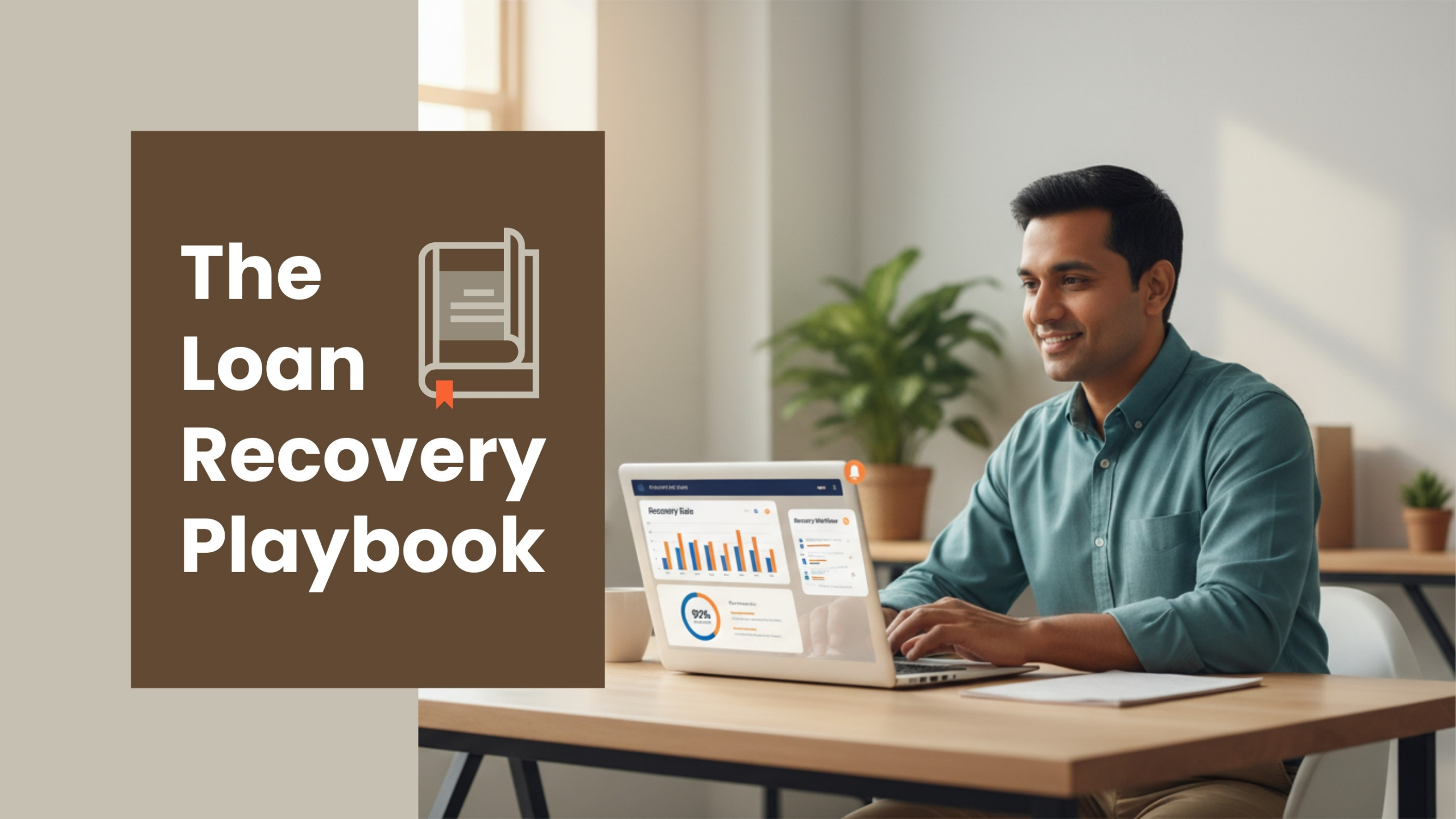

Loan defaults and delayed repayments are growing concerns for financial institutions worldwide. Traditional recovery models struggle with high NPAs (non-performing assets), compliance risks, and process inefficiencies. Research shows loan recovery automation can improve recovery rates by 20–40% and cut costs by 25% or more. The solution lies in a strategic approach to automation that transforms how lenders manage debt recovery.

