Credit card debt is widely used by millions of people globally to manage their short term finance needs for the spends. As of June 2024, credit card outstanding in India amounted to nearly Rs 2.7 lakh crore. The rise of digital payments, e-commerce, and increasing consumer spending have made credit cards a popular tool for everyday financial transactions. However, with the increase in credit card usage comes the risk of debt accumulation. Unfortunately, there are many myths and misconceptions about credit card debt that sometimes lead to poor financial decisions.

In this blog post, Credit Card Debt Myths Debunked, we will address the ten common misconceptions and provide practical advice to help you make informed decisions about your finances.

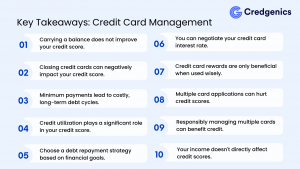

Myth 1: Carrying a balance helps improve your credit score

Why this is a myth

One of the most prevalent myths about credit cards is that carrying a balance from month to month can improve your credit score. Many believe that paying the minimum while keeping a balance shows creditworthiness, but this is entirely false.

The truth

Carrying a balance does not improve your credit score. In fact, it can hurt your finances in the long run due to high-interest charges. The two key factors that influence your credit score are payment history and credit utilization ratio. Paying off your full balance each month positively impacts both of these areas. On-time payments show you are a responsible borrower, and keeping your utilization low (preferably below 30%) reflects good financial management.

Practical advice: Always aim to pay your full balance each month to avoid unnecessary interest charges and maintain a healthy credit score.

Myth 2: Closing a credit card will improve your credit score

Why this is a myth

Many people believe that closing a credit card, especially one they don’t use often, will help their credit score. The assumption is that fewer accounts equal less risk. However, closing a card can actually harm your credit score.

The truth

Closing a credit card can reduce your overall available credit, which can increase your credit utilization ratio. A higher utilization ratio (the percentage of your total credit limit you’re using) can negatively impact your credit score. Additionally, closing older accounts can shorten your credit history, another factor that influences your score.

Practical advice: If you don’t want to use a credit card, it is usually better to keep it open, especially if it has a long history. Consider using it for small recurring expenses and paying them off each month to keep the account active without increasing your debt.

Myth 3: You only need to make the minimum payment

Why this is a myth

Credit card companies often highlight the option to make minimum payments, giving the impression that it’s a sustainable way to manage debt. Some people believe that as long as they pay the minimum, they are avoiding penalties or major financial harm.

The truth

Paying only the minimum is a costly mistake. Minimum payments typically cover just the interest on the balance and a small portion of the principal. This means that the majority of your debt remains unpaid, and interest continues to accumulate. Over time, this can lead to a cycle of debt, where you end up paying significantly more than the original amount borrowed.

Practical advice: Whenever possible, pay more than the minimum to reduce your principal balance faster and avoid excessive interest charges.

Myth 4: Credit utilization doesn’t matter as long as you pay on time

Why this is a myth

Many people believe that if they make timely payments, their credit utilization ratio is irrelevant. However, credit utilization, which measures the percentage of available credit you’re using, is a critical factor in your credit score.

The truth

Credit utilization, which measures how much of your available credit you’re actively using, is a crucial factor in calculating your credit score. According to major credit bureaus, maintaining a credit utilization ratio below 30% is considered optimal. It is the second most influential factor after payment history. Financial experts recommend keeping your utilization under 30% to maintain a healthy credit score, though staying below 10% can be even more beneficial for your creditworthiness.

Practical advice: Monitor your credit card balances regularly and aim to keep your credit utilization low. You can do this by spreading purchases across multiple cards or making early payments to reduce your balances before they are reported to credit bureaus such as CIBIL, Experian, or Equifax India.

Myth 5: All debt repayment strategies are equal

Why this is a myth

When dealing with credit card debt, many people assume that simply paying off any amount each month is enough, or they might not distinguish between different repayment strategies. The reality is, some methods are far more effective than others.

