Unplanned debts that extend over a long period of time and are not effectively managed may well become a burden or trap. People at times resort to impulsive or excessive borrowing through credit cards, loans, or mortgages due to a lack of funds for various expenses. This challenge tends to grow with the accrual of interest compounding over time, making the debt increasingly expensive to serve. This issue is particularly pronounced with credit card debt, where exceeding 30 percent of the overall limit can adversely affect credit scores, potentially leading to more expensive future borrowing. Given this situation, it is advisable for borrowers to explore alternative approaches or ways to pay off debt.

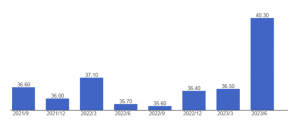

In India, the household debt to GDP ratio has consistently increased in the last few years. While the economy continues to grow, individuals’ declining capacity to repay debt can cause concern if not mitigated on time. As of June 2023, India’s household debt to GDP stood at 40.3 per cent.

Given the potential consequences, expeditious and well planned debt repayment becomes crucial to improving one’s financial health and creating an overall robust economy. Swiftly becoming debt-free is not only financially prudent but also alleviates the stress associated with mounting debt. Several strategies can facilitate this process. Some of the ways to pay off debt are discussed below.

Creating a comprehensive budget: Conducting a detailed analysis of income and expenses involves thoroughly examining income sources and fixed monthly expenses. From rent and utilities to groceries and loan payments, understanding cash flow is the first step in effective debt management. Categorizing and prioritizing debts based on interest rates and outstanding balances enables efficient allocation of resources while identifying areas for cutbacks in discretionary spending contributes to effective debt reduction.

Snowball or Avalanche Method: Choosing between the snowball and avalanche methods involves a strategic approach to debt repayment. The snowball method focuses on paying off the smallest debt first, providing psychological motivation as smaller debts are eliminated. In contrast, the avalanche method targets debts with the highest interest rates, minimizing overall interest paid over time. Individuals can select the method that aligns with their preferences and circumstances.

Negotiating interest rates: Actively engaging with creditors to discuss the possibility of lowering interest rates is a proactive strategy. Communicating one’s financial situation and commitment to debt repayment may lead to favorable negotiations. Additionally, consolidating high-interest debts into a single, lower-interest loan presents an opportunity to reduce the total amount paid over the life of the debt.

Establishing achievable goals: Setting realistic goals for debt repayment involves a nuanced approach. Rather than abrupt lifestyle changes, a thoughtful review of financial statements guides the establishment of objectives for each expense category. Gradual adjustments, considering one’s unique lifestyle and priorities, create a balanced and attainable plan.

Generating additional income: Supplementing income through freelancing, consulting, part-time work, or starting a side business expands the resources available for debt repayment. Directing additional income exclusively towards debt, without increasing discretionary spending, expedites the payoff process.

Seeking professional guidance: Consulting a financial advisor or credit counsellor is advisable when managing debt becomes overwhelming. These professionals offer personalized strategies for debt management, budgeting, and overall financial planning. Non-profit credit counselling agencies, with their expertise, may negotiate with creditors to lower interest rates or establish structured repayment plans. Before considering debt consolidation loans, seeking advice from a financial advisor helps assess suitability based on individual financial situations and goals.

Navigating debt repayment in India requires a thoughtful and strategic combination of these approaches, tailored to individual circumstances. A consistent outlook that is well aligned with the relevant financial landscape, contributes to the success of the debt repayment journey.

Click here to read more about how to stay ahead and avoid debt traps!

If you are looking to transform your debt collections strategy with the power of digital and data-powered insights, reach out to us to request an exploratory session at sales@credgenics.com or visit us at www.credgenics.com

FAQs:

1. What is the first step when it comes to ways to pay off debt in India?

The initial step is to create a comprehensive budget and analyze income sources and fixed monthly expenses, including rent, utilities, groceries, and loan payments. Categorize and prioritize debts based on interest rates and outstanding balances. Understanding your cash flow allows for efficient allocation of resources and forms the foundation for effective debt management.

2. How do the Snowball and Avalanche methods differ, and which is more suitable for debt repayment in India?

The Snowball method involves paying off the smallest debt first, providing psychological motivation as smaller debts are eliminated. On the other hand, the Avalanche method targets debts with the highest interest rates, minimizing overall interest paid over time. The choice depends on individual preferences and circumstances. The Snowball method offers motivation through visible progress, while the Avalanche method is financially efficient but may require patience for larger debts.

3. Is negotiating interest rates with creditors one of the viable ways to pay off debt in India?

Yes, negotiating interest rates with creditors is a proactive strategy. Reach out to creditors, explain your financial situation, and express your commitment to debt repayment. Some lenders may explore the possibility of lowering interest rates, especially if you have a good repayment history. Additionally, consolidating high-interest debts into a single, lower-interest loan can significantly reduce the overall amount paid over the life of the debt.

4. How can one supplement income to expedite debt repayment in India?

Identifying income-generating opportunities is crucial. Assess your skills and explore options such as freelancing, consulting, part-time work, or starting a side business. Platforms offering gig opportunities or freelancing projects can be valuable resources. Any additional income generated should be allocated directly to debt repayment, accelerating payments, and avoiding the temptation to increase discretionary spending.