Easy access to formal credit has been a challenge for a section of the population due to a variety of reasons. India’s expansive and diverse demographic landscape, complicated loan application procedures, inflexible qualification norms, dependency on physical setups etc. have limited the access to credit. However, the growing popularity of digital lending has initiated a transformative wave that is increasing financial inclusion and providing individuals and businesses with the requisite financial support.

Technology is the key driving force behind this rapid transition. From robust mobile applications to intuitive online portals, digital lending platforms have harnessed the power of technology to streamline the lending process, making it faster, more efficient, and highly accessible. With the emergence of versatile platforms, digitally integrated ecosystems and agile processes adopted by fintech firms, instant loan approvals and credit disbursal have become possible. Digital lending platforms eliminate the dependency on physical branches, allowing borrowers to access loans easily, regardless of their geographical location. Bringing the underbanked into the banking fold has brought the country closer to the vision of Digital India.

How does digital lending work?

Digital lending in India has simplified the loan application process, offering convenience and speed. With a few clicks, borrowers can apply online, submit the necessary documents, and receive loan approval within hours. Once approved, the loan amount is swiftly transferred directly into the borrower’s bank account in a day or two.

Fintech companies leverage real-time data from multiple unconventional sources to effectively assess credit worthiness and underwrite loans efficiently. By analyzing digital buying behavior, they provide credit-based payment options like BNPL or EMI products, thereby revolutionizing purchase transactions. These companies significantly reduce the time required for loan approval by using customers’ financial and transactional data through an API-driven approach that is comprehensive, more proactive and user friendly.

The result is a seamless and convenient borrowing experience that eliminates obstacles and process inefficiencies associated with offline loans.

Digital lending in India

With millennials more in need for finance, the demand for digital lending platforms has never been greater. Fintech startups and NBFCs are catering to the growth building up in recent years. They are revolutionizing the lending sector by leveraging cutting-edge technology to provide quick, accessible, and convenient loan services, transforming how people access credit in India. As per a PwC report, the digital lending market in India will grow by 48% by 2023 and is expected to reach $1.3 trillion by 2030.

Consumers are now increasingly in need of small-sized short-term loans, further supporting the growth in digital lending. The industry players continue to innovate to align with new digital lending guidelines, ensuring they meet the evolving needs of borrowers. The use of alternative data is emerging as another prominent trend as lenders leverage diverse data sources to make more informed and data-driven lending decisions.

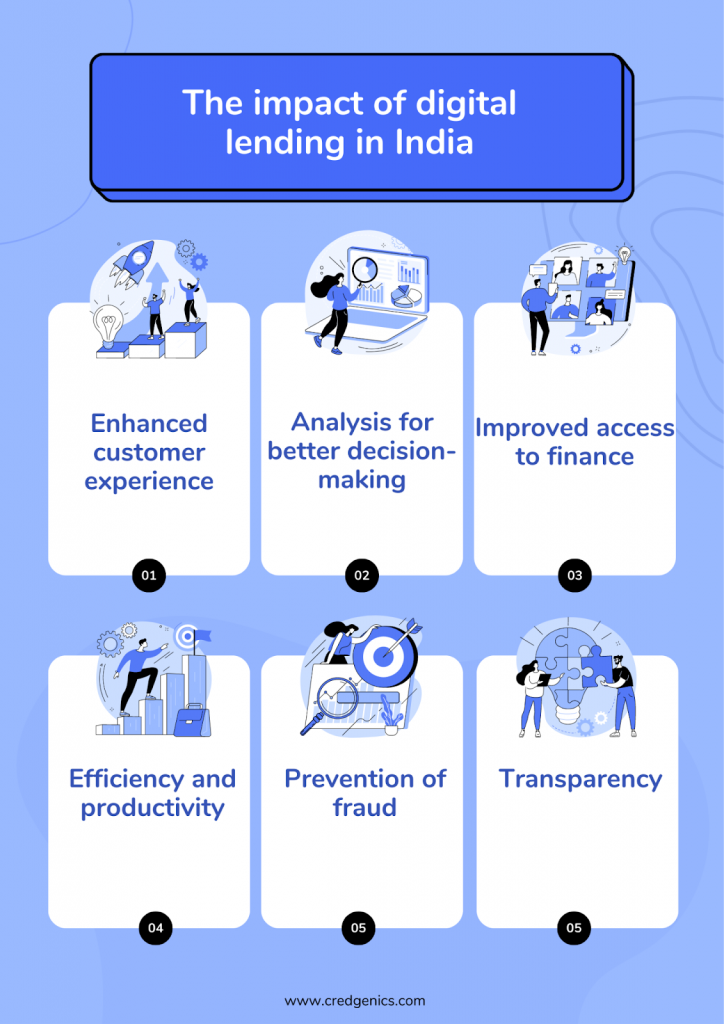

Let us look at some of the ways in which digital lending is impacting lenders, borrowers, and the finance industry at large.

