banks and NBFCs, this intelligent and multichannel capability ensures high coverage across large and diverse portfolios. For digital debt collection for fintech lenders, it supports high-frequency, fully digital interactions aligned with mobile-first customers.

4) Progressive Escalation Path

- Digital channels first → Automated reminders and digital-assisted support

- Human intervention when needed → Calling teams with contextual scripts guide borrowers through resolution steps

- Field & legal escalation → Field collectors for visits and pre-legal/legal workflows for complex or high-risk cases

This structured path balances empathy and firmness, enabling faster debt recovery with digital collection while keeping costs in control.

5) Frictionless Payment Options

Borrowers can pay instantly through UPI, cards, net banking, or wallets. They can also split payments into EMIs, pay partially, or schedule future payments. All transactions update in real time, providing transparency and reducing friction.

By making it extremely simple to pay, lenders see higher promise-to-pay conversions and better digital debt collection recovery rates across product lines.

6) Continuous Optimization

Live dashboards track channel effectiveness, optimal timing, and message performance per segment. AI models update automatically to improve recovery rates and reduce defaults continuously across all buckets.

This feedback loop is essential for lenders that want to standardize how digital debt collection improves recovery rates and scale best practices across teams, geographies, and product portfolios.

How digital-led collections transform lender performance

Stronger and earlier recoveries

Digital journeys help lenders engage borrowers proactively, increasing the share of accounts that get resolved before they become problematic and lifting overall recoveries versus call-only models. As a result, digital debt collection recovery rates improve from early-stage buckets all the way to write-off prevention.

Faster resolutions with less friction

Automated, contextual nudges across preferred digital channels keep borrowers informed and responsive, shortening the time from first contact to commitment and final resolution. For lenders, this translates into faster debt recovery with digital collection and improved cash flows.

Lean, scalable cost of collections

Self-service flows, smart segmentation, and automated workflows reduce the need for manual calling and field effort, lowering cost per case while allowing teams to handle far more accounts.

A borrower experience that builds trust

Private, respectful, and self-directed repayment options across chat, messaging, email, IVR, and bots make it easy for borrowers to stay on track, improving engagement and preserving long-term relationships.

Tighter control on risk and compliance

Policy-led, fully traceable digital journeys with centralized dashboards and standardized workflows make it easier to monitor collections quality and enforce compliance.

This combination of higher recoveries, lower costs, and better experience is precisely how digital debt collection improves recovery rates in a sustainable, compliant manner.

Recommended Read | Lender’s guide for crafting borrower-centric repayment solutions

Why Credgenics

Credgenics is the AI-powered, end-to-end full stack platform for digital debt collection, uniting strategy, analytics, omnichannel outreach, payments, and legal workflows in one system.

With Credgenics, lenders can:

- Predict who to contact, what to say, and when to act using explainable AI

- Launch GenAI-assisted outreach that stays within brand and compliance guardrails

- Offer seamless payments across UPI, cards, wallets, and net banking

- Track performance with real-time dashboards

- Run policy-driven operations

- Move from manual follow-ups to precise, empathetic recoveries at scale

Whether you are designing digital debt collection for banks and NBFCs with large-scale operations or implementing digital debt collection for fintech lenders that run fully digital journeys, Credgenics helps standardize best practices and uplift digital debt collection recovery rates across the board.

FAQs

What is digital debt collection, and how does it work?

Digital debt collection is the use of technology, automation, and data analytics to recover overdue payments through digital channels like SMS, WhatsApp, email, IVR, and voicebots.

It combines AI/ML algorithms, omnichannel communication, and self-service payment options to deliver faster recoveries with minimal human intervention. Instead of relying solely on phone calls, digital debt collection creates personalized, automated journeys that engage borrowers on their preferred channels at optimal times—directly improving digital debt collection recovery rates across delinquency stages.

What are the main benefits of digital debt collection?

The key benefits of digital debt collection include:

- Higher digital debt collection recovery rates

- Faster payment resolution

- Reduced costs

- Better customer experience

- 24/7 availability

- Improved compliance

- Real-time insights

Together, these benefits explain how digital debt collection improves recovery rates while strengthening borrower relationships.

How do AI and machine learning improve debt collection outcomes?

AI and machine learning enhance digital debt collection through several mechanisms:

- Predictive analytics: Identifies which borrowers are most likely to pay or default, optimizing collection prioritization

- Sentiment analysis: Adjusts communication tone to maximize impact and receptiveness

- Best-time prediction: Determines the optimal time and channel to contact each borrower based on behavioral patterns

- Risk scoring: Automatically categorizes accounts into different risk tiers for appropriate handling

- Promise-to-pay prediction: Forecasts which borrowers are most likely to commit to repayment

- Personalization: Customizes messaging, offers, and payment plans for individual debtors

- Continuous learning: Systems improve over time as they process more data and interactions

For lenders, these capabilities deliver faster debt recovery with digital collection and more reliable, predictable outcomes.

How do personalized payment links work in digital debt collection?

Personalized payment links are secure and unique URLs that are sent to borrowers to streamline the credit repayment process. Each link is customized with the exact amount due and offers multiple payment options, including cards, net banking, and UPI. Borrowers can click the link and complete payment in seconds.

By reducing friction in the last mile, personalized links contribute meaningfully to higher digital debt collection recovery rates.

How can digital debt collection improve customer experience?

Digital debt collection enhances customer experience by:

- Offering flexibility: Multiple payment options, EMI splits, and schedule options reduce stress

- Providing convenience: 24/7 availability means borrowers can pay anytime, anywhere

- Using empathetic communication: Personalized, contextual messaging respects borrower circumstances

- Enabling self-service: Borrowers control their interactions without mandatory agent contact

- Delivering instant gratification: Real-time payment confirmation and settlement updates

- Respecting preferences: Systems communicate through the borrower’s preferred channel

- Reducing friction: Minimal steps to complete payment reduce abandonment

This empathetic, digital-first experience is central to how digital debt collection improves recovery rates without damaging brand equity.

Is digital debt collection suitable for all types of lenders?

Yes, digital debt collection is beneficial for all types of lenders, including banks, NBFCs (Non-Banking Financial Companies), fintech lenders, and credit card companies.

The scalability of digital systems makes them particularly effective for lenders managing large borrower bases, while the personalization capabilities serve niche lenders well. Whether managing retail credit, consumer loans, SME lending, or credit cards, digital debt collection adapts to different lending products, borrower profiles, and regulatory environments.

This makes digital debt collection for banks and NBFCs and digital debt collection for fintech lenders equally relevant, and crucial for improving digital debt collection recovery rates at scale.

NBFCs in India have emerged as one of the most dynamic forces shaping the nation’s financial ecosystem. Operating alongside traditional banks, they have bridged critical credit gaps and unlocked economic growth opportunities for millions—from micro-entrepreneurs and rural households to infrastructure developers. Over the past six years, the sector’s scale and influence have expanded remarkably, with NBFCs’ assets under management (AUM) nearly doubling from approximately ₹23 trillion in FY19 to ₹48 trillion as of FY25, reflecting a robust CAGR of 13.2%. This phenomenal growth underscores their transformation from a “shadow banking” system into a true powerhouse.