This is where Credgenics’ digital debt collection solutions come in. Far from replacing human collectors, automation empowers them with more advanced tools to reach more borrowers, engage them meaningfully, and accelerate repayments.

This playbook highlights six proven automation strategies, backed by Credgenics’ innovations, to help banks, NBFCs, MFIs and fintech lenders build efficient, compliant, and customer-centric recovery operations.

The challenge with traditional loan recovery

Traditional debt collection methods are failing to meet the demands of today’s lending environment. Manual processes create barriers that directly impact recovery rates and operational efficiency.

- Fragmented communication: Collection teams juggling digital comms, phone calls,, and field visits often miss an overall view with gaps in critical follow-ups and logical steps leading to delayed recoveries.

- Siloed borrower data: Without centralized data visibility, teams work with incomplete information, making strategies reactive rather than strategic.

- High costs: Manual recovery demands significant manpower, extensive paperwork, and costly field resources that strain operational budgets.

- Poor borrower experience: Aggressive or inconsistent outreach damages customer relationships and reduces willingness to cooperate.

The result? Rising delinquency rates, declining repayment efficiency, and mounting operational pressure for financial institutions.

Credgenics solves these challenges by blending automation with AI in loan recovery, analytics, and digital payments to make recovery faster, compliant, and customer-centric.

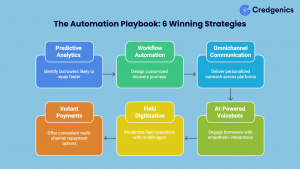

The automation advantage — 6 Proven playbook strategies

1. Predictive Analytics & Data-Driven Prioritization

Not all borrowers are alike. The Credgenics platform uses machine learning to identify which borrowers are most likely to repay faster, allowing lenders to focus their efforts strategically. This predictive power is a hallmark of a modern debt collection platform in India, where scale and diversity require smart segmentation.

Core Analytics Capabilities:

- Risk scoring algorithms: Analyze payment history, behavioral patterns, and demographic data to predict repayment likelihood.

- Dynamic segmentation: Automatically categorize borrowers into risk profiles that determine appropriate collection approaches.

- Performance tracking: Real-time dashboards monitor recovery rates, resolution timelines, and campaign ROI across different segments.

- Behavioral insights: Identify optimal communication timing, preferred channels, and effective messaging strategies for each borrower profile.

Platforms like Credgenics leverage sophisticated analytics to help lenders maximize both efficiency and recovery outcomes through intelligent prioritization.

Recommended Read | Leveraging Analytics to Improve Debt Collections Performance

2. Workflow automation

Managing debt recovery workflows manually is time-consuming, error-prone, and limits real-time optimization. Workflow automation transforms this process with Credgenics platform that allows lenders to design customized recovery journeys with ease.

Key Capabilities:

- No-code journey builder: Create both simple and complex workflows tailored to borrower conditions.

- Automated allocation: Smartly assign cases to field or telecalling teams, manage repossession, set reminders, and create settlement buckets.

- Trigger-based execution: Instantly launch workflows based on loan uploads, updates, or borrower actions.

- Real-time dashboards: Gain full visibility into loan activities, monitor campaign success, and measure borrower engagement.

- Omnichannel integration: Combine SMS, Email, WhatsApp, IVR, App-based alerts for maximum reach and effectiveness.

- AI-driven insights: Predict borrower behavior and optimize strategies dynamically for faster recoveries.

