With a booming economy and a swiftly increasing tech-oriented population, India is steadily carving its niche as a global hotspot for digital innovation, predominantly in the financial services landscape. The amalgamation of Artificial Intelligence (AI) and financial technologies (FinTech), particularly in AI in banking, acts as a catalyst in this transformative surge. This combination gives a promising outlook for the future of FinTech in India, with the country poised to lead this revolutionary transition.

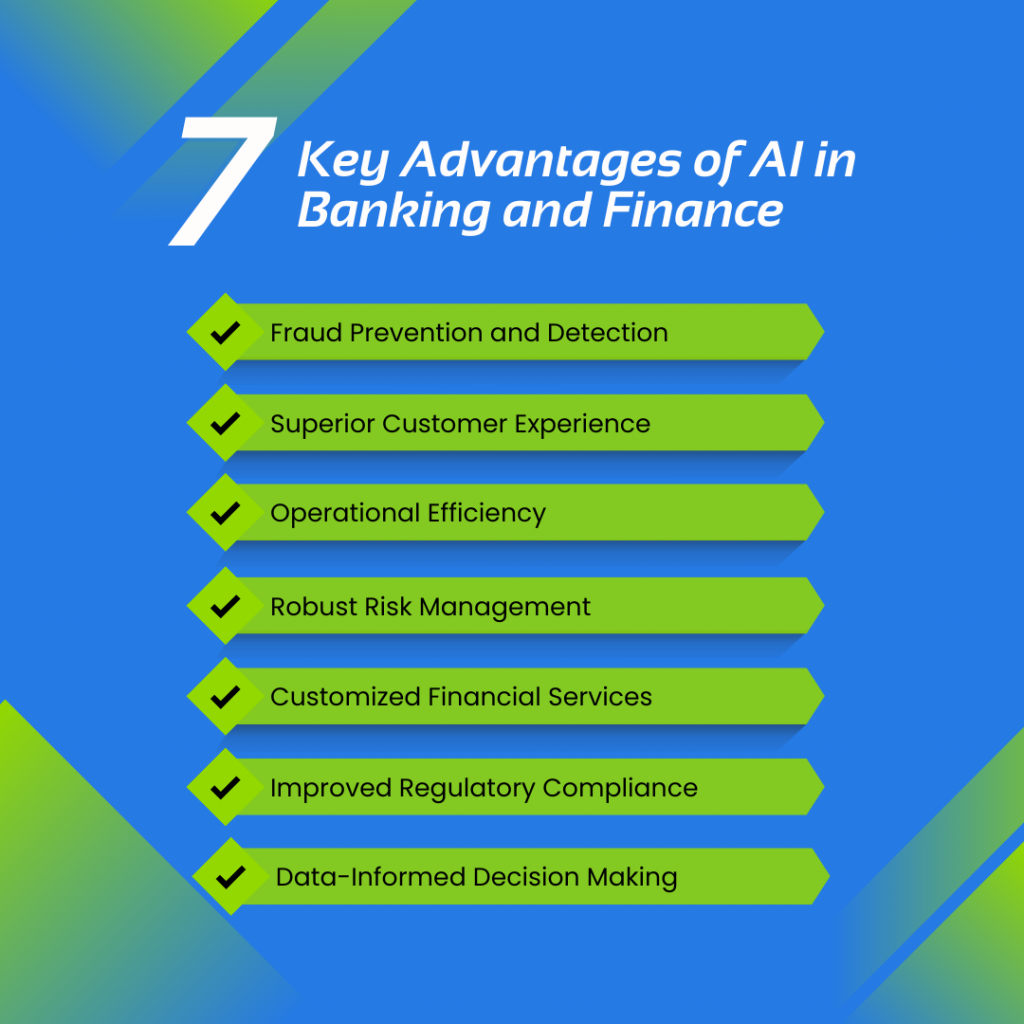

Fraud Prevention and Detection

The fusion of AI in FinTech is ushering in proactive solutions for spotting and mitigating fraudulent transactions. By scrutinizing large data sets to detect patterns and discrepancies, AI offers a level of surveillance that transcends human capabilities. This increased security strengthens customer confidence and enhances financial stability – a significant pillar for the Future of FinTech in India.