What is a non-banking financial company (NBFC)?

A Non-Banking Financial Company (NBFC) is a company registered under the Companies Act, 2013 (originally Companies Act, 1956) of India, engaged in financial services such as loans and advances, investments, and asset financing without holding a banking license.

The working and operations of NBFCs are regulated by the Reserve Bank of India (RBI) within the framework of the Reserve Bank of India Act, 1934. NBFCs play a pivotal role in delivering credit to segments often underserved by traditional banks.

Core activities include:

- Lending: Personal loans, SME finance, housing loans, microfinance, and asset loans.

- Investments: Acquisition of shares, stock, bonds, and participation in securities markets

- Asset Financing: Funding productive assets like vehicles and equipment that drive economic activity.

- Other Financial Services: Hire-purchase insurance business and chit-fund business

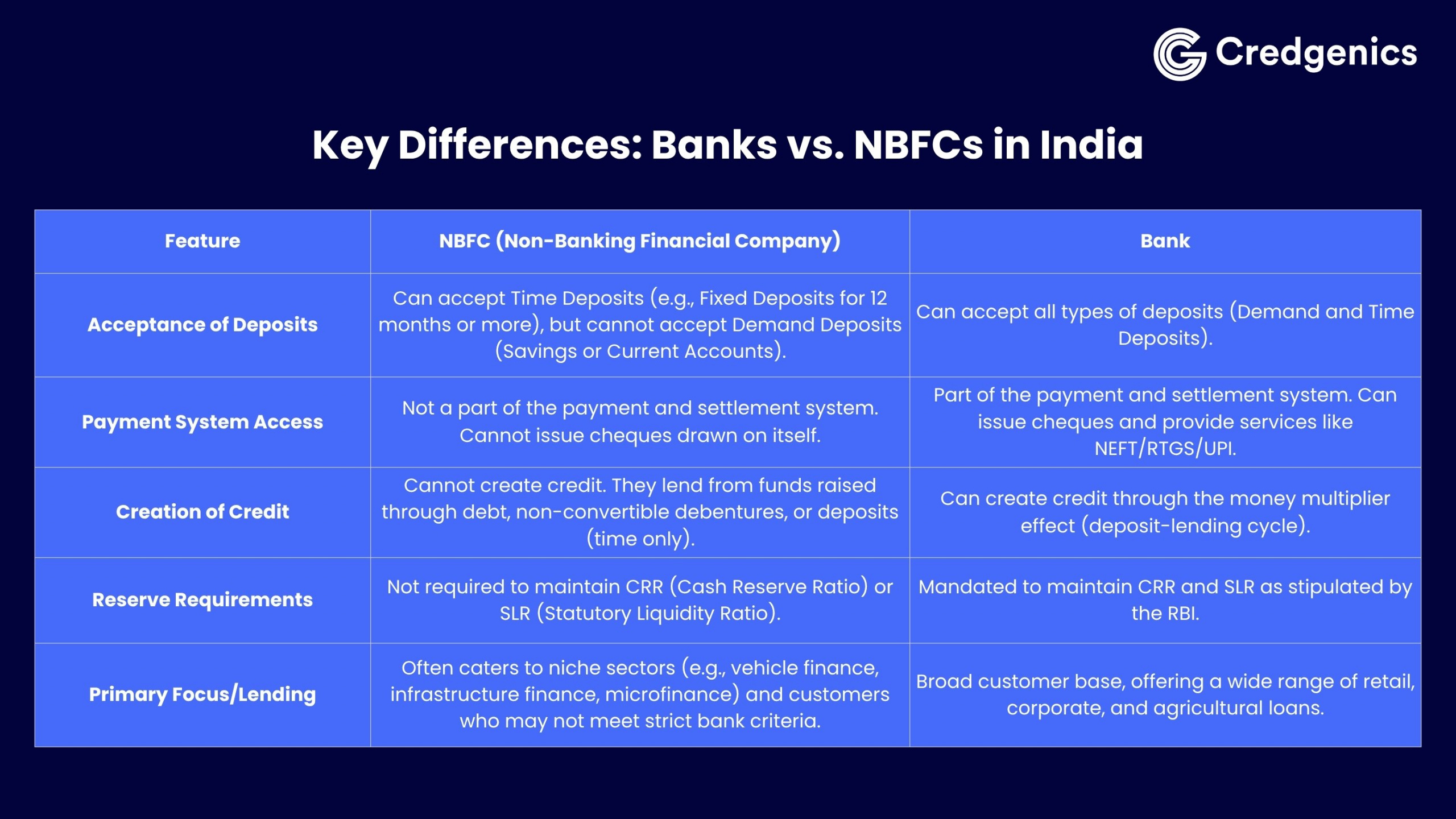

NBFCs vs. Banks: Key differentiators for the Indian consumer

While both are regulated by the RBI, NBFCs enjoy greater flexibility in designing niche products and pricing strategies. They focus on specialized lending – catering to customer segments such as small businesses, rural borrowers, and first-time credit seekers. While banks provide a broader array of financial services. This specialization enables NBFCs to be faster, more customer-centric, and agile in risk-taking.

NBFCs don’t carry the deposit-related risks that banks do, allowing them to focus purely on lending and asset financing.

Recommended Read | How NBFCs are Transforming Consumer Lending in the Digital Age

Key catalysts driving NBFC growth in India

The growth of NBFCs in India has been propelled by a mix of deep market understanding, technology adoption, and supportive policy frameworks. NBFCs now contribute nearly 18–20% of total credit outflows in India, a figure that underscores their expanding systemic importance. Here are the fundamental drivers propelling their growth:

1. Deep market understanding and customer-centric approach

NBFCs have developed an intimate understanding of unorganized and underdeveloped market segments that traditional banks often overlook. By focusing on what customers truly need and ensuring last-mile delivery of financial products and services, they’ve created sustainable niches in underserved communities. This granular market intelligence enables them to design tailored solutions that are better equipped to address the real-world financial challenges.

2. Tailored product offerings with flexible pricing

Rather than offering one-size-fits-all solutions, NBFCs have mastered the art of customization and personalization. They analyze specific customer segments carefully and adapt their product offerings to meet unique characteristics and requirements. This targeted approach extends to pricing models as well, with NBFCs creating flexible structures that accommodate the financial realities of diverse borrower groups—from self-employed professionals to micro-entrepreneurs and farmers to small business owners.

3. Expanded geographic and channel reach

NBFCs are breaking geographical barriers by penetrating Tier 2, Tier 3, and Tier 4 markets where banking infrastructure remains sparse. They distribute loans across multiple customer touchpoints and have built truly omnichannel experiences that provide seamless sales and service 24/7. This phygital model, combining physical presence through local team members with digital platforms, ensures that financial services reach even the most remote corners of India.

4. Technology-driven efficiency and enhanced customer experience

The integration of technology has fundamentally transformed NBFC operations. Advanced fintech partnerships and digital tools have enabled these institutions to customize credit assessments with greater precision, reduce processing times dramatically, and offer instant loan approvals. This technological edge translates directly into superior customer experience and operational efficiency that rivals and often surpasses traditional banking.

