Microfinance companies have always been a cornerstone for financial inclusion, serving millions of underserved people worldwide. However, in an era where technology is reshaping every sector, digitalizing loan collections is becoming essential for sustainable operations. For microfinance institutions (MFIs), digitalizing loan collections is an absolute necessity. Let’s explore why this shift is crucial and how platforms like Credgenics are leading the transformation.

The challenges of traditional collection methods in microfinance

Catering primarily to underserved segments, microfinance institutions often extend small-ticket loans to individuals and SMEs. However, conventional collection models come with several critical limitations, which directly affect collection rates, profitability, and compliance—all essential pillars of an MFI’s success.

1. Manual Processes & Paperwork: Field collectors relying on physical documentation increase the risk of errors, delays, and fraud. Manual reconciliations hinder real-time visibility into payment statuses.

2. High Operational Costs: Physical visits, follow-ups, and administrative tasks require significant manpower and travel, adding to costs.

3. Limited Scalability: As MFIs grow their borrower base, manual collection systems fail to keep pace, which results in inefficiencies and poor borrower experiences.

4. Inadequate Customer Communication: Traditional channels like in-person visits or phone calls are time-consuming and often intrusive, which also leads to negative borrower sentiment.

5. Lack of Real-Time Insights: Without digital systems, there’s minimal data visibility, which makes it difficult to track delinquencies, assess risks, and optimize strategies.

Why digitalizing loan collections is the future

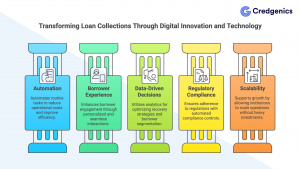

1. Rising operational costs demand automation

Managing large field teams, physical outreach, manual tracking, and repetitive administrative tasks drain both time and money. Digital platforms automate repetitive tasks such as payment reminders, EMI tracking, and reconciliation.

How digitalization helps:

- Automation of Routine Tasks: Credgenics’ AI-powered collections platform, for instance, automates repetitive workflows like reminder notifications, payment scheduling, and follow-ups.

- Real-time Tracking: Digital systems allow MFIs to track borrower interactions and field collectors in real time, which reduces manual oversight.

- Reduced Field Workforce Dependence: By leveraging digital channels like WhatsApp, SMS, IVR, and Voicebots, MFIs can cut back on field visits. Moreover, field collectors equipped with mobile apps can access borrower data, payment history, and schedules in real-time, enabling more informed and productive interactions.

2. Improved borrower experience through personalization

Borrowers today are increasingly comfortable with digital channels. Offering seamless, multi-channel communication—SMS, WhatsApp, emails, IVR calls, voicebot and chatbot—not only enhances borrower engagement but also ensures timely reminders and personalized repayment options.

How digitalization helps:

- Multi-Lingual, Multi-Channel Communication: Credgenics enables lenders to reach borrowers in 8+ languages via personalized messages on preferred channels.

- Self-Service Options: Digital repayment links, eNACH mandates, and easy mobile-based payment systems empower borrowers to repay conveniently without pressure.

- Consistent Engagement: Automated engagement keeps borrowers informed and improves transparency, fostering trust.

Credgenics’ platform allows MFIs to engage borrowers through a suite of digital touchpoints, increasing repayment adherence while maintaining borrower dignity and convenience.

3. Data-driven decision making for better recovery rates

One of the most significant advantages of digital collections is real-time data visibility. Microfinance companies can leverage advanced analytics to track delinquency patterns, segment borrower profiles, and predict defaults.

How digitalization helps:

- ML-Based Borrower Segmentation: Modern platforms leverage machine learning to segment borrowers based on risk profiles, repayment behavior, and financial health.

- Optimized Recovery Strategies: Data-driven insights enable lenders to apply tailored recovery strategies—be it friendly reminders for low-risk borrowers or legal notices for chronic defaulters.

- Real-Time Analytics Dashboard: Platforms like Credgenics offer insightful dashboards and reporting tools, which empower MFIs to fine-tune their collection strategies based on borrower behavior, regional trends, or loan type.

4. Regulatory compliance & audit readiness

As regulatory norms tighten in the microfinance sector, maintaining transparent, compliant, and auditable records is more critical than ever. Manual processes often risk missed documentation, unauthorized communication, or data privacy lapses.

How digitalization helps:

- Built-in Compliance Controls: Regulatory policies, Do-Not-Disturb (DND) preferences, and borrower privacy protocols are seamlessly embedded into the system, ensuring adherence by default.

