The digital age has ushered in transformative changes across various industry segments and services sectors in India. In the banking and financial services industry, technological advancements have streamlined processes, enhanced accessibility and helped expand the reach. However, parts of the debt repayment and resolution processes remain archaic and complicated, leading to delays and backlog of cases in the legal stages.

With the advent of Online Dispute Resolution (ODR) platforms for BFSI, the dispute resolution landscape is transforming significantly. By harnessing the power of digital capabilities, ODR offers a modern, more efficient, and easily accessible approach to resolve disputes. This marks a pivotal shift in India’s approach to financial dispute resolution.

In this comprehensive blog, we will explore the potential of ODR and how they are reshaping the future of dispute resolution. From its ability to ease the burden on courts to its people-friendly nature, ODR presents a compelling solution to the longstanding challenges in the legal ecosystem.

The Need for ODR and its Benefits

Traditional methods of dispute resolution, such as courtroom litigation, can be time-consuming, costly, and often inconvenient for all parties involved. ODR provides a modern digital platform for resolving conflicts with several compelling benefits:

1) Accessibility: ODR eliminates the need for physical presence in a courtroom or arbitration setting, making the dispute resolution process more easily accessible to individuals and businesses.

2) Efficiency: Compared to traditional legal proceedings, ODR processes are often faster, completely transparent and cost-effective. The streamlined digital approach saves time and resources for all parties involved.

3) Preserving Relationships: ODR facilitates a less adversarial approach, enabling parties to resolve disputes amicably while maintaining valuable business relationships and ongoing collaboration.

4) Enhanced Confidentiality: ODR platforms provide enhanced privacy and confidentiality measures, ensuring that sensitive information remains protected throughout the resolution process.

5) Flexibility: ODR offers a more informal and flexible process, making it easier for parties involved to find mutually agreeable solutions tailored to their specific needs.

In the BFSI sector, where swift and fair resolution of disputes is essential, ODR has become a crucial tool. Businesses and individuals can benefit from a streamlined, cost-effective, and accessible approach to resolving disputes.

Recommended Read: Expediting Debt Settlements using the ODR Framework

Challenges and Considerations for ODR

The adoption of Online Dispute Resolution (ODR) mechanisms presents several challenges that need to be addressed for its successful implementation. One of the primary challenges is the digital literacy gap that exists across different demographics in India. Ensuring a basic level of digital literacy is a prerequisite for the widespread adoption of ODR, as it requires familiarity with digital tools and platforms.

Another significant challenge is the lack of robust digital infrastructure across the country. A broad base adoption of ODR necessitates the availability of essential technology infrastructure. ODR platforms rely heavily on technology, and any technical issues can disrupt the smooth functioning of the dispute resolution process.

Furthermore, there is a general lack of trust and awareness regarding ODR services among the public. Many people are skeptical about emerging technologies, making it difficult to gain their confidence in ODR mechanisms. Additionally, a considerable portion of the population remains unaware of the existence and potential benefits of ODR solutions.

Security concerns are also a critical consideration, as ODR involves the exchange of sensitive information electronically. Ensuring the confidentiality and security of data shared between parties is crucial to maintaining trust and confidence in the ODR solution.

How Credgenics ODR is transforming Financial Dispute Resolution

Credgenics is revolutionizing financial dispute resolution with its cutting-edge Online Dispute Resolution (ODR) platform. By combining advanced technology with legal expertise, Credgenics offers a streamlined, digital solution for resolving debt disputes. Its ODR platform integrates multi-channel communication, case management, and digital signatures.

Credgenics’ ODR framework transforms the arbitration process with a user-friendly interface for managing arbitration matters. Users can initiate, schedule, and monitor arbitration proceedings directly within the platform, conduct virtual hearings with built-in video conferencing capabilities, and manage multiple stages of arbitration, including sending notices and passing awards. This innovative ODR solution ensures transparency, expedites conflict resolution, and meets the evolving needs of modern financial services.

Highlighting the significance of the ODR framework, Mayank Khera, Co-founder and COO of Credgenics, said, “At Credgenics, we are on a mission to empower individuals to navigate their financial disputes with transparency and inclusivity. Our ODR platform leverages cutting-edge technology and strong legal-tech expertise to provide a transparent, cost-effective, and accessible solution for resolving financial disputes. As we continue to lead the intersection of technology, finance, and legal processes, we are at the forefront of Online Dispute Resolution in India, committed to fair and efficient dispute resolution in the digital age.”

The Future of ODR

As the digital landscape continues to expand, Online Dispute Resolution (ODR) is set to play an increasingly vital role in resolving disputes efficiently and fairly. This innovative approach leverages cutting-edge technology to streamline conflict resolution processes, providing accessible, efficient, and equitable solutions to diverse disputes arising in the digital age.

With features such as secure document sharing, virtual mediation sessions, and automated negotiations, ODR empowers individuals and businesses to navigate conflicts with unprecedented ease and transparency.

However, the success of ODR hinges on the collective efforts of stakeholders, including businesses, consumers, and ODR providers. All parties must stay informed about the evolving legal landscape and embrace ODR as an effective means of conflict resolution in our interconnected world. By fostering collaboration, developing best practices, and ensuring compliance with regulatory frameworks, we can unlock the full potential of ODR and pave the way for a more harmonious and efficient digital future.

FAQs:

1. What is Online Dispute Resolution (ODR)?

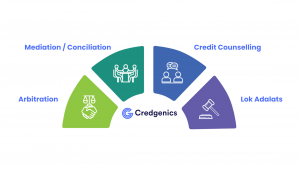

A: Online Dispute Resolution (ODR) refers to the use of innovative technology platforms and digital tools to resolve disputes outside of the traditional court system. It encompasses various methods, such as negotiation, mediation / conciliation, and arbitration, conducted online. Credgenics’ LMS incorporates an ODR feature that streamlines the arbitration process. This innovative capability enables users to initiate, schedule, and monitor proceedings within the platform.

2. What are the benefits of using ODR?

The key benefits of utilizing ODR include:

1. Cost-effectiveness: Faster and more economical than traditional litigation process.

2. Convenience: Accessible from anywhere, 24/7.

3. Efficiency: Streamlines the dispute resolution process, saving time and resources.

4. Confidentiality: Maintains the privacy of the parties involved.

3. What is the need for Online Dispute Resolution (ODR)?

ODR solutions are crucial in India to reduce court backlogs through efficient online alternatives. These innovations also enhance accessibility via virtual participation and expedite cost-effective dispute resolution for businesses and individuals. Moreover, they facilitate amicable resolutions preserving business relationships while ensuring confidentiality and data protection. ODR solutions provide a flexible, user-friendly platform tailored to diverse dispute types.

Author: Antim Amlan (Senior Product Manager, Credgenics)