Retail lending companies now realize the importance of maximizing efficiency in debt collections. Lenders are working on tailored strategies to address the challenges, which include high cost, delays in repayment, and cumbersome communication methods associated with manual processes. Instead, they are implementing simpler, seamless and efficient debt collections strategies to attain higher productivity and collections rates. By adopting fresh approaches, lenders are successfully nurturing enduring connections with borrowers and cultivating a favourable competitive edge in the market.

What is debt collections?

Debt collections is the process of recovering outstanding instalments on a loan or line of credit from the borrowers. Creditworthy borrowers often repay their loans on time. However, there are instances where borrowers default, sometimes even several days after the due date. The reasons may include:

- Financial crunch due to job loss or other situations

- Lack of awareness about when and how to pay

- Lack of awareness about implications of missing repayments

- Unresolved dispute with lender on repayment

- Broken communication with the lender

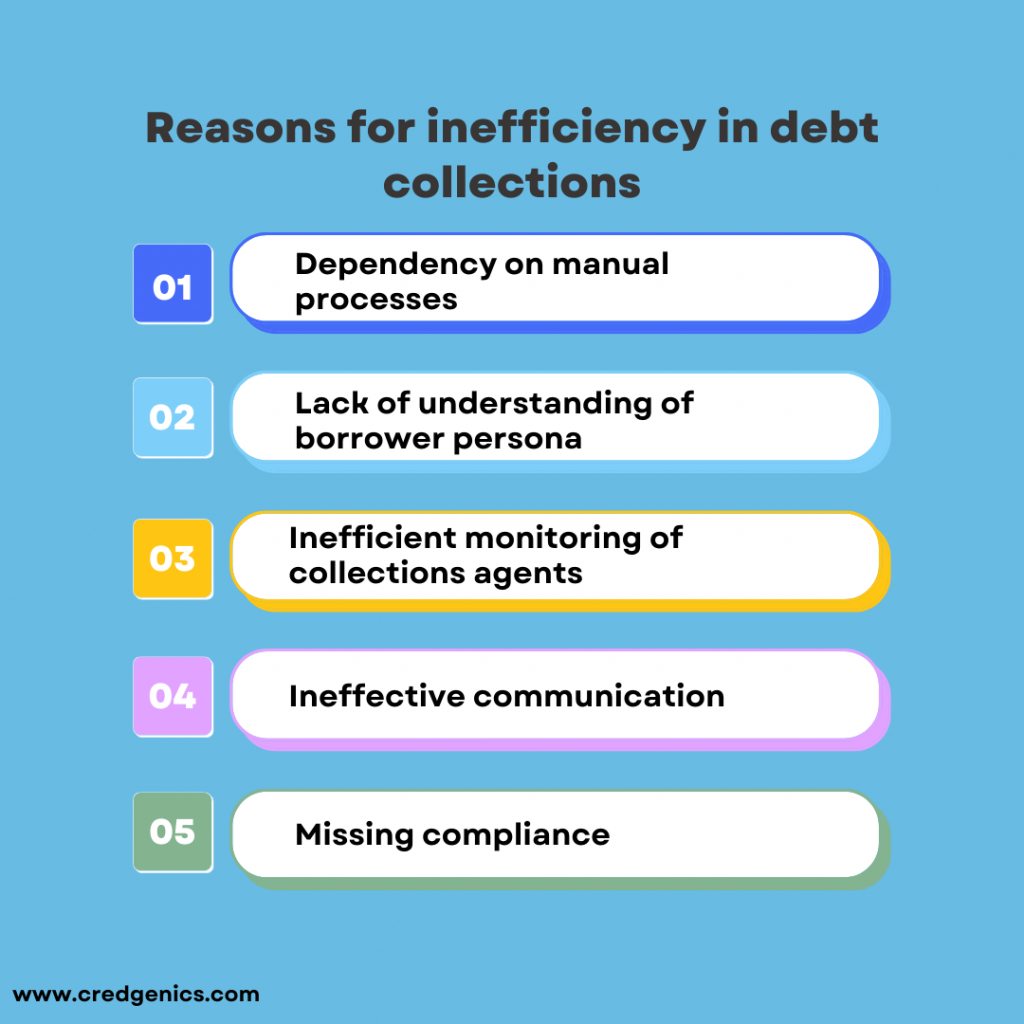

Owing to the large number of delinquent and potentially delinquent borrowers, improving collections efficiency is the primary driving force for lenders. Some of the factors that contribute to the inefficiency of debt collections are:

- Dependency on manual processes: Without any digitization or automation, manual mechanisms fall short of achieving the desired result, leading to a significant fall in collections rates when viewed from a long-term perspective.

- Lack of understanding of borrower persona: This leads to gaps in creating an effective collections strategy that is unique to a borrower. Without analysis of borrower behavior, response patterns over different communication channels, and gaining insight into historical data through technology, lenders cannot accurately evaluate the borrowers’ propensity to pay.

- Inefficient monitoring of collections agents: This leads to lower productivity and faulty reporting. Lack of operational transparency in the field and digital debt collections contribute to complex practices and inefficiencies in collections.

- Ineffective communication: This includes mistimed outreach efforts, which lead to a negative borrower experience and contribute significantly to the volume and magnitude of NPLs. Ineffective communication leads to gaps in implementing debt collections strategies suited to each borrower’s unique persona.