- Enhanced customer experience: One of the most significant changes brought about by digital lending is the simplification of loan processes. Aside from the ease of getting loans, borrowers can customize their loan tenure and repayment amount plan to suit their requirements. Even after the disbursal, AI-enabled 24/7 support and personalized communication strategies further drive borrower satisfaction and engagement. Consolidating borrower information empowers lenders to standardize credit decision making and audit tracking. By digitizing and consolidating customer information, transparency is improved, bottlenecks are reduced, and a superior lending experience is delivered to all stakeholders involved.

- Data driven analysis for decision making: To enhance lending processes, financial institutions are embracing data analytics supported by digital transformation. The challenge of inconsistent estimates and assessments, which often result in faulty calculations, incorrect credit decisions, and inaccurate reporting can be better addressed with data. Integrating a digital lending system within a digital banking platform allows each loan product to undergo swift and precise analysis, approval, and pricing. Digitization allows lenders to gather valuable data points, resulting in insights that support portfolio risk assessment and informed decisions.

- Improved access to finance: Digital lending fintech players are transforming the lending landscape by making financial products accessible to millions of people in an easy and affordable manner. Members of the underserved population are able to access loans from formal credit institutions to actualize their idea for a business, a house, or more needs.

- Enhanced efficiency and productivity: Automated solutions are crucial for firms aiming for efficient, streamlined processes. Lending institutions can go paperless, reduce man hours spent in operations, optimize costs, and accomplish much more owing to digital lending. AI is helping fintech firms understand data and reduce errors. Employee productivity is improving due to communication and collaboration, freeing up employees for more critical tasks. Technologies are also helping lenders cater to demands faster, drive agility, and enhance the experience.

- Mitigation of fraudulent practices: Digital lending is helping mitigate one of the biggest concerns in the Indian financial services industry – the risk of fraud, the occurrence of which, not only impacts a business financially but also affects its reputation in the market. Technology enables lenders to adopt new ways to check frauds, stay ahead of fraudsters by detecting and preventing suspicious activity.

- Offering transparency and convenience: Digital lending ensures that borrowers know upfront what amount they are receiving and how much it will cost them. There are no hidden charges, and therefore there is greater trust in fintech firms. Lenders are becoming accountable to borrowers, ensuring that compliance requirements and regulations are met.

A comparison with traditional lending

Key differences between digital and traditional lending are highlighted in the table below.

| Parameter | Digital lending | Traditional lending |

| Speed | Faster and instant approvals in some cases | Applications and approvals takes longer to process and disburse |

| Process | Completely online | In-person applications and lot of paperwork |

| Borrower experience | Convenient, accessible, and personalized | Physical customer presence is required in the branch, which limits access and hampers experiences |

| Risk assessment | Relying more on technology to assess credit risk | Reliance on checks by loans officers, documents, manual underwriting processes |

| Repayment terms | Flexible and customizable depending on the nature, value and tenure of credit | Less flexible |

| Credit amount | Usually a smaller value | Can range from small to high values |

| Credit requirements | May consider alternative data points / parameters other than formal sources of credit worthiness | Emphasis is on formal sources of credit worthiness such as income, account statements, credit score and borrowing history |

The way forward

Digital lending has emerged as a game-changer, revolutionizing the financial landscape of India. By leveraging technology, data analytics, and inclusive practices, digital lending platforms are breaking barriers and providing access to credit for individuals and businesses nationwide. As this transformation gains momentum and more disruptive technologies emerge, it will empower millions by outperforming the traditional lending model, stimulating economic growth, and propelling India toward a more inclusive and prosperous future.

FAQs:

- What are the benefits of digital lending?

Digital lending presents a hassle-free, cost-effective, and efficient approach to accessing loans. Digital lending offers numerous advantages compared to traditional loan options. It provides a swift and convenient loan application process, enabling borrowers to apply online without needing to make physical visits to banks or financial institutions. Moreover, digital lenders often offer lower interest rates, making loans more affordable for borrowers. Once approved, the loan amount is disbursed directly into the borrower’s bank account.

- How secure is digital lending?

Digital lending platforms prioritize the security of user information and financial data by implementing robust encryption and other advanced security measures. Many platforms are regulated by government entities and adhere to rigorous security standards. However, it remains crucial for borrowers to exercise caution and share personal information exclusively with reputable and trustworthy lenders, ensuring the highest level of data privacy and protection.

- What is the documentation required for digital lending?

While specific document requirements for digital lending can vary among lenders, there are typically common prerequisites. These commonly include identification proof such as PAN or Aadhaar cards and income proof like bank statements or salary slips. Additionally, lenders may request other essential documents, such as employment details and address proof, to complete the loan application process.