Debit card transactions have long dominated the market in India, a country with a fast expanding economy. However, recent trends suggest a rise in credit card usage in the country. This change is the result of several factors, such as the emergence of novel payment products, the fintech industry’s disruptive influence, and the integration of credit cards with digital payment platforms like the Unified Payments Interface (UPI). In this article, we will explore the growth and potential of the Indian credit card market, its impact on the financial landscape, and the key trends shaping its future.

The growth of credit cards in India

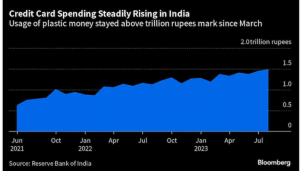

Traditionally, credit cards in India were seen as a premium product, with limited adoption compared to other forms of formal credit. However, in recent years, there has been a significant surge in Indian credit card issuance and usage. According to data from the Reserve Bank of India (RBI), the amount transacted through cards rose to an all-time high of Rs 1.48 trillion ($17.8 billion) in August 2023, up from July’s Rs 1.45 trillion, according to the latest data by the Reserve Bank of India. This growth can be attributed to the increasing acceptance and adoption of credit cards by consumers, especially the millennial population.

Factors driving the growth

Several factors have contributed to the rise in credit card usage in India. Firstly, the overall ecosystem supporting credit cards has been expanding, with banks, financial institutions, and FinTech companies collaborating to make Indian credit card access easier for the untapped, unbanked, and underserved segments of the population. These collaborations have resulted in the introduction of co-branded credit cards with attractive features, rewards, and discounts targeted at specific market segments.

Secondly, the strong recovery of the Indian economy post-COVID-19 pandemic has played a crucial role in driving credit card usage. As economic growth accelerated and consumer confidence increased, there was a significant uptick in discretionary spending on travel, entertainment, lifestyle accessories, clothing, and consumer durables. Credit cards, with their convenience and benefits such as interest-free periods and enhanced security, became the preferred mode of payment for these expenditures.

The impact of Unified Payments Interface (UPI)

One of the key factors expected to fuel the growth of credit cards in India is the integration of credit cards with the Unified Payments Interface (UPI). UPI, a popular payment system in India, has gained widespread adoption among individuals and merchants. Its dominance in the payment landscape presents a significant opportunity for credit cards to penetrate deeper into the market.

The National Payments Corporation of India (NPCI), which operates the UPI, has already allowed the linkage of credit cards with the UPI. This integration is expected to open up millions of UPI QR payment terminals to credit cards, further expanding their acceptance and usage. As credit cards gain a strong foothold on the UPI platform, their market penetration is likely to increase significantly.

The Indian credit card landscape

Credit Card Penetration and Market Size

Despite the recent growth, credit card penetration in India is still relatively low, estimated at around 5.5% of the population, which translates to approximately 77 million people. However, considering India’s population size, this already represents a substantial market. As India continues to witness economic growth and an increase in disposable income, the potential for credit card adoption is expected to grow steadily.

Revenue models for credit card issuers

Credit card issuers in India generate revenue through various channels. Interest income is the main source of income for card issuers, making up 40–50% of their total revenue. This interest income is derived from revolving customers who carry balances on their cards and pay interest on the outstanding amounts. The interest charged by issuers ranges from 18% to 42%, depending on the specific credit product.

Another significant revenue stream for issuers is interchange fee income. Interchange fees are charged by issuers to process credit card transactions, and they contribute around 20–25% of the overall revenue. The exact interchange fee varies based on the card type and customer segment.

Apart from interest and interchange fees, issuers also earn revenue from various charges, such as joining/annual fees, over-limit fees, late payment fees, cash advance fees, and conversion fees for transactions and balances. The majority of credit card issuers’ revenue comes from these fees and interest income.

Key trends shaping the credit card market in India

1. FinTech disruption

The credit card market in India has witnessed significant disruption from FinTech companies. These innovative start-ups, along with new-age banks and original equipment manufacturers (OEMs), have entered the credit card issuance space and introduced new products and offerings to consumers. By leveraging digital technologies, these FinTech players are transforming the customer experience, offering faster and more convenient onboarding processes, streamlined mobile applications, and user-friendly interfaces.

One of the key strategies adopted by FinTechs is co-branding partnerships with traditional banks. These collaborations allow them to leverage the established brand presence and customer base of banks while offering attractive features, rewards, and discounts to credit card users. Co-branded credit cards have become a popular way to acquire new customers and foster customer loyalty.