- Comprehensive Audit Trails: Every payment, communication, and field visit is digitally logged, providing a complete, easily accessible record for audits and dispute resolution.

- Legal Process Automation: Automated generation and tracking of pre-legal and legal notices reduces manual errors and speeds up the initiation of legal proceedings.

5. Scalability to serve growing markets

Microfinance institutions aim to scale rapidly to meet the credit needs of underserved markets. Manual processes will not be sustainable for institutions aiming to scale. By embracing digital collection platforms, MFIs can seamlessly manage growing borrower volumes without proportionally increasing operational costs.

How digitalization helps:

- Cloud-Based Scalability: SaaS platforms like Credgenics allow MFIs to scale their operations without investing heavily in infrastructure or workforce.

- AI & Predictive Analytics: Predictive modeling helps institutions stay proactive, anticipating defaults before they occur and refining strategies dynamically.

- Easy Adoption: Modern plug-and-play platforms require no complex integrations. They effortlessly align with existing core banking systems while ensuring a streamlined tech ecosystem.

Recommended Read | The Psychology of Collections: AI, Data & Behavioral Science for Smarter Debt Recovery

The road ahead for MFIs

As highlighted in several industry reports, the future of microfinance is undeniably digital. The competition is intensifying, borrower expectations are evolving, and regulatory scrutiny is increasing. Digitalizing loan collections is no longer just an operational upgrade—it’s a strategic necessity to remain relevant, efficient, and customer-centric in 2025 and beyond. Therefore, equip your microfinance institution with a next-gen digital collections and redefine the way you manage loan recoveries.

How Credgenics supports digital debt collections in microfinance

Credgenics is at the forefront of digitalizing debt collections in microfinance and allied sectors with its comprehensive, AI-powered, borrower-centric collections and recovery platform. Here’s how Credgenics specifically empowers MFIs:

- Customizable Digital Workflows: Tailor collection strategies based on borrower segments, repayment history, or loan type.

- Omnichannel Communication: Engage borrowers via SMS, email, WhatsApp, Chatbots and Voicebots, and digital and physical notices—all managed through one platform.

- Advanced Analytics: Access real-time dashboards, collection efficiency metrics, and predictive insights to make informed decisions.

- Performance Management App: Equip field collectors with mobile tools to track and record borrower interactions efficiently.

- Seamless Integrations: Easily integrate with existing Loan Management Systems (LMS) for a cohesive digital ecosystem.

- Legal & Recovery Solutions: Manage legal notices, arbitration, and recovery proceedings digitally, which streamlines the end-to-end process.

FAQ’s

1. Why is digitalizing loan collections important for microfinance companies?

Digitalizing loan collections is crucial for microfinance companies because it reduces operational costs, enhances borrower engagement, improves recovery rates, and ensures regulatory compliance. Traditional methods are manual, error-prone, and hard to scale. By adopting digital debt collections in microfinance, institutions can automate workflows, track payments in real-time, and personalize borrower communication, which ultimately improves efficiency and sustainability.

2. How does digitalizing loan collections improve borrower experience in microfinance?

Digitalizing loan collections in microfinance offers borrowers a seamless and respectful repayment experience. Through multi-channel communication (WhatsApp, SMS, email, IVR, Vociebot, Chatbots, and GenAI-based videos), multilingual support, and self-service options like digital payment links, borrowers receive timely, personalized reminders. This not only increases repayment rates but also builds borrower trust and satisfaction.

3. What are the challenges of traditional loan collection methods in microfinance?

Traditional loan collection methods involve manual paperwork, high field operations cost, delayed reconciliations, and poor borrower communication. These challenges limit scalability and reduce collection efficiency. By digitalizing debt collections in microfinance, institutions can overcome these issues and gain real-time visibility into borrower behavior and repayment trends.

4. How can microfinance institutions ensure compliance through digital collections?

Digital debt collections platforms help microfinance institutions maintain compliance by automating regulatory checks, logging all communications, and maintaining auditable records. With built-in controls and legal process automation, MFIs can reduce errors and be audit-ready at any time.

5. What role does Credgenics play in digitalizing loan collections for microfinance?

Credgenics is a leading digital collections platform ideal for microfinance, and allied institutions. It supports digitalizing loan collections through AI-powered automation, omnichannel borrower engagement, real-time analytics, and legal recovery tools. Its scalable SaaS-based system helps MFIs improve efficiency, reduce defaults, and expand operations without increasing costs.