The banking and Financial Services industry has adopted mobile-based platforms/apps extensively to increase its customer reach, simplify operations, and leverage the power of digital connect. This is where Field Service Management (FSM) for the automation and monitoring of numerous field processes, such as KYC, document collections, and drop services, is gaining momentum. The field loan collections teams have implemented multiple use cases in FSM, as automation and digital for field loan collections can reduce costs and improve collections efficiency. New developments are making the FSM apps for field debt collections simpler and easier to adopt.

Depending on the profile of field loan collections agents, having English as the only language in FSM apps might lead to a lower adoption rate among agents and users. Field agents prefer carrying paper documents to record the services delivered, instead of going digital with FSM apps. Imagine a field debt collections agent unable to transact in a particular mobile app because of language barriers. As per a KPMG survey, 60% of Indian language internet users stated that limited language support and content were the major barriers to the adoption of online services. This is certainly a challenge for the services extended to tier-2 and tier-3 cities, where the adoption of the English language is lower compared to their metro-city peers.

India has 22 official languages with 6,000+ dialects and 55+ languages with 1Mn+ speakers.

Financial institutions have a unique opportunity to enhance their relevance and engage more closely with their customers and users in their native languages, given the diversity of the Indian subcontinent. Providing multilingual support to enhance the agent experience is no more optional. The need to enable vernacular support for the FOS teams, and allow agents to select their preferred language, instead of English as the default is a must.

CG Collect, the leading field debt collections mobile app, that digitizes door-to-door debt collections efficiency, offers an advanced multilingual interface to boost adoption and improve agent productivity. The feature eliminates the language barrier so that agents can use the app quickly and effectively.

What is CG Collect’s multilingual support for field loan collections agents?

CG Collect mobile debt collections app allows the lender’s / collections agency’s field force to have access to multiple languages, tailored as per their geographies, on the application. CG Collect supports all 22 Indian national languages along with the Indian regional languages, Bahasa (Indonesia), and Vietnamese. The application can be easily configured as per the collections agents’ language needs.

Multiple language options provide flexibility to the field agents, who can opt for their preferred language on the app, for a better understanding of the instructions and functionalities of the application. Users can easily select any language by visiting the account settings page in their profile section.

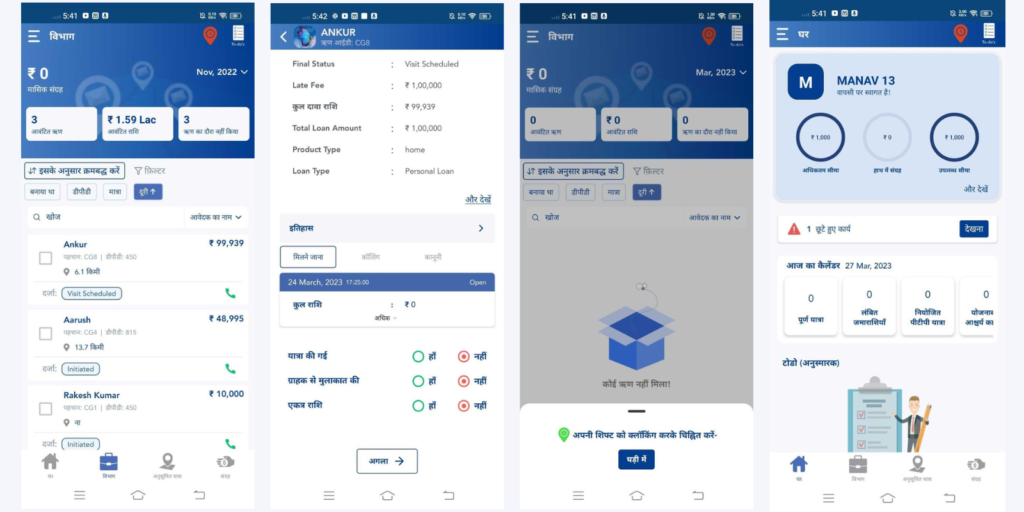

Here is a quick view of the language setting flow for the field loan collections agent.

Figure: How the Localization support enhances agent experience in CG Collect

Benefits of multilingual features for field debt collections agents

The diverse demographics of Indian states, cultural backgrounds, and linguistic variations make end users relate more to digital platforms that communicate with them in their native language. Most debt collections agents in the field and on calls are trained to interact with borrowers primarily in English or Hindi. This results in friction in the field collections process or contact centre operations, leading to a lack of trust, misunderstandings, and conflicts. Thus, providing the debt collections software’s interface in native languages is crucial for enhancing the performance and outcomes in operations.

Fig: Application User Interface content gets updated based on the selected language

Improving digital adoption for agents: The agents can quickly understand the function of various tabs, statuses, and buttons, which they might not have been able to comprehend in English, and perform the respective necessary actions without any ambiguity. The availability of status information in the native language for daily operations, goals, and performance metrics enables agents to respond to the respective actions quickly.

Build trust: This receipt translation, which will soon be introduced, will simplify receipt validation for the borrowers making the payments. This will also help the agent verify the details of the amount being collected and deposited at the respective branch or bank.

Increasing productivity

Ease of operations helps agents better serve the borrowers. They can service more borrowers, which increases collections efficiency. The time spent on training for the app is reduced with agents easily working via the mobile app.

Schedule visit ( Hindi)

The multilingual feature on the CG Collect mobile app enables lenders and their field collections teams to deal with cases effectively and efficiently, especially in rural areas, to track their allocations and recover loan payments. Learn more about Credgenics’ CG Collect mobile app and how this field loan collections app is transforming collections by automating and digitizing last-mile collections.