With the growing demand for retail debt amidst the volatile economic scenario there is a potential for a rise in delinquencies. In this scenario, the inadequacy of traditional collections mechanisms can become a handicap and pose challenges for lenders and other financial institutions. Lenders need to revisit their approaches across the entire debt collections lifecycle in the current context while analyzing the need to transition to sophisticated digital and data-driven capabilities.

Technology has aided lenders in adapting to this dynamism, providing them with the tools that improve efficiency, deliver cost-effectiveness, and help provide a customer-centric experience. As borrower preferences change, technology has evolved to suit their new behavior. Modes of accessing credit are becoming more technology-oriented with digital adoption on the rise. Banks and other lending entities aim not only to bolster their collections performance but also to make intelligent use of capabilities such as artificial intelligence (AI) to optimize processes. AI, Machine Learning (ML), Natural Language Processing (NLP), predictive analytics, and data science help lenders adopt tailored strategies while reaching borrowers through digitized communication channels, tracking repayment histories, and studying past responses. This helps in identifying non-compliant practices, reduce recovery time, and lower the volume of non-performing loans.

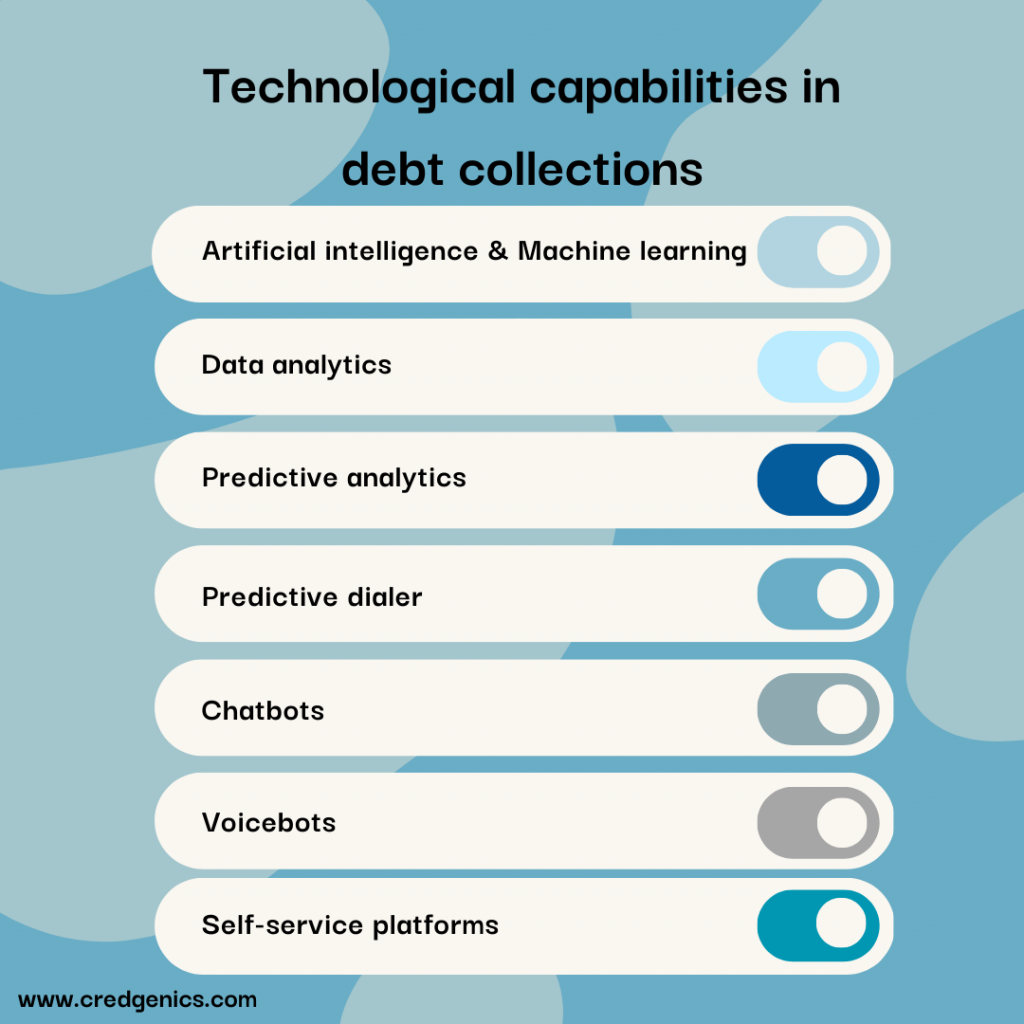

Some of the technological capabilities used in debt collections are:

- Artificial Intelligence and Machine Learning: AI is the foundation for many other emerging technologies in the debt collections industry. ML provides actionable predictive insights on borrower repayment risk by analyzing customer data. Equipping collections teams with insights that help in informed decisions, make the collections process more efficient, personalized, humane, and productive.

