Introduction

The advent of digitization has been a game-changer across sectors, transforming the way businesses operate and serve customers. The banking industry, once the stalwart of traditional business models, has embraced this digital wave with open arms. As we delve deeper into this blog, you will gain a comprehensive understanding of digitization in banking industry.

The emergence of digitization in banking industry

The process of digitization in banking wasn’t a sudden occurrence. It has been an evolutionary progression that initiated with the primitive computerization of bookkeeping tasks in the later part of the 1900s, gradually paving the way for universal acceptance of online and mobile banking in the 21st century. We’ve transitioned from a phase when physical banking was the standard practice, to a digital age where a plethora of banking services are readily accessible with a few taps on our screens.

Understanding digitization in banking industry

Digitization involves leveraging digital technologies to modify, enhance, or replace traditional banking services. It spans all facets of banking, from simple account balance inquiries to complex transaction processes. Today’s consumers can apply for loans, transfer funds, pay bills, and even invest in securities online. This digital shift has reshaped the banking experience into a fast, efficient, and customer-centric model.

The role of digitization in modern banking

Digitization has brought a paradigm shift in the modern banking industry. The convenience of banking anytime, anywhere has elevated customer expectations, necessitating constant innovation. Few Banks have emerged as digital leaders, using advanced analytics, AI, and other technologies to offer personalized services, enhance security, and make banking frictionless.

How is digitization supporting financial inclusion?

Digital technology is catapulting financial services into uncharted territories, broadening their horizons and making financial inclusion a reality, not just a dream. Here are some ways in which this digital revolution is turning the tide in favour of financial inclusivity:

The advent of online and mobile banking: These platforms bring everyday banking operations to the doorstep of individuals, even in the most remote corners of the world. A user can handle transactions, manage accounts, pay bills, and even seek credit facilities from their smartphone, bypassing the need for physical banking infrastructure.

Mobile-centric money services: These solutions have been transformative in many parts of the globe. Individuals can use their mobile devices for fund deposits, transfers, payments and receipts without needing a traditional bank account.

Microcredit and peer-to-peer lending mechanisms: Platforms providing these services have democratized access to credit, especially for small and informal businesses often bypassed by traditional banks. They link borrowers directly to lenders, making it more feasible and economical to provide small loans.

Digital transactions: Making transactions digitally has proven to be more efficient and cost-friendly than handling cash, which is a boon for households with lower income and individuals pressed for time. These digital transactions also record a financial footprint, enabling access to a wider array of financial services for users.

Revolution in Insurance through technology (Insurtech): Insurtech platforms leverage technology to extend the reach of insurance products, making them more accessible and cost-effective for a wider demographic. These digital solutions allow for the creation of individual-centric insurance plans, catering to specific needs.

Financial education through digital channels: Digital platforms play a crucial role in spreading financial literacy, informing users about available financial services and empowering them to make wise financial decisions.

Benefits of digitization in banking industry

The advent of digitization in banking has unlocked unprecedented benefits. For banks, it has led to lower operational costs, reduced errors, and improved risk management. For customers, it has resulted in enhanced convenience, faster services, and personalized offerings. These transformations have led to increased customer satisfaction and loyalty, as evidenced by the success stories of digitally advanced banks, neo-banks, fintechs and other financial companies.

Challenges to digitization in banking sector

Despite its many benefits, the journey of digitization is not without hurdles. Banks often grapple with challenges such as cybersecurity threats, regulatory complexities, and the integration of legacy systems with new technologies. Moreover, the digital skills gap in the workforce and resistance to change can also hinder the pace of digital transformation. However, with a robust strategy and a culture of innovation, these challenges can be effectively addressed.

How digitization in banking industry is impacting B2B relationships

Digitization has not only revolutionized retail banking but has also significantly impacted B2B relationships. It has facilitated the automation of payment processes, improved transaction speed, and enhanced data sharing, all of which have fostered trust and efficiency in B2B relationships. For example, the use of APIs has allowed banks to offer white-label solutions to their B2B partners, creating win-win situations.

