In debt collection, every borrower conversation is unique and needs to be handled with utmost importance and care. A simple reminder call may trigger an instant repayment, a clarification conversation, or a support request. Managing these diverse debt collection-related interactions at scale across millions of borrowers, different loan products, varying delinquency stages, multiple languages, and unique repayment behaviors has always been complex.

This is where Swara – Credgenics’ GenAI voicebot for debt collections and DialNext – predictive dialer for collections are transforming the communication approach for debt recovery.

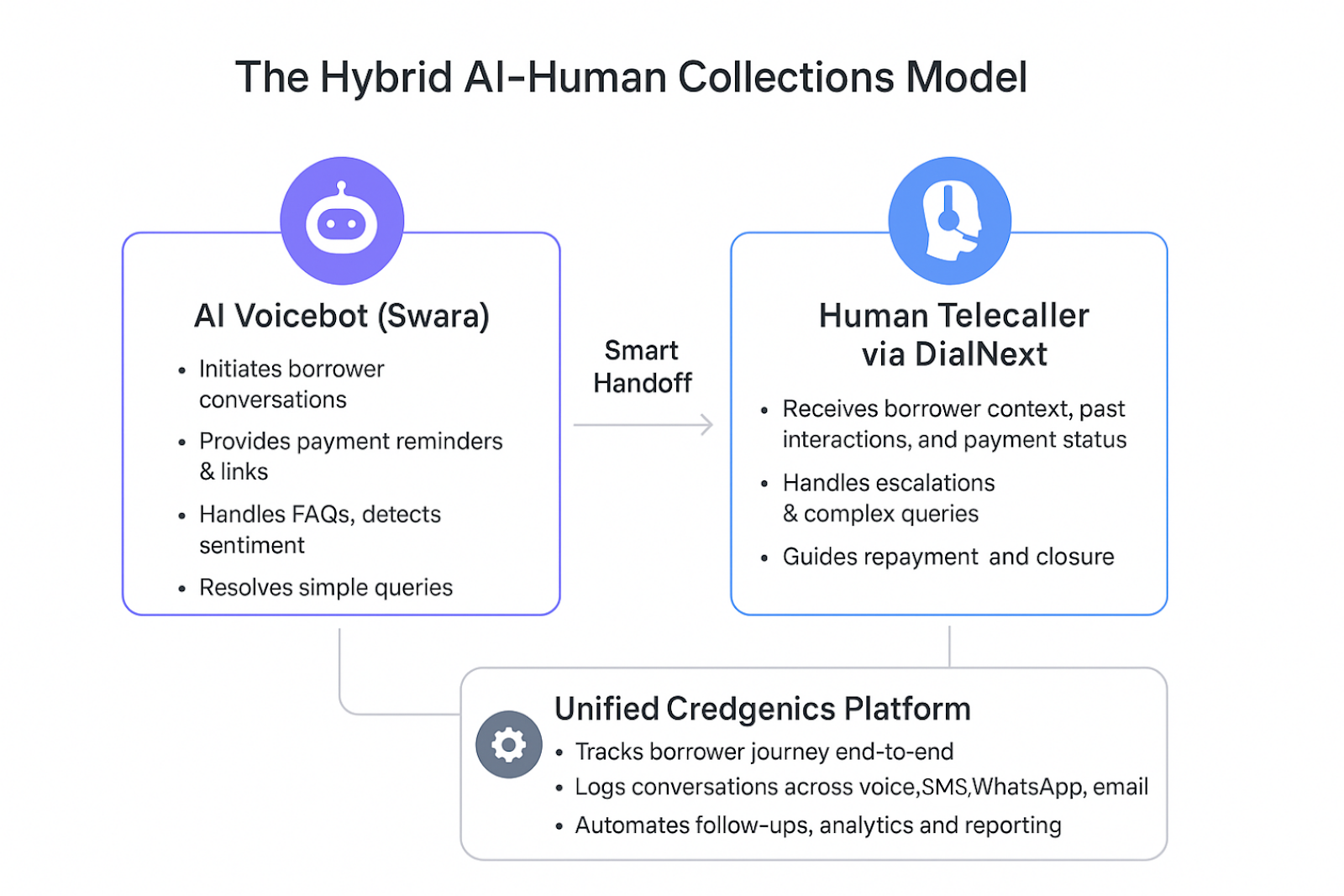

Together, they power an intelligent AI-powered contact center for debt collections that delivers a hybrid model where smarter automation handles professional calls at scale with human-like empathy, while human telecallers step in at the right moment to provide quick resolution for complex situations or escalations.

The Borrower’s Journey: From Voicebot to Telecaller

Let’s take a simple repayment reminder scenario.

Step 1: The Voicebot Makes the Call

A credit customer receives a call from Swara, the Credgenics AI voicebot for debt collections. The conversation is natural in tone, in the customer’s preferred language, personalized, and empathetic. Swara reminds the customer of a missed due date, the possible impact of delay, shares the outstanding amount, and even provides an instant UPI link for payment.

For many customers, this is enough—they understand the situation and complete the payment within minutes.

Step 2: A Query Arises

But sometimes, the customer has a question. Maybe they are facing a technical issue, want to confirm whether a partial payment is acceptable, or they are unsure about late fee calculations. These are queries where empathy, flexibility, and context are essential.

Here, Swara does something smart: it uses proprietary LLM, TTS, and STT models to interpret the query, uses voice analytics to analyze borrower sentiments, and provides the best solution based on pre-approved scenarios, customer engagement history on the platform. This can be a penalty waiver offer on late payments, a partial payment acceptance procedure, or even educating the borrower on the impact of late payments on their credit score.