Business Impact:

Up to 25% increase in team productivity through automated allocations, and 30% labor cost savings by reducing repetitive manual work. By embedding workflow automation into recovery operations, lenders can minimize repetitive tasks, adapt quickly to regulatory changes, and scale recovery efforts more effectively.

Recommended Read | Modernizing Debt Collections: The Advantages of SaaS Platforms

3. Omnichannel communication automation

Modern borrowers expect communication through their preferred channels at convenient times. AI-driven omnichannel systems deliver personalized outreach across multiple platforms—SMS, email, WhatsApp, IVR, and RCS—with timing and content optimized through intelligent borrower profiling.

Key Features:

- Dynamic personalization: Messages automatically incorporate borrower details, account status, and contextual insights to create relevant and respectful communications.

- Intelligent optimization: Advanced algorithms analyze individual response patterns to identify optimal communication windows, channels and frequency for each customer.

- Smart escalation workflows: Automated sequences adjust frequency and channel priority based on borrower engagement, seamlessly escalating across platforms when needed.

- RCS support in workflows and communications: It enables businesses to deliver visually rich content and images as part of multi-channel communication flows. Additionally, new RCS carousel templates allow multiple images with individual descriptions, creating richer, more interactive customer engagement experiences.

Proactive communication significantly outperforms reactive approaches. For example, automated payment reminders with integrated digital payment links sent 2-3 days before due dates can improve on-time payments.

Comprehensive platforms such as Credgenics enable sophisticated omnichannel strategies that balance automation efficiency with personalized customer engagement—forming the foundation of loan collection best practices.

4. AI-Powered voicebots & call automation

Voice automation solutions like Swara, Credgenics’ GenAI voicebot, are transforming borrower engagement by delivering consistent, empathetic interactions at scale. Alongside AI-powered voice conversations, Credgenics’ automated calling modules enhance both agent productivity and borrower experiences by ensuring smarter, faster, and compliant outreach.

Key capabilities:

- Multi-lingual support: Communicate in regional Indian languages to build comfort and trust with diverse borrower bases.

- Sentiment detection: Analyze borrower tone and emotional state to adjust conversation style dynamically.

- 24/7 availability: Handle high call volumes without human fatigue or downtime.

- Integrated response: Automated follow-ups across digital, calling, field, and legal teams.

- Instant resolution & payments: Address common queries, capture payment/settlement intent, and share secure links instantly.

- Advanced call automation modules:

-

- Click-to-Call – One-click outbound calls, ideal for focused cases.

- Auto Dialer – Sequential dialing for higher volumes with reduced manual effort.

- Predictive Dialer – AI-enabled bulk calling via round-robin allocation, maximizing connect rates and minimizing idle time.

- Campaign management: Configure both outbound and inbound campaigns with disposition-based rules for automated handling of loans/leads.

- Real-time dashboards: Monitor agent performance, connectivity, call duration, resolution rates, and channel utilization.

Operational benefits: This intelligent automation reduces contact center costs by up to 80% while maximizing agent productivity through smart call flows and optimized allocation. Every borrower interaction is safeguarded with full regulatory compliance. Boost recovery rates with higher customer connect success and accelerated resolution.

Customer Experience: Borrowers receive immediate, respectful assistance in their preferred language, supported by both AI and trained agents. Calls are better structured, responses faster, and interactions more empathetic, improving cooperation rates and satisfaction.

Implementation impact

Organizations using Credgenics’ calling suite typically see:

- Improved first-call resolution

- Increased campaign efficiency through predictive and automated dialing

- Reduced agent burnout via automation of repetitive tasks

- Enhanced scalability to manage growing portfolios seamlessly

Advanced voice automation and smart solutions like Credgenics’ Swara along with AI-powered dialers show how AI can complement human expertise, ensuring both efficiency and empathy in debt collection.

