The traditional banking ecosystem in India is heavily reliant on paper-based documentation for various processes such as account opening, lending, and record-keeping. Many interactions are associated with necessitated in-person visits, inflexible routines, and lengthy wait times. As a result of a shift towards the digital engagement model and the need to prioritise time management, people are gradually transitioning toward self-service channels, leading to a digital revolution in banking sector.

Conversational banking is an emerging trend that supports this flexibility, helping banks in interacting with customers and providing personalized recommendations on various banking services. To facilitate faster query resolution and access to banking information, chatbots are becoming popular and driving the digital revolution in banking sector. Currently, North America is considered the biggest chatbot market. Meanwhile, Asia-Pacific as a chatbot market is also growing fast due to the focus shown by many startups.

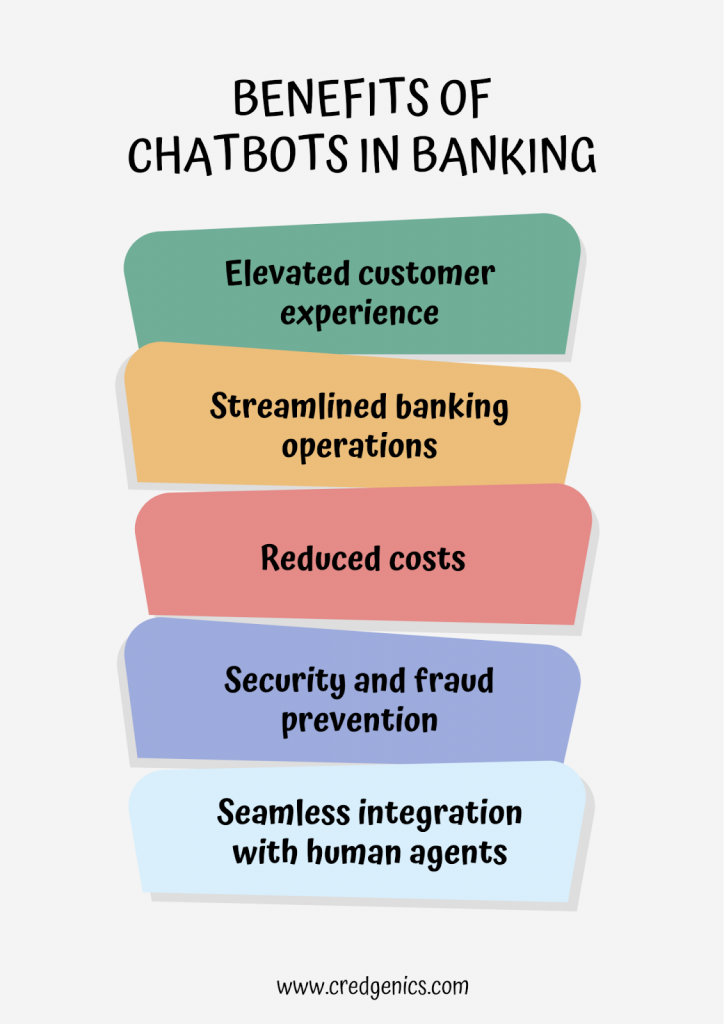

Benefits of chatbots in banking industry

Powered by Artificial Intelligence, chatbots are reshaping how customers engage with banks. They are facilitating communication that is both two-way and non-intrusive at the same time. Moreover, having access to self-service channels gives customers the independence to resolve queries through a frictionless mechanism. Leading banks in India are deploying chatbots across various channels, including websites, mobile applications, and messaging platforms. As per a report, India is among the top countries with chatbot users at 11%. Like virtual assistants, chatbots are 24/7 support platforms, helping simplify legacy processes, and making banking more accessible in a fast-paced digital environment.

Some of these benefits are explained below.

- Elevated customer experience: One of the key advantages of chatbots in the banking sector is their ability to deliver personalized and efficient customer experiences. Chatbots can provide tailored recommendations and financial advice by analyzing customer data and transaction history. For instance, a chatbot can suggest suitable investment options based on the customer’s risk appetite and financial goals. Moreover, chatbots eliminate customers’ need to navigate complex websites or wait in long phone queues. With a simple chat interface, customers can access information instantly, saving time and effort. Chatbots also offer multilingual support, catering to customers from diverse backgrounds and improving accessibility.

- Streamlined banking operations: Chatbots assist customers by acting as personal financial assistants. Moreover, they assist customers by sending pending payment reminders and automating scheduled payments, ensuring timely financial management. With chatbots as personal financial assistants, banking experiences become more efficient and customer-centric.

In addition to their advisory role, banking chatbots streamline various time-consuming processes. They eliminate the need for time-consuming and extensive paperwork by simplifying tasks such as opening bank accounts, providing balance information, facilitating simple transactions, offering debit and credit card reports, and granting access to specific bank details.

By offering these comprehensive services, chatbots enhance the efficiency and appeal of banking for all customers. They provide quick and accurate information, handle routine tasks promptly, and offer a convenient and accessible channel for customers to manage their finances effectively.

- Reduced costs: Chatbots contribute significantly to reducing operational costs since deploying human resources is more expensive. Moreover, bots can handle multiple chats simultaneously, leading to a higher ROI.

