Debt collection is an essential and most important component of the lending ecosystem. It ensures the smooth functioning of lending institutions and is a key element of credit risk management. Debt collection is essential to recover outstanding debts while abiding by regulatory requirements in India, as it is in many other nations.

Despite the consistent growth of the debt collections industry in India, the sector grapples with notable hurdles, including processing times, manual collections practices, and grievance resolution mechanisms, impacting debt support and risk mitigation. In order to enforce stricter adherence to debt recovery procedures, the Reserve Bank of India (RBI) increased its supervision of lending institutions earlier this year.

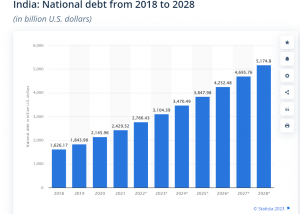

Source: Statista

The regulatory landscape

The debt collections industry in India operates within a framework of laws and guidelines that are designed to protect the rights and interests of both creditors and debtors. Some of the key regulatory bodies and laws that govern this industry include:

- Reserve Bank of India (RBI): The RBI provides guidelines for the conduct of banks and non-banking financial institutions engaged in debt collections. These guidelines are meant to ensure fair practices and protect the rights of borrowers.

- The Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act, 2002: This act allows banks and financial institutions to enforce security interests without the intervention of a court. It outlines the procedures for the sale and management of assets.

- The Recovery of Debts Due to Banks and Financial Institutions Act, 1993: Commonly referred to as the DRT Act, it established Debt Recovery Tribunals (DRTs) and Appellate Tribunals. These bodies handle cases involving the recovery of debt, further streamlining the process.

- Telecom Regulatory Authority of India (TRAI): In the case of telecom debt collections, TRAI regulates the industry to ensure that borrowers are not contacted with calls or messages beyond the necessary frequency.

Challenges faced by lenders

One of the significant concerns for every lender revolves around the issue of irregular payments and loan defaults by borrowers. Due to the accumulation of non-performing assets (NPAs), many commercial banks and regulated entities are facing financial losses and are becoming less willing to extend new loans in the future. This is understandable given that interest is the primary source of revenue for lenders. Additionally, the challenge of establishing contact with borrowers compounds these issues. Debt collections faces hurdles stemming from the absence of advanced technological tools, inefficient processes, and instances of borrower bankruptcy. These collective challenges underscore the urgent necessity for reform in the debt collections industry.

When repeated reminders and extensive follow-up attempts fail to yield loan repayments from borrowers, lenders often resort to initiating legal proceedings against defaulting borrowers as a means of debt recovery.

The role of technology

Technology plays a crucial role in ensuring compliance within the debt collections industry. Debt collections software and customer relationship management (CRM) systems have made it possible to monitor, record, and audit communications and interactions between collectors and borrowers. These digital tools help in tracking compliance with regulatory guidelines, ensuring a fair and transparent debt collections process.

Best practices for debt collections compliance

- Training: It is imperative that collections agents receive comprehensive and relevant training in various aspects of debt collections. This includes a deep understanding of debt collections laws, both at the national and local levels, to ensure compliance. Agents should also be trained in ethical practices, which encompass fair treatment of borrowers and adherence to a code of conduct. Customer interaction skills, such as negotiation techniques and conflict resolution, are equally crucial for effective debt recovery.

- Documentation: Maintaining meticulous records of all interactions with borrowers is not just advisable but essential. This documentation encompasses call logs, email correspondence, and written letters. These records serve multiple purposes, such as providing a clear history of communication, ensuring compliance with regulations, and assisting in resolving disputes or grievances.

- Consent and authorization: Debt collectors should operate within the boundaries of consent and authorization. Before initiating any communications or actions related to debt recovery, they must secure the explicit consent of the borrower. Furthermore, collectors need to possess proper authorization to undertake actions such as deducting funds from a bank account or negotiating settlements. Obtaining these permissions in a transparent and well-documented manner is crucial.