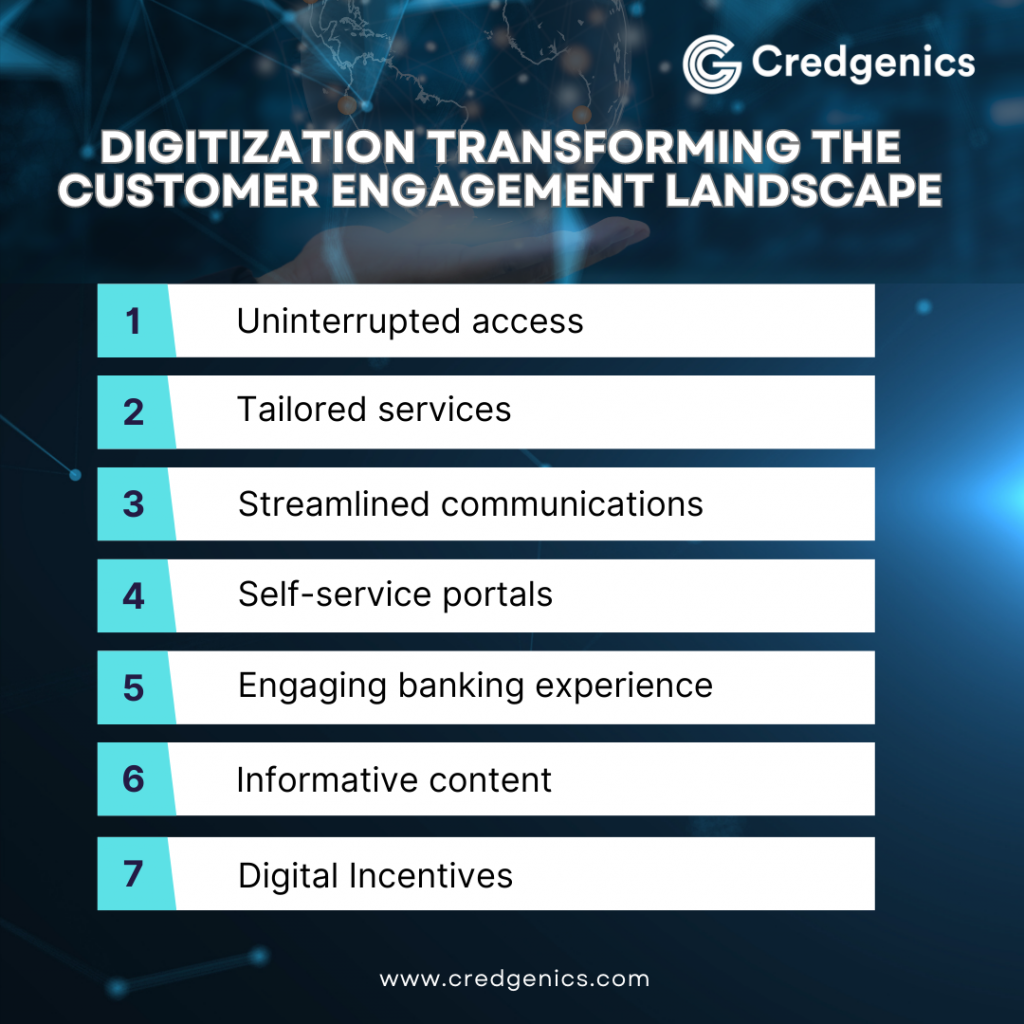

In what ways is digitization transforming the customer engagement landscape?

Digitization is redefining the landscape of customer engagement across various industries, including banking. Here are some ways in which digital transformation is reshaping customer interactions:

Uninterrupted access: The digital era heralds round-the-clock banking services, enabling customers to manage their finances at their convenience, irrespective of time or location. This unfettered accessibility amplifies customer engagement as it transcends the confines of traditional banking hours.

Tailored services: Through the power of data analytics and machine learning, banks can glean insights into customer behaviors and preferences. This data-driven understanding facilitates the provision of bespoke products and services, augmenting the customer experience and fostering deeper engagement.

Streamlined communications: The rise of chatbots, AI-driven virtual advisors, and social media engagement has opened up new communication channels. These technologies enable banks to respond to customer queries promptly, resolve issues effectively, and offer immediate assistance, thereby enhancing customer interaction.

Self-service portals: Digital platforms offer customers the option to carry out a range of banking tasks independently. By providing a sense of control and expediting processes, these self-service capabilities boost customer satisfaction and engagement.

Engaging banking experience: Banks are tapping into augmented reality (AR) and virtual reality (VR) technologies to create immersive banking experiences. Features like AR-based banking applications and virtual assistants add an element of interactivity, fostering a higher degree of customer engagement.

Informative content: Many banks are using their digital platforms to share educational content about financial products and services. By helping customers understand the complexities of financial services, banks empower them to make informed decisions, leading to increased engagement.

Digital Incentives: To keep customers engaged and loyal, banks are rolling out various digital rewards programs, including discounts, cashback offers, and more. These digitally facilitated incentives cultivate customer loyalty and foster repeated engagement.

In essence, digitization is supercharging customer engagement by making banking services more accessible, personalized, and interactive. It’s creating a customer-centric ecosystem that enriches the banking experience and revitalizes the way customers interact with their banks.

The future of digitization in banking industry

The banking sector’s future landscape is likely to witness trends like the widespread application of AI and machine learning in banking operations and the continued growth of mobile and online banking. The digital era necessitates continuous adaptation, urging banks to evolve with technological progress to remain relevant and competitive.

As we look ahead, the need for sustained digitization in the banking sector is crystal clear. The digital wave is set to continue shaping the contours of the banking world.

Conclusion

Amidst the unstoppable wave of digitization, the banking sector stands dramatically transformed. What we witness is not just an alteration but a remarkable transition from traditional banking to a digitally-enabled, highly efficient model that prioritizes the customer and includes everyone in the financial ecosystem.

Every corner of the banking industry today breathes digital; it’s an evolution that streamlines processes, optimizes customer journeys, fortifies B2B partnerships, and paves the way for inclusive finance. This digital revolution in banking is more than a trend; it’s a new standard that is here to stay.

FAQs

Q: Can you define digitization within the banking framework?

Within the banking sector, digitization signifies the shift from traditional banking methods to technology-driven solutions. This transition leverages advancements such as AI, machine learning, blockchain, and big data analytics, leading to the rise of facilities like web-based banking, mobile banking platforms, and digital wallet services.

Q: How has the banking sector evolved through digitization?

Digitization has acted as a catalyst for transformation in the banking sector. This transformation is evident in the heightened operational productivity, enriched customer interactions, advocacy for greater financial access, improved methodologies for risk management, and the introduction of ground-breaking financial services and products.

Q: What are the key advantages brought about by digitization in banking?

The digitization of the banking industry has yielded numerous benefits. These include amplified operational efficiency, customized banking experiences, constant accessibility to services, increased financial accessibility, more sophisticated risk management strategies, and the evolution of novel financial services and products.

Q: How is digitization transforming customer relationships in banking?

Digitization is transforming customer relationships by enabling banks to offer personalized services based on data analytics, enhancing customer satisfaction. It also provides 24/7 access to banking services, improving the overall customer experience.

Q: What could be the future trends in digital banking?

Future trends in digital banking could include increased use of artificial intelligence and machine learning in banking operations, the continued growth of mobile and online banking, and the emergence of more innovative financial products and services due to digitization.