Retail lending refers to the practice of providing loans to individual consumers or small businesses for personal or commercial purposes. Unlike wholesale lending, which typically involves larger loans to corporate clients, retail lending focuses on meeting the financial needs of individuals and small businesses.

The parties involved in retail lending are:

- The Borrower: They require funds for various purposes such as purchase, education, homebuying, etc.

- The Lender (Bank/Institution): They possess funds available for lending (with specific conditions attached).

- The Bridge: The loan agreement. The borrower agrees to borrow a specific amount and repay it with interest over a set period (loan term), effectively reaching their goal.

Imagine Monica, who wants to buy her first home. She is the Borrower in this scenario, needing funds for the payment of the house. Monika approaches ABC Bank, which is the Lender in this case. ABC Bank has a pool of money available for lending, subject to conditions such as creditworthiness and income verification.

The Bridge in this situation is the loan agreement that Monica and ABC Bank enter into. They agree that Monica will borrow a specific amount at an interest rate over a set period, say 30 years, which is the loan term. By agreeing to this loan agreement, Monika can effectively reach her goal of purchasing her dream home with the help of retail lending.

Retail lending encompasses a wide range of loan products, including:

1. Personal Loans: Unsecured loans for various needs (debt consolidation, home improvements, medical expenses, weddings) with fixed/variable rates repaid in monthly instalments over a set term.

2. Home Loans: Long-term loans for buying or building a home, secured by the property, offering lower interest rates and extended repayment terms (10-30 years).

3. Auto Loans: Used to finance new/used vehicles, secured or unsecured depending on the lender, with fixed rates and repayment terms of 3-7 years.

4. Education Loans: Designed to cover education expenses (tuition, books, living costs, etc.), can be subsidized/unsubsidized, with repayment typically starting after completing education.

5. Small Business Loans: Support entrepreneurs and small businesses for operations, equipment, expansion, or working capital, with secured/unsecured options and fixed/variable interest rates.

Let’s take a scenario to explain some key terms in retail lending:

With a new car in sight, Neelam heads to XYZ Bank for an auto loan. But amidst the paperwork and financial jargon, things can get confusing. Let’s break down how these key terms play out in Neelam’s situation:

- Interest Rate: Think of it as the “rent” paid for borrowing money. XYZ Bank offers a fixed interest rate of 5%. This means Neelam pays an extra 5% of the loan amount each year on top of the borrowed sum.

- Principal: The actual amount Neelam borrows to buy the car is the principal. In this case, it’s $20,000.

- Term: This is the loan repayment duration. Neelam’s loan term is 5 years, which translates to 60 monthly payments. Imagine it as a “rental agreement” for the borrowed money.

- Collateral: Since the loan is for a car, the car itself acts as collateral. If Neelam can’t keep up with payments, XYZ Bank can repossess the car to recoup their money.

- Credit Score: A good credit score, like Neelam’s 750, indicates responsible borrowing behavior. This score influences the interest rate and loan terms offered by XYZ Bank.

- Amortization: Each of Neelam’s monthly payments chips away at both the principal amount and the interest. XYZ Bank provides an amortization schedule that details this breakdown over time.

- Debt-to-Income Ratio (DTI): This ratio compares Neelam’s monthly debt obligations (rent, credit cards) to her income. A healthy DTI, like Neelam’s, assures XYZ Bank she can manage the loan payment comfortably.

- Prepayment Penalty: If Nelam decides to pay off the loan early, she might face a prepayment penalty – a fee charged by XYZ Bank.

- Origination Fee: A one-time fee, typically a percentage of the loan amount. XYZ Bank charges a 2% origination fee on Neelam’s $20,000 loan, covering processing costs.

- Default: Missing loan payments is considered a default. This can lead to penalties, damage to Neelam’s credit score, and even legal action by XYZ Bank to recover the outstanding debt.

Understanding these terms empowers Neelam to make informed decisions. She can compare interest rates, choose a suitable loan term, and manage her finances responsibly, ensuring a smooth ride towards her dream car.

Obtaining a Retail Loan:

When considering borrowing money, it is essential to engage in comparison shopping. This involves researching and comparing interest rates and terms offered by different lenders to find the most favorable option. Additionally, maintaining a good credit score is crucial, as it can lead to better loan options and lower interest rates. Once a lender is chosen, the next step is to submit the required documents, such as proof of income and employment, as part of the loan application process. If the loan requires approval, the lender will assess the borrower’s financial situation to determine eligibility. It is important for borrowers to diligently make repayments on time, as missing payments can have a negative impact on their credit score and may result in penalties.

