The debt collections industry in Indonesia has traditionally relied on manual processes and outdated methodologies. However, the rapid advancements in technology are also making an impact on the Indonesian debt collections practices. Innovative technology platforms and digital solutions are carving a space in the dynamic environment, revolutionizing the debt collections market, and enabling more efficient and effective practices. Let us explore how technology is reshaping debt collections in Indonesia, benefiting both lenders and borrowers.

The power of digital to transform debt collections in Indonesia

Banks and other finance companies in Indonesia have been embracing modern ways of collecting debt. Empowering their operations with AI-powered technology across the debt collections lifecycle is resulting in improved collections.

Digital channels, including chatbots, voicebots, and interactive voice response (IVR) systems, are increasingly being leveraged to minimize the need for human intervention in debt collections processes. These technologies are being deployed to manage delinquency rates and optimize recovery outcomes while reducing costs. Predictive and autodialers are playing a significant role in enhancing calling agent performance, increasing call attempts, and ultimately improving collection rates overall.

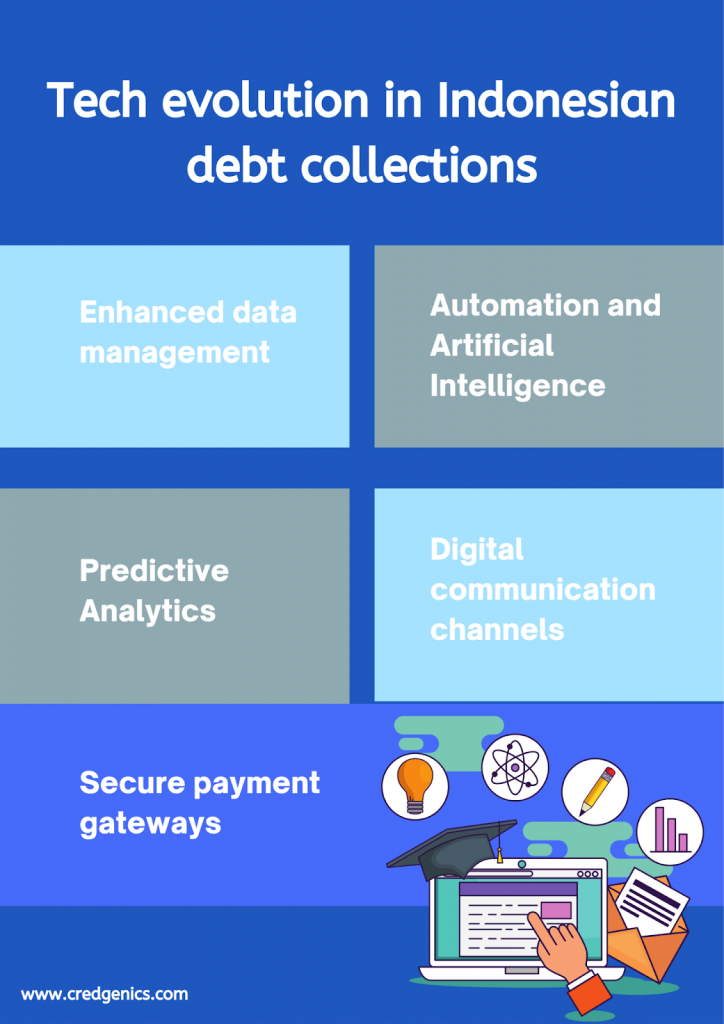

The technological evolution in the debt collections industry in Indonesia is driving several notable advancements. Here are a few key ways in which technology is transforming debt collections market in the country:

- Enhanced data management: Technology has revolutionized data management in Indonesia’s debt collections industry. Traditional methods relied heavily on physical documentation and manual record-keeping, leading to inefficiencies and errors. With the advent of digital platforms, lenders now have access to robust software solutions that enable efficient data storage, retrieval, and analysis. Advanced data models can quickly identify patterns, segment data, and prioritize collections efforts based on various parameters, improving overall efficiency.

- Automation and Artificial Intelligence (AI): Automation and AI are playing a vital role in streamlining debt collections in Indonesia. Manual tasks, such as repetitive phone calls and letter generation, can now be automated, saving valuable time and resources. AI-powered voicebots and virtual assistants are being deployed to handle routine inquiries, provide accurate information, and guide borrowers through repayment processes. These technologies enable debt collection platforms to scale their operations, handle larger volumes of accounts, and focus their efforts on more complex cases requiring human effort.

