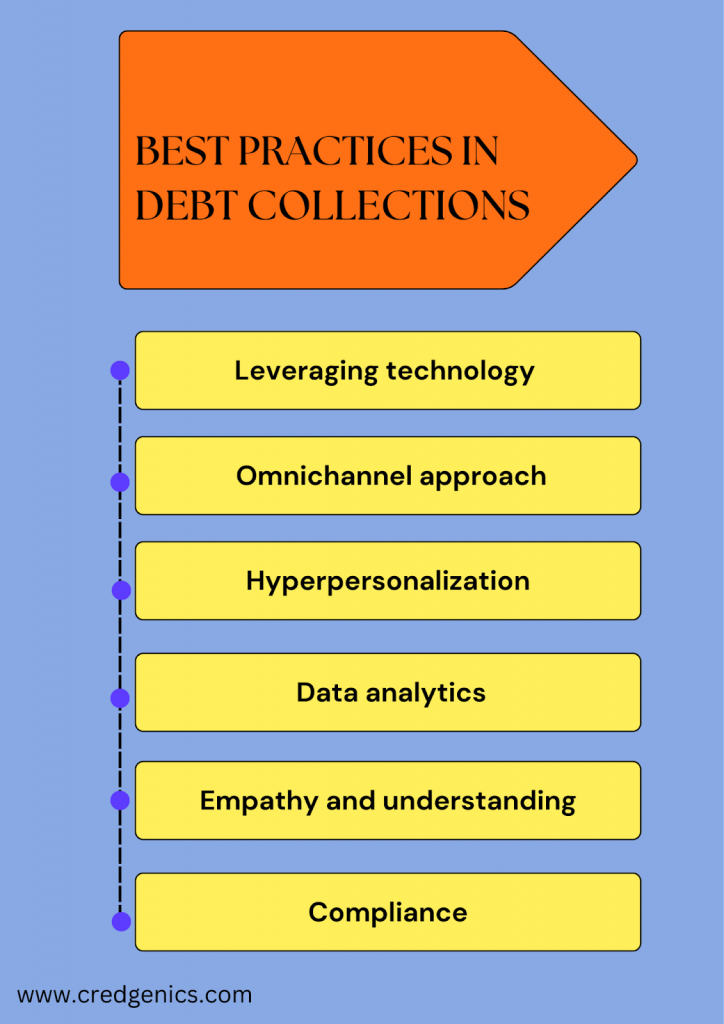

The rapidly changing consumer behavior is characterized by a paradigm shift in how people search, buy, borrow, consume, engage, and communicate. Digital engagements have become a way of life, and customer experience expectations are continuously evolving. In an era where customer needs reign supreme, and personalization is rapidly becoming a norm, lenders must reassess their approach to debt collections. Adopting best practices in debt collections, such as finesse in processes, empathy in communication, and understanding the legal landscape, can lead to success in this dynamic environment.

Let us explore a few of these best practices in detail.

- Leveraging technology and automation: Incorporating technology and automation can streamline debt collection processes. Using software that automates repetitive tasks, seamlessly integrates different activities, simplifies payments, and provides clear visibility of actions reduces errors, plugs gaps, saves time, and increases efficiency. It also allows the debt collections team to focus on more productive and sophisticated tasks along with strategic resolution engagements.

- Agile communication with an omnichannel approach: To align well to the rapidly evolving digital model, businesses must adopt an omnichannel approach. This means providing borrowers a seamless journey across multiple channels including the digital platforms. It is important for lenders to use the right mix of communication channels that correspond to the preferences of the borrowers. This requires lenders to gain insights into their past response patterns and behaviour over different channels through the use of machine learning. Insights can also help create the right message that reaches borrowers at the right time.

- Hyperpersonalization: Delivery of custom-made services and solutions to suit borrower needs is no longer optional for modern lending institutions, but a necessity for a financially literate population. Offering solutions tailored for the borrowers based on an understanding of their unique needs enhances customer experience and improves debt recovery rates. Technology-driven innovation and personalized communication promotes transparency and improves debtor-lender relations, leading to streamlined collections processes.

- Centralized management with data analytics: By creating a centralized and standardized approach to debt recovery, lenders can avoid any lapses and will be better positioned to automate the subsequent processes. The data-powered approach which provides actionable insights enhances focus in actions, reduces operational costs, saves time spent on conflict resolution, and helps lenders achieve best practices in debt collections strategies for pre-delinquent borrowers.

- Empathy and understanding: While being firm and assertive is crucial, empathy plays a vital role in debt collection. Lenders must remember that debtors may be facing financial hardships or unforeseen circumstances. Approaching them with understanding, listening to their concerns, and exploring potential solutions can lead to cooperation during resolution and increase the chances of recovery.

- Awareness and compliance with regulations: It is imperative for lenders to stay informed about debt collection regulations to avoid legal pitfalls. Familiarity with RBI guidelines pertaining to various aspects of the debt collections process and any other local regulations will ensure that debt collections practices are protective of the rights of both lenders and borrowers.

To achieve improved debt collections, it is essential for lenders to adopt a well-rounded approach that encompasses assertiveness, empathy, and compliance with regulatory protocols. By incorporating the best practices in debt collections outlined above, lending institutions can transform their debt collection actions by increasing successful outcomes and cultivating positive relationships with borrowers. When these techniques are cohesively merged into a comprehensive strategy, the potential opportunities magnify tremendously.

FAQs:

- What is a proactive debt collection strategy?

Proactive collections focus on leveraging technology to highlight repayment dates, engage with borrowers in advance, adopt a nudge based approach, identify potentially delinquent borrowers, and take remedial actions. As a result of incorporating these strategies in the collections workflow, lenders can improve their debt recovery timelines and deliver superior customer experiences.

- What strategies to employ to ensure efficient debt collection?

The first step in developing a successful debt collection strategy is to understand the borrower profile. Leveraging data analytics to segment the borrowers into different segments can help lenders formulate a tailored strategy for each category of borrowers. Subsequent steps include creating a holistic communications strategy based on this segmentation, automating the communication process, and providing borrowers with flexible payment options to repay the debt.

- How is empathy towards the borrower an effective strategy for debt collection?

While it is important for lenders to recover debt on time, empathy holds a vital position in the realm of debt collections. Lenders must acknowledge borrowers’ privacy and adopt frictionless and less-intrusive methods of communication. Approaching them with genuine understanding and a desire to provide borrower satisfaction will result in long-term relationships with borrowers and significantly improve collections rates.