- Security and fraud prevention: Concerns about security and fraud are paramount when it comes to digitalization in the banking sector. However, chatbots are designed with robust security measures in place. They can authenticate users, verify transactions, and detect potential fraud based on patterns and anomalies. By leveraging machine learning algorithms, chatbots continuously learn from customer interactions and become more adept at identifying suspicious activities, providing additional protection.

- Seamless integration with existing systems: While chatbots excel at handling routine tasks and providing quick responses, they also work in conjunction with human agents to handle more complex scenarios. Chatbots seamlessly transfer the conversation to a human agent when a customer requires personalized assistance or faces a unique situation. This integration ensures a smooth handover, enabling customers to receive specialized support without disruptions.

The uses of chatbots in banking industry

Top private sector banks in India, such as HDFC Bank, Axis Bank, and ICICI Bank, are leveraging chatbots for many customer service-related processes. Some of the present use cases of chatbots in the banking industry are:

- Lead generation: Chatbots can collate customer data from the initial conversation and build on subsequent ones by using the acquired information for a conversational advantage. By understanding the demographics, banking chatbots can use tailor-made interactions to reach new customers directly.

- 24/7 customer support: AI chatbots use Natural Language Processing to understand customer queries using specific keywords and answer accordingly. Automating FAQs and replies via chatbots, banks can make themselves available 24/7 for customer queries as they come, especially when queries are repetitive.

- Push notifications: Chatbots can help send timely notifications like payment reminders, bank offers, new products, and more. Customers can be notified directly about the preferred communication channels, and a rapport can be established between the customer and the bank.

- Financial advice: AI-powered financial services chatbots can be used as virtual financial advisory assistants. Chatbots can offer tailored financial advice and guide customers to develop a habit toward financial planning and protection.

- Customer feedback: Chatbots can be used to reach out to customers and collect their reviews and feedback in conversation. This information can be used to improve customer service experiences and create longer lasting relationships with customers.

The potential of chatbots in the banking sector extends beyond customer service. Banks are exploring innovative use cases such as personalized financial planning, automated loan approvals, and voice-enabled banking. With the ability to simplify complex banking processes, provide round-the-clock support, and advancements in NLP and ML, chatbots will continue to evolve, providing more sophisticated services to customers, and an unprecedented digital revolution in banking sector.

FAQs:

- How are chatbots impacting banking?

Chatbots are having a significant impact on the banking industry. They are transforming customer experiences by providing 24/7 support, personalized assistance, and quick access to information. Chatbots automate routine tasks such as balance inquiries, fund transfers, and account management, improving efficiency and reducing response times. They also enhance security measures by monitoring transactions and detecting fraudulent activities in real-time. Moreover, chatbots play a vital role in lead generation by collecting customer data and providing tailored recommendations. Overall, chatbots are revolutionizing banking by streamlining processes, increasing customer engagement, and improving operational efficiency.

- What are the benefits of banking chatbot?

Banking chatbots offer several benefits.

- Enhanced Customer Experience: Chatbots provide instant and personalized assistance, offering a seamless customer experience. They can answer queries, provide account information, and offer financial advice, all in real-time, improving customer satisfaction and engagement.

- 24/7 Availability and scope for self service: Chatbots are available round-the-clock, enabling customers to access banking services and support at any time. This flexibility creates a self-service platform that ensures convenience and eliminates the limitations of traditional banking hours.

- Improved Efficiency: Chatbots automate routine tasks, such as balance inquiries, fund transfers, and bill payments, reducing the need for manual intervention. This improves efficiency, speeds up processes, and frees up human agents to focus on more complex customer needs.

- Cost Savings: By automating processes and reducing the reliance on human agents, banking chatbots can lead to cost savings for financial institutions. They can simultaneously handle a large volume of customer inquiries, minimizing the need for additional staffing.

- Personalization: Chatbots leverage customer data to offer personalized recommendations and financial advice. They can analyze transaction history, preferences, and market trends to provide tailored solutions, enhancing the customer’s banking experience.

- Enhanced Security: Chatbots contribute to enhanced security by monitoring transactions in real-time and detecting suspicious activities. They can raise alerts and provide security tips, helping customers protect their financial information.

- What are the potential use cases for chatbots in banking industry?

Chatbots have several use cases in the banking industry. Some of these are:

- Customer Support: Chatbots can handle customer inquiries, provide account information, assist with transactions, and address frequently asked questions. They offer 24/7 support, reducing the need for human agents and ensuring prompt responses.

- Account Management: Chatbots enable customers to check their account balances, review transaction history, and manage account settings. They can also assist with tasks such as updating personal information or requesting new loans or cards.

- Financial Advice: Chatbots can offer personalized financial advice based on customer profiles, transaction history, and financial goals. They can provide recommendations on investment options, savings strategies, and suitable banking products.

- Loan Applications and Mortgage Assistance: Chatbots can assist customers in applying for loans, providing information on eligibility criteria, required documentation, and repayment terms. They can also offer mortgage assistance, guiding customers through the application and approval process.

- Product Information and Cross-selling: Chatbots serve as virtual assistants, providing information about banking products, features, and benefits. They can suggest relevant products based on customer needs, driving cross-selling and upselling opportunities.

- Fraud Detection and Security: Chatbots contribute to fraud prevention by monitoring transactions, detecting suspicious activities, and raising alerts. They can educate customers about security best practices and provide tips for protecting their financial information.