Step 3: Escalation to DialNext

Let’s say the borrower is not satisfied with the solution shared or with the voicebot call and still wants to talk to a human telecaller. The query is instantly passed on to DialNext – the AI Predictive Dialer for collections. DialNext instantly connects the borrower to an available expert telecaller. But this isn’t just a blind transfer—the telecaller has full visibility of the borrower’s interaction history, including:

- What Swara voicebot has already discussed

- Payment reminders sent earlier via digital communications

- Borrower’s response patterns and preferences

Empowered with this context, the telecaller doesn’t need to further repeat the questions or waste more time. They step in directly into the borrower’s journey, build trust, and resolve the query faster.

Step 4: Resolution and Payment

The telecaller explains the repayment options, answers the query, and guides the borrower to complete the payment, often within the same call. The result? A smoother borrower experience and a higher likelihood of resolution.

Why this matters for BFSI companies

The AI-powered contact center for debt collections with hybrid and smarter automation addresses the three biggest challenges that lenders face in debt collections:

- Rapid Scalability at Low Cost

Swara AI voicebot for debt collections can handle thousands of calls simultaneously in 8+ languages, which reduces the need for having huge human calling teams. - Seamless Addressing of Escalations

DialNext predictive dialer for collections ensures that no borrower query falls through the cracks as it routes them to telecallers only when necessary – resulting in reduced cost and faster resolutions while improving customer experience. - Context-driven Conversations

With full visibility into past interactions, telecallers skip redundant questions that help build trust in the conversation and lead to faster repayments.

Fig 1: A sample flow with Swara and DialNext integrated into the contact center journey

End-to-End Automation: When Voicebots Close the Loop

| For Borrowers | For Lenders |

|

|

The entire customer engagement journey is handled end-to-end by Swara Voicebot, with no human telecaller intervention required. This frees telecallers to focus on complex/sensitive cases and escalations.

DialNext: AI-Powered Predictive Dialer for Collections Edge

When escalations to human telecallers are needed, DialNext ensures maximum efficiency with:

- Smart Dialing: Predictive algorithms reduce the telecaller’s idle time and maximize connect rates

- Compliance First: Built-in safeguards for Do-Not-Call lists and call-window rules

- Integrated journeys: Telecallers receive borrower details and history before the call connects

- Real-Time Monitoring: Supervisors track telecaller productivity and campaign outcomes instantly. Telecaller live interaction monitoring also ensures policy control

- Real Time Agent Assist: The system supports live chats and videos with screen sharing. Instant recommendations and knowledge prompts help to resolve queries faster

By intelligently routing escalations and managing outbound campaigns, DialNext reduces costs while keeping compliance airtight.

Swara: Empathy and Efficiency at Scale

Unlike the basic IVR systems and voicebots, GenAI-powered Swara uses natural language processing to hold real human-like conversations, tailored for debt collections.

- Multilingual Reach with real-time language switch: 8+ languages supported to ensure that borrowers can engage freely.

- Adaptive Dialogue: Handles interruptions, clarifies doubts, and adjusts tone / context in real time.

- Payment Integration: Shares personalized payment links instantly and confirms status updates to close the collection loop.

- Behavioral Learning: Learns from borrower interactions to adjust frequency and style of outreach.

- Follow-up actions: Automatically follows up for next actions across digital, calling, field, and legal engagements.

This makes Swara an empathetic front line collection AI assistant , fatigue-free, and always compliant.

A Future-Ready Solution for Smarter Contact Centers

Collection calls don’t have to feel combative or inefficient. With Swara’s Conversational AI and DialNext finesse, lenders get the best of both worlds: AI-powered automation for scale, and human empathy where it matters most.

Whether it’s a credit customer making a repayment with a voicebot call, or a query escalated seamlessly to an informed human telecaller, the result is the same—higher recoveries, stronger compliance, and better customer experiences.

The hybrid model of GenAI Voicebot + Predictive Dialer is more than just a tech upgrade. It represents a fundamental shift in how BFSI AI-powered contact centers for debt collections operate:

- From manual to automated conversation

- From generic to personalized discussions

- From reactive to proactive follow-up

- From error-prone to error-free communications

- From basic to advanced systems

- From broken to integrated platforms

At Credgenics, we’re enabling the transformation of AI-powered contact centers for debt collections with Swara and DialNext AI Predictive Dialer. We are powering an ecosystem — where AI and humans don’t compete, but collaborate to deliver benchmark outcomes that matter.

Frequently Asked Questions (FAQs)

1. How is an AI Voicebot for collections like Swara different from traditional IVR systems?

Unlike IVR systems that rely on fixed menus and keypad inputs, Swara uses Generative AI and Natural Language Processing (NLP) to hold human-like, two-way conversations in multiple languages. It understands borrower intent, adjusts tone, and provides personalized responses — creating a far more empathetic and efficient experience.

2. What role does DialNext play in the hybrid model?

DialNext is an AI-powered Predictive Dialer for collections that optimizes outbound campaigns, connects telecallers to borrowers instantly, and ensures faster resolutions and higher productivity.

3. How do Swara and DialNext together improve borrower experience?

The hybrid model ensures the best of both worlds, AI for scale and humans for empathy. Swara handles routine calls with automation and accuracy, while DialNext routes complex or sensitive cases to trained telecallers with full visibility, creating seamless, context-rich borrower interactions.

4. Can lenders customize and integrate these solutions easily?

Yes. Both Swara and DialNext are part of the Credgenics AI full-stack collections platform, designed for easy integration with existing LOS and LMS systems. They support multilingual, compliance-ready workflows and can be customized to reflect each lender’s process, communication tone, borrower profile, and operational goals.