A strong credit score serves as a crucial factor in facilitating access to a wide array of consumer loans and credit facilities. However, what if you find yourself on the other side of this equation, with no credit history to boast of? Does this mean you are locked out of the option of availing personal loans?

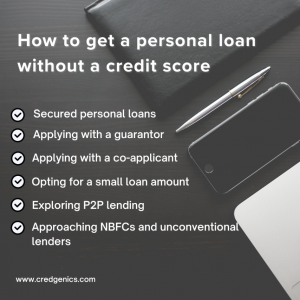

Though a credit score plays a pivotal role in securing loans and credit cards in India, circumstances may arise where they need a personal loan but don’t have an established credit score. However, it is still possible to secure a personal loan without a credit score. Some of the ways to do that are discussed below.

1. Secured personal loan: A secured personal loan is an excellent option for individuals without a credit score. In order to secure the loan, they offer collateral like gold, fixed deposits, or real estate. Since the lender has an asset as security, they may be more willing to grant a loan, even without a credit score. However, if the borrower defaults on the loan, they risk losing the collateral.

2. Applying with a guarantor: Securing a personal loan without a credit score becomes more feasible by enlisting the support of a guarantor. This trusted individual could be a family member, friend, colleague, or confidante. The crucial requirement is that the chosen guarantor possess a strong credit score, as it significantly enhances the likelihood of the loan application being approved with ease. However, it’s important to note that finding a willing guarantor may hinge on the applicant’s reputation for financial responsibility and trustworthiness.

3. Applying with a co-applicant: Another effective method to secure a personal loan without a credit score or income proof is by having a co-applicant with a steady income. It’s crucial, though, that the co-applicant is a family member who is well-informed beforehand about the applicant’s intent to apply for an instant loan. Both a guarantor and a co-applicant serve as a form of assurance to the lender. They convey that in the event the borrower defaults for any reason, the outstanding loan amount can be reclaimed from the guarantor or co-applicant. In both scenarios, the guarantor or co-applicant will be required to fulfill the necessary know-your-customer (KYC) and eligibility criteria, just like the primary applicant. This ensures compliance with the lender’s guidelines and helps facilitate the loan approval process.

4. Opting for a small loan amount: When a potential borrower does not have a credit score, it’s advisable to start with a small loan amount. Lenders may be more willing to approve smaller loans with limited risk. Once the borrower successfully repays this loan, it will help them establish a positive credit history, paving the way for larger loans in the future.

5. Exploring Peer-to-Peer lending: Peer-to-peer (P2P) lending platforms offer an alternative to traditional banks and financial institutions. These platforms connect borrowers directly with individual lenders. Some P2P lenders may have more lenient eligibility criteria than traditional banks, making it easier to secure a personal loan without a credit score.

6. Approaching NBFCs and smaller lenders: Non-banking financial companies (NBFCs) and smaller lenders may have more flexible lending criteria compared to major banks. They may be willing to consider factors other than credit score, such as income stability, employment history, and relationship with the institution.

Conclusion

Reports suggest that there will be a steady increase in the size of the personal loan market in India, which is expected to grow by 10% by 2025. These numbers validate that in a vastly populated country like India, personal loans will be a huge contributor to the retail loan book of the country. As such, securing a personal loan without a credit score can be a daunting task, but it’s not insurmountable. The first crucial step in this endeavor is to grasp the significance of a credit history. Lenders heavily rely on credit scores to assess an applicant’s creditworthiness, and a non-existent credit score can often be equated with uncertainty. While the absence of a credit score may present initial hurdles, a thoughtful combination of these strategies and alternative options can pave the way for obtaining the financial assistance that customers require.

If you are looking to transform your debt collections strategy with the power of digital and data-powered insights, reach out to us to request an exploratory session at sales@credgenics.com or visit us at www.credgenics.com

FAQs:

1. Can I get a personal loan if I have no credit history at all?

Yes, it’s possible to secure a personal loan even with no credit history. Lenders may consider alternative factors such as income, employment history, and the presence of a co-signer or guarantor to assess creditworthiness.

2. What is a co-applicant, and how can it help me get a loan without a credit score?

A co-signer is someone with an established credit history who agrees to take responsibility for the loan if you default. Their strong credit profile can reassure lenders and increase the potential borrower’s chances of loan approval.

3. Are there specific lenders that specialize in loans for individuals with no credit score?

Yes, some lenders, including certain online lenders and Non-Banking Financial Companies (NBFCs), are more open to borrowers with limited or no credit history. These institutions may have more flexible criteria for loan approval.

4. Should I start with a secured loan if I don’t have a credit score?

Secured loans, where you provide collateral, can be a viable option to build credit history. However, they also carry the risk of losing the collateral if the borrowers default. It’s essential for them to carefully consider their ability to repay before opting for a secured loan.

5. Can I improve my chances of loan approval without a credit score by starting with a small loan?

Yes, starting with a smaller loan and successfully repaying it can help borrowers establish a positive credit history. Lenders may be more inclined to approve larger loans once they see a track record of responsible borrowing and repayment.