A debt instrument is any fixed-income asset that allows the lender (or giver) to earn a fixed interest along with the principal amount while allowing the issuer (or taker) to raise funds at a cost. Debt market instruments act as a legal obligation on the issuer, who must repay the borrowed sum along with interest in a timely manner. Some common instruments of money market include debentures, bonds, government securities (G-Secs), fixed deposits (FDs), and mortgages.

The instruments of money market are available both in physical and electronic form. The oldest and largest element of the Indian debt market instruments is Government Securities (G-Secs). These instruments play a crucial role in determining the interest rates in the country and are considered risk-free investments.

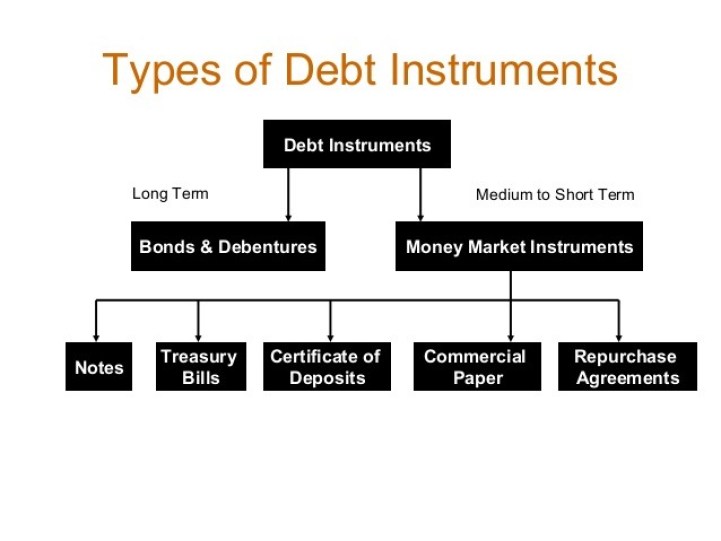

Types of Debt Market Instruments

-

Debentures

are certificates of agreement of loans issued under a company’s stamp, ensuring the lender receives fixed returns based on a predetermined interest rate. These debt market instruments are generally long-term and commonly used by governments and large companies to raise funds. Since debentures are unsecured, they do not put a burden on the issuer’s assets.2. Bonds

A bond is an IOU in which an investor lends money to a company or government in exchange for a predetermined interest rate. These are one of the most commonly used instruments of money market, ensuring fixed returns to investors. Examples include government bonds, corporate bonds, municipal bonds, and institutional bonds.

3. Government Securities (G-Secs)

G-Secs are the most secure debt instruments issued by the Reserve Bank of India (RBI) on behalf of the Government of India. These instruments of money market have zero default risk since they carry a sovereign guarantee. They are highly liquid and can be traded in the secondary market. G-Secs have maturities ranging from 2 to 30 years.

4. Fixed Deposits (FDs)

Fixed Deposits (FDs) are one of the safest debt instruments where money is deposited in a bank for a specific duration at a fixed interest rate. These instruments of money market are highly liquid, allowing premature withdrawals with a penalty. FDs offer guaranteed returns, making them a popular investment option despite lower returns compared to other financial instruments.

5. Mortgages

A mortgage is a long-term loan secured against real estate property. It is a type of debt instrument where the borrower repays the loan over a predetermined period. Failure to pay may result in foreclosure, where the lender can seize and sell the property to recover the loan amount. The most common mortgages are 15-year fixed and 30-year fixed mortgages.

Recommeded Read: Analysis of Section 138 Negotiable Instrument Act

Conclusion

Debt market instruments play a crucial role in the financial system, helping businesses and governments raise funds while offering stable returns to investors. Some instruments of money market, like G-Secs and FDs, provide low-risk options, whereas corporate bonds and debentures offer higher returns for moderate risk-takers. A well-balanced portfolio with a mix of debt instruments and equity can help maximize financial security and long-term growth.

FAQ’s on Debt Market Instruments

1. What is a Debt Instrument?

Debt instruments act as a legal obligation for the borrower to repay the borrowed sum along with interest within a specified time. Lenders earn fixed returns, making these instruments a popular choice for investors seeking stability.

2. What are the types of debt instruments?

Common types include:

Debentures – Unsecured long-term corporate loans

Bonds – Loans issued by corporations or governments

Government Securities (G-Secs) – Risk-free securities issued by the government

Fixed Deposits (FDs) – Bank deposits with fixed returns

Mortgages – Loans secured against real estate property

3. Why are Government Securities (G-Secs) considered risk-free?

G-Secs carry a sovereign guarantee from the government, ensuring no default risk. They are highly liquid and can be traded in the secondary market, making them one of the safest investment options.

4. How do bonds differ from debentures?

While both are debt instruments, bonds are typically secured and may have a collateral backing, whereas debentures are unsecured and rely solely on the issuer’s creditworthiness.

5. What is the difference between short-term and long-term debt instruments?

Short-term debt instruments: Must be repaid within a year (e.g., treasury notes, credit card bills).

Long-term debt instruments: Have a repayment period of more than a year (e.g., mortgages, long-term loans).

By: Sparsh Duggal