5. Collaborative lending models

The introduction of co-lending norms by the RBI marked a watershed moment for the sector. These regulations enable banks and NBFCs to collaborate on priority sector lending (PSL), combining the funding strength of banks with the market reach and specialized expertise of NBFCs. This synergistic model has unlocked significant capital for underserved segments while maintaining prudent risk management.

6. Supportive government and regulatory initiatives

Government policy has been instrumental in creating an enabling environment for NBFC growth. Strategic initiatives addressing structural challenges in small business lending, including licensing account aggregators, launching the Pradhan Mantri Mudra Yojana (PMMY), establishing UPI platforms, unveiling digital infrastructure like TReDS, and the Open Network for Digital Commerce (ONDC), and implementing GST, have collectively reduced friction in financial transactions and expanded the addressable market for NBFCs significantly.

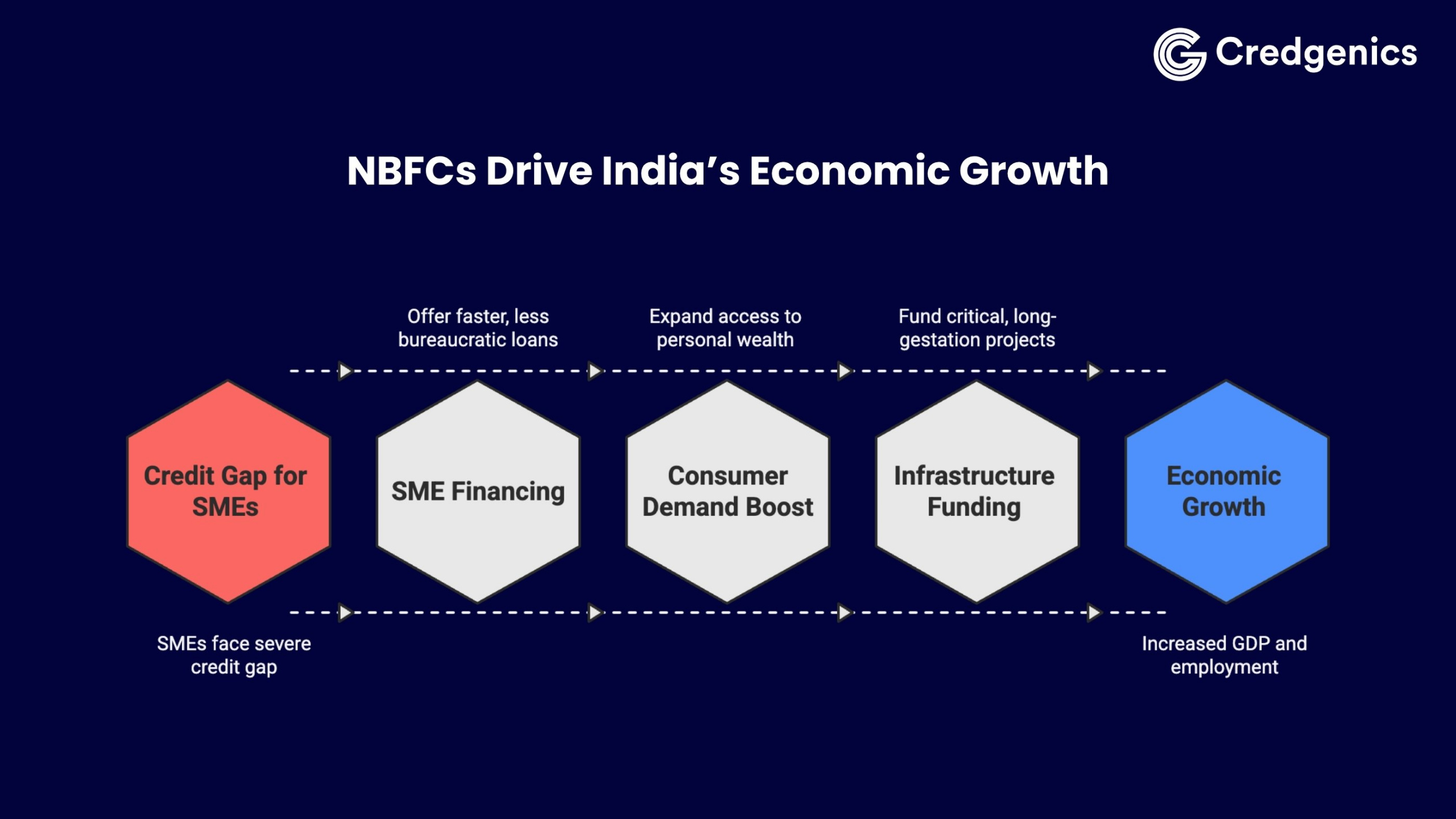

How NBFCs are driving India’s economic growth

NBFCs in India are recognized as the ‘shadow banking’ system, but their impact on real economic activity is very real, driving credit penetration where it matters most.

1. Financing small and medium enterprises (SMEs)

SMEs and Micro, Small, and Medium Enterprises (MSMEs) are the lifeblood of the Indian economy – contributing significantly to GDP growth and employment creation. However, they frequently face a severe credit gap to address their diverse needs. NBFCs play a vital role in bridging this gap by offering faster, less bureaucratic loan processing and accepting non-traditional collateral. These tailored financial products enable MSMEs to manage working capital, purchase inventory, and fund expansion, making NBFCs essential catalysts for business growth.

2. Boosting consumer demand and asset ownership

NBFCs have democratized access to personal wealth through instant personal loans and financing for consumer durables.

- Instant personal loans & consumer durable finance expand access to education, healthcare, and essential household assets.

- Asset Finance Companies (AFCs) drive sales of vehicles and equipment across agriculture, e-commerce logistics, and construction—linking credit to productive use and income generation.

3. Fueling infrastructure and developmental projects

Specialized NBFCs, particularly Infrastructure Finance Companies (IFCs), are crucial for India’s long-term developmental goals. By funding critical, long-gestation projects—including roads, renewable energy, urban infrastructure, logistics networks, telecommunications, and transportation—they ensure sustained capital formation. This support is vital because these projects often require highly specialized financing structures that traditional banks might hesitate to underwrite.

The role of NBFCs in empowering India’s financial inclusion journey

NBFCs in India play a crucial role in extending financial services to underserved and unbanked communities, helping bridge the gap toward true financial inclusion.

1. Reaching the underserved and rural markets

Unlike banks, NBFCs do not require a massive physical branch network to operate. They utilize phygital models, technology, and local agents to extend financial services beyond major urban centers. This reach is critical, as they cater to populations with limited or no formal credit history, providing them with the necessary credit to improve their livelihoods.

2. Specialized financial products for inclusion

- Microfinance Institutions (MFIs): Provide small, collateral-free loans that fuel micro-entrepreneurship, primarily reaching women in self-help groups (SHGs) and enabling economic independence at the grassroots level.

