Machine Learning (ML) and Artificial Intelligence (AI) are gradually becoming a key technology enabler for the financial services industry with their extensive usage and innovative use cases including advancements such as better underwriting and improved foundational fraud scores.

While AI has proven beneficial to finance businesses in diverse ways, the finance industry is now embracing generative AI and harnessing its power as an invaluable tool for operations. As traditional AI/ML is focused on making predictions or classifications based on existing data, generative AI creates novel content by analyzing patterns in existing data. This versatile technology can generate content in a wide range of modalities, including text, images, code, and music, making it ideal for a range of use cases. Its potential to enhance accuracy and efficiency has made it increasingly popular in the banking and financial services industry.

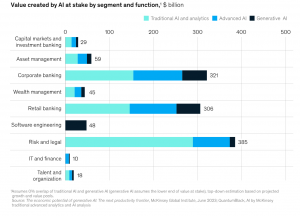

Recent statistics highlight the growing adoption of generative AI in financial services According to the McKinsey Global Institute, the global implementation of generative AI (gen AI) could contribute an estimated annual value ranging from $2.6 trillion to $4.4 trillion across 63 analyzed use cases within various industries. Among these sectors, banking is poised to seize one of the most substantial opportunities, with a potential annual impact ranging from $200 billion to $340 billion. Notably, while initial generative AI pilots in banking have rightly prioritized productivity in response to broader economic challenges, the technology holds the potential to significantly reshape job roles and redefine customer interactions with banks. It may even pave the way for entirely new business models.

Factors contributing to the growing use of Generative AI in financial services

- Advancements in Machine Learning algorithms: With the evolution of advanced ML algorithms, including deep learning and reinforcement learning, their usage in the financial services industry has gone up. These sophisticated algorithms enable the training of models on extensive datasets, leading to the creation of highly accurate predictions. Consequently, financial institutions now leverage the capabilities of generative AI for diverse applications such as portfolio optimization and fraud detection.

- Surge in data volume: The financial sector generates a considerable amount of data, posing challenges for analysis through traditional methods. Generative AI in financial services emerges as a solution for institutions to effectively use this data. Employing generative AI techniques allows the extraction of new insights and predictions, furnishing valuable information to guide decision-making processes in the finance industry.

- Cost reduction in the financial sector: Through the automation of manual processes such as data analysis and fraud detection, financial institutions can bolster operations efficiency and trim operational expenses. Generative AI plays a pivotal role in enabling this automation, facilitating streamlined operations and more efficient resource allocation. As a result, financial institutions experience substantial cost savings.

Generative AI use cases that are picking up pace

1. Personalized customer service: For the banking and financial services sector, the importance of personalized customer experiences cannot be overstated as customers increasingly seek solutions tailored to their individual needs. Generative AI emerges as a potent tool to fulfill this need, empowering financial institutions to provide personalized financial guidance and craft bespoke investment portfolios. Through the analysis of extensive customer data, encompassing transaction history and financial objectives, generative AI algorithms generate recommendations tailored to each customer’s unique circumstances, fostering a sense of trust and loyalty. By scrutinizing customer behavior and transaction history, the technology tailors recommendations for credit cards, loans, insurance, and investment products. This not only elevates customer satisfaction and engagement but also opens avenues for cross-selling and upselling, contributing to increased revenue and enhanced customer lifetime value. In essence, the impact of generative AI on customer engagement and satisfaction extends to improved retention, loyalty, positive referrals, and a competitive edge in the market.

2. Investment strategies: In finance, the introduction of generative AI brings forth innovative approaches to refine the decision-making processes. Generative AI models delve into historical market data, discerning patterns and correlations to generate trading signals and pinpoint investment prospects. Through the utilization of sophisticated algorithms, generative AI enriches the comprehension of market dynamics, contributing to the development of more resilient strategies. The role of generative AI is pivotal in optimizing returns by pinpointing effective trading parameters and continuously adapting strategies to evolving market conditions. This integration holds significant implications for the financial performance of institutions, bestowing a competitive advantage in trading execution, risk mitigation, and heightened profitability. As strategies are fine-tuned and opportunities are accurately identified, financial institutions can elevate their overall financial performance, delivering enhanced value to their clients.

3. Cybersecurity: In the domain of the banking industry and other financial services, substantial cybersecurity challenges arise due to the sensitive nature of data and the prevalence of high-value transactions. Generative AI plays a pivotal role in addressing these challenges by simulating cyber-attacks to test and enhance security systems. It facilitates the real-time detection and mitigation of threats through machine learning algorithms, enabling swift responses to potential breaches. By analyzing historical data and identifying patterns, generative AI models predict and anticipate cybersecurity risks, allowing for proactive risk mitigation. This technology contributes to the fortification of cybersecurity defenses by detecting unauthorized access, monitoring user behavior, and encrypting sensitive data. Through the strategic utilization of generative AI, financial institutions strengthen their security measures, ensuring the safeguarding of customer data and fostering trust in an ever-evolving cybersecurity landscape.

