Feeling overwhelmed by debt?

Here’s the truth: you can take back control.

If you are a borrower juggling loans or credit card bills, this debt management guide is designed specifically for you. It is practical, empathetic, and completely non-judgmental. Taking debt is not a moral failing, it is a phase that millions face every day.

Inside, you’ll find a clear roadmap to managing debt without chronic stress. No overwhelming financial jargon. No shame. Just small, actionable steps that add up to real progress and lasting peace of mind.

Think of this as your path to a calmer, more confident financial future—and it starts right here.

Why taking debt doesn’t define you

Let’s begin with something important: having debt is a situation, not a character flaw.

People from all walks of life need debt, often for reasons beyond their control:

- Medical emergencies

- Job loss

- Family obligations

- Unexpected expenses

- Funding future growth

There’s no shame in having debt. The courage lies in choosing to manage it well.

The critical first step is clarity: see your financial situation clearly. When you assess your debt honestly, without judgment, you take away its power to overwhelm you. What once felt impossible becomes manageable.

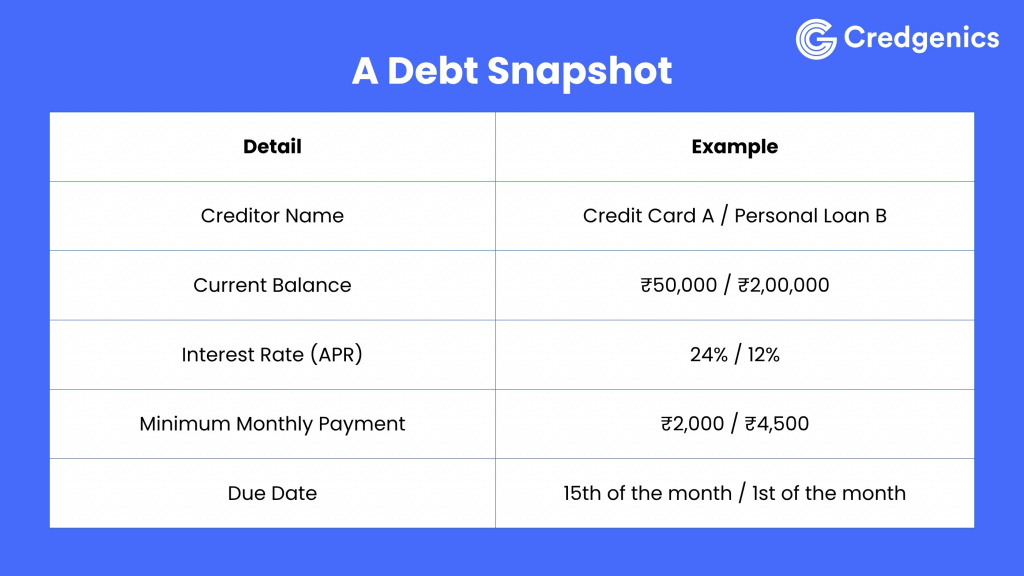

Step 1: Know exactly what you owe – create a debt snapshot

Before any plan can work, clarity is essential. Grab a notebook or open a spreadsheet and list every single debt. Here’s how to do a full debt audit:

Step 2: Choose a debt repayment strategy that fits you

Two proven strategies work well:

- Debt Avalanche: Pay off the highest-interest debt first while making minimum payments on others. This saves the most money in the long run.

- Debt Snowball: Pay off the smallest balance first for quick wins and motivation, while keeping up minimum payments elsewhere.

You can also use a hybrid approach—start with the snowball for psychological wins, then switch to the avalanche for financial efficiency.

Step 3: Explore restructuring, consolidation & negotiation

If debt feels unmanageable, explore these options:

- Debt Consolidation / Loan Transfer

- Take a lower-interest personal or balance transfer loan and use it to pay off high-rate debts.

- Be mindful of processing fees or hidden charges.

- Ensure the new repayment plan is sustainable.

- Negotiate with Lenders

- Many lenders prefer repayment over default.

- Explain your income constraints and request lower interest or revised schedules.

- Banks and NBFCs sometimes offer hardship relief.

- Settlement / One-Time Negotiation

- As a last resort, you may settle with a lump sum lower than the owed amount.

- Be cautious: this can negatively affect your credit report.

Step 4: Protect yourself against future shocks

A debt plan without safeguards can collapse under new pressures. Build resilience with:

- Emergency Fund – Start small (₹5,000–10,000) to avoid new borrowing.

- Insurance / Health Cover – Prevent medical costs from derailing your finances.

- Smart Credit Use – Avoid maxing out cards just because limits are available.

- Monitor Credit Reports – High utilization (above 70%) can damage your credit score.

Step 5: When it feels overwhelming, don’t do it alone

You don’t need to carry the burden by yourself. Consider:

- Credit Counseling & Financial Advisors – A certified expert can help you structure repayment plans.

- Legal Rights & Frameworks – Understand protections under Indian law (like Debt Recovery Tribunals for institutional loans).

- Technology Tools & Apps – Use budgeting or debt-tracking apps to stay consistent.

Real-World Success: Priya’s 14-Month Debt-Free Journey

- Starting Point:

- ₹2,00,000 credit card debt at 26% interest (₹4,333/month in interest alone!)

- ₹1,50,000 personal loan at 14% interest

- Income: ₹75,000 | Fixed Expenses: ₹40,000 | Available for debt: ₹35,000

- Her Strategy:

- Month 1–2: Full debt audit → Choose Debt Avalanche method.

- Month 3 onwards: Paid minimum on loan (₹8,000) and threw ₹27,000 at the credit card.

- Month 8: Credit card balance down to ₹50,000 (from ₹2,00,000).

- Month 10: Credit card fully cleared → redirected ₹35,000 to personal loan.

- Month 14: Completely debt-free. Saved over ₹45,000 in interest.

Lesson: With clarity, strategy, and discipline, debt freedom is achievable.

Related Read | Gen Z and debt: How lenders can build trust with the next-gen borrowers

Key Takeaways

Debt does not vanish overnight, but you can reduce stress and regain control step by step.

Action Steps You Can Start Today:

- Do a debt audit—list all debts and terms.

- Build a simple budget and identify free cash for repayment.

- Pick a repayment strategy (avalanche, snowball, or hybrid).

- Explore consolidation and negotiation options.

- Start a small emergency buffer.

- Review and adjust monthly.

- Seek expert counseling if needed.

Conclusion

Managing debt doesn’t have to be a lifelong struggle. With the right strategies, tools, and mindset, you can transform debt from a source of stress into a challenge you have full control over. Remember: it’s not about perfection, it is about consistent progress. Whether you choose the avalanche method, snowball approach, or a combination of both, the key is to start today. Your path to a stress-free, financially confident life begins with one small step.

FAQs on Debt Management

Q1. What is the best way to manage debt stress-free?

The best way is to create a debt snapshot, choose a repayment strategy like avalanche or snowball, and set up an emergency fund to avoid new borrowing.

Q2. Is debt consolidation a good idea?

Yes, if you qualify for a lower-interest loan, debt consolidation can simplify repayments and reduce costs. However, watch out for hidden fees.

Q3. Can negotiating with lenders really help?

Absolutely. Many lenders are open to revising repayment schedules, lowering interest rates, or waiving fees if you show genuine intent to repay.

Q4. How long does it take to become debt-free?

It depends on your income, expenses, and debt size. With consistent planning, many borrowers see significant results within 12–24 months.

Q5. How can I avoid falling back into debt?

By building an emergency fund, monitoring expenses, using credit responsibly, and regularly reviewing your financial plan.