Debt collection practices that were associated primarily with aggression, stress, fear, and frustration are slowly undergoing transformation. Banks and other non-banking financial services companies are gradually shifting away from the conventional and transactional approaches that were used solely for the purpose of debt recovery. Instead, they are now embracing a more compassionate and humane debt collections approach that places a high value on empathy, building strong customer relationships, and aligning with borrowers’ expectations.

The fintech industry has grown rapidly due to a number of factors, including widespread smartphone use, high internet penetration, the ease of digital payments, seamless data sharing, long-term initiatives to promote financial inclusion, and the rising demand for simpler access to financial services. This transformation is characterized by an ongoing effort to elevate the quality of interactions between lenders and borrowers.

The Reserve Bank of India (RBI) has also taken proactive measures to establish robust regulatory frameworks in related areas. These measures involve the introduction of comprehensive guidelines for digital lending and other fintech focused areas. These guidelines are thoughtfully designed to align with broader objectives, which encompass leveraging the substantial $1.3 trillion fintech opportunity in India while safeguarding the best interests of customers.

Elements of a human-centric debt collections mechanism

- Understanding the psychological impact of debt and formulating mechanisms that prioritize borrowers: Before drawing up a human-centered debt collections strategy, it is important to understand the impact of debt on businesses and individuals. Acknowledging that the burden of unmanaged debt triggers an emotional impact can go a long way in increasing the volume of collections. Lenders should be able to listen with empathy and understand the financial challenges that result in unpaid debt. Then, a combination of strategies can help lenders adopt a humane debt collections approach. These include engaging in open and honest conversations and aiming to find a solution that maintains the dignity and respect of the borrowers while fulfilling the business requirements. Research shows that 66% of respondents are more loyal to businesses that demonstrate empathy when they are in the midst of financial adversity.

Subsequently, lenders may use data and technology to elevate the efficiency, ease of use, and overall user experience of various processes and systems. Its cutting-edge capabilities represent a vast reservoir of opportunities for the financial services sector. These capabilities are instrumental in dismantling barriers, equipping teams with the right tools, enabling insights driven decision-making across different tiers, promoting transparency, standardizing operations, and fueling innovation.

2. Creating end-to-end digital-first borrower journeys: As customers increasingly embrace digital banking, it becomes imperative for lenders to maximize the use of digital resources. However, this extends beyond limited interventions like emails and texts; it necessitates the development of a comprehensive and customer-centric collections strategy with digital enablement as its cornerstone. This implies a shift towards adopting a “digital-first” approach at every stage of the customer journey, complemented by the availability of contact centers and personalized interactions.

A central goal of implementing digital frameworks should be to promote greater self-service capabilities. In cases where local regulations permit, digital prompts via SMS or WhatsApp prove to be less intrusive and cost-effective compared to voice calls. Moreover, digital-first solutions facilitate customized messaging tailored to individual preferences, offering an opportunity to establish feedback loops for continuous refinement, even at a microsegment level.

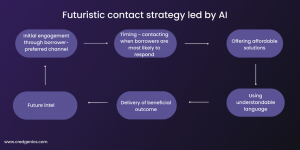

3. Decision-making through advanced analytics and machine learning: To establish a customer-first approach, harnessing the power of advanced analytics driven by AI is paramount. This approach empowers lenders to strategically manage risk at critical junctures of customer support and optimize outcomes, benefiting both clients and the business. The foundational elements for successful large-scale implementation encompass swift model development and recalibration cycles, adaptable open-architecture tools and methodologies, a robust repository of internal and external data sources, and an essential talent pool capable of developing applications and effectively translating advanced analytics into practical business solutions.

Data is the lynchpin of efficient analytics, driving lenders to improve their models with new data sources and alternative risk indicators. This entails augmenting traditional metrics, such as loan characteristics, with insights into customer behavior, spending patterns, and anticipated responses. The overarching objective is to construct a comprehensive 360-degree customer profile. These insights can then be continuously integrated into models through reinforcement learning, ultimately leading to more efficient and tailored communications.

4. Mitigating the risk of fraud for enhanced security: Banks and lending institutions grapple with challenges including credit fraud, data discrepancies, erroneous entries, and technical glitches. However, the emergence of intelligent systems, enhanced data analysis capabilities, seamless API integrations, and automation enhancements have simplified the resolution of these hurdles. A multitude of data sources are now accessible for verification, ensuring precision and diminishing the risks associated with fraud and inaccuracies.