Recommended Read | Conversational AI in collections: Building trust between borrowers and lenders

5. Field digitization

Despite digitization, field collection remains relevant. Mobile technology transforms traditional field operations into efficient and accountable processes. Modern apps for field recovery agents, modernizes the process through digital field capabilities:

-

- Mobile-optimized interfaces: Agent-friendly apps provide route planning, comprehensive borrower profiles, and real-time case updates.

- Paperless documentation: Digital receipts and electronic signatures eliminate manual paperwork while ensuring proper documentation.

- Real-time synchronization: Field activities update central systems immediately, providing complete visibility into recovery progress.

- Real-time tracking: Field managers can geo-track and geo-fence their on-ground team members with complete control on operations

Digital field tools boost agent productivity by 30-50% through optimized routing, instant data access, and streamlined reporting processes.

The Credgenics CG Collect field app shows how mobile technology can modernize field operations while maintaining the personal touch that certain situations require.

Recommended Read: Transforming field debt collections with CG Collect

6. Instant payments & real-time settlement

Frictionless payments are crucial. With solutions like Credgenics Billy Payments Platform, lenders can offer instant, multi-channel repayment options that enhance convenience and speed up settlements.

- Multi-channel payment links: Borrowers can easily pay through auto-generated links sent via SMS, WhatsApp, and email for immediate accessibility.

- Instant processing: Real-time payment confirmation and account updates eliminate delays and confusion.

- Comprehensive tracking: Live dashboards provide visibility into transactions, simplifying reconciliation and enabling faster settlement oversight.

Impact: Borrowers find it convenient to pay immediately, while institutions accelerate cash flow and reduce reconciliation delays.

Solutions like Credgenics’ Billzy demonstrate how integrated digital payments can transform the recovery experience for both lenders and borrowers.

Related Read | 5 Must-Have Features of Digital Loan Payments Software for Modern Lenders

Industry impact and results

Financial institutions adopting digital debt collection solutions see measurable gains:

- Recovery Performance: Recovery rates improve by 25–40% with comprehensive loan recovery automation.

- Operational Efficiency: Automated systems reduce manual workloads, cut compliance risks, and optimize agent productivity.

- Customer Experience: Borrowers benefit from respectful, multilingual, and convenient repayment experiences.

The debt collection landscape in India and worldwide is evolving rapidly, with technology driving efficiency, compliance, and empathy.

Conclusion

The loan recovery landscape is evolving rapidly. Loan recovery automation has emerged as the ultimate playbook—empowering lenders to maximize recoveries, lower costs, and deliver empathetic borrower experiences.

By adopting these proven strategies: predictive analytics, omnichannel communication, AI-powered voicebots, field digitization, and digital payments—along with workflow automation, lenders can future-proof their operations. Together, these solutions enable smarter prioritization, seamless execution, and real-time adaptability, ensuring higher repayment rates and greater operational efficiency.

FAQs

- How do digital debt collection solutions improve recovery rates?

By combining automation, analytics, and omnichannel communication, digital solutions help lenders engage borrowers effectively, streamline processes, and improve repayment rates significantly. - Is automation too impersonal for debt recovery?

No. AI voicebot solutions deliver empathetic, multilingual conversations while leaving complex cases for human agents. - Can Credgenics Swara voicebot replace human agents?

No, Swara supplements agents by handling routine calls empathetically, freeing human agents to focus on sensitive, complex negotiations. - Is field collection still necessary in digital-first recovery?

Yes, and tools like Credgenics CG Collect make it more efficient, transparent, and secure. - How is AI in loan recovery changing the industry?

AI enables predictive analytics, empathetic voice interactions, and personalized borrower engagement, ensuring collections are faster, smarter, and borrower-friendly. - What are the loan collection best practices for 2025?

Key practices include omnichannel communication, real-time digital payments, AI-driven borrower prioritization, and field digitization with mobile apps. - What makes Credgenics a leading debt collection platform in India?

Credgenics offers AI-powered tools like the Swara voicebot, Billzy digital payments, and CG Collect field app, making it the most comprehensive digital-first platform for lenders in India.