The rapid emergence of innovative technologies in the debt collections industry is creating new opportunities for lending institutions. Lending institutions have already redefined how they interact with their customers, indicating that 2023 will see a significant amount of change. A technology-driven ecosystem is becoming more prevalent thanks to increased use of data analytics and tools like artificial intelligence and machine learning. Lenders now need to reconsider their current processes and make the switch to digital enablement at the earliest due to fast changing consumer demands. This evolution is giving rise to some loan recovery trends expected to soon become foundational in the debt collections landscape.

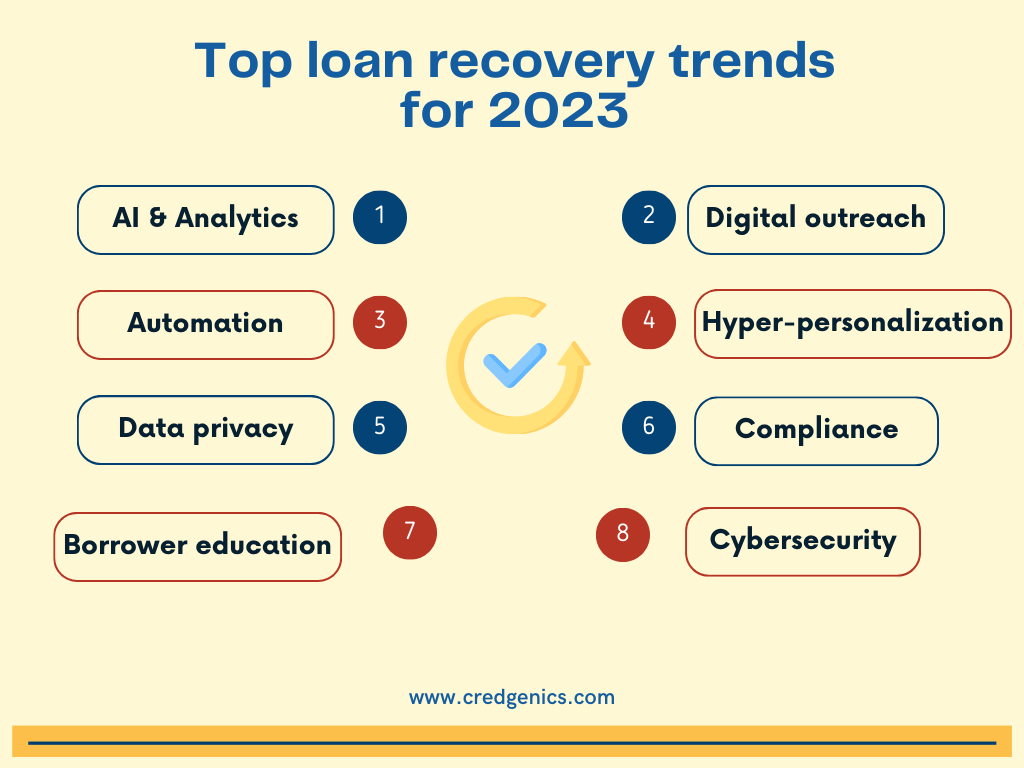

Some of the top loan recovery trends to watch out for in 2023 are:

- Artificial Intelligence (AI), Machine Learning (ML), and Advanced Analytics: Lending institutions are revisiting their collections strategies by leveraging AI and ML to simplify processes that have mostly been manual and human effort focused. These technologies make data more useful by providing accurate, actionable insights into borrower risk categories and future delinquencies. Not only does this help lenders formulate a futuristic roadmap for contact strategies, but it also facilitates efforts in achieving cost-effectiveness and lowering NPLs. Predictive models powered by AI also help lenders understand borrower behaviour and make informed decisions regarding debt resolution. As demographics evolve and people become more financially and digitally literate, a holistic approach to the borrower profile will become vital for lenders.

- Digital communications leading the way: With the rise of digital technology and its fast adoption caused by the pandemic, efforts for loan recovery in India are rapidly shifting to digital channels. Digital outreach is emerging as a more constructive mechanism to streamline collections. Customers now find intrusive communications like phone calls and in-person visits less appealing. A wider section of the borrowers is more responsive to emails and SMS notifications than phone calls and letters.

A report states that SMS has the highest open rate at 98%. Adopting frictionless means of communicating with customers will help lenders adhere to the compliance requirements that limit the intensity and frequency of contacting borrowers.

- Automation to increase collections efficiency: Automating debt collections processes can help overcome the challenges associated with manual approaches, such as language barriers and poor communication between customers and collections teams. By leveraging digital capabilities and data analytics, lenders can gain insights into borrowers’ preferred timing and communication channels and create customized conversational tones for different borrower categories. This not only reduces recovery time but also helps lenders lower non-performing loans. Moreover, digital communication channels offer borrowers the autonomy to use self-service options to complete repayment, which helps lenders reduce their operating expenses. As a result, lenders can scale their operations over time and expand their reach to a larger customer base.