In the realm of debt collections, technological advancements play a pivotal role in reducing the likelihood of fraud while streamlining operations, particularly in field collections. By embracing the digitization of the entire process, complete transparency in transactions is achieved. Embedded checks are integrated at each stage of debt collections, enabling real-time tracking of agents, geo-fencing measures, and the instantaneous issuance of digital receipts. These measures collectively contribute to a notably improved customer experience while enhancing the security and efficiency of debt collection operations.

5. Providing tailored experiences: Borrowers today expect their lenders to show a deep understanding of their lifestyles, digital inclinations, and financial requirements. They look to lenders as trusted financial advisors who possess technological prowess and can engage with them in real-time, seamlessly integrating financial interactions into their daily routines, regardless of the time and place they choose. This shift in customer preferences has given rise to trends like embedded finance, ubiquitous access to financial services, super-apps, and the popularity of Buy Now, Pay Later (BNPL) services. The ascent of FinTech and digital lenders can be attributed to the demand for expeditious, uncomplicated, and user-centric service experiences. When applied to the principle of debt collections, these technological advancements have ushered in a transformation in customer engagements, rendering them more pertinent, efficient, and productive.

Through the utilization of technology, lenders can now connect with borrowers via their preferred communication channels at preferred intervals and timings, employing their language of choice, while furnishing precise information pertaining to their accounts and transactions. Borrowers highly value this more individualized level of service because it not only saves them time but also takes care of any inconveniences, greatly streamlining the resolution procedure.

The road ahead

The task of evolving the collections function into a comprehensive customer-assistance capability is substantial, especially in the light of focus on driving up efficiencies at lower costs. However, failing to embark on this transformation could result in collections falling short of expectations over time and exposing lenders to inherent risks.

The encouraging news is that early victories can be achieved, progressively generating efficiencies that not only cover the initial investment but ultimately surpass it. Additionally, there is no immediate need to define a final target state at the outset of this journey. Given the rapidly evolving landscape, it is more practical to cultivate adaptable capabilities that can evolve over time.

Many institutions won’t be starting their collections transformation from scratch. In fact, numerous organizations have already initiated data and analytics transformations as part of their customer acquisition strategies. These initiatives offer valuable insights, aiding in decisions such as whether to acquire or develop the necessary capabilities. Above all, decision-makers must seize the opportunity and take decisive actions across the entire collections spectrum. To accomplish this, assembling a cross-functional team of experts is essential.

For lenders that successfully navigate this transformation, the potential benefits are substantial. They include optimized collections precisely when economic conditions are critical, more responsive customer service, enhanced long-term customer loyalty, decreased compliance risk, and the assurance of keeping pace with more ambitious peers in the financial landscape.

If you are looking to transform your debt collections strategy with the power of digital and data-powered insights, reach out to us to request an exploratory session at sales@credgenics.com or visit us at www.credgenics.com

FAQs:

1) How does a humane debt collections approach differ from traditional methods of collecting debt?

Human-centric debt collection is an approach that places a strong emphasis on empathy, understanding, and personalized communication when recovering debts from individuals. Unlike traditional methods that often rely on aggressive tactics, humane debt collections approach prioritizes respectful and customer-focused interactions. It aims to build trust, offer assistance, and work collaboratively with borrowers to find mutually beneficial solutions.

2) How can lenders in India implement human-centric debt collections strategies effectively?

Implementing human-centric strategies in the debt collection procedure in India involves several key steps. Lenders should begin by training their collections teams to prioritize empathy and active listening. They should also invest in technology that allows for personalized and automated communication with borrowers. Additionally, adopting data-driven insights can help tailor repayment plans to individual financial circumstances. Regular customer feedback and continuous improvement are vital for the successful implementation of these strategies.

3) What are the regulatory considerations for humane debt collections processes in India?

The Reserve Bank of India’s guidelines and the Fair Practices Code, among other regulations, govern how debt is collected in India. Lenders must ensure compliance with these regulations when adopting human-centric approaches. It’s crucial to respect borrower rights, maintain transparency in communications, and adhere to ethical practices. Staying updated on any changes in regulations and seeking legal guidance when needed is essential to ensuring compliance and avoiding legal issues in debt collection efforts.