Non-Banking Financial Companies (NBFCs) in India are now increasingly leveraging the digital public infrastructure and its diverse components to craft innovative and customer centric digital lending solutions. Through digitally enabled seamless experiences, NBFCs are orchestrating personalized and frictionless journeys for borrowers. They encompass automated loan applications that fetch customers’ financial details, analytics-driven risk assessments, and swift approvals leading to rapid disbursements. Banks and NBFCs are tapping into the consent-based Account Aggregator for access to customers’ financial data and using digital financial transactions in a cash flow-based lending model. The data-driven risk assessment in banks and NBFCs is helping the latter foster an inclusive credit ecosystem, particularly benefiting the MSME sector, thus addressing the prevailing credit gap in the nation.

The dynamics of borrower profiles are evolving in tandem with shifting credit demands. This surge in digital adoption is an encouraging trend for digital NBFCs, prompting them to fortify their technological infrastructure, making digital lending an intuitive and seamlessly integrated experience for customers.

Understanding data-driven risk assessment

Data-driven risk assessment in banks and NBFCs involves the comprehensive analysis of extensive datasets to evaluate the creditworthiness, financial stability, and potential risks associated with borrowers. Traditional methods often rely on historical financial data and credit scores, but the contemporary approach embraces a broader spectrum of data points. This includes not only financial records but also non-traditional data sources such as social media activity, transaction history, and even behavioral patterns.

Key components of data-driven risk assessment:

1. Big data analytics: The advent of big data has revolutionized risk assessment by allowing financial institutions to process and analyze vast amounts of structured and unstructured data. This includes customer transaction history, online behavior, and external economic indicators. Advanced analytics extract valuable insights, identifying patterns and trends that contribute to more informed risk assessments.

2. Machine Learning and AI algorithms: Machine learning algorithms play a pivotal role in predicting and managing risks. These algorithms continuously learn from data patterns, enabling institutions to make real-time risk assessments. AI-driven models can predict default probabilities, detect anomalies, and dynamically adjust risk parameters based on evolving market conditions.

3. Alternative data sources: Beyond traditional financial metrics, alternative data sources have become crucial in evaluating creditworthiness. Information from social media, online platforms, and utility payments provides a more holistic view of an individual’s or a business’s financial behavior. Integrating such alternative data sources enhances the accuracy and depth of risk assessments.

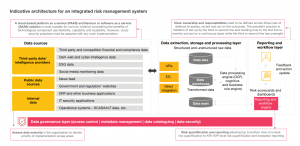

Source: PwC

Use cases

1. Credit scoring and loan approval: One of the primary use cases for data-driven risk assessment in banks and NBFCs in India is the enhancement of credit scoring models. By leveraging vast datasets, including traditional financial records and alternative data sources, banks can employ advanced analytics and machine learning algorithms to assess the creditworthiness of individuals and businesses more accurately. This enables banks to make informed decisions on loan approvals, interest rates, and credit limits, reducing the risk of default. This is particularly beneficial for expanding financial inclusion by reaching individuals who may not have a robust credit history but demonstrate creditworthiness through alternative data.

2. Fraud detection and prevention: Data-driven risk assessment plays a crucial role in fraud detection and prevention for financial institutions. By continuously analyzing transactional data, customer behavior, and patterns, banks can deploy machine learning algorithms to identify anomalies and potential fraudulent activities. This proactive approach allows banks to detect and prevent fraudulent transactions in real time, safeguarding both the financial institution and its customers. With the rising sophistication of fraud schemes, data-driven risk assessment becomes indispensable in staying ahead of emerging threats and protecting the integrity of the banking system.

3. Operational risk management: Banks in India utilize data-driven risk assessment to manage operational risks effectively. This involves analyzing historical data, identifying patterns of operational disruptions, and predicting potential risks to the bank’s operations. Machine learning models can assess factors such as system downtime, cybersecurity threats, and internal process inefficiencies, providing insights that enable banks to implement preventive measures and enhance their overall operational resilience. This proactive risk management approach contributes to the stability and reliability of banking operations, ultimately safeguarding customer interests and maintaining the trust of stakeholders.

Benefits of data-driven risk assessment:

1. Enhanced accuracy and predictability: Data-driven risk assessment in banks and NBFCs significantly improves the accuracy of predicting creditworthiness and potential defaults. By analyzing a diverse range of data points, financial institutions can make more precise assessments, reducing the likelihood of inaccurate risk categorizations.

2. Real-time decision-making: Traditional risk assessment methods often involve time-consuming manual processes. Data-driven approaches, powered by AI and machine learning, enable real-time decision-making. This agility is especially crucial in dynamic market conditions, allowing institutions to respond promptly to emerging risks.

3. Customized risk models: Data-driven risk assessment allows for the customization of risk models based on specific criteria and objectives. Institutions