In today’s competitive and highly regulated lending environment, rigid repayment modes and aggressive collection tactics are no longer effective. Modern lenders need borrower-first approaches to debt collection that balance compliance, recovery, and customer loyalty.

A borrower-centric repayment strategy not only reduces defaults and drives stronger recoveries but also strengthens long-term relationships, builds brand trust, and supports sustainable profitability.

This lender’s guide serves as a practical aid to insights on digital debt recovery, lending best practices, and effective debt collection strategies. It provides actionable insights for creating repayment solutions that maximize recovery while enhancing Customer Lifetime Value (CLV).

The business case for borrower-centric lending

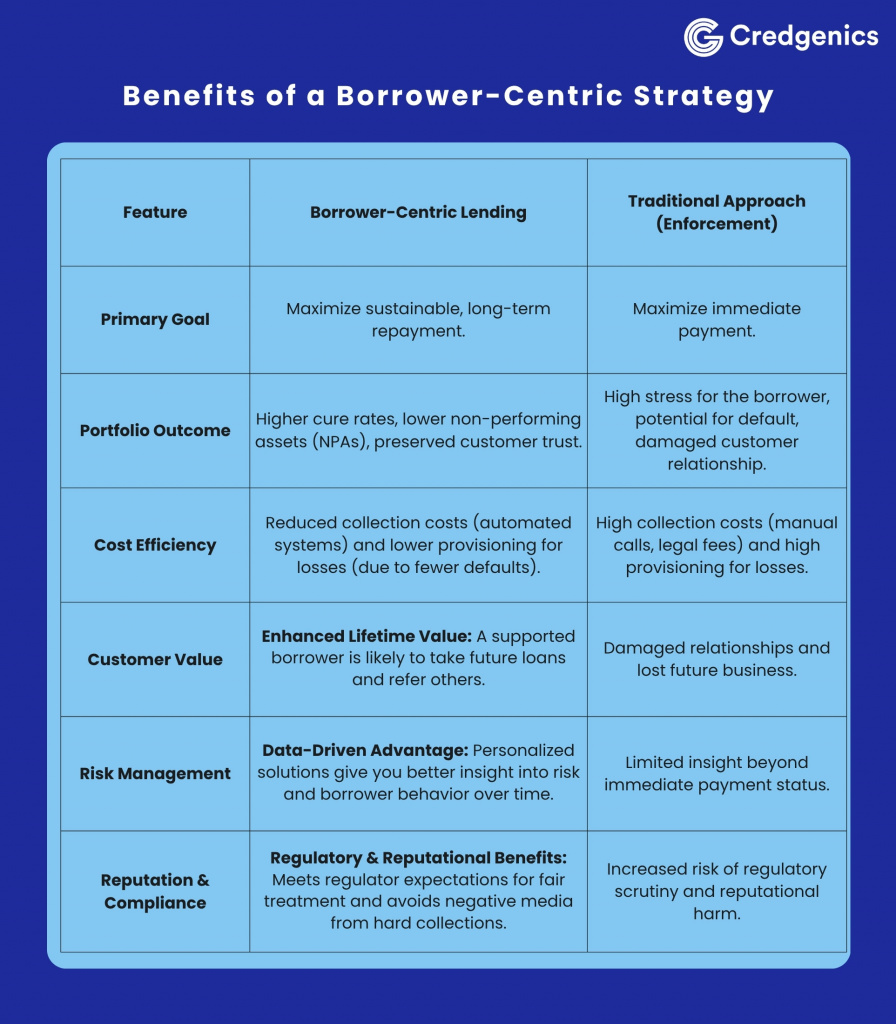

Investing in a borrower-centric repayment approach is not only about good customer service; it is a strategic move that drives superior portfolio performance and long-term value.

Key benefits of a borrower-centric strategy

By focusing on understanding and supporting your borrowers, you shift the relationship from transactional to collaborative. This results in reduced defaults and losses, a stronger, more loyal customer base, and a data-driven advantage in managing risk, ultimately creating a healthier and more profitable lending portfolio.

1. Understand the modern borrower beyond credit scores

Holistic credit assessment

- Incorporate alternative data such as utility bills, mobile payments, cash flow, and even behavioral patterns.

- Use machine learning to spot early warning signs, like sudden drops in bank balances or earnings.

- Remember that many borrowers face short-term shocks (job loss, medical emergencies), but they may not be a refusal to pay.

Behavioral segmentation

- Segment borrowers by their payment behavior: consistent payers, irregular payers, and those at risk.

- Tailor the communication and provide offers accordingly.

- Use journey mapping to see when and how people begin to struggle.

Predictive modeling & early warning

- Build early-warning systems to flag accounts at risk of slipping 30–60 days delinquent.

- Step in early with gentle reminders or restructuring options. Don’t wait for defaults.

2. Offer flexible, tiered repayment options

Rigid one-size-fits-all payment plans are outdated. Implementing borrower-centric repayment options is a core lending best practice. Some options:

- Dynamic due dates: Let borrowers choose or shift due dates to align with salary cycles (1st/15th/30th).

- Enabling quick payments: Send personalized payment links via SMS/WhatsApp/email that borrowers can click and pay anytime, anywhere.

- Bi-weekly or flexible installments: Breaking a large monthly EMI into two half-payments can ease cash flow for borrowers.

- Skip-a-payment / payment holiday: Allow one skip per year (with clear terms on how the missed payment is recovered).

- Interest-only period: Temporarily let the borrower pay only interest (not principal) during a tough patch.

- Step-up / step-down payment paths: A borrower expecting income growth can start with lower EMIs and ramp up, or vice versa in a downturn.

