Debt collections have long been a necessary but often challenging process. Traditionally, lenders have relied on phone calls, emails, and formal letters to recover outstanding debts. These approaches, while effective to some extent, are often time-consuming, generalized, and can lead to a stressful experience for both lenders and debtors. According to a survey, communicating with customers is a top priority for debt collection companies. Now, the debt collection landscape is undergoing a profound transformation, driven by the advent of Artificial Intelligence (AI).

AI chatbots and voicebots are reshaping debt collections, offering a more efficient, convenient, and potentially less stressful approach to the process. These intelligent virtual agents are changing the way lenders and borrowers interact. The global AI market is projected to expand from US$ 59.67 billion in 2021 to US$ 422.37 billion by 2028, with a remarkable CAGR of 39.4%. In India alone, the AI market is expected to grow from US$ 3.1 billion in 2020 to US$ 7.8 billion by 2025.

Unlike traditional methods, AI-driven chatbots and voicebots can engage debtors in personalized, efficient, and non-confrontational conversations. By leveraging natural language processing and machine learning capabilities, they can analyze payment history, communication preferences, and intent to pay. This allows for gathering crucial information and facilitating personalized interactions that enhance the debtor’s experience.

As we delve into this technological transformation, we’ll explore how AI chatbots and voicebots are not only streamlining the collections process but also improving customer experiences and potentially increasing the recovery rates in previously unimaginable ways.

Overview of AI Chatbots and Voicebots in debt collections

AI chatbots and voicebots are reshaping debt collections practices, transforming them into intelligent and empathetic interactions. While these technologies have applications across various sectors, they are particularly prevalent in financial services and insurance. These AI-powered tools are increasingly employed to automate and enhance communication with debtors, offering a more efficient and personalized approach to debt recovery.

Chatbots:

Chatbots are text-based virtual agents that interact with users through messages on websites, apps, or other digital platforms. Using NLP, chatbots comprehend the meaning behind user queries and respond with relevant information or actions. They can handle a wide range of tasks, from answering common questions to facilitating payment arrangements, freeing human agents to focus on more complex cases.

Voicebots:

Voicebots operate through spoken language, utilizing Automatic Speech Recognition (ASR) to convert speech into text that the AI can understand. They then use Natural Language Generation (NLG) to formulate responses, which are converted back into speech for the user. Commonly found in smart speakers and virtual assistants, voicebots enable hands-free, conversational interactions, providing a seamless user experience.

Both chatbots and voicebots use conversational AI to automate debt collection calls, addressing significant industry challenges. As these technologies evolve, they continue to refine their capabilities, making debt collections smarter and more effective.

Advantages for financial institutions

The integration of AI chatbots and voicebots in debt collections offers numerous benefits for financial institutions, such as banks, non-banking financial companies (NBFCs), and fintech lenders. These sophisticated AI tools are reshaping account receivable management by driving remarkable improvements across various aspects of the collection process. By leveraging natural and empathetic communication channels, these systems are not only enhancing operational efficiency but also transforming the debtor experience, leading to more effective and customer-centric collection strategies.

1) Cost Savings: Automating debt collection processes with AI significantly reduces operational expenses. AI-powered bots can handle high volumes of interactions without fatigue, allowing financial institutions to reallocate resources to more value-added activities, such as customer relationship management and strategic planning, instead of spending heavily on manual collection efforts.

2) Improved Recovery Rates: The 24/7 availability and swift response times of AI bots lead to more timely and consistent communication with debtors. This increased engagement, coupled with personalized repayment options, often results in higher collection success rates.

3) Enhanced Customer Relationships: AI chatbots and voicebots leverage Natural Language Processing (NLP) and Natural Language Understanding (NLU) to offer personalized communication tailored to each debtor’s financial situation and history. This individualized, non-intrusive approach helps maintain positive relationships with debtors, even in challenging financial times. Ultimately, it leads to improved customer retention and satisfaction, which are essential for financial institutions.

4) Scalability: AI chatbots and voicebots can handle a large volume of customers simultaneously, making the debt collections process more scalable. This capability allows financial institutions to manage more accounts without a proportional increase in staffing costs.