- Predictive analytics: One of the most significant advancements in Indonesian debt collections market is the integration of predictive analytics. By analyzing historical data and patterns, machine learning algorithms can forecast the likelihood of repayments for each borrower. This enables collections teams to prioritize accounts and allocate resources effectively. Predictive analytics also aid in identifying early warning signs of potential delinquency, allowing proactive interventions to prevent default. As a result, lenders can optimize their recovery rates and reduce losses.

- Digital communication channels: Technology has opened up new channels of communication between debt collectors and borrowers. Digital communication methods such as emails, SMS, and mobile applications are replacing traditional phone calls and physical letters. These channels offer convenience and accessibility for borrowers, who can respond and interact at their convenience. Additionally, automated reminders and personalized notifications can be sent through these digital platforms, increasing the chances of timely repayment and reducing the need for manual follow-ups.

- Secure payment gateways: The rise of secure online payment gateways has significantly simplified the repayment process for borrowers. Lending institutions are leveraging these platforms to offer multiple payment options, including credit/debit cards, bank transfers, and e-wallets. Convenient payment methods encourage borrowers to settle their debts promptly, reducing the likelihood of default. Furthermore, secure payment gateways ensure the safety and confidentiality of financial transactions, enhancing trust between borrowers and lenders. Some of the popular payment gateways in Indonesia include Xendit, Doku, PayPal, dLOcal, and Adyen, to name a few.

Technology is transforming the debt collections space in Indonesia, bringing greater efficiency, accuracy, and customer-centricity. It is experiencing a significant transformation as technological advancements reshape traditional practices. Key areas where technology is driving this change include data management, automation, predictive analytics, digital communication channels, and secure payment gateways. By embracing these technological innovations, lenders can optimize their operations, enhance recovery rates, and cultivate a more robust and sustainable financial ecosystem.

FAQs:

- How is automation helping debt collections market in Indonesia?

Automation is making a positive impact on the debt collections ecosystem of Indonesia in the

following ways:

- Improved efficiency: Automation streamlines the debt collection process, allowing for faster and more efficient operations. Automated systems can handle repetitive and time-consuming tasks, such as data entry, document processing, and payment reminders, which reduces the workload on collection agents.

- Enhanced accuracy: Manual processes are prone to errors, leading to inaccurate records and miscommunication. Automation minimizes human errors by automating data entry, calculations, and document generation, ensuring accurate and reliable debt information.

- Customized Communication: Automation is enabling personalized and targeted communication with debtors. Debt collection software can automatically send personalized reminders, notifications, and payment options to debtors, increasing the chances of successful collections.

- Workflow Automation: Debt collection platforms can automate the workflow by creating predefined workflows and assigning tasks to specific agents. Automation helps track and prioritize debt collection activities, ensuring timely follow-ups and reducing delays.

- Data Analytics: Automated systems can analyze vast amounts of data, providing insights into debtor behavior, payment patterns, and trends. This data can help collection agencies make informed decisions, optimize collection strategies, and identify high-risk debtors.

- Compliance and Documentation: Automation in debt collections processes helps ensure compliance with debt collection regulations. Organizations can maintain accurate and complete records by automating documentation and record-keeping, which is crucial for adhering to legal requirements. This reduces the risk of non-compliance and potential legal issues that may arise from inadequate documentation or improper practices.

- Integration with other Systems: Automation systems can integrate with other software and databases, such as customer relationship management (CRM) systems, accounting software, and payment gateways. This integration enables seamless data exchange and improves overall efficiency in debt collection processes.

2. What are some of the ways in which technology has helped debt collections in Indonesia?

Technology has played a significant role in enhancing debt collection practices in Indonesia. Here are some ways in which technology has helped improve the debt collection process:

- Automation: Debt collection software and tools have automated various aspects of the process, such as generating payment reminders, tracking overdue accounts, and scheduling follow-ups. This streamlines operations, improves efficiency, and reduces the manual effort required.

- Predictive Analytics: Advanced data analysis techniques, such as predictive analytics, are utilized to assess debtor behavior and prioritize collection efforts. By analyzing historical data and patterns, collectors can identify high-risk accounts, predict the likelihood of repayment, and allocate resources accordingly.

- Online Payment Channels: The widespread adoption of online payment platforms and electronic banking systems has made it easier for debtors to settle their debts. Debt collection agencies and creditors often offer multiple online payment options, including bank transfers, e-wallets, and payment gateways, providing convenience and accessibility to debtors.

- Digital Communication Channels: Technology has facilitated communication between debt collectors and debtors through digital channels such as email, text messages (SMS), and instant messaging apps. These channels enable quick and efficient communication, reducing the need for physical visits or phone calls.

- Skip Tracing Tools: Technology-based skip tracing tools help locate debtors who have moved or changed contact information. These tools leverage various data sources, including public records, social media platforms, and databases, to track down debtors and ensure contact is established.