Technologies such as AI and ML help lenders execute customer segmentation based on predefined parameters. Thereafter, lenders can contact different segments and create a unique recovery strategy for each one. Based on a study of borrower behavior through AI insights, lenders can tailor their outreach to suit the needs of the borrowers. AI and ML aid in the automation of repetitive, manual processes and help simplify complex tasks. Compliance risks associated with traditional approaches can also be mitigated with the help of AI. A number of capabilities derived from the application of AI and ML are being deployed in debt collections to achieve desired results.

- Data analytics: AI-based data analysis in debt collections helps lenders obtain pertinent information about the debtor. Borrower demographics, past repayment behavior, and communication preferences can be the parameters based on which the customers can be segmented. Lenders can deliver tailor-made debt resolutions to borrowers based on this segmentation. Additionally, identifying high-risk customers and formulating an appropriate contact strategy based on data analysis expedites resolutions.

Lenders can achieve higher operational efficiencies by using analytics to automate low-priority interactions based on segmentation and classification of large volumes of borrower data. Long-term efficiency and increased revenue are the by-products of such an approach based on data analysis.

- Predictive analytics: Another form of advanced analytics that is making a breakthrough in the financial services and debt collections industry is predictive analytics. It includes several techniques, such as AI and ML-based data mining and statistical modelling, to predict pre-delinquencies, the likelihood of resolution and the borrower’s propensity to pay. Delinquency management techniques and customer contact strategies can be evolved based on the inputs from predictive analytics.

- Predictive dialer: Debt collections involve high volume calling that adds to the cost and operational inflexibility due to call-waiting, unanswered calls, idle time, or disconnected calls. With the delivery of service and the subsequent probability of collections getting impacted, predictive dialling, a service that uses AI-based algorithms can filter out busy signals, inoperative phone numbers, and voicemails and pass on the calls to live agents when the borrower answers the call. Moreover, the dialer predicts the best time to initiate the next call during an existing call. Such a structured allocation of calls results in improved agent productivity, leading to more calls being handled simultaneously.

- Self-service chatbots: An essential component of AI that is gradually becoming popular for a tech-driven collections strategy is using self-service chatbots. Connecting with borrowers over a phone call may prove ineffective where text and language interpretation may be required. A multilingual chatbot can overcome this impediment, and customer interactions can be more conversational even without a human agent. It can also handle basic questions about early-stage arrears, freeing up agents to handle more advanced or complex queries. As a result, chatbots are gaining traction across industries globally.

- AI-based voice-bots: Voice-bots are proving to be a successful medium to achieve efficiency in the debt collections industry. They are also able to handle a large volume of calls and help lenders achieve efficiency and employee productivity.

In an ecosystem where customer contact depends mainly on phone calls, voice-bots mimic human responses and help lenders deliver a conversational customer experience.

AI-powered voice-bots can accurately capture borrowers’ intent during calls. Amicable and frictionless exchanges based on a structured approach help build borrower trust, thereby reducing the resolution time and the value of outstanding repayments. By automating the interactions, borrower stress and embarrassment can also be reduced leading to better response rates.

- Self-service repayment options: In order to achieve streamlined debt collections, lenders are acknowledging the importance of providing borrowers with autonomous options to repay the debt. These include techniques that allow lenders to establish non-intrusive contact with debtors, such as SMS-based repayment reminders, email or text-messaging-based payment links or QR codes, or the availability of a self-service platform for consolidated and simplified repayments. Safe and digital methods that give borrowers options to repay as per their own preferences will become instrumental for debt recovery, considering the rapid development of the digital age.

Technology has transformed several industries, and debt collections need to follow suit. The various tech-based disciplines discussed above must be deployed harmoniously to improve the efficiency of collection mechanisms. AI and ML-based data analytics provide input to lenders and help them build a suitable contact strategy. Chatbots and voice bots are aiding the resolution of early-stage queries, while self-serving options will help borrowers repay the debt through their preferred time and channel of payment. Overall, technology is foundational to the accomplishment of lenders’ objectives, at the same time providing borrowers with a holistic and frictionless repayment experience. As advancements continue, it will be imperative for lenders to adopt alternative technology-led capabilities to achieve faster and more streamlined collections without compromising on the borrowers’ expectations.

FAQs:

- How has technology affected the credit and collection industry?

Technology has an all-encompassing impact on debt collections since the various stages of recovery and the processes involved in each, can be digitized and streamlined. Technology enables efficient portfolio management by automating payment follow-up, generating alerts, and segmenting priorities, resulting in a higher percentage of debt recovery. Lenders are able to strengthen customer relationships as a result of frictionless and less intrusive communication with borrowers.

- What are digital debt collections?

Digital debt collections is the usage of conversational technology and digital channels to contact borrowers regarding their outstanding debt repayment, in contrast to traditional methods such as phone calls and physical visits. This method is more data-driven and allows personalized engagements since borrowers can use their preferred channel and time for interacting with lenders and resolving the debt using a suitable platform.

- How can technology improve debt collection?

Technology is helping lenders reduce financial risk by providing real-time insights into the risk level of potential defaulters, predicting the borrowers’ propensity to repay, and the likelihood of resolution. This helps lenders proactively reach out to the borrowers and lower the volume of outstanding debt and NPLs.