- Missing compliance: Banks and NBFCs must adhere to compliance protocols imposed by the financial regulators. Failure to meet these requirements results in significant penalties. Relying on the human instinct for debt collection strategies increases the likelihood of errors and non-compliance, posing a greater risk to the institutions.

Tips to maximize debt collections efficiency

Lenders must deploy strategies to streamline collections and achieve higher efficiency in debt collections. Let us explore some of the best practices in collections strategies.

- Application of technology: Technology can be used to streamline many touchpoints in the debt collection processes. Automation can help businesses avoid human errors, minimize rework, track payment histories, trigger payment reminders, and escalate non-payment issues. Automated payment reminders, use of voicebots, providing multilingual interfaces can help reduce the workload of collection agents, and real-time data can help businesses identify delinquent accounts quickly.

- Consolidated and accurate records: Keeping track of repayment history and past communication with borrowers is crucial to effective debt collection. Lenders can track defaulting borrowers and take pre-emptive steps to minimize delinquent loan accounts. Having a detailed knowledge of different borrower buckets allows lenders to create a customer-centric mechanism. The accuracy of data also makes it easier to implement automation to segment borrowers as per different parameters.

- Focus on borrower experience: Personalized communication is one way to directly connect with the targeted borrower base. This also helps lenders understand the borrowers’ challenges in repaying, leading to better business relationships. There could be several reasons for delayed loan repayments, but unless lenders take a borrower-focused approach, they will not be able to understand the issue nor find a way to address it.

- Regularity in communication: Lenders should stay in constant touch with borrowers. This is why a non-intrusive approach is necessary to ensure that regularity in outreach does not become overwhelming for the borrower. Friendly reminders can be sent through email or phone calls to remind customers of their outstanding debt. Lenders should also make it easy for borrowers to contact them with any questions or concerns about any aspect of the repayment process.

- Deploying a multi-channel payment approach: Lenders must give borrowers the option to repay their installments through the platform that they are most comfortable with. The communication channel should be tailored to the preference of each borrower. Though many respond to digital media such as emails and calls, some may prefer self-service payment options.

- Leveraging a debt collections software: Not all lenders have the technical expertise to maximize the efficiency of debt collections. Debt collections software and platforms can be used to automate processes and make them transparent. Various advanced capabilities in a debt collections software platform can help lenders improve collection rates, reduce operating costs, and time taken to collect.

Lending institutions must achieve maximum efficiency in the new world of fast-paced and innovative technological advancements. The industry’s once insurmountable challenges associated with faulty mechanisms can now be overcome. This is due to technological advancements, as well as increased financial awareness on the part of borrowers. With the implementation of the aforementioned techniques for increasing efficiency, the debt collection ecosystem will be forever transformed, resulting in the financial services industry’s stabilization and growth.

FAQs:

- How can I maximize my debt collection?

Maximizing debt collections requires a strategic approach and technology powered systems to ensure the highest possible recovery rate. Some tips to maximize debt collections are:

- Prompt reminders: A follow-up policy with polite payment reminders close to the due date is helpful for borrowers. Utilizing technology such as email automation to streamline the process helps maintain regular communication with debtors.

- Offer flexible payment options: Providing flexible payment options helps to accommodate debtors’ financial situations. Offering installment plans or alternative payment arrangements makes it easier for them to fulfill their obligations. This approach increases the likelihood of receiving at least partial payments.

- Maintain open communication: Open lines of communication with debtors helps lenders address any concerns, negotiate payment plans, and offer assistance if they are experiencing financial difficulties. Building a rapport and showing empathy can lead to better cooperation and increased chances of debt recovery.

- Evaluate and improve: Continuous evaluation of debt collection processes and identify areas for improvement. Analyzing the effectiveness of debt collections strategies, identify patterns, and adjust the approach accordingly is important to refine the debt collections efforts over time.

- What are the reasons for inefficiency in debt collections?

A large part of the inefficiency in debt collections processes is due to the heavy dependence on manual processes. Large volumes of NPLs are challenging to segment and classify without automation. Lenders face difficulty gaining insight into borrower profiles as a result. Other impediments, such as inconsistent communication and discrepant monitoring of collections agents, arise from the disconnect between processes and technology. Regulatory protocols pose another challenge since large volumes of NPLs and lack of automation lead to non-compliance across processes.

- What are some of the easy and effective debt collections strategies to maximize efficiency?

A few of the strategies to maximize collections efficiency include:

- Deployment of technology in end-to-end processes: Deployment of technology helps lenders simplify mechanisms, reduce the time taken to collect, and improve collection rates. With the advent of modern debt collections softwares and platforms, lenders now have access to powerful tools that can automate and streamline their operations while providing transparency throughout the process. By leveraging the technological capabilities offered by these software platforms, lenders can significantly improve their collection rates, reduce operating costs, and expedite the time taken to collect debts.

- Use of data analytics: Through the use of data analytics, lenders can correctly collate the data needed to get a clear picture of the delinquent borrowers, their past payment history, responses over different channels, and propensity to pay.

- Digital and personalized communication: A digital communication strategy helps lenders collect debts seamlessly. This is because borrowers prefer to be contacted at their preferred time over their preferred channel of communication. Automation makes it possible for lenders to achieve this goal.