4. Debt collections: Generative AI transforms debt collection procedures by refining communication strategies and optimizing customer interactions. Employing natural language processing, AI algorithms produce personalized and empathetic messages tailored to the specific circumstances of individual debtors. This not only enhances the overall customer experience but also increases the likelihood of successfully resolving debts. Additionally, AI scrutinizes extensive datasets to identify patterns and forecast debtor behavior, enabling proactive and targeted interventions.

Through the automation of routine tasks and communication workflows, generative AI enables debt collection agencies to allocate resources more efficiently, thereby reducing operational costs and streamlining the debt recovery process. Moreover, the technology continually learns and adapts based on evolving debtor responses, ensuring a dynamic and adaptive approach to debt collections strategies.

5. Marketing and lead generation: The integration of AI, particularly through the utilization of generative AI, brings a transformative boost to marketing and lead generation in the banking sector. In the highly competitive financial landscape, targeted marketing holds paramount importance in attracting new customers, but the traditional process can be resource-intensive. AI intervenes to streamline marketing efforts by swiftly analyzing customer preferences and online behavior and effectively segmenting leads into distinct groups. Generative AI plays a crucial role in this context, aiding in the creation of personalized marketing materials tailored to specific customer segments.

Further, it contributes significantly to tracking conversion rates and gauging customer satisfaction, providing valuable insights for continuous improvement. Employing A/B testing, banks can assess the effectiveness of various strategies, allowing for ongoing refinement of marketing approaches. This iterative approach enhances the precision of marketing campaigns, fostering a more streamlined and cost-effective lead-generation strategy. Ultimately, this contributes to an improved return on investment for marketing initiatives over time.

Looking ahead

In today’s dynamic scenario, successfully implementing Generative AI solutions requires a considerable shift, starting with a focus on the end-user experience and working backward. This necessitates a reevaluation of processes, leading to the creation of AI agents that not only prioritize user-centric design but can also adapt through reinforcement learning from human feedback. This ensures that Generative AI-enabled capabilities evolve in a manner aligned with human input.

Effectively scaling up Generative AI also demands a comprehensive change management plan. This plan should engage teams through user-centered change management, provide training for senior leadership and employees, include role modeling by leaders and influencers, articulate clear priorities, investments, and outcomes, succinctly delineate how to shift mindsets and cultures, and define explicit and implicit incentives for people to embrace the capability. Crucially, the change management process must be transparent and pragmatic.

Undoubtedly, Gen AI holds the potential to generate significant value for banks and financial institutions by enhancing productivity, with new examples emerging regularly. However, scaling up is inherently challenging, and the effectiveness of how financial institutions bring Generative AI solutions to market and persuade employees and customers to fully embrace them remains uncertain. Only by following a plan that addresses all relevant hurdles, complications, and opportunities can financial establishments fully unlock the vast potential of Gen AI well into the future.

If you are looking to transform your debt collections strategy with the power of digital and data-powered insights, reach out to us to request an exploratory session at sales@credgenics.com or visit us at www.credgenics.com.

FAQs:

Q1: What is the role of generative AI in financial services?

A1: Generative AI in financial services plays a crucial role in transforming various aspects of the industry. It enables personalized customer experiences, optimizes trading strategies, enhances cybersecurity measures, and streamlines marketing and lead generation processes.

Q2: How does generative AI contribute to personalized customer experiences in finance?

A2: Generative AI analyzes vast amounts of customer data, including transaction history and financial goals, to generate personalized and empathetic messages. This enhances communication strategies, improves customer interactions, and increases the likelihood of successful debt resolution.

Q3: Can generative AI improve trading and investment strategies in the financial sector?

A3: Yes, generative AI analyzes historical market data, identifies patterns, and generates trading signals, contributing to the development of more robust strategies. It aids in optimizing returns by identifying effective trading parameters and adapting strategies to changing market conditions.

Q4: How can financial institutions benefit from generative AI in marketing and lead generation?

A4: Generative AI streamlines marketing efforts by swiftly analyzing customer preferences and online behavior, aiding in the creation of personalized marketing materials. It also tracks conversion rates, gauges customer satisfaction, and allows for ongoing refinement of marketing approaches, ultimately improving the return on investment for marketing initiatives over time.