5) Compliance and Data Security: AI-powered debt collection tools are designed to adhere to strict data protection regulations, ensuring secure data handling and advanced encryption. This compliance reduces the risk of legal issues and builds trust among debtors and financial institutions.

AI chatbots and voicebots streamline debt collections for financial institutions by making the process more efficient and customer-centric. By leveraging these advanced technologies, institutions can achieve better recovery rates while reducing operational costs. The result is a more effective, compliant strategy that benefits both the lenders and borrowers.

Recommended Read: Chatbots: Driving the Digital Revolution in Banking Sector

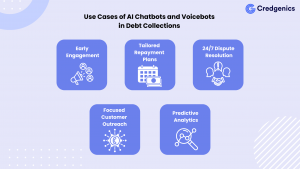

Use cases of AI Chatbots and Voicebots in debt collections

AI-powered chatbots and voicebots are introducing efficiency, personalization, and automation into the debt collections process. Let’s explore some key use cases that demonstrate their transformative potential:

1. Proactive Early-Stage Engagement

AI chatbots and voicebots excel at initiating timely contact with debtors. They can send personalized reminders about upcoming payments and offer convenient options to facilitate transactions. This proactive approach helps prevent accounts from falling into delinquency and maintains positive customer relationships.

2. Customized Repayment Solutions

By analyzing individual financial situations, these AI tools can propose tailored negotiation strategies and payment plans. This personalized approach increases the likelihood of successful debt resolution while accommodating the debtor’s circumstances.

3. Round-the-Clock Financial Dispute Resolution

AI chatbots and voicebots provide 24/7 accessibility for debtors to resolve disputes, access account information, or make payments. This constant availability ensures that debtors can receive assistance whenever they need it, which enhances customer satisfaction and improves collection efficiency.

4. Multi-Channel Communication for Focused Customer Outreach

AI chatbots can interact with customers on their preferred platforms, such as text messages, social media messengers, and company websites or apps. Voicebots can make calls and leave voicemails, providing a flexible, multi-channel approach that increases the chances of successful contact and engagement. Additionally, these AI tools support multiple languages, ensuring effective communication with a diverse customer base. This comprehensive approach increases the chances of successful contact and resolution.

5. Gathering and Analyzing Data for Useful Insights

These AI tools continuously gather and analyze interaction data, providing valuable insights into debtor behavior, payment patterns, and successful collection strategies. This intelligence allows financial institutions to refine their approaches and improve overall collection effectiveness.

Recommended Read: 8 Use cases of Artificial Intelligence and Machine Learning in finance

The future of AI Chatbots and Voicebots in debt collections

The integration of AI chatbots and voicebots in debt collections is poised to revolutionize the industry, offering unprecedented levels of personalization and efficiency. As these technologies evolve, they will leverage advanced natural language processing to tailor communication styles and strategies to individual debtors, potentially increasing engagement and successful repayments.

AI’s predictive capabilities will play a crucial role in assessing repayment likelihood, allowing collection agencies to prioritize cases and allocate resources more effectively. This data-driven approach could lead to more successful outcomes while reducing unnecessary contact with those likely to repay without intervention.

Moreover, AI-powered systems have the potential to serve as financial literacy hubs, offering debtors valuable resources and advice to improve their financial health. By providing educational content and personalized financial management tips, these systems could help prevent future debt issues and foster a more positive relationship between collection agencies and consumers.

However, it’s crucial to emphasize the responsible use of AI in debt collection practices. As these technologies become more prevalent, industry leaders must prioritize ethical considerations, data privacy, and fair treatment of debtors. Striking the right balance between automation and human empathy will be key to building trust and ensuring that AI serves as a tool for positive change in the financial recovery landscape.

Transform debt collections process with Credgenics AI and ML models

Credgenics’ cutting-edge AI and ML models are transforming the debt collections landscape. By leveraging advanced technologies, we deliver exceptional results that consistently outperform traditional methods. Our innovative approach offers unparalleled benefits:

- Increase collection rates by up to 92%

- Reduce operational costs by 20-35%

- Leverage advanced data analytics for targeted, efficient outreach

- Utilize GenAI voice bots for seamless customer engagement

- Automate routine communications while preserving human touch where it matters most

Our AI-driven solutions don’t just streamline operations—they redefine collections process and drive unprecedented success.