- Gold loan NBFCs: Offer highly accessible credit against household gold jewelry. This product is popular because it is secure, quick to process, and utilizes a commonly held asset, providing immediate liquidity without a high level of scrutiny.

3. Leveraging digitalization and fintech partnerships

Digitalization has exponentially amplified the reach of NBFCs. Using technology for faster loan application processing, digital KYC (Know Your Customer), and instant disbursal, NBFCs are creating a genuinely seamless customer experience. The rise of digital lending platforms, often powered by NBFCs, is key to achieving true financial inclusion at scale.

Related Read | Digital Lending: Empowering Rural, Semi-urban India Amid Financial Inclusion Challenges

The diverse landscape: Key types of NBFCs

The structure of the NBFC sector is highly diversified based on their core activity:

- Asset Finance Companies (AFCs): Focus on financing the acquisition of physical assets, like machinery, vehicles, and industrial equipment.

- Housing Finance Companies (HFCs): Regulated separately, these companies specialize exclusively in providing loans for housing and mortgage finance.

- Micro Finance Institutions (MFIs): Offer small loans and financial services to low-income borrowers.

- Core Investment Companies (CICs): Systemically important institutions primarily holding investments in group companies.

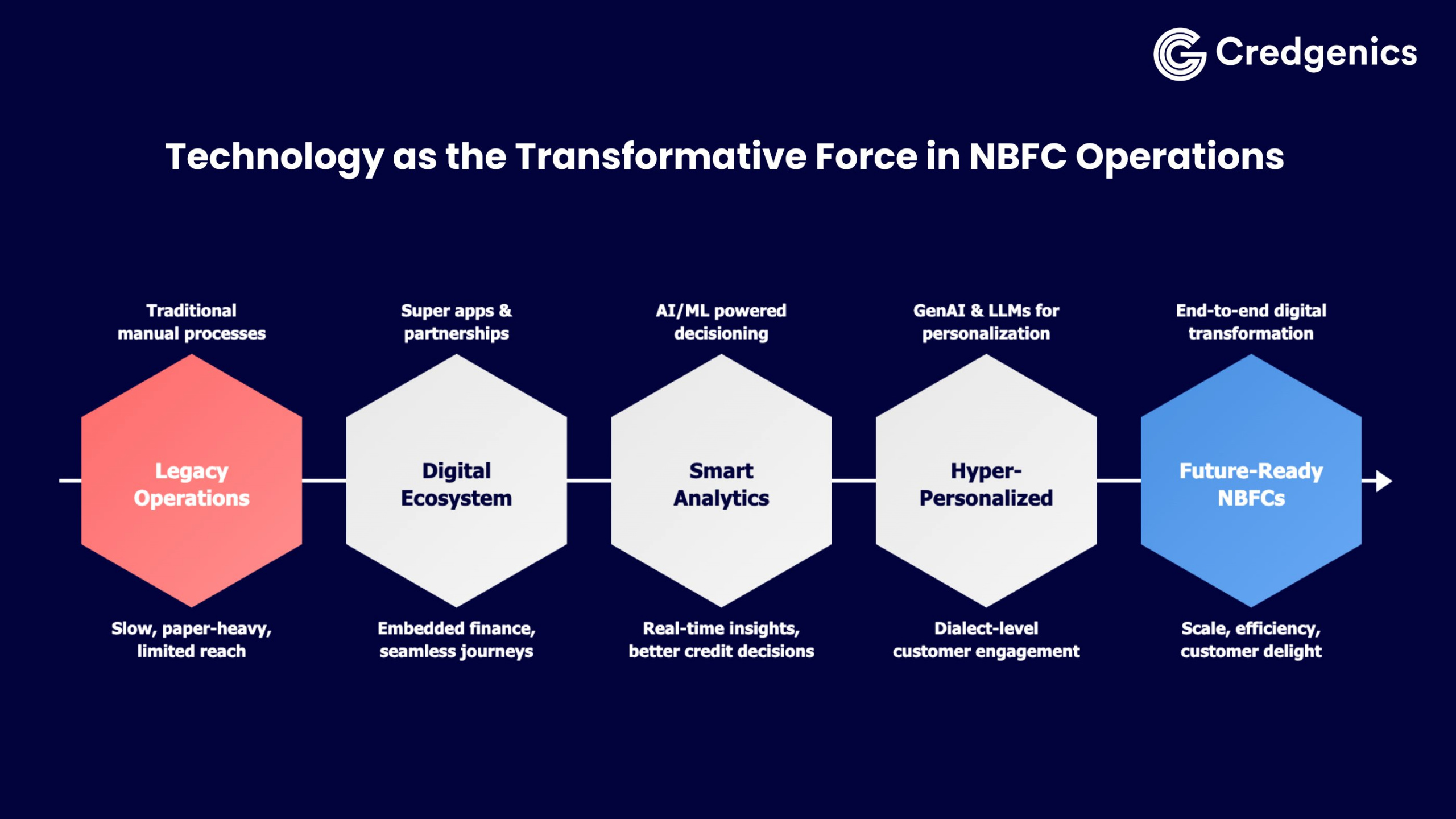

Technology as the transformative force in NBFC operations

Technology has evolved from being a mere enabler to becoming the central nervous system of modern NBFC operations. It touches every aspect of the lending lifecycle—from customer acquisition and credit decisioning to disbursement, portfolio monitoring, and collections.

Key technologies reshaping the NBFC ecosystem:

1. Super apps and strategic partnerships

The emergence of super apps is redefining customer engagement in financial services. These one-stop digital platforms address customer needs from an end-to-end perspective, creating seamless journeys that were previously impossible. While super apps dominate banking and e-commerce, NBFCs are strategically embedding their products within these ecosystems, servicing customers through app-enabled journeys.

2. Frictionless credit enabling platforms and open protocols

The RBI’s frictionless credit enablement platform and the Open Credit Enablement Network (OCEN) represent game-changing infrastructure for the financial services industry. These platforms dramatically ease integration efforts and provide rich, standardized data sources that can be leveraged across the entire loan lifecycle—from sourcing to servicing to collections. For NBFCs, this means faster onboarding, better credit decisions, and more efficient operations.

3. Digital-first and paperless customer journeys

NBFCs are pivoting decisively toward seamless and integrated digital-first and mobile-first experiences. This transformation ensures operational ease, enables better controls, and delivers superior customer convenience. Paperless documentation, digital KYC, instant approvals, and immediate disbursements have become standard expectations rather than competitive differentiators.

4. Analytics as a strategic competitive advantage

Data analytics has emerged as mission-critical across multiple business functions:

Sourcing: Pre-approved databases enable faster sanctions and more attractive customer offers

Customer Lifetime Value Optimization: Analytics maximize the long-term value of customer relationships, optimize product penetration, enable strategic partnerships, and facilitate successful cross-selling and up-selling initiatives

Credit Decisioning: The integration of financial and non-financial data sources has revolutionized credit assessment, dramatically improving the accuracy of scorecards and enabling NBFCs to serve previously “unscorable” segments

Portfolio Monitoring: Real-time, accurate portfolio monitoring coupled with evolved Early Warning Systems (EWS) leads to proactive interventions and more effective collection strategies

5. Generative AI and Large Language Models (LLMs)

GenAI and LLMs represent the frontier of NBFC technology adoption. These technologies are critical for achieving scale while cost-effectively delivering hyper-personalized experiences. The ability to interact with customers at dialect and sub-dialect levels—understanding regional linguistic nuances—is transforming awareness campaigns, customer sourcing, service delivery, and collections.