- Hyper-personalization to meet customer needs: With a transformation in customer experience expectations, borrowers are more likely to repay on time if lenders focus on their unique financial needs. Instead of providing generic offerings, lenders need to provide tailor-made solutions to build long-lasting relationships with borrowers. Thanks to emerging technologies, historical, social, and behavioral customer data can be accessed, and personalized financial strategies can be created for each customer. Hyper-personalization, therefore, offers the dual benefit of achieving customer satisfaction while helping lenders recover debts faster.

- Data privacy is a priority: One of the aspects causing a shift in consumer behavior is the growing emphasis on data privacy. Borrowers do not wish for their sensitive data to be shared among collections agents. With increasing concerns about data privacy and security, lenders will prioritize the implementation of robust data protection measures to safeguard the personal information of borrowers. Regulatory bodies are identifying the risks owing to the storage, usage, and sharing of borrower information, and lending institutions will have to move in the same direction to build trust with customers.

- Compliance and borrower dignity: The debt collections market in India is growing at a rapid pace. This enormous expansion calls for streamlined grievance redressal and dignity in collection mechanisms. At the start of 2023, the Reserve Bank of India implemented stringent controls to ensure compliance is adhered to by banks and NBFCs. Technology based solutions and digital communications in debt collections are the paths that lenders are embracing, in order to combat challenges such as irregular repayments and a lack of response over traditional communication channels. Leveraging digitization will help lenders safeguard individual dignity, comply with RBI guidelines, and ensure fair practices throughout the debt collections process.

- Focus on borrowers’ financial literacy: Even though personalization in the finance sector is on a gradual rise in India, there is a need to achieve greater financial literacy to simplify the industry for customers. Presently, the percentage of the Indian population that is financially educated stands at a mere 27 per cent. In order to prevent delinquencies and facilitate the adoption of self-service repayment options, lenders need to find ways to educate the population at large about financial management and budgeting. This will prevent borrowers from falling behind on loan repayments and make the financial infrastructure more robust and future-proof.

- Cybersecurity will become crucial: With sophisticated technological advancements, cyber security threats are also evolving at a similar pace. As per a report, India witnessed 13.91 lakh incidents in 2022. Digital fraud prevents innovation and is an impediment to organizational productivity. Cybersecurity breaches compromise borrowers’ personally identifiable information (PII), and are valuable for hackers. Lenders can potentially lose huge sums of money as a result. Financial institutions will look to prioritize cybersecurity in 2023, not only to optimize their processe but also to simplify collaboration with third-parties that put data at the heart of everything they do as part of the debt collection process.

Leverage these loan recovery trends to improve your collection strategies in 2023

A digital transformation is already underway in the debt collections landscape. The top loan recovery trends outlined above will help lenders modify collections strategies to remain competitive in India’s fast growing credit ecosystem. The rapid pace of change leaves no room for lending institutions to fall behind. Understanding emerging technologies and formulating strategies based on them is the surest way for lenders to achieve scalability and improved debt collections.

FAQs:

- What are the strategies for loan recovery?

The process of debt collections begins with lenders gaining insight into the borrower profile through data analysis and AI-based techniques. Determining the creditworthiness of the borrower is important to ensure timely repayment. Lenders then need to implement an automated communication mechanism to reach out to borrowers at their preferred time and through a channel of their choice. In case digital methods prove insufficient in recovering the debt, lenders need to leverage techniques such as field debt collections and skip tracing techniques. Combining a few or all of these methods will help lenders create an effective loan recovery strategy.

- What is the future of debt collection?

Digitization in communication is expected to be a major development in the debt collections space. Leveraging AI and ML-based capabilities to segment data and analyze borrower response will also cause a paradigm shift for lending institutions. Digital debt collection processes will enable lenders to tailor solutions and responses as per borrower preferences. In an age where customer awareness and financial literacy are on the rise, adopting technology in various processes will be instrumental in improving collection rates and lowering NPLs.

- What is loan management?

Loan management can be understood as a confluence of several functions, such as servicing of loans, debt collections, litigation management, reporting and analytics, and other end-to-end processes which can exist in part or whole. An effective loan management system assists in automating these processes to streamline recovery mechanisms and reduce the risk of manual errors. The dynamism of a loan management system can help both lenders and borrowers, reducing operational costs and frequency of aggressive follow-ups, thereby transforming the customer experience. Customer-centricity and The lending landscape, if made more data-driven and customer-centric, can make for an invincible loan management system.