- Loan modification / term extension: Extend the tenor or reduce the rate (even marginally) to reduce the monthly burden.

3. Proactive, transparent communication channels

How lenders speak to borrowers matters as much as what they offer. Effective communication is central to digital debt recovery.

- Automated, personalized nudges and reminders: Use SMS, WhatsApp, email, or app notifications—timed before due dates and at critical junctures.

- Self-service borrower portal: Provide a dashboard where the borrower can view outstanding balance, due dates, and upcoming schedule.

- Clear, jargon-free explanations: Use plain language to explain interest, fees, consequences of late payment, and options available.

- Proactive outreach during distress: Rather than waiting for non-payment, trigger outreach when signals suggest stress (e.g., drop in bank balances).

- Multichannel support: Voice, chat, web—let borrowers choose the channel most comfortable for them.

Borrower-friendly and tech-enabled communication significantly improves reach and borrower satisfaction.

4. Ethical debt collection & workout strategies

When borrowing becomes delinquency, how you recover matters. Effective debt collection strategies prioritize ethical treatment and sustainable recovery.

- Segmented collection strategies: Different delinquency buckets (30, 60, 90+ days) get different strategies—gentle reminders, guided restructuring, or collections.

- Workouts / restructuring: Offer tailored options like reduced EMI, guidance on implications, term extension, or one-time settlement.

- Negotiated settlements: In appropriate cases, settle at a reduced amount if a timely or lump-sum payment can be arranged, but ensure full transparency and documentation.

- Ensure fair treatment and compliance: Avoid high-pressure tactics, misleading statements, or misrepresentation. Comply with regulations and maintain reputational integrity.

These borrower-first approaches to debt collection build long-term trust.

5. Use technology & data as enablers

Technology is not a substitute for empathy, but it is the scaffolding for modern digital debt recovery and lending best practices.

- Platform integration: Your lending platform should integrate early-warning, communications, and collections in one workflow.

- Analytics dashboards: Monitor delinquency trends, restructuring acceptance rates, customer satisfaction, and cost of recovery.

- AI / ML models: Predict obstacles before they materialize.

- Automated reconciliation & payment systems: A modern payment engine that handles multiple modes (UPI, auto-debit, cards, net banking) reduces friction and errors.

- A/B testing & continuous feedback loops: Test different communication styles or restructuring offers and iterate based on borrower response.

6. Measure success beyond defaults

To understand the real value of borrower-centric repayment programs, track holistic metrics. Use the metrics below to continuously refine your strategies:

- Reduction in default and write-off rates

- Restructuring success rate

- Customer satisfaction / NPS

- Customer retention / repeat borrowing

- Cost of recovery

- Effect on brand / market share

- Lifetime value / margin

- Behavioral health metrics (e.g., less volatility in borrower payment patterns, higher on-time payments)

Related Read: The loan recovery automation playbook: 6 Proven ways to boost repayment rates

Actionable takeaways for lenders

Shifting from harsh collection tactics to borrower-friendly repayment options is not just the right thing to do—it is smart business. It cuts down on defaults, earns customer loyalty, and keeps your portfolio healthy.

This Lender’s guide recommends the following action steps:

- Audit current repayment and collection policies from a borrower’s perspective.

- Build or enhance early-warning analytics to flag stress signals.

- Roll out one flexible repayment option (e.g., skip-payment or date shift) in a pilot segment.

- Design a self-service interface for requesting help.

- Adjust KPIs to reward quality recovery and retention, not just collection volume.

- Train teams in empathy, negotiation skills, and financial counseling basics.

- Monitor results and iterate. Measure not only default but retention, satisfaction, and cost of recovery.

Conclusion

For Credgenics and its lending partners, the future of collections comes down to four things: smart data, the right technology, automation, and treating people with empathy. These effective debt collection strategies, combined with borrower-first approaches to debt collection, drive stronger portfolio performance while building a financial brand that borrowers actually trust. Master these principles in this Lender’s guide, and you’ll stay ahead in lending that’s both profitable and sustainable.

FAQs

1. What is a borrower-centric repayment strategy, and why is it important for lenders?

A borrower-centric repayment strategy focuses on understanding individual borrower needs and creating flexible repayment options that align with their financial reality. This approach replaces one-size-fits-all models with personalized, ethical, and data-driven solutions — reducing defaults, improving recoveries, and strengthening long-term borrower relationships.

2. How does a borrower-first approach improve digital debt recovery?

Borrower-first approaches to debt collection prioritize empathy, transparency, and proactive communication. By combining digital tools, data analytics, and borrower segmentation, lenders can predict repayment challenges early and offer flexible restructuring options. This approach leads to faster recoveries and higher borrower satisfaction.

3. What are the key components of an effective borrower-centric repayment model?

The most effective borrower-centric repayment solutions include:

- Flexible repayment options (dynamic due dates, skip-a-payment, step-up/step-down EMIs)

- Proactive communication (personalized reminders, multi-channel support)

- Ethical collection practices (fair treatment and compliance)

- Technology integration (AI-driven analytics and automation)

These practices drive compliance, trust, and profitability in lending portfolios.

4. How can lenders use technology to improve debt collection efficiency?

Modern lenders use AI, predictive analytics, and digital communication platforms to automate repayment workflows, detect early delinquency risks, and personalize outreach. Technology enhances both recovery performance and borrower experience, making debt collection smarter, faster, and more ethical.

5. What ethical principles should guide modern debt collection?

Ethical debt collection emphasizes fairness, transparency, and compliance. Lenders should avoid aggressive tactics and instead offer negotiated settlements, transparent communication, and restructuring options where feasible. This approach safeguards brand reputation and builds borrower trust.