Debt collection has always been a tricky business. An overly aggressive approach can shut out borrowers, while a lenient strategy may lead to payment delays. But what if there was a smarter way—one that taps into the psychology of collections, understands borrower behavior, personalizes outreach, and increases repayments without burning bridges?

Enter the game-changers: AI, data analytics, and behavioral science. No more spam calls or one-size-fits-all reminders. Instead, lenders can now use predictive insights, automated nudges, and psychology-backed engagement strategies rooted in the psychology of collections to make recovery efforts more effective, less stressful, and even borrower-friendly.

This blog breaks down how smart tech and human behavior work together to transform debt recovery. Let’s dive in.

1. The evolution of debt recovery: From traditional to predictive

Traditionally, debt collection relied heavily on manual processes, where agents would contact borrowers through phone calls or letters, urging them to settle their dues. While these methods had their merits, they often lacked personalization and failed to consider individual borrower circumstances – leading to suboptimal recovery rates and strained relationships. Enter advanced analytics and AI.

AI-driven predictive analytics now empowers lenders to:

- Assess default risks in real time by analyzing financial patterns.

- Segment borrowers based on behavioral tendencies, rather than just credit scores.

- Personalize engagement strategies, ensuring each borrower receives the most effective communication and repayment options.

By leveraging these insights, lenders can effectively prevent financial issues and reduce late loan payments.

2. Understanding borrower psychology for better collection strategies

At the heart of effective debt recovery lies a profound understanding of human behavior. Behavioral science delves into the cognitive processes that influence decision-making, offering invaluable insights into how borrowers perceive and respond to debt-related communications. Some key psychological principles in debt recovery include:

Empathy matters – People facing financial struggles, health issues, or personal challenges respond better when they feel understood. A supportive message with flexible repayment options works better than a harsh reminder.

Fear of losing out – Borrowers are more likely to act when they realize they could lose something valuable, like their credit score or financial stability.

Seeing others succeed – When people see others in similar situations successfully paying off debts, it encourages them to take action.

Making choices easy – Giving borrowers simple and structured repayment options reduces stress and makes it easier for them to commit.

Right message, right time – The way and timing of communication matter. Some borrowers prefer texts or emails, while others respond better to phone calls. Reaching them in their preferred way increases engagement.

Gentle reminders work – Small nudges like friendly texts, emails, or app notifications can encourage repayment without making borrowers feel pressured.

3. Multi-channel engagement: Meeting borrowers where they are

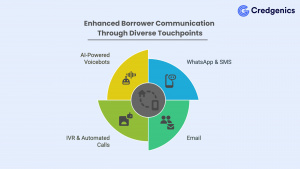

In the digital age, borrowers interact across various platforms—be it SMS, email, Voicebots, WhatsApp, or Interactive Voice Response (IVR) systems. A multi-channel engagement strategy ensures that lenders can connect with borrowers through their preferred communication mediums, which enhances the effectiveness of outreach efforts.

Diverse Touchpoints for Seamless Borrower Communication:

- WhatsApp & SMS – Quick, interactive, and highly engaging, ensuring borrowers see and respond to messages promptly.

- Email – Useful for detailed repayment plans, invoices, and formal communication.

- IVR & Automated Calls – Ideal for reminders, payment confirmations, and simple self-service interactions.

- AI-Powered Voicebots – Streamlining debt recovery through automation of routine tasks like payment reminders, data collection, and account updates.

- Mobile Apps & Portals – Providing self-service options enhances convenience and empowers borrowers to manage their repayment plans on their own.

For instance, younger demographics might be more responsive to WhatsApp messages, while others might prefer traditional emails or SMS. By analyzing data on borrower preferences and behaviors, lenders can determine the optimal channels for communication, ensuring messages are not only received but also acted upon.

Furthermore, integrating AI-driven voicebots into these channels can provide real-time assistance, answer common queries, and guide borrowers through the repayment process. This approach offers a seamless and supportive experience.

