Big data analytics is powering massive transformation in the Indian banking and financial services landscape. It is ushering in an era of personalized banking and experiences, tailored financial products, and secure services to cater to individual consumer needs and aspirations.

Leveraging Customer Data for Tailored Solutions

Consider the scenario of a customer researching to buy a motorcycle online. Through big data analysis of their browsing habits and digital interactions, the bank can identify their needs and interests. The next day, the customer logs in to their banking app and encounters a pre-approved loan offer specifically for a “dream bike purchase.” This targeted approach leverages customer data to create highly relevant and timely financial solutions.

Enhanced Financial Planning and Budgeting

Big data empowers banks to analyze items such as customer’s income, spending patterns, and past bill payments to create a comprehensive financial picture. This analysis allows banks to offer personalized budgeting tools and connect customers with loan options that align with their specific financial situation and needs. This data-driven approach fosters informed financial planning and responsible money management.

Strengthened Security Measures

Big data plays a crucial role in combating fraud and protecting customer assets. By analyzing a customer’s regular transaction patterns and locations, banks can identify anomalies in real time. This enables them to implement proactive security measures, such as requesting verification codes or temporarily blocking suspicious transactions. These data-driven safeguards enhance customer trust and ensure the security of their financial information.

Promoting Financial Inclusion

Big data analytics holds the potential to bridge the gap between traditional banking services and India’s vast rural population. By analyzing alternative data sources like mobile phone usage patterns and purchase transactions, banks can develop alternative creditworthiness assessments. This opens doors for loans and financial products for previously unbanked segments, fostering greater financial inclusion across the country.

Personalized Investment Strategies:

Historically, investment advice often relied solely on a broker’s perspective. Big data offers a more customized approach. By analyzing a customer’s risk tolerance, investment goals, and past investment behavior, banks can suggest personalized investment portfolios or connect them with robo-advisors that align with their unique financial aspirations. This data-driven approach empowers customers to make informed investment decisions and achieve their long-term financial objectives.

Statistical insights

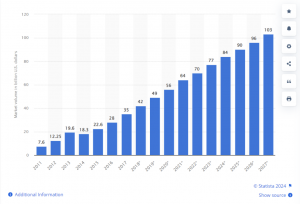

As per a report by Statista, the global big data market is projected to reach $103 billion by 2027, more than doubling in size since 2018. With a share of 45 percent, the software segment would become the largest big data market segment by 2027.

The Evolving Future of Indian Banking

As big data analytics continues to develop, the future of Indian banking promises exciting possibilities. Imagine receiving real-time spending alerts tailored to individual budgets or automatically saving a portion of your salary towards predefined goals. Big data, coupled with the innovative spirit of Indian fintech, is paving the way for a future where banking seamlessly integrates into daily life, empowering customers to achieve financial success.

If you are looking to transform your debt collections strategy with the power of digital and data-powered insights, reach out to us to request an exploratory session at sales@credgenics.com or visit us at www.credgenics.com.

FAQs:

1. How does big data facilitate personalized banking services in India?

Banks analyze vast amounts of consent-based customer data including transaction history, income sources, and online behavior. This allows them to understand customer’s financial habits and goals. Using these insights, banks can offer personalized services like:

- Pre-approved loans: Need a car loan but worried about eligibility? Big data can help banks pre-approve loans based on the financial profile, simplifying the process.

- Targeted financial products: Banks can recommend investment options that align with an individual’s risk tolerance and long-term goals.

- Budgeting tools: Data-driven insights can empower people with personalized budgeting tools tailored to their spending habits and income.

2. Is big data safe for Indian consumers using banking services?

Data security is paramount. Reputable banks prioritize data protection and adhere to regulations like the Information Technology Act (2000) and the upcoming Personal Data Protection Bill. People should check a bank’s privacy policy before engaging with their services.

3. What are the advantages of personalized banking for Indian consumers?

Personalized banking offers several benefits:

- Convenience and Relevance: Receive recommendations and offers directly relevant to an individual’s financial needs and goals.

- Informed Decisions: Data-driven insights empower people to make informed choices about loans, investments, and overall financial planning.

- Enhanced Security: Big data can help banks detect unusual spending patterns or attempted fraud, protecting your financial well-being.

- Improved Customer Experience: Personalized interactions foster stronger relationships between customers and their banks.

4. How can I experience personalized banking services in India?

Many Indian banks are already leveraging big data to personalize their services. Research different banks and their offerings to find the one that aligns best with your financial needs and goals. Look for banks that advertise data-driven personalized banking solutions for Indian customers or personalized banking powered by big data.