The global banking crisis caused by volatile interest rate movements dominated the year 2023. Many small and mid-sized banks in North America, as well as established institutions in America and Europe, have experienced stress, with some even declaring bankruptcy. Amidst subdued economic growth and ongoing geopolitical uncertainties, the global banking sector’s growth and profitability are likely to remain under pressure. In contrast, Indian banks have thus far remained resilient, weathering macroeconomic and interest rate fluctuations. However, it’s increasingly clear that financial returns alone cannot ensure sustained shareholder value, and holistic banking in tech-driven India is becoming a necessity.

Indian banks must now consider a broader perspective, focusing on their impact across various dimensions. Research by McKinsey reveals that measuring performance solely through financial metrics is no longer sufficient, as institutions emphasizing sustainability have seen a 50 percent increase in growth. With rising investor expectations and workforce demands for holistic impact, assessing performance across operations, customer relations, employee engagement, and environmental and social aspects becomes crucial. Any lapses in these areas can potentially translate into significant risks to profit and value creation.

Challenges in the banking landscape in India

Key drivers contributing to challenges in the banking sector and affecting profitability are:

- Overheads: Increasing competition and changes in the talent landscape are likely to result in elevated personnel costs on a per-unit basis. This potential cost increase, however, can be mitigated by embracing technology-driven transformations in sourcing, underwriting, operational, and support functions. Such digital advancements are expected to translate into heightened productivity gains over the next few years. Consequently, we may witness a significant divergence in operating expenses among banks, contingent on their approaches to talent management, digital transformation initiatives, and investments in technology capital expenditure (CapEx).

- Fee income: The Indian banking industry has observed a sustained decrease in fee-based income. This trend could potentially continue as financial services undergo disintermediation, customer awareness rises, and regulatory mandates emphasize the need for transparent fee structures. Additionally, the increasing prevalence of partnerships has resulted in a fragmentation of fee income distribution across banks, non-banking financial companies (NBFCs), and fintech firms.

- Interest margins: As financial services continue to reach a wider audience, the pools of new-to-credit (NTC) individuals are expected to undergo credit evaluations, and the diversity of NTC across various products is beginning to stabilize. This trend may restrict opportunities for expanding yields. Additionally, the growth of deposits is likely to face limitations due to India’s ongoing structural shift in the allocation of household financial products. This shift could exert sustained upward pressure on interest rates in the market.

Opportunities in the Indian banking sector

- Performance: Financially, Indian banks have demonstrated impressive performance over the past decade. They have achieved robust credit growth, averaging around 10 percent, and have consistently outperformed their global counterparts in terms of Return on Assets (ROAs). This sustained excellence in performance has earned them a valuation premium. Indian banks have adopted a conservative approach when it comes to investment portfolios. They have also built granular deposit bases and diversified their asset portfolios, setting them apart from banks in many other countries. This strategic approach has bolstered their resilience against market risks and portfolio concentration issues. Additionally, Indian banks have increasingly directed their resources toward retail credit and expanded into deeper geographic regions, further enhancing their financial stability and growth prospects.

- Customer experience: While there have been noticeable enhancements in customer experience and customer-centric approaches, there remains room for further improvement through continuous investments. Despite strides made in digital journeys and the development of banking super apps, Indian banks have yet to completely streamline processes, particularly in areas such as customer onboarding, underwriting, and service touchpoints. However, the emerging public digital infrastructure in India holds the potential to significantly amplify customer service and operational efficiency.

- Industry health: The transformation in the banking landscape has been primarily catalyzed by the consolidation of Public Sector Banks (PSBs), reducing their count significantly from 27 to 12 in the past half-decade. This consolidation, combined with recapitalization efforts, has resulted in more robust and larger banks, fostering increased competition within the sector. The emergence of specialized banking entities and agile fintech companies, particularly in the domains of payments and microlending, has driven innovation. This, in turn, has spurred established incumbent banks to revamp their approaches to customer acquisition and service delivery to remain competitive in the evolving market.

- Social responsibility: Indian banks have played a pivotal role in advancing financial inclusion, notably through initiatives like business-correspondent (BC) coverage and microfinance. However, there is still progress to be made in terms of further expanding their market reach. On the environmental front, while many banks have begun pledging commitments to achieve net-zero climate impact, there remains a need for comprehensive strategies and key performance indicators (KPIs) to effectively monitor and evaluate their progress. Collaboration between regulators and banking institutions is essential to establishing viable institutions, supportive policies, and frameworks conducive to climate finance. Financing the transition to a sustainable economy is anticipated to require annual investments of approximately INR 12 to 13 lakh crore ($145 billion to $160 billion) over the next decade and an average of INR 35 lakh crore ($430 billion) annually over the next 25 years. It’s worth noting that India currently fulfills only a quarter of this demand, highlighting the urgency for action in this area.

- Business continuity: Indian banks face an urgent need for comprehensive action, with a focus on bolstering their technological infrastructure, enhancing cybersecurity measures, optimizing data management practices, and refining talent management strategies. These steps are essential to operating effectively within a vastly altered scale and operating landscape. While banks have made substantial investments in digital banking, data management, and privacy practices, as well as the modernization of core tech platforms, some areas still warrant careful attention.

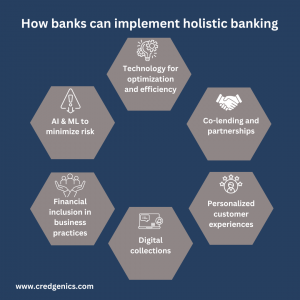

Building financial resilience through holistic banking

While Indian banks have demonstrated success in their financial metrics, they must take substantial measures to sustain their outperformance. Moreover, they can continually enhance various non-financial metrics to maintain a consistent trajectory of value creation. To achieve these objectives, there are a few priority actions that can be implemented.

