Decentralized Finance (DeFi) is a rapidly evolving ecosystem built on blockchains that aims to disrupt traditional financial services like lending, borrowing, and trading by providing a more accessible, transparent, and efficient experience.

But what exactly is DeFi, and how is it poised to impact the future of lending? Let’s dive in:

The Core of DeFi: Cutting Out the Middleman

At its heart, DeFi eliminates the need for centralized institutions like banks. Instead, transactions occur peer-to-peer, powered by smart contracts that are self-executing with the code stored on the blockchain that dictates the terms of an agreement. This approach offers several advantages:

1. Transparency: Every transaction is recorded and can be viewed, offering complete transparency into lending and borrowing activity. One can see interest rates, collateral requirements, and the smart contract code governing the agreement. Also, traditional banks often have hidden fees and complex terms, making it difficult to understand the true cost of a loan. In DeFi, everything is transparent, and the interest rate one sees is what they pay.

2. Accessibility: Unlike traditional loans, DeFi lending doesn’t rely on credit scores, opening doors for individuals with limited or no credit history. This promotes financial inclusion and empowers individuals to participate in the financial system.Anyone with an internet connection and a crypto wallet can access DeFi platforms, regardless of location or financial background. This removes geographical barriers and democratizes access to financial services.

3. Efficiency: DeFi eliminates manual processes and paperwork, leading to faster transactions and lower costs. Loan origination, approvals, and repayments happen instantly without human intervention. DeFi platforms operate 24/7, allowing access to financial services anytime, anywhere. This flexibility is unmatched by traditional banks with limited operating hours.

4. Flexibility: DeFi offers a variety of lending and borrowing options beyond traditional loans, including flash loans, margin trading, and yield farming. This caters to diverse financial needs and risk tolerances. Due to the elimination of middlemen and increased competition, DeFi often offers more competitive interest rates for both borrowers and lenders compared to traditional financial institutions.

Key Components of DeFi:

1. Smart Contracts: Smart contracts are self-executing contracts with the terms of the agreement directly written into code. In the context of DeFi lending, smart contracts automate the lending process, including loan origination, collateralization, and repayment, without the need for intermediaries.

2. Decentralized Exchanges (DEXs): Decentralized exchanges facilitate the trading of digital assets without the need for intermediaries. These platforms enable users to trade cryptocurrencies and other digital assets directly with one another, enhancing liquidity and reducing counterparty risk.

3. Stablecoins: Stablecoins are cryptocurrencies designed to maintain a stable value by pegging their price to a fiat currency or another asset. Stablecoins play a crucial role in DeFi lending by providing a stable medium of exchange and store of value.

4. Oracles: Oracles are third-party services that provide external data to smart contracts. In the context of DeFi lending, oracles supply information such as asset prices and market data, enabling smart contracts to execute lending agreements based on real-world conditions.

Borrowing and lending in DeFi

In the DeFi world, borrowing operates through collateralization, where individuals deposit cryptocurrency as security against the borrowed funds. It’s akin to placing a security deposit. The type and quantity of collateral vary depending on the lending platform and the terms of the loan. Rather than borrowing directly from a specific lender, borrowers tap into liquidity pools composed of funds contributed by other DeFi users. These pools dictate both the available loan amount and the interest rate. Dynamic interest rates characterize DeFi lending, fluctuating in response to shifts in supply and demand within the liquidity pool. While borrowers may benefit from lower rates during periods of low demand, they also face the risk of rates rising when demand spikes.

On the lending side of DeFi, individuals participate by depositing cryptocurrency into liquidity pools, where they earn interest from borrowers. The interest rate offered depends on the demand within the pool and the perceived risk associated with the deposited asset. DeFi presents an avenue for passive income generation, as individuals can earn interest by locking up their cryptocurrency in lending pools. However, it’s crucial to acknowledge that the value of cryptocurrency itself is subject to fluctuations, which can impact overall returns. One significant risk associated with lending in DeFi is impermanent loss. This occurs when the price of the deposited cryptocurrency fluctuates relative to other assets in the pool, potentially resulting in reduced returns despite earning interest. It’s a factor that lenders must consider when participating in DeFi lending pools.

Challenges and Considerations

While decentralized lending holds immense promise, it also faces several challenges and considerations that must be addressed for widespread adoption:

1. Regulatory Uncertainty: The regulatory landscape surrounding DeFi remains uncertain and evolving, with regulators grappling to understand and regulate this nascent technology. Regulatory clarity is essential to ensure compliance with existing laws and regulations and to foster trust and confidence in DeFi lending platforms.