Regulatory challenges and future outlook

While growth is strong, the NBFC sector operates with inherent risks, demanding sophisticated credit and risk management solutions.

1. Navigating liquidity and funding risks

NBFCs often face higher funding costs and are heavily dependent on market borrowing (issuing bonds and commercial paper). This reliance exposes them to higher liquidity and asset-liability management (ALM) risks, especially during periods of economic uncertainty. The RBI’s enhanced focus on the regulatory framework is designed to ensure stability and mitigate systemic risk across the sector.

2. Maintaining asset quality (Non-performing assets – NPAs)

The core challenge for any financial institution is managing credit risk. Due to their focus on riskier or unbanked segments, NBFCs must implement robust strategies for credit risk assessment and delinquency management. Advanced, AI-driven digital collection strategies are no longer optional, they are essential for proactive delinquency management and maintaining low Non-Performing Assets (NPAs).

Modern collections intelligence platforms use real-time data, predictive analytics, and machine learning to segment customers and personalize the recovery journey. This shift moves collections from a reactive process to a proactive, customer-centric one, balancing efficiency with the maintenance of customer trust.

Credgenics is at the forefront of this collections transformation for leading NBFCs. By integrating AI powered solutions, collections intelligence, legal process automation, and modular solutions, collections platforms like Credgenics turn delinquency management into a competitive advantage. This approach significantly reduces losses, improves overall asset quality, and provides crucial feedback that reinforces better lending decisions.

3. The future: Embracing digital transformation and hybrid models

The future of NBFCs is inextricably linked to technology. They must adapt to increasing competition from traditional banks and disruptive Fintech firms by accelerating their digital transformation. The industry is moving toward a hybrid, regulated model that leverages technology for both underwriting new business and efficiently recovering overdue payments, ensuring a resilient and tech-forward financial ecosystem.

RBI’s regulatory framework: The backbone of NBFC stability & growth

The Reserve Bank of India (RBI) serves as the cornerstone of India’s financial architecture, ensuring that Non-Banking Financial Companies (NBFCs) operate within a sound, transparent, and resilient framework. As the primary regulator and supervisor, the RBI’s role extends beyond compliance—it is about building trust, sustaining growth, and safeguarding the stability of India’s credit ecosystem.

The RBI classifies NBFCs based on their size, activity, and systemic importance. Its oversight encompasses liquidity management, asset quality monitoring, and risk governance, while enforcing robust disclosure standards and stress-testing mechanisms.

Beyond regulation, the RBI also acts as a facilitator of modernization. Initiatives such as the Digital Lending Guidelines, co-lending models, and data-driven supervision promote transparency, consumer protection, and financial innovation. This balanced approach empowers NBFCs to innovate responsibly while maintaining financial discipline.

Ultimately, the RBI’s regulatory stewardship ensures that NBFCs remain both agile and accountable—fueling economic expansion while upholding the integrity of India’s financial system.

Related Read | RBI digital lending directions 2025: What NBFCs & fintechs must know

Conclusion: NBFCs – Anchoring India’s financial future

NBFCs in India stand at the heart of the country’s financial growth, expanding access to credit while complementing the banking system. Their continued success will hinge on three capabilities:

- Credit discipline through data-led underwriting and proactive risk management.

- Liquidity resilience via prudent asset-liability strategies and diversified funding.

- Smart collections using AI-driven, compliant recovery processes that balance efficiency with customer trust.

From Credgenics’ perspective, integrating collections intelligence, legal automation, and analytics can turn delinquency management into a competitive advantage—reducing losses, improving asset quality, and reinforcing better lending decisions.

As digital transformation accelerates, the convergence of AI, analytics, and open financial networks will reshape India’s financial landscape. Supported by fintech collaboration and RBI’s enabling regulation, NBFCs will remain a resilient, inclusive, and innovation-driven pillar of the nation’s financial ecosystem.

In today’s competitive and highly regulated lending environment, rigid repayment modes and aggressive collection tactics are no longer effective. Modern lenders need borrower-first approaches to debt collection that balance compliance, recovery, and customer loyalty.

A borrower-centric repayment strategy not only reduces defaults and drives stronger recoveries but also strengthens long-term relationships, builds brand trust, and supports sustainable profitability.

This lender’s guide serves as a practical aid to insights on digital debt recovery, lending best practices, and effective debt collection strategies. It provides actionable insights for creating repayment solutions that maximize recovery while enhancing Customer Lifetime Value (CLV).

The business case for borrower-centric lending

Investing in a borrower-centric repayment approach is not only about good customer service; it is a strategic move that drives superior portfolio performance and long-term value.