The truth

Not all repayment strategies are created equal. Two popular methods are the debt avalanche and debt snowball methods. The debt avalanche method focuses on paying off high-interest debts first, saving money in interest over time. The debt snowball method targets smaller balances first, providing psychological momentum. Both strategies can work, but choosing the right one depends on your goals—either minimizing interest or gaining quick wins.

Practical advice: If minimizing costs is your priority, the debt avalanche method is likely the best approach. If you need motivational boosts, the debt snowball method may be a better fit.

Related Read: Why the rise in unsecured credit is a concern for the RBI

Myth 6: You can’t negotiate credit card interest rates

Why this is a myth

Many consumers believe that credit card interest rates are set in stone, but this isn’t true. Cardholders often assume that they have no control over the rates they’re charged, especially if they’ve already accumulated debt.

The truth

Credit card interest rates are often negotiable. Many card issuers are willing to lower rates for customers with an excellent payment history or those facing financial hardship. According to a study, around 70% of people who asked for a lower interest rate got it.

Practical advice: If you’ve been a reliable customer, don’t hesitate to call your credit card company and request a lower rate. Be prepared to explain why you deserve it, and consider mentioning competitive offers from other companies.

Myth 7: Credit card rewards are ‘free money’

Why this is a myth

Credit card rewards programs are often marketed as a way to get free flights, cashback, or points for everyday purchases. While it’s true that rewards can be valuable, they are far from “free money.”

The truth

Credit card rewards are only beneficial if you use them wisely. If you carry a balance and pay interest on your purchases, any rewards you earn can easily be wiped out by interest charges. Additionally, some rewards cards come with annual fees, which may exceed the value of the rewards you earn if you don’t use the card frequently.

Practical advice: To truly benefit from credit card rewards, only use the card for purchases you can pay off in full each month. Also, evaluate the card’s fees and rewards structure to ensure that it is a perfect fit for your spending habits.

Myth 8: Applying for multiple credit cards at once is beneficial

Why this is a myth

Some people think that applying for multiple credit cards at the same time is a smart strategy to increase available credit quickly.

The truth

Each time you apply for a new credit card, a hard inquiry is made on your credit report, which can temporarily lower your credit score. Applying for multiple cards in a short period can raise red flags to lenders, signaling that you might be in financial distress or trying to take on too much credit too quickly.

Practical advice: Space out your credit card applications to avoid multiple hard inquiries. Focus on improving your credit score steadily before applying for new cards.

Myth 9: Having too many credit cards hurts your credit score

Why this is a myth

It’s a common belief that owning multiple credit cards automatically lowers your credit score, but this is a misconception.

The truth

The number of credit cards you own doesn’t directly affect your credit score. What matters more is how you manage those accounts. If you keep your balances low, pay your bills on time, and maintain a low credit utilization ratio, having multiple credit cards can actually benefit your credit score by increasing your available credit.

Practical advice: Don’t be afraid of owning multiple cards, but ensure you manage them responsibly. Avoid carrying high balances and make payments on time to keep your score intact.

Myth 10: Your income impacts your credit score

Why this is a myth

Some people assume that their income plays a role in determining their credit score, believing that higher earnings will automatically result in a better score.

The truth

Your income is not a factor in your credit score. Credit scoring models do not take wealth or earnings into account. Instead, your credit score is based on factors such as payment history, amounts owed, length of credit history, new credit, and credit mix.

Practical advice: Focus on factors that truly impact your score—like on-time payments and managing credit utilization—rather than worrying about your income’s influence.

Conclusion: Financial literacy is key

Understanding the facts about credit card debt is essential for maintaining financial health. By examining these credit card myths debunked, we aim to provide clarity and practical advice to help you manage your finances responsibly. Focusing on what truly impacts your credit score and making smart decisions allows you to use credit cards as a tool for financial success rather than falling into debt traps.