Superior Customer Experience

AI is redefining customer interactions with banks and other financial services companies. AI-enabled chatbots and virtual assistants provide 24/7 support, tackling customer inquiries, offering financial advice, and facilitating transactions. By delivering personalized services, AI-powered tools enhance customer satisfaction and foster stronger relationships.

Operational Efficiency

AI has the power to automate routine tasks which reduces operational costs and minimizes errors, enabling the operations teams to focus on more complex tasks. As AI capabilities evolve, we can expect further advancements in automation, reshaping the operations to a larger extent within the banking and financial industry.

Robust Risk Management

The ability to analyze multiple factors in real-time allows for accurate risk assessments and predictions. By providing insights into customer credit worthiness and potential investment outcomes, AI assists banks and other lending companies in making well-informed decisions, crucial for the industry’s sustainability and profitability.

Customized Financial Services

Utilizing AI, banks can analyze past transactions and behaviors to deliver personalized financial services. This leads to more tailored offerings, enhancing customer satisfaction and opening new revenue opportunities for banks. As AI personalizes services to meet customers’ specific needs, it boosts product uptake and loyalty. In the future of FinTech in India, this degree of personalization will play an increasingly significant role.

Improved Regulatory Compliance

AI offers vital assistance to banks in meeting stringent regulatory compliance requirements. It continuously monitors transactions and activities, swiftly identifying any deviations from standard protocols. In addition, AI can automate the generation of regulatory reports, thereby easing the compliance burden.

By integrating various data sources, AI provides a unified compliance perspective, enabling banks to remain adaptable to evolving regulatory changes. Furthermore, AI’s predictive capabilities can anticipate potential non-compliance areas, allowing for proactive remediation and preventing penalties.

Data-Informed Decision Making

AI leverages the vast data banks possess, transforming it into actionable insights through machine learning and predictive analytics. These insights inform strategic planning and decision-making processes, driving innovation and growth.

AI is no longer a luxury, but a survival necessity in a rapidly digitizing world. India’s banking sector stands to reap significant benefits from integrating AI with FinTech, which will permeate the entire financial ecosystem.

To remain competitive, banks in India must harness AI’s power to elevate services, streamline operations, and fortify security. This not only improves customer services but also promises a future that is secure, efficient, and customer-centric. The union of AI and FinTech is not just reshaping Indian banking but redefining the very future of finance itself.

FAQs on AI in banking and the Future of FinTech in India

Q1: How is AI influencing the future of FinTech in India?

AI is transforming financial services by enhancing accuracy, speed, and reducing human errors and costs. AI’s contributions to fraud detection, risk management, personalized services, and more mark a bright future for FinTech in India.

Q2: What effect does AI have on customer service in banking?

AI significantly enhances customer service, with AI-powered chatbots and virtual assistants providing personalized, immediate, and round-the-clock support. Their ability to learn from customer interactions leads to insightful financial advice.

Q3: How does AI aid risk management in FinTech?

The real-time analysis of a multitude of parameters enables sophisticated risk management. It offers insights into market volatility, customer creditworthiness, and investment outcomes, ensuring safer, informed financial decisions.

Q4: What part does AI play in regulatory compliance in banking?

AI systems monitor transactions and activities, flagging any deviations from regulations or protocols. They also automate the generation of regulatory reports, simplifying the compliance process.

Q5: Can AI impact decision-making in banking?

Yes, AI facilitates data-driven decision-making. It uses machine learning and predictive analytics to glean actionable insights from vast data, influencing strategic planning and market opportunity identification.

Q6: How does AI contribute to personalized financial services?

AI analyses past transactions and behaviors to understand a customer’s financial habits and risk profile. This allows banks to offer tailored financial products and savings plans to each customer.