Related Read: The Role of Generative AI in Customer Communication for Loan Collections

4. The power of predictive analytics & machine learning

Predictive analytics and machine learning (ML) are transforming debt recovery by making them more proactive and efficient. By analyzing historical data, these technologies can identify patterns and trends that signal potential defaults or delinquencies. Here’s how AI and ML is transforming the process:

- Delinquency prediction – AI models analyze borrower data to predict potential defaults before they happen.

- Personalized repayment plans – Machine learning suggests customized repayment plans based on past behavior and financial health.

- Automated decision-making – AI prioritizes cases and automatically recommends the best recovery actions.

- Dynamic strategy optimization – AI continuously refines collection strategies by analyzing response rates and borrower engagement levels.

For example, if a borrower has a history of late payments during certain periods (e.g., post-holiday seasons), predictive models can flag these accounts for preemptive action. Lenders can then reach out with tailored reminders or offer customized repayment plans before the borrower falls behind, which helps in mitigating risks and fostering trust.

Additionally, machine learning algorithms can continuously learn and adapt from new data to refine their predictions over time. This dynamic capability ensures that debt recovery strategies remain agile and responsive to changing borrower behaviors and economic conditions.

Conclusion: The future of smarter debt collections

The integration of AI, data analytics, and behavioral science in collections is ushering in a new era of debt recovery—one that is efficient, personalized, and empathetic. By leveraging these technologies, lenders can not only enhance their recovery rates but also build lasting relationships with borrowers, grounded in understanding and trust.

As the financial landscape continues to evolve, embracing these innovative strategies will be crucial for institutions aiming to stay ahead of the curve and meet the diverse needs of their borrowers.

The Credgenics advantage: Integrating technology with empathy

Platforms like Credgenics exemplify the seamless integration of AI, behavioral science, and data analytics in debt recovery. By offering a comprehensive suite of tools—from digital collections and multi-channel communications to litigation management and analytics—Credgenics empowers lenders to adopt a holistic approach to debt recovery.

Moreover, Credgenics’ emphasis on empathetic communication ensures that interactions are borrower-centric, fostering positive relationships and preserving brand reputation. By acknowledging the human aspect of debt recovery, Credgenics helps lenders navigate the delicate balance between efficiency and empathy.

FAQs: The Psychology of Collections, Behavioral Science & Data Analytics in Debt Recovery

1. What is the psychology of collections and why is it important in debt recovery?

The psychology of collections refers to understanding the cognitive and emotional behaviors of borrowers during the debt recovery process. By applying behavioral science principles, lenders can personalize communication, foster trust, and encourage timely repayments. This borrower-centric approach not only improves recovery rates but also helps maintain positive relationships without aggressive tactics.

2. How do AI and Data Analytics improve debt collections?

AI and Data Analytics in Debt Recovery enhance the psychology of collections by analyzing borrower data and predicting behavioral patterns. These insights allow lenders to create tailored repayment plans, segment borrowers effectively, and communicate via preferred channels. Predictive analytics ensures that outreach is empathetic, timely, and aligned with each borrower’s financial situation.

3. What are the key types of data collection in psychology used for debt recovery strategies?

In the context of debt recovery, common types of data collection in psychology include observational data (borrower behavior patterns), self-reported data (borrower feedback or surveys), and transactional data (payment histories). By combining these data types, lenders gain deeper psychological insights, which enables them to craft personalized and effective debt collection strategies.

4. How does behavioral science in collections influence borrower engagement?

Behavioral science in collections leverages psychological principles like empathy, loss aversion, social proof, and choice architecture. These tactics help lenders design communications that resonate with borrowers, reduce repayment anxiety, and increase the likelihood of successful debt resolution. Nudges such as friendly reminders and flexible payment options encourage positive borrower responses.

5. What role do multi-channel engagement and AI-driven voicebots play in the psychology of collections?

Multi-channel engagement and AI-driven voicebots play a crucial role in enhancing the psychology of collections. They ensure borrowers are reached via their preferred communication platforms—SMS, email, WhatsApp, or IVR—making interactions convenient and borrower-friendly. Voicebots automate routine tasks while providing empathetic assistance, fostering a supportive and efficient debt recovery process.