Smarter debt collections rely on well-thought-out account allocation strategies that consider the collection team’s intricacies, ageing of loan accounts, modus of approaching, time of contact and frequency of communicating. While manual systems such as spreadsheets or email-based methods may suffice for a limited number of recovery accounts, they prove inefficient and impractical as debt collections efforts scale up. The need for intelligence-based allocations becomes increasingly crucial for the success of collections, especially with challenges of ad-hoc strategy modifications and loan account scope change or last-minute borrower contact information updates.

The Credgenics Collections platform offers Credgenics Smart Allocate to automate the creation of agent and agency allocation plans for collections. This approach provides an accurate assessment of how well an allocation logic performs over time, offering insights into the effectiveness of the overall collections strategies of the call centre, in-house team, field agent, or a third-party collection agency via the debt collections management system.

Addressing Allocation Capacity Constraints at Agency and Agent Level

Lenders typically follow a point-in-time allocation concept, making simultaneous allocations in different months cumbersome. There is a need to shuffle, de-allocate, or reallocate accounts to agents and agencies that consumes valuable time and energy. Larger lenders dealing with multiple third-party agencies face further complexities. Biases in choosing agencies can impact collections performance, potentially resulting in higher operational costs.

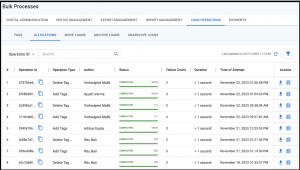

With Credgenics Smart Allocate, team leads can define limits or percentages for account allocation to agencies or agents. In addition to considering random allocation, Credgenics’ allocation algorithms will consider the concepts of agency collection limit (FOS), which is set by the lenders’ collections leads, and loan capacity (both tele and FOS). This feature allows on-the-go modifications, ensuring that no agency or agent takes undue advantage of multiple allocations, misleading borrowers or engaging in fraudulent activities to increase incentives on collections. Credgenics Collections platform streamlines individual agency or agent management, providing greater control and efficiency.

Fig 1: Credgenics Smart Allocate feature – Bulk allocations streamlined

Improving Collections Agent Performance with Load Balancing

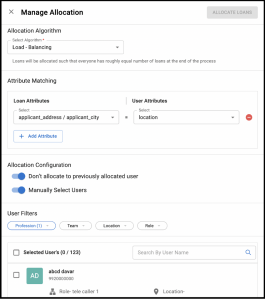

Conventional debt collections technology systems have limitations when it comes to mapping loans to accounts, which allows for multiple agents to visit or call the same borrower simultaneously. Credgenics Smart Allocate comes with a sophisticated allocation logic that enables team leads to distribute accounts equally among the corresponding agents, guaranteeing a daily change in the agents’ portfolios. The time saved by this automated process is substantial. It saves up to 70–80% of the time and frees up team leads to concentrate more on strategy than on operational tasks.

Fig 2: Credgenics Smart Allocate feature – Manage Allocation with multiple attributes

Automating, Configuring Multiple Combinations, and Using Templates for Allocation

Large lenders dealing with multiple delinquencies often face challenges in quickly identifying the best channel for physical collections. Following a specific set workflow for account allocation to agents may not always yield success and can lead to errors in collections due to faulty or redundant allocations. The Credgenics Collections platform offers 200+ filters to define complex collections strategies.

Credgenics Smart Allocate allows collections leads to accommodate all or a combination of these variables at the loan and user level with rule-based allocation in batches of loans to agents and agencies. Examples include priority allocation for agents and pincode-based agent allocations, making Credgenics CG Collect field debt collections mobile app stand out in terms of field debt collections.

What Does Smart Allocate Mean for Debt Collections Leads?

Credgenics Smart Allocate empowers lenders to measure their collections team’s performance accurately in real-time. The attribute matching functionalities allow for complex allocations based on language, pincode, product type, and other such loan and user-specific attributes. The lender can ensure that the loans are shuffled among agencies every month if required, so that fraud at the agency level can be minimized. Rather than reacting to hand-off reports from agencies, collections leads can be proactive in understanding the role and bandwidth requirements for each account. This predictive approach allows for accurate forecasting of demand for contact frequency, preempting collections bottlenecks, and planning for more efficient collections.

In essence, Credgenics’ smart account allocations create perfect harmony, ensuring a well-paced workload for the collections team, timely collections, and a positive impact on the business’s bottom line. To know more about this feature, write to us at marketing@credgenics.com.

Author: Piyush Gupta (PM- Credgenics)