The debate of “P2P lending vs traditional lending” is crucial for borrowers and investors. Borrower’s options for availing credit are no longer limited to traditional loans offered by banks and other non-banking financial services companies. With the rise of peer-to-peer (P2P) lending, individuals and businesses now have an alternative option that connects them directly with lenders through online platforms. While traditional loans are typically associated with stability and comprehensive financial services, they can also involve lengthy processes and higher interest rates. In contrast, P2P lending offers a more streamlined, flexible, and potentially cost-effective solution. However, choosing between these options requires careful consideration of one’s unique financial needs and goals. As P2P lending continues to gain traction in India, regulated by the RBI, understanding its dynamics can empower borrowers and investors alike to capitalize on this innovative financial model. Read on to discover the best approach for your financial journey.

Understanding P2P lending

Peer-to-peer (P2P) lending is an innovative financial model that allows individuals and businesses to borrow and lend money directly through online platforms, eliminating the need for traditional financial institutions. This practice, also known as “social lending” or “crowd lending,” originated in 2005 and has evolved into a significant sector within alternative finance. P2P lending platforms offer a range of financing options, including personal loans, business loans, and other types of credit, making them accessible to a wide audience. In the P2P lending vs traditional lending discussion, P2P platforms are often noted for offering easier access to credit and potentially lower interest rates than those provided by traditional banks.

For investors, P2P lending presents an opportunity for attractive returns, often higher than those available through conventional savings accounts or investment products. However, as with any financial investment, there are risks involved, such as the possibility of borrower default. Therefore, both borrowers and lenders should carefully assess the terms and conditions of P2P lending platforms before participating.

How does P2P lending work?

1. Application: Borrowers apply for loans on a P2P platform, providing details about their financial situation and loan requirements.

2. Evaluation: The platform assesses the borrower’s creditworthiness using various criteria, including credit scores, income, and financial history.

3. Listing: Approved loan applications are listed on the platform, where potential investors can review and decide to fund them.

4. Funding: Once the loan is fully funded by investors, the borrower receives the money and agrees to repay it over a specified period, typically with fixed monthly payments.

5. Repayment: The platform facilitates repayments from the borrower to the investors, including interest.

Benefits of P2P lending

1. Accessibility: P2P lending platforms often have more lenient credit requirements than traditional banks, making them accessible to borrowers with varying credit profiles. It often provides opportunities for borrowers who may face challenges with traditional banking systems.

2. Direct Connections: P2P platforms connect borrowers directly with lenders, reducing intermediary costs.

3. Online Facilitation: The entire process, from application to funding, occurs on digital platforms. The online nature of P2P lending allows for faster application processing and funding compared to traditional loans.

4. Potential for Higher Returns: Lenders may earn higher interest rates compared to traditional savings accounts.

5. Risk Distribution: Lenders can spread their investments across multiple loans to manage risk.

6. Automated Matching: Many platforms use algorithms to match lenders with suitable borrowers based on risk profiles and preferences.

7. Transparency: P2P platforms typically provide detailed information about borrowers and their credit histories.

Drawbacks of P2P lending

Risk for Investors: Investors face the risk of default, as borrowers may fail to repay the loan.

Limited Regulation: P2P lending is less regulated than traditional banking, which may pose risks for both borrowers and investors.

Higher Rates for Low Credit: Borrowers with poor credit may face higher interest rates than they would from traditional lenders.

Recommended Read: Digital Vs. Cash: Exploring India’s changing payment landscape

Understanding traditional loans

Traditional loans are financial products provided by established institutions like banks and other non-banking financial institutions. These loans include a variety of options such as personal loans, mortgages, auto loans, and business loans, each tailored to meet specific financial needs. The loans are funded by the lender and require a formal application and approval process. They offer a dependable source of financing for individuals and businesses, providing the capital needed to achieve a range of goals. When considering P2P lending vs traditional lending, it’s important to note that traditional loans are known for their clear repayment terms, transparent interest rates, and specific eligibility criteria.