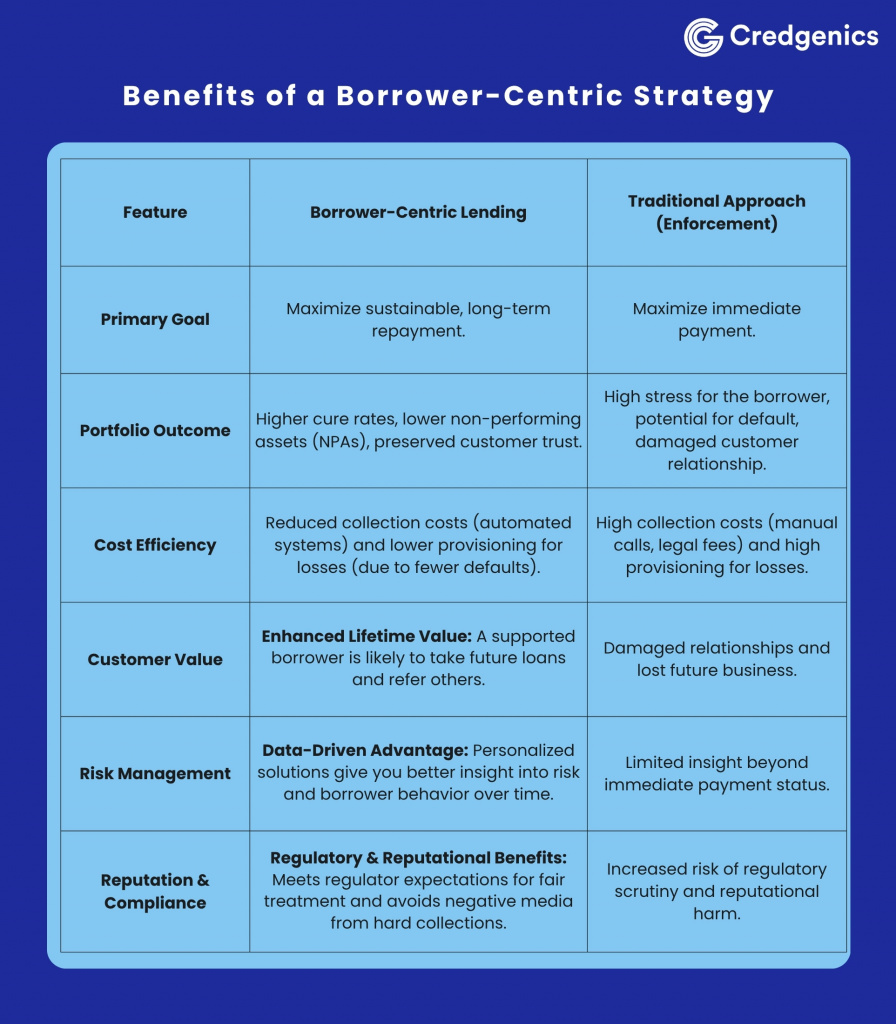

Key benefits of a borrower-centric strategy

By focusing on understanding and supporting your borrowers, you shift the relationship from transactional to collaborative. This results in reduced defaults and losses, a stronger, more loyal customer base, and a data-driven advantage in managing risk, ultimately creating a healthier and more profitable lending portfolio.

1. Understand the modern borrower beyond credit scores

Holistic credit assessment

- Incorporate alternative data such as utility bills, mobile payments, cash flow, and even behavioral patterns.

- Use machine learning to spot early warning signs, like sudden drops in bank balances or earnings.

- Remember that many borrowers face short-term shocks (job loss, medical emergencies), but they may not be a refusal to pay.

Behavioral segmentation

- Segment borrowers by their payment behavior: consistent payers, irregular payers, and those at risk.

- Tailor the communication and provide offers accordingly.

- Use journey mapping to see when and how people begin to struggle.

Predictive modeling & early warning

- Build early-warning systems to flag accounts at risk of slipping 30–60 days delinquent.

- Step in early with gentle reminders or restructuring options. Don’t wait for defaults.

2. Offer flexible, tiered repayment options

Rigid one-size-fits-all payment plans are outdated. Implementing borrower-centric repayment options is a core lending best practice. Some options:

- Dynamic due dates: Let borrowers choose or shift due dates to align with salary cycles (1st/15th/30th).

- Enabling quick payments: Send personalized payment links via SMS/WhatsApp/email that borrowers can click and pay anytime, anywhere.

- Bi-weekly or flexible installments: Breaking a large monthly EMI into two half-payments can ease cash flow for borrowers.

- Skip-a-payment / payment holiday: Allow one skip per year (with clear terms on how the missed payment is recovered).

- Interest-only period: Temporarily let the borrower pay only interest (not principal) during a tough patch.

- Step-up / step-down payment paths: A borrower expecting income growth can start with lower EMIs and ramp up, or vice versa in a downturn.

- Loan modification / term extension: Extend the tenor or reduce the rate (even marginally) to reduce the monthly burden.

3. Proactive, transparent communication channels

How lenders speak to borrowers matters as much as what they offer. Effective communication is central to digital debt recovery.

- Automated, personalized nudges and reminders: Use SMS, WhatsApp, email, or app notifications—timed before due dates and at critical junctures.

- Self-service borrower portal: Provide a dashboard where the borrower can view outstanding balance, due dates, and upcoming schedule.

- Clear, jargon-free explanations: Use plain language to explain interest, fees, consequences of late payment, and options available.

- Proactive outreach during distress: Rather than waiting for non-payment, trigger outreach when signals suggest stress (e.g., drop in bank balances).

- Multichannel support: Voice, chat, web—let borrowers choose the channel most comfortable for them.

Borrower-friendly and tech-enabled communication significantly improves reach and borrower satisfaction.

4. Ethical debt collection & workout strategies

When borrowing becomes delinquency, how you recover matters. Effective debt collection strategies prioritize ethical treatment and sustainable recovery.

- Segmented collection strategies: Different delinquency buckets (30, 60, 90+ days) get different strategies—gentle reminders, guided restructuring, or collections.

- Workouts / restructuring: Offer tailored options like reduced EMI, guidance on implications, term extension, or one-time settlement.

- Negotiated settlements: In appropriate cases, settle at a reduced amount if a timely or lump-sum payment can be arranged, but ensure full transparency and documentation.

- Ensure fair treatment and compliance: Avoid high-pressure tactics, misleading statements, or misrepresentation. Comply with regulations and maintain reputational integrity.

These borrower-first approaches to debt collection build long-term trust.

5. Use technology & data as enablers

Technology is not a substitute for empathy, but it is the scaffolding for modern digital debt recovery and lending best practices.

- Platform integration: Your lending platform should integrate early-warning, communications, and collections in one workflow.

- Analytics dashboards: Monitor delinquency trends, restructuring acceptance rates, customer satisfaction, and cost of recovery.

- AI / ML models: Predict obstacles before they materialize.

- Automated reconciliation & payment systems: A modern payment engine that handles multiple modes (UPI, auto-debit, cards, net banking) reduces friction and errors.

- A/B testing & continuous feedback loops: Test different communication styles or restructuring offers and iterate based on borrower response.

6. Measure success beyond defaults

To understand the real value of borrower-centric repayment programs, track holistic metrics. Use the metrics below to continuously refine your strategies:

- Reduction in default and write-off rates

- Restructuring success rate

- Customer satisfaction / NPS

- Customer retention / repeat borrowing

- Cost of recovery

- Effect on brand / market share

- Lifetime value / margin

- Behavioral health metrics (e.g., less volatility in borrower payment patterns, higher on-time payments)

Related Read: The loan recovery automation playbook: 6 Proven ways to boost repayment rates

Actionable takeaways for lenders

Shifting from harsh collection tactics to borrower-friendly repayment options is not just the right thing to do—it is smart business. It cuts down on defaults, earns customer loyalty, and keeps your portfolio healthy.

This Lender’s guide recommends the following action steps:

- Audit current repayment and collection policies from a borrower’s perspective.

- Build or enhance early-warning analytics to flag stress signals.

- Roll out one flexible repayment option (e.g., skip-payment or date shift) in a pilot segment.

- Design a self-service interface for requesting help.

- Adjust KPIs to reward quality recovery and retention, not just collection volume.

- Train teams in empathy, negotiation skills, and financial counseling basics.

- Monitor results and iterate. Measure not only default but retention, satisfaction, and cost of recovery.

Conclusion

For Credgenics and its lending partners, the future of collections comes down to four things: smart data, the right technology, automation, and treating people with empathy. These effective debt collection strategies, combined with borrower-first approaches to debt collection, drive stronger portfolio performance while building a financial brand that borrowers actually trust. Master these principles in this Lender’s guide, and you’ll stay ahead in lending that’s both profitable and sustainable.

FAQs

1. What is a borrower-centric repayment strategy, and why is it important for lenders?

A borrower-centric repayment strategy focuses on understanding individual borrower needs and creating flexible repayment options that align with their financial reality. This approach replaces one-size-fits-all models with personalized, ethical, and data-driven solutions — reducing defaults, improving recoveries, and strengthening long-term borrower relationships.

