The lending process can feel like navigating a financial labyrinth—a world of forms, jargon, and uncertainty. Navigating this territory, especially for first-time borrowers, can be daunting. But what if borrowing money could be a smooth, even empowering experience?

By prioritizing a clear and personalized communication, lenders can transform the lending journey and empower borrowers. This blog explores how lenders can elevate the borrowing experience through effective, borrower-focused communication strategies.

1: Communicate Clearly: Ditch the Jargon, Use Simple Terms

Lenders can achieve this by using straightforward language, breaking down complex terms, and avoiding financial acronyms. Borrowers could consider using interactive tools or explainer videos to make the learning process more engaging.

2: Embrace Transparency: Empower Borrowers with Clarity

Surprise fees and hidden details buried in fine print are the enemies of trust. Lenders should be upfront about costs, interest rates, and repayment terms. Transparency empowers borrowers to make informed decisions and builds trust—the foundation of any financial relationship. Lenders can think of it as a financial roadmap, clear and concise, guiding borrowers on their loan journey.

In PwC’s recent Customer Loyalty Survey, 82 percent of respondents said they would be willing to share personal data in exchange for a better customer experience.

3: Tune In: Actively Listen to Uncover Borrowers’ Needs

It takes more than just a borrower’s income and credit score to understand their needs and aspirations. You can uncover the human story behind the numbers by actively listening to their goals for the loan—a new business venture, a dream vacation, or a safety net for their finances. Lenders can consider incorporating interactive tools within the application process that encourage borrowers to share their aspirations.

4: Foster Collaboration: Facilitate Open, Two-Way Communication

Communication is a two-way street. Lenders should encourage questions, address concerns promptly, and be readily available throughout the lending process. Open communication fosters a sense of partnership, replacing the borrower-lender power dynamic with a collaborative spirit. It could be helpful to utilize multiple communication channels like chatbots, email, and phone calls to cater to different borrower preferences.

Source: PwC

5: Build Trust: Timely and Personalized Communication

Being proactive in communicating with borrowers entails first getting in touch with them. Excited applicants waiting for loan approval shouldn’t be left in the dark. Update them on their application status, reducing uncertainty and building trust. A simple text confirming the documents received shows that the lender cares about building the relationship. The journey doesn’t end with funding. Lenders should provide personalized financial guidance and relevant need based options that demonstrate an ongoing support for the customer’s financial well-being.

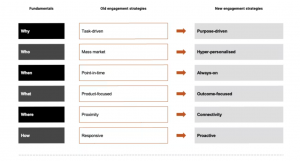

6: Enhance the Experience: Tailor Communications, Not Mass Marketing

A generic mass email blast is a missed opportunity. Communication must be customized based on the loan type, characteristics and borrower’s circumstances. Would they prefer email updates, phone calls, or a user-friendly online portal to track their progress? Understanding their communication pattern and aligning to it ensures that customers stay informed and engaged.

7: Leverage Data: Offer Relevant Solutions

Lenders can leverage customer data – past purchases, searches, and interests to understand their existing and evolving needs. This allows lenders to offer relevant products and not generic promotions. Imagine a customer browsing car loans. When contacted, the bank should offer assistance with a tailored car loan offer rather than a generic home loan. Tailored outreach builds trust and strengthens relationships.

Recommended Read: Role of Big Data Analytics in Personalized Banking Services for Indian Consumers

8: Empathy Makes the Difference: Strengthen Borrower Relationships

Financial situations can be stressful. Demonstrating empathy and understanding, especially if a borrower faces challenges, shows the human side of lending. It fosters trust and strengthens the relationship.

9: Empower Borrowers: Continuous Education and Support

Empowering borrowers with knowledge is essential for making informed financial decisions. Lenders can incorporate educational resources, such as blog posts, webinars, and interactive tools, to provide valuable insights into various aspects of borrowing and personal finance. Furthermore, offering personalized support and guidance throughout the loan lifecycle can help borrowers confidently navigate challenges and achieve their financial goals.

What is the most important thing for customer centricity? Watch this video by Steven Goldbach, Chief Strategy Officer, Deloitte USA, to learn more!

Conclusion: Customer-centric communication isn’t a nicety, it’s a necessity

By prioritizing clear, personalized interactions, lenders create a more positive experience for borrowers and build stronger relationships and, ultimately, a more successful business. Remember, a loan isn’t just a transaction, it’s an opportunity to be a part of someone’s financial journey. By prioritizing communication and putting the customer at the center, lenders can transform loan talk from jargon to a journey filled with understanding and empowerment.

If you are looking to transform your debt collections strategy with the power of digital and data-powered insights, reach out to us to request an exploratory session at sales@credgenics.com or visit us at www.credgenics.com.

FAQs:

1. What’s the difference between reactive and proactive communication in lending?

Reactive communication means waiting for borrowers to contact you. Proactive communication involves reaching out first with relevant information throughout the loan process. This keeps borrowers informed, reduces uncertainty, and builds trust.

2. How can clear communication help borrowers during the loan application process?

Clear communication means explaining loan terms, interest rates, repayment schedules, and fees in an easy-to-understand way. Borrowers feel empowered when they understand the details, make informed decisions, and build trust with the lender.

3. What are some examples of proactive communication during the loan application process?

- Sending updates on application status.

- Confirming receipt of documents via text messages

- Offering step-by-step tutorials or FAQs to guide borrowers through the process.

4. Why is it important to communicate with borrowers even after loan approval?

The lending relationship shouldn’t end with funding. Proactive communication after approval can include:

- Personalized offers for future financial needs based on the borrower’s situation.

- Financial guidance and resources for managing loan repayments.

5. How can lenders personalize the lending experience using data?

Banks and lenders can analyze customer data like past purchases, browsing history, and interests. This allows them to target outreach with relevant loan options, not generic promotions. For example, if a customer researches car loans, the bank should offer car loan support, not a home loan offer. Tailoring outreach builds trust and strengthens relationships.