2. Better mobile apps and user experience

In an increasingly digital world, customers expect seamless and user-friendly experiences across all channels, including mobile applications. Credit card issuers are recognizing this demand and investing in the development of mobile apps with best-in-class user interfaces and experiences. These apps enable customers to perform various actions, such as applying for new cards, accessing statements, disputing transactions, and managing their accounts. The focus on mobile apps reflects the growing importance of digital banking and the need for convenient and accessible services.

3. Contactless payments and digital transformation

Contactless payments, including QR code-based payments and tokenization, have gained popularity among Indian consumers. The convenience and security offered by these payment methods have made them a preferred choice, especially in the wake of the pandemic. Credit card issuers are adapting to this trend by enabling contactless payments through their cards and mobile apps, further enhancing the customer experience.

Additionally, the digital transformation of the credit card industry has led to the introduction of new risk models beyond traditional credit ratings. Issuers are exploring alternative credit assessment methods to cater to customers with limited or no credit history. These new risk models leverage data analytics, machine learning, and artificial intelligence to evaluate creditworthiness and offer credit to a broader segment of the population.

Conclusion

The rising adoption of credit cards in India signifies a shift in the country’s financial transactions landscape. India’s credit card market is changing as a result of the country’s growing credit card issuance and usage, which is being fueled by factors like rising consumer spending, the integration of credit cards with digital payment platforms like UPI, and the disruption brought about by FinTech companies. This shift presents vast opportunities for banks, non-banking financial institutions, and FinTech players to tap into the unbanked and underserved segments of the population and provide them with easy access to formal credit. As the credit card ecosystem expands and evolves, maintaining a balance between innovation, customer experience, and responsible lending practices will be crucial for sustainable growth and financial inclusion in India.

If you are looking to transform your debt collections strategy with the power of digital and data-powered insights, reach out to us to request an exploratory session at sales@credgenics.com or visit us at www.credgenics.com.

FAQs:

1. How is the Indian credit card market gaining momentum?

The Indian credit card market has been gaining momentum for several reasons:

- Rising Middle-Class Population: India’s growing middle-class population, coupled with increasing disposable incomes, has resulted in a higher demand for credit cards. As more individuals move into higher income brackets, they seek access to credit facilities and financial products, including credit cards.

- Digital Transformation: The digital revolution in India has played a significant role in the growth of the credit card market. With the increased adoption of smartphones and internet banking, more people have access to and are comfortable using digital financial services, including online credit card applications and transactions.

- Lifestyle Changes and Aspirations: Changes in lifestyle and aspirations have led to an increased desire for convenience and purchasing power. Credit cards offer a convenient and flexible means of payment, along with various rewards and benefits, making them attractive to consumers.

- Promotional Offers and Rewards Programs: Credit card issuers in India often provide attractive promotional offers, cashback rewards, and loyalty programs. These incentives encourage individuals to apply for and use credit cards for their transactions, driving market growth.

- E-commerce Boom: The surge in e-commerce activities in India has significantly contributed to the growth of credit card usage. Many consumers prefer using credit cards for online transactions due to the added layer of security and the availability of exclusive discounts and cashback offers on various e-commerce platforms.

- Increasing Financial Inclusion: The Indian government’s focus on financial inclusion has led to the expansion of banking services, including credit cards, to a broader segment of the population. Financial institutions are working towards offering credit cards to individuals with varying income levels, contributing to market expansion.

- Innovations in Credit Products: Credit card issuers have introduced innovative products and features, such as contactless payments, easy EMI options, and specialized cards for specific purposes (travel, dining, fuel, etc.). These innovations cater to diverse consumer preferences and needs.

2. What factors are contributing to the growth of the credit card market in India?

The growth of the credit card market in India can be attributed to several factors, including the rising middle-class population, increased digitalization, changing consumer lifestyles, promotional offers and rewards programs, the booming e-commerce sector, efforts towards financial inclusion, and innovations in credit products. These elements collectively contribute to the expanding adoption and usage of credit cards across diverse consumer segments.

3. How is the digital transformation influencing the surge in credit card usage in India?

Digital transformation has played a pivotal role in driving the growth of the credit card market in India. The increased penetration of smartphones and internet connectivity has made it easier for individuals to access and apply for credit cards online. Additionally, the convenience of digital transactions, coupled with the security features offered by credit cards, has fueled their popularity. The seamless integration of credit cards into the digital ecosystem, including e-commerce platforms and mobile payment apps, has further accelerated their usage among consumers.