How do traditional loans work?

1. Application: Borrowers apply for a loan through a bank or financial institution, providing detailed financial information and documentation.

2. Evaluation: The institution assesses the borrower’s creditworthiness, considering credit scores, income, employment history, and collateral (if applicable).

3. Approval: Approved loans come with specific terms, including interest rates, loan amounts, and repayment schedules.

4. Funding: Once approved, the loan amount is disbursed to the borrower, who begins making scheduled repayments.

5. Repayment: Borrowers make regular payments, typically monthly, including both principal and interest.

Benefits of traditional loans

1. Stability and Security: Traditional loans are offered by established financial institutions with a long history of lending.

2. Regulation: These loans are heavily regulated, offering borrowers protection and clear terms.

3. Variety: Traditional lenders offer a wide range of loan products, catering to various needs.

4. Potentially Lower Rates: Borrowers with excellent credit may secure lower interest rates compared to P2P loans.

Drawbacks of traditional loans

1.Stringent Requirements: Traditional loans often have strict credit and income requirements, making them inaccessible to some borrowers.

2. Slower Process: The application and approval process can be lengthy and require extensive documentation.

3. Less Flexibility: Traditional loans may offer less flexibility in terms of loan amounts and repayment terms.

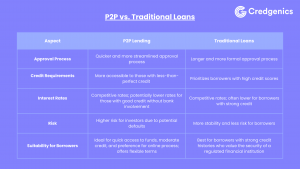

P2P lending vs. Traditional loans: A comparison

When comparing P2P lending vs traditional lending, it’s clear that each has its own set of benefits and drawbacks. P2P lending offers flexibility, accessibility, and the potential for higher returns, while traditional lending provides stability, regulation, and potentially lower interest rates for those with strong credit profiles.

Conclusion: Which is the best option?

The choice between P2P lending and traditional loans is not merely a financial decision—it’s a strategic move that can significantly impact your financial future. P2P lending emerges as a disruptive force, offering unprecedented accessibility, rapid processing, and flexibility that resonates with the modern borrower. However, this innovation comes with its own set of challenges, including potential risks and an evolving regulatory landscape.

On the other hand, traditional loans stand as pillars of stability and security, backed by established institutions and diverse product offerings. Yet, they may present hurdles in accessibility and agility, potentially leaving some borrowers underserved.

To make an informed decision:

1. Conduct a comprehensive self-assessment of your financial health and goals.

2. Rigorously compare offers across both P2P platforms and traditional lenders.

3. Scrutinize the fine print, including interest rates, fees, and repayment terms.

4. Consider the potential impact on your credit score and future borrowing capacity.

5. Stay informed about the regulatory environment and its implications for borrowers.

Remember, the best lending solution is one that not only meets your current needs but also aligns with your long-term financial strategy. Whether you opt for the innovative approach of P2P lending or the time-tested path of traditional loans, your choice should empower your financial journey, not constrain it.

FAQs

1. What is the main difference between P2P lending and traditional loans?

The main difference lies in the source of funding. P2P lending connects borrowers directly with individual investors through online platforms, while traditional loans are funded by banks and financial institutions.

2. Are P2P loans safe?

P2P loans can be safe, but they come with risks, especially for investors. Borrowers should choose reputable platforms and understand the terms and conditions before proceeding.

3. Can I get a P2P loan with a low credit score?

Yes, P2P lending platforms often have more lenient credit requirements, making them accessible to borrowers with less-than-perfect credit. However, interest rates may be higher for those with low credit score.

4. How long does it take to get approved for a traditional loan?

The approval process for traditional loans can vary but typically takes several days to weeks, depending on the lender and the borrower’s financial situation.

5. Which option is better for business loans?

Both P2P lending and traditional loans can be suitable for business loans, depending on the business’s credit profile, funding needs, and preferred terms. Businesses with strong financials may benefit from the stability and lower rates of traditional loans, while those seeking quick funding might prefer P2P lending.