Generation Z is the youngest generation in the workforce, and they are transforming how credit is accessed. Understanding the relationship between Gen Z and debt is crucial for financial institutions seeking to capitalize on this rapidly growing segment.

Imagine a 22-year-old fresh graduate approaching a bank website / app to apply for their first loan. They’ve already compared rates, read reviews, and explored options on their phone. They expect the experience to be fast, easy, and digital, just like ordering a meal through an app. If it is not, they will leave and find a lender that understands them.

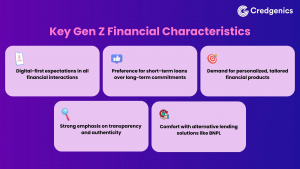

This scenario highlights the new reality for lenders: Gen Z brings a fresh set of expectations. They value speed, personalization, transparency, and trust. To connect with this generation, financial institutions must behave as per their expectations, speak their language and rethink the lending experience.

Let’s explore in detail what lenders need to understand about Gen Z and debt management:

1. Prioritize digital-first, personalized experiences

Gen Z stays online, from shopping to studying to banking. This generation expects banking and lending services to be as seamless as their other favorite apps, setting new standards for digital financial experiences.

For lenders addressing Gen Z and debt needs, this means:

- Mobile-first design: Ensure apps are not just functional but beautifully intuitive.

- Omnichannel communication: Provide consistent, seamless interactions across web, mobile, and in-branch channels. This approach enables users to get support or updates wherever they are.

- Data-driven personalization: Use AI and analytics to offer real-time, customized loan offers, spending insights, and financial advice based on individual behavior and goals.

2. Educate and empower: Smart debt management

Gen Z is cautious with credit. They’ve seen millennials struggle with multiple loans and economic downturns, making them wary of long-term debt. Instead, they often opt for BNPL services and short-term loans. While these tools offer flexibility, they can become risky if not managed well.

Here’s how lenders can help improve Gen Z’s financial literacy:

- Offer clear, simple tools that track payment due dates, spending habits, and budget forecasts.

- Educate users on how credit scores work, the dangers of overspending, and the long-term impact of debt.

- Provide alerts and nudges for due dates, payment limits, and financial health indicators.

When lenders position themselves as partners in financial well-being, they become more than service providers—they become trusted advisors in the Gen Z and debt landscape.

3. Make financial literacy a built-in feature

Knowledge is power. Empowering Gen Z with the right insights helps them avoid debt traps and builds trust in the process.

- Embed budgeting tools and savings planners in apps.

- Use bite-sized content to teach about loans, credit, saving, and investing.

- Host online webinars or community events focusing on key financial skills.

- Let users explore financial choices, like “What happens if I miss a loan payment?” or “How does increasing my EMI affect my credit score?”

4. Understand and adapt to their borrowing patterns

Unlike other generations who favored large-ticket borrowing like home loans or long-term financing, Gen Z often borrows money to finance purchases such as smartphones, gadgets, travel, and education. They also show increasing demand for credit in semi-urban and rural areas, driven by better connectivity and rising aspirations.

Lenders addressing Gen Z and debt patterns should:

- Offer micro loans and short-term credit tailored to Gen Z’s consumption habits.

- Enable credit-building tools using non-traditional data like rent and utility payments.

- Design products that support financial independence—e.g., a “starter loan” product with low interest and flexible repayment options to help build credit history.

5. Be transparent, be authentic

More than anything, Gen Z wants honesty. They quickly notice hidden fees and unclear terms. For lenders, this means putting transparency at the heart of every offering. Gen Z rewards brands that are real, accountable, and honest.

- Break down fees, interest rates, and conditions in plain language.

- Use real human communication, not just bots or complex terms.

- Highlight customer success stories and real user testimonials.

- Own up to mistakes, be responsive on social media, and foster two-way dialogue.

Understanding Gen Z’s financial challenges

Gen Z faces unique financial hurdles that require a fresh approach from lenders.

Navigating the Gig Economy

Many Gen Z earners rely on freelance work or multiple part-time jobs. Traditional income checks often don’t reflect this reality. Lenders should adapt by recognizing diverse income sources like gig work and seasonal jobs.

Building Credit from Scratch

Limited credit history makes it tough for Gen Z to qualify for loans. Forward-thinking lenders now use alternative data, such as rent, utility, and phone payments, to help them build and access credit while improving Gen Z financial literacy.

Affordability Matters

With rising living costs and lower starting wages, Gen Z is highly price-sensitive. Lenders can win trust by offering clear terms, competitive rates, and flexible repayment options.

Technology that Gen Z expects

Advanced Security Measures

Gen Z expects sophisticated security features, including biometric authentication, multi-factor authentication, and real-time fraud detection alerts. They want their financial data protected, but expect security measures to be seamless and user-friendly.

AI and Automation

This generation is comfortable with AI-powered customer service—if it is helpful and efficient. Successful implementations offer both AI and human support options, which makes it easy to escalate to a human agent when needed.

Integration and Connectivity

Gen Z appreciates services that work together seamlessly, including account aggregation, spending insights, automated savings, and integrated financial management tools that provide a holistic view of their financial health.

Final Thoughts

Building trust with Gen Z is about meeting them where they are: in their experiential journeys, in sync with their behavior, and aligning with their financial goals. By embracing digital innovation, offering smarter credit solutions, and prioritizing transparency and education, lenders can build lasting relationships with this new generation of borrowers.

FAQs

1. Why is Gen Z approaching debt differently than previous generations?

Gen Z and debt go hand in hand with new digital behaviors and cautious financial attitudes. Unlike older generations, Gen Z prefers short-term loans, avoids long-term commitments, and expects full transparency. Their approach is shaped by witnessing millennial debt struggles and a desire for more control and personalization in borrowing.

2. What are the biggest financial challenges Gen Z faces when it comes to debt?

Key challenges include limited credit history, income instability from gig work, and a lack of tailored financial products. Gen Z also struggles with rising living costs and affordability, making smart borrowing and financial literacy crucial to avoiding long-term debt traps.

3. How can lenders build trust with Gen Z borrowers?

To gain the trust of Gen Z, lenders must offer digital-first, personalized experiences, be fully transparent about loan terms, and educate borrowers on debt and credit management. Empowering Gen Z with tools and insights helps position lenders as trusted financial partners.

4. What role does financial literacy play in Gen Z’s relationship with debt?

Gen Z’s financial literacy is a critical factor in managing debt responsibly. When lenders embed budgeting tools, offer bite-sized educational content, and provide interactive financial simulations, they help Gen Z understand the risks and rewards of borrowing, building long-term trust.

5. What types of debt products does Gen Z prefer?

Gen Z borrowers often favor micro-loans, Buy Now Pay Later (BNPL) services, and short-term credit options over traditional long-term loans. They also value flexible repayment plans and products that help build credit from scratch using alternative data.