2. How does a borrower-first approach improve digital debt recovery?

Borrower-first approaches to debt collection prioritize empathy, transparency, and proactive communication. By combining digital tools, data analytics, and borrower segmentation, lenders can predict repayment challenges early and offer flexible restructuring options. This approach leads to faster recoveries and higher borrower satisfaction.

3. What are the key components of an effective borrower-centric repayment model?

The most effective borrower-centric repayment solutions include:

- Flexible repayment options (dynamic due dates, skip-a-payment, step-up/step-down EMIs)

- Proactive communication (personalized reminders, multi-channel support)

- Ethical collection practices (fair treatment and compliance)

- Technology integration (AI-driven analytics and automation)

These practices drive compliance, trust, and profitability in lending portfolios.

4. How can lenders use technology to improve debt collection efficiency?

Modern lenders use AI, predictive analytics, and digital communication platforms to automate repayment workflows, detect early delinquency risks, and personalize outreach. Technology enhances both recovery performance and borrower experience, making debt collection smarter, faster, and more ethical.

5. What ethical principles should guide modern debt collection?

Ethical debt collection emphasizes fairness, transparency, and compliance. Lenders should avoid aggressive tactics and instead offer negotiated settlements, transparent communication, and restructuring options where feasible. This approach safeguards brand reputation and builds borrower trust.

Feeling overwhelmed by debt?

Here’s the truth: you can take back control.

If you are a borrower juggling loans or credit card bills, this debt management guide is designed specifically for you. It is practical, empathetic, and completely non-judgmental. Taking debt is not a moral failing, it is a phase that millions face every day.

Inside, you’ll find a clear roadmap to managing debt without chronic stress. No overwhelming financial jargon. No shame. Just small, actionable steps that add up to real progress and lasting peace of mind.

Think of this as your path to a calmer, more confident financial future—and it starts right here.

Why taking debt doesn’t define you

Let’s begin with something important: having debt is a situation, not a character flaw.

People from all walks of life need debt, often for reasons beyond their control:

- Medical emergencies

- Job loss

- Family obligations

- Unexpected expenses

- Funding future growth

There’s no shame in having debt. The courage lies in choosing to manage it well.

The critical first step is clarity: see your financial situation clearly. When you assess your debt honestly, without judgment, you take away its power to overwhelm you. What once felt impossible becomes manageable.

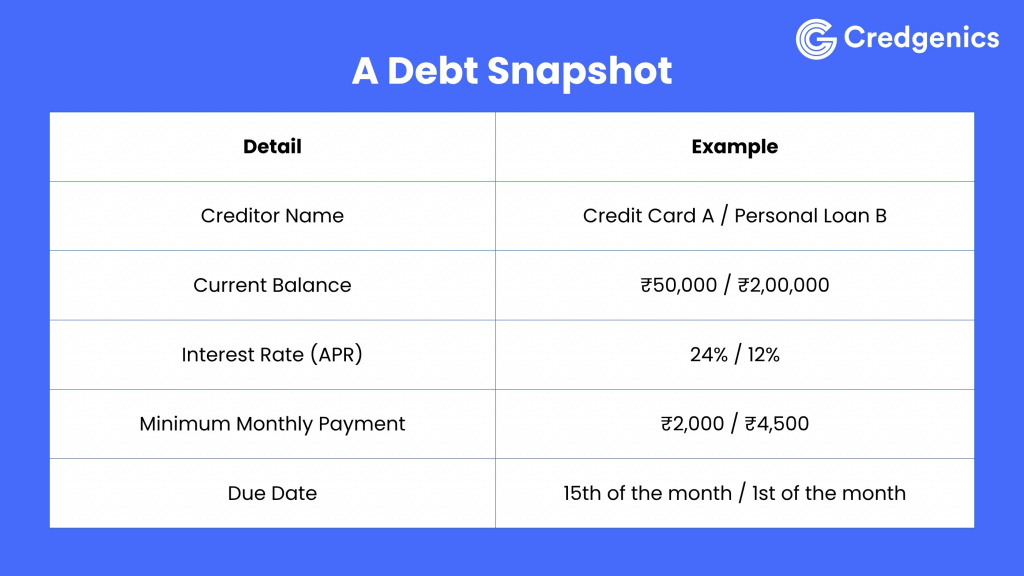

Step 1: Know exactly what you owe – create a debt snapshot

Before any plan can work, clarity is essential. Grab a notebook or open a spreadsheet and list every single debt. Here’s how to do a full debt audit:

Step 2: Choose a debt repayment strategy that fits you

Two proven strategies work well:

- Debt Avalanche: Pay off the highest-interest debt first while making minimum payments on others. This saves the most money in the long run.

- Debt Snowball: Pay off the smallest balance first for quick wins and motivation, while keeping up minimum payments elsewhere.

You can also use a hybrid approach—start with the snowball for psychological wins, then switch to the avalanche for financial efficiency.

Step 3: Explore restructuring, consolidation & negotiation

If debt feels unmanageable, explore these options:

- Debt Consolidation / Loan Transfer

- Take a lower-interest personal or balance transfer loan and use it to pay off high-rate debts.

- Be mindful of processing fees or hidden charges.

- Ensure the new repayment plan is sustainable.

- Negotiate with Lenders

- Many lenders prefer repayment over default.

- Explain your income constraints and request lower interest or revised schedules.

- Banks and NBFCs sometimes offer hardship relief.

- Settlement / One-Time Negotiation

- As a last resort, you may settle with a lump sum lower than the owed amount.

- Be cautious: this can negatively affect your credit report.

Step 4: Protect yourself against future shocks

A debt plan without safeguards can collapse under new pressures. Build resilience with:

- Emergency Fund – Start small (₹5,000–10,000) to avoid new borrowing.

- Insurance / Health Cover – Prevent medical costs from derailing your finances.

- Smart Credit Use – Avoid maxing out cards just because limits are available.

- Monitor Credit Reports – High utilization (above 70%) can damage your credit score.

Step 5: When it feels overwhelming, don’t do it alone

You don’t need to carry the burden by yourself. Consider:

- Credit Counseling & Financial Advisors – A certified expert can help you structure repayment plans.

- Legal Rights & Frameworks – Understand protections under Indian law (like Debt Recovery Tribunals for institutional loans).

- Technology Tools & Apps – Use budgeting or debt-tracking apps to stay consistent.

Real-World Success: Priya’s 14-Month Debt-Free Journey

- Starting Point:

- ₹2,00,000 credit card debt at 26% interest (₹4,333/month in interest alone!)

- ₹1,50,000 personal loan at 14% interest

- Income: ₹75,000 | Fixed Expenses: ₹40,000 | Available for debt: ₹35,000

- Her Strategy:

- Month 1–2: Full debt audit → Choose Debt Avalanche method.

- Month 3 onwards: Paid minimum on loan (₹8,000) and threw ₹27,000 at the credit card.

- Month 8: Credit card balance down to ₹50,000 (from ₹2,00,000).