- Respectful communication: Interactions with borrowers should consistently adhere to respectful and humane communication practices. This means refraining from using tactics that may encroach on privacy and human dignity. Treating borrowers with dignity and respect not only upholds ethical standards but also improves the chances of successful debt recovery by fostering cooperation and trust.

- Privacy: Borrower privacy is a paramount concern in the debt collections market in India. Collectors must be vigilant about safeguarding the sensitive information of borrowers. They should refrain from disclosing any personal or financial data to third parties without proper authorization. This not only ensures compliance with privacy regulations but also protects borrowers from potential harm or identity theft.

- Incorporating these principles into debt collections practices not only upholds legal and ethical standards but also contributes to a more effective, transparent, and sustainable debt recovery process that benefits both lenders and borrowers.

Conclusion

Compliance is the bedrock of the Indian debt collections industry. It ensures that the collections process is ethical, lawful, and respectful of borrower rights. Through adherence to regulatory guidelines, professionalism, and the responsible use of technology, the debt collections industry can contribute to the overall health of the financial ecosystem in India. Assuring strict compliance with the relevant RBI norms, Credgenics’ technology platform incorporates extensive checks and control mechanisms. It facilitates a very customer- centric, compliant, and dignified approach to collections. It encourages the adoption of an unobtrusive, personalized, and digital communications approach, along with a comprehensive digital collections strategy. The platform prioritizes clear communication, negotiation, and empathy, aiming to find mutually beneficial solutions for both lenders and borrowers while maintaining a respectful and ethical approach throughout the collections process.

If you are looking to transform your debt collections strategy with the power of digital and data-powered insights, reach out to us to request an exploratory session at sales@credgenics.com or visit us at www.credgenics.com

FAQs:

1. Why is compliance important in the Indian debt collections industry?

Compliance is crucial in the Indian debt collections industry for several reasons. Firstly, it ensures that debt collections practices adhere to legal and regulatory frameworks, preventing unethical or illegal practices. Secondly, it helps maintain the reputation of lenders and collections agencies, fostering trust among borrowers and the public. Compliance also mitigates the risk of legal challenges and penalties, safeguarding the financial stability of both lenders and debt collections agencies.

2. What are some key regulations governing debt collections in India?

The primary regulation governing debt collection in India is the Reserve Bank of India’s (RBI) Fair Practices Code, which sets standards for ethical behavior in debt recovery. Furthermore, legal procedures for debt recovery and insolvency are outlined in the Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 (SARFAESI Act) and the Insolvency and Bankruptcy Code, 2016 (IBC). Various state-specific regulations may also apply.

3. How does compliance impact borrower relations in debt collections?

Compliance plays a significant role in maintaining positive borrower relations. When borrowers are treated fairly and ethically, it fosters trust and cooperation. Conversely, non-compliance can lead to strained relations, complaints, and legal action. By following compliance guidelines, collectors can achieve a more amicable resolution with borrowers.

4. What are the consequences of non-compliance in debt collections in India?

Non-compliance in the Indian debt collections industry can have serious consequences. Lenders and collections agencies may face legal penalties, including fines and sanctions. It can also lead to damaged reputations and the loss of clients. In some cases, non-compliance may result in criminal charges, which can have severe repercussions for individuals involved in the collection process.

5. How can lenders and collections agencies ensure compliance in their operations?

To ensure compliance, lenders and collections agencies should invest in thorough training for their staff, ensuring they understand relevant laws and regulations. They should also implement strong documentation practices, maintain clear records of communications, and conduct regular internal audits to identify and rectify potential compliance issues. Staying informed about evolving regulations is equally important.

6. How does compliance benefit the overall financial industry in India?

Compliance in debt collections benefits the broader financial industry in India by contributing to its stability and credibility. It reduces the risk of systemic issues caused by unethical practices, maintains investor and depositor confidence, and supports the overall health of the financial ecosystem.