- Technology to optimize efficiency and experience: AI, including generative AI, is on the verge of revolutionizing banking by scaling up multiple experimental use cases. Generative AI, in particular, can significantly reduce human intervention, especially in repetitive, rule-based processes like KYC, AML, customer service, and certain credit decisions. To fully leverage AI’s potential, banks must address challenges such as fragmented data, limited data governance, talent shortages, and underutilized analytics platforms. Banks should aim for zero-ops capabilities to simplify complex, data-intensive back-end operations. This entails reevaluating end-to-end operations, not just within the operations function, leading to significant efficiency improvements.

- Co-lending and digital partnerships: The India co-lending model stands as a distinctive framework, designed to facilitate lending to the smallest MSMEs and segments where expertise is limited. While there has been notable progress in recent quarters, the absence of standardized product norms, policy templates, and API protocols has hindered the growth of direct integrations between stakeholders. To overcome this hurdle, banks and intermediaries have the opportunity to collaborate, creating an industry-wide solution that can drive accelerated progress in co-lending. Fintech companies represent a significant partnership avenue due to their strengths in digital lending, proficiency in interpreting surrogate data, and technologically advanced operational models. Additionally, forging connections with large-scale B2B and B2C consumer platforms offers banks a substantial opportunity to enhance digital sourcing reach and reduce operating costs.

- Creating personalized customer experiences: While personalization is a common practice in most banks, its depth and sophistication can vary significantly. Many Indian banks rely on segment- or rule-based engagement strategies that target similar groups of customers with similar messages. This static approach often fails to consider past interactions and the most recent signals from customers. However, the maturation of the digital marketing and analytics landscape has opened the door to tailoring engagement strategies and content at an individual level. This shift toward dynamic hyperpersonalization has the potential to yield a three- to five-fold increase in conversion and retention rates. Banks can chart a clear roadmap, encompassing digital capabilities, analytics infrastructure, and organizational structure, to guide them toward achieving this level of personalized engagement.

- Digital and data-led collections: Customers are increasingly digitally adept and now demand a consistent experience throughout their loan journey. To retain these customers, banks must pivot from a collections-focused approach to a customer-centric mindset when it comes to loan servicing. This shift involves not only a cultural transformation but also the establishment of essential technology infrastructure and analytical models to customize strategies based on individual customer behaviors. Our analysis indicates that this shift has the potential to deliver substantial benefits, including a potential reduction in collections costs of up to 15 percent and a potential five-fold increase in customer engagement.

- Financial inclusion and expanding markets: Rural credit demand has witnessed substantial growth in recent years, highlighting the substantial untapped potential in these segments. While public sector entities and inclusion-focused players such as microfinance institutions (MFIs) and rural NBFCs have traditionally driven this demand, there is a clear opportunity for banks to achieve profitable and significant expansion. Although the rural market may appear fragmented, strategic market selection based on factors such as crop varieties, specialty produce, allied activities, and investment credit can enable banks to penetrate profitable clusters deeply. This approach allows them to establish a tailored go-to-market strategy by harnessing value chains, business correspondents (BCs), self-help groups (SHGs), and other intermediaries.

- Technology to manage operational risk: Technology resilience encompasses multiple dimensions and necessitates deliberate design and continuous proactive management. Indian banks can prioritize three critical areas:

- Modernizing core systems and API management: Banks should embark on the journey of modernizing their core systems while emphasizing effective API management. Flexibility and scalability should be integral to this process, and clear governance and ownership structures must be established across infrastructure, application, and event management.

- Developing a robust cloud strategy: A well-defined cloud strategy is essential for efficient load management and secure data access for decision-makers. Banks should focus on designing a cloud infrastructure that can handle increased loads effectively while maintaining data security.

- Enhancing Cybersecurity: In an increasingly digital landscape, heightened cybersecurity measures, stringent information security practices, and rigorous data privacy norms are imperative to safeguard customer data and institutional integrity.

Conclusion

Tech-driven innovation, customer-centricity, sustainability, and adaptability are the cornerstones upon which the future of banking in India will be built. By embracing cutting-edge technologies, fostering robust customer relationships, championing sustainable finance, and remaining agile in the face of change, banks can not only thrive but also lead the charge in shaping a resilient financial ecosystem.

In this ever-changing landscape, financial institutions that commit to holistic banking in tech-driven India and are bolstered by an unwavering commitment to customer well-being will not only survive but thrive in the years ahead.

If you are looking to transform your debt collections strategy with the power of digital and data-powered insights, reach out to us to request an exploratory session at sales@credgenics.com or visit us at www.credgenics.com

FAQs:

- What is holistic banking, and how does it differ from traditional banking?

Holistic banking goes beyond traditional banking by embracing technology-driven solutions, fostering customer-centricity, and prioritizing sustainability. It involves leveraging advanced technologies, enhancing customer experiences, and integrating sustainability principles into financial practices to ensure long-term resilience.

- How can Indian banks leverage technology to build financial resilience in a rapidly evolving landscape?

Indian banks can harness technology through digitization, artificial intelligence, and data analytics to streamline operations, personalize customer experiences, and proactively manage risks. These technological advancements empower banks to adapt swiftly to changing market dynamics and ensure financial resilience.

- What role does customer-centricity play in building financial resilience, and how can banks achieve this in a tech-driven environment?

Customer-centricity is crucial to understanding and meeting the evolving needs of customers. In a tech-driven environment, banks can employ data-driven insights to tailor services, enhance customer engagement, and build trust. This approach not only strengthens customer relationships but also contributes to the overall financial resilience of the institution.