2. Smart Contract Risks: While smart contracts offer numerous benefits, they are not immune to vulnerabilities and bugs. Smart contract exploits and vulnerabilities have led to significant losses in the past, highlighting the importance of robust security audits and testing processes.

3. Price Volatility: Cryptocurrencies are known for their price volatility, which can pose risks to both lenders and borrowers in decentralized lending markets. Stablecoins help mitigate this risk to some extent, but price volatility remains a key consideration for participants in DeFi lending.

4. Scalability: Scalability remains a challenge for many blockchain networks, particularly during periods of high demand and congestion. Scaling solutions such as layer 2 protocols and sharding are being developed to address this issue, but scalability concerns persist as DeFi continues to grow.

Market size and user demographics

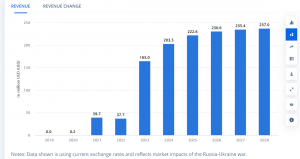

As per Statista, revenue in the DeFi market in India is projected to reach US$203.5 million in 2024. This shows steady growth, with an expected annual growth rate (CAGR 2024-2028) of 3.88%, leading to a projected total amount of US$237.0 million by 2028. The average revenue per user in the DeFi market in India is expected to be US$39.9 in 2024. This indicates a moderate adoption rate compared to some other countries.

According to the Chainalysis 2023 Global Crypto Adoption Index, India ranks in the top 10 globally in terms of cryptocurrency adoption. This suggests fertile ground for DeFi to flourish in the future.

Watch this video by Forbes

to understand what DeFi is and how it can revolutionize our Financial system.

The future of lending

DeFi isn’t just disrupting lending; it’s dismantling the very foundation of traditional finance. Imagine a world where access to financial services isn’t dictated by geography or credit scores but by the power of blockchain and smart contracts. This is the promise of decentralized lending, a future brimming with:

- Democratized Access: No more gatekeepers, just peer-to-peer connections, empowering everyone to participate.

- Unleashed Innovation: Open-source DeFi fosters a wave of new financial products and services, unlocking untold potential.

- Global Economic Growth: Inclusive finance paves the way for stronger communities and thriving economies worldwide.

Challenges remain, but the tide is turning. Advancements in technology and the rise of decentralized governance are building a more secure, transparent, and user-friendly DeFi landscape.

If you are looking to transform your debt collections strategy with the power of digital and data-powered insights, reach out to us to request an exploratory session at sales@credgenics.com or visit us at www.credgenics.com.

FAQs:

1. What is Decentralized Finance (DeFi), and how does it differ from traditional finance?

Decentralized Finance, or DeFi, refers to a blockchain-based financial ecosystem that operates without the need for traditional intermediaries such as banks or financial institutions. In contrast to traditional finance, DeFi utilizes smart contracts and decentralized applications (DApps) to enable peer-to-peer transactions, lending, borrowing, and trading of digital assets. It offers greater accessibility, transparency, and efficiency compared to traditional finance.

2. Is DeFi legal in India?

As of now, there isn’t explicit regulatory clarity on DeFi in India. While cryptocurrencies and blockchain technology are not banned, the regulatory framework surrounding DeFi platforms remains uncertain. Users need to stay updated on regulatory developments and exercise caution when participating in DeFi activities.

3. How can individuals in India participate in DeFi?

Individuals in India can participate in DeFi by accessing decentralized applications (DApps) through blockchain wallets compatible with the Ethereum network or other blockchain platforms. They can engage in activities such as lending, borrowing, staking, and yield farming using cryptocurrencies as collateral or investment.

4. What are the risks associated with DeFi in India?

While DeFi presents exciting opportunities, it also comes with inherent risks. These risks include smart contract vulnerabilities, price volatility of digital assets, regulatory uncertainty, and potential loss of funds due to hacks or exploits. Users must conduct thorough research, exercise caution, and only invest what they can afford to lose.

5. How does DeFi contribute to financial inclusion and impact the future of lending in India?

DeFi has the potential to promote financial inclusion in India by providing access to financial services for individuals who are underserved or excluded from traditional banking systems. Through DeFi platforms, individuals can access lending, borrowing, and investment opportunities without the need for intermediaries or extensive documentation. This can empower individuals, particularly those in rural or remote areas, to participate in the global economy and build wealth.