- Month 10: Credit card fully cleared → redirected ₹35,000 to personal loan.

- Month 14: Completely debt-free. Saved over ₹45,000 in interest.

Lesson: With clarity, strategy, and discipline, debt freedom is achievable.

Related Read | Gen Z and debt: How lenders can build trust with the next-gen borrowers

Key Takeaways

Debt does not vanish overnight, but you can reduce stress and regain control step by step.

Action Steps You Can Start Today:

- Do a debt audit—list all debts and terms.

- Build a simple budget and identify free cash for repayment.

- Pick a repayment strategy (avalanche, snowball, or hybrid).

- Explore consolidation and negotiation options.

- Start a small emergency buffer.

- Review and adjust monthly.

- Seek expert counseling if needed.

Conclusion

Managing debt doesn’t have to be a lifelong struggle. With the right strategies, tools, and mindset, you can transform debt from a source of stress into a challenge you have full control over. Remember: it’s not about perfection, it is about consistent progress. Whether you choose the avalanche method, snowball approach, or a combination of both, the key is to start today. Your path to a stress-free, financially confident life begins with one small step.

FAQs on Debt Management

Q1. What is the best way to manage debt stress-free?

The best way is to create a debt snapshot, choose a repayment strategy like avalanche or snowball, and set up an emergency fund to avoid new borrowing.

Q2. Is debt consolidation a good idea?

Yes, if you qualify for a lower-interest loan, debt consolidation can simplify repayments and reduce costs. However, watch out for hidden fees.

Q3. Can negotiating with lenders really help?

Absolutely. Many lenders are open to revising repayment schedules, lowering interest rates, or waiving fees if you show genuine intent to repay.

Q4. How long does it take to become debt-free?

It depends on your income, expenses, and debt size. With consistent planning, many borrowers see significant results within 12–24 months.

Q5. How can I avoid falling back into debt?

By building an emergency fund, monitoring expenses, using credit responsibly, and regularly reviewing your financial plan.

The lending landscape is experiencing a seismic shift. Embedded finance and personalized lending, powered by AI-driven decision engines and alternative data sources, are helping to dismantle these barriers. The result? A more inclusive, accurate, and seamless lending ecosystem that represents the true future of consumer lending.

What is embedded finance?

Embedded finance transforms how we access financial services by integrating them directly into non-financial platforms and experiences. Instead of visiting a bank or filling out lengthy loan applications, credit becomes available at the exact point of need.

- When you opt for Buy Now, Pay Later (BNPL) at an e-commerce checkout, that’s embedded finance.

- When a ride-sharing app offers you an instant micro-loan or flexible payment option, that’s embedded finance.

- When a SaaS platform integrates credit lines for small business users, that’s embedded finance at work.

Recommended Read: What is embedded finance, and how will it change fintech?

How AI-powered smart decisioning is revolutionizing credit assessment

Thanks to AI in lending, financial institutions are moving beyond static credit scores. With alternative data and advanced algorithms, lenders can now assess creditworthiness more holistically, creating fairer, more accurate, and more inclusive models.

Some examples of the new data sources powering this shift include:

- Payment history: Rent, phone bills, utilities, and subscription services.

- Transaction data: Bank account inflows and outflows.

- Cash flow analysis: Especially for small businesses and freelancers.

- Behavioral insights: Spending patterns, savings discipline, and repayment behavior on digital platforms.

The benefits of personalized lending

For Consumers:

- Expanded Financial Inclusion: Previously underserved populations (gig workers, recent graduates, and small business owners) gain access to credit based on their actual financial behavior rather than limited credit history.

- Seamless User Experience: Embedded payments and lending options integrated into apps and websites eliminate friction, making financing as simple as a few taps on a smartphone.

- Customized Terms: Personalized interest rates, repayment schedules, and loan amounts based on individual financial profiles, making credit more affordable and manageable.

- Point-of-Need Access: Credit becomes available exactly when and where it is needed—during checkout, at service booking, or when business opportunities arise.

For Lenders:

- Market Expansion: Access to first-time borrowers and previously underserved demographics represents massive growth opportunities in untapped markets.

- Enhanced Risk Management: AI-powered underwriting reduces default rates by incorporating comprehensive financial behavior data, leading to more accurate risk assessment.

- Operational Excellence: Automation dramatically reduces processing costs while improving approval speed and customer satisfaction.

- Competitive Differentiation: Early adoption of embedded finance capabilities provides significant competitive advantages in crowded financial markets.

Embedded lending platforms thus create a true win-win, expanding access while protecting lenders’ bottom line.

Recommended Read: Top lending innovations transforming the future of finance

The future is personalized and embedded

As digital ecosystems expand, the line between banking and non-banking services will blur even further. From embedded payments in everyday apps to AI-powered decision engines offering tailored loans, the future of consumer lending is deeply integrated into the platforms people already use daily.

This is not just innovation—it is transformation. Financial services are moving from being products you seek out to experiences that find you, at the right time, in the right place.

Conclusion: A shift we can’t ignore

Embedded finance and personalized lending mark more than just an upgrade in financial services, they represent a fundamental reimagining of how credit fits into people’s lives. As finance becomes deeply woven into digital ecosystems, it moves from being a product people seek out to an experience that meets them where they are.

What lies ahead is a landscape where credit is contextual, invisible, and instant, integrated seamlessly into platforms, tailored to individual needs, and powered by AI-driven intelligence. This shift expands inclusion, enhances trust, and creates new growth opportunities for lenders willing to adapt.

The message is clear: the future of lending is embedded, personalized, and transformative. The only question is how prepared institutions are to embrace it.

FAQs

- What is embedded finance in simple terms?

Embedded finance is when financial services like loans, payments, or insurance are integrated directly into non-financial platforms. For example, when you choose a “Buy Now, Pay Later” option at an e-commerce checkout, that’s embedded finance in action. - How does embedded finance change the future of consumer lending?

By making credit accessible at the point of need, embedded finance eliminates friction in the borrowing process. It allows consumers to access real-time credit approval while giving lenders new ways to reach customers within the apps and services they already use. - How does AI improve personalized lending?

AI in lending analyzes alternative data such as transaction history, digital payments, and cash flow patterns. This creates a more accurate picture of a borrower’s financial health, enabling tailored loan offers, faster approvals, and better risk management for lenders. - What role do alternative credit scoring methods play?

Alternative credit scoring goes beyond traditional models by considering non-traditional data points like mobile payments, subscription history, or even e-wallet usage. This helps lenders serve “thin-file” borrowers who would otherwise be invisible to the system. - Are embedded lending platforms safe for consumers?

Yes. Embedded lending platforms operate within regulated frameworks and often partner with licensed banks or NBFCs. Combined with AI-powered risk assessment, they ensure both compliance and consumer protection while delivering faster, more convenient credit access. - What industries are adopting embedded finance the fastest?

E-commerce, ride-sharing, travel, healthcare, and SaaS platforms are leading the way. From embedded payments at checkout to in-app microloans, these industries are integrating lending solutions to enhance customer experience and drive loyalty.