Let’s consider an example to explain these terms:

Monika wants to buy a home and needs a home loan. Here’s how the retail lending process unfolds:

Comparison Shopping: Monika researches different lenders and their Home loan offerings. She compares interest rates, loan terms (such as fixed or adjustable rates, loan duration), and fees associated with each lender.

Credit Score Check: Monika checks her credit score before applying for a Home loan. Her excellent credit score of 800 allows her to qualify for lower interest rates and better loan options.

Loan Application: Monika chooses a lender and submits her Home loan application. She provides all the required documents, including proof of income, employment history, bank statements, and information about the property she intends to buy.

Loan Approval: The lender reviews Monika’s application and financial documents. They assess her creditworthiness, debt-to-income ratio, and ability to repay the loan. Based on this evaluation, the lender approves Monika’s Home loan application.

Diligent Repayment: After securing the Home loan, Monika diligently makes her monthly payments on time. She understands that missing payments can harm her credit score and lead to penalties or even foreclosure.

Throughout this process, Monika’s careful comparison shopping, good credit score, thorough loan application, and diligent repayment habits contribute to a successful home loan experience.

Retail lending: The India story

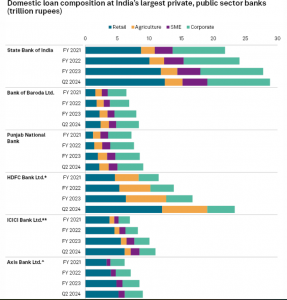

Data from S&P Global Market Intelligence reveals a surge in retail lending by Indian commercial banks in the last few years. This growth has outpaced loans to large businesses, raising concerns from the central bank regarding unsecured loans. Across the three biggest private sector lenders and their state-owned counterparts, retail loans have emerged as the fastest-growing segment. This trend has been consistent since at least the fiscal year ending March 2021.

India’s largest lender by assets, State Bank of India, exemplifies this trend. Their retail loans witnessed a significant 42.7% increase, reaching ₹12.43 trillion by September 30, 2023, compared to ₹8.71 trillion as of March 31, 2021. In contrast, credit to corporates grew by a comparatively modest 19.4% during the same period. Similar patterns are evident at other banks. Public sector lender Bank of Baroda Ltd. saw a 61% rise in retail loans, while private sector player Axis Bank Ltd. experienced a 57% increase over the same timeframe.

Data as of November 2023, Source: S&P Global Market Intelligence

Read here: Retail lending shows rising trends in rural areas, as per a recent CAFRAL report.

Retail lending is a powerful tool for achieving financial goals, but knowledge and good understanding is paramount. By understanding the basics and approaching it cautiously, individuals can navigate the borrowing process effectively and reach their financial objectives.

If you are looking to transform your debt collections strategy with the power of digital and data-powered insights, reach out to us to request an exploratory session at sales@credgenics.com or visit us at www.credgenics.com.

FAQs:

1. What is retail lending?

Retail lending is when a bank or other institution lends money directly to consumers for personal use. This can include things like car loans, mortgages, credit cards, and personal loans.

2. What is the difference between secured and unsecured retail loans?

Secured retail loans are backed by collateral, such as a home or vehicle, which the lender can seize if the borrower defaults on the loan. Unsecured retail loans, on the other hand, do not require collateral but may have higher interest rates to compensate for the increased risk to the lender.

3. How does my credit score impact my ability to obtain a retail loan?

Your credit score plays a crucial role in determining your eligibility for a retail loan and the terms you may receive. Lenders use credit scores to assess your creditworthiness, with higher scores indicating lower risk to the lender. A good credit score can result in lower interest rates and more favorable loan terms, while a poor credit score may lead to higher rates or loan rejection.

4. What factors should I consider before taking out a retail loan?

Before applying for a retail loan, consider factors such as your current financial situation, repayment ability, loan terms, interest rates, fees, and any potential impact on your credit score. It’s essential to evaluate your needs carefully and compare offers from multiple lenders to find the most suitable loan option for your circumstances.

5. How can I improve my chances of getting approved for a retail loan?

To increase your chances of loan approval, focus on improving your credit score by paying bills on time, reducing outstanding debt, and avoiding new credit inquiries. Additionally, maintain stable employment and income, provide accurate and complete information on your loan application, and consider applying with a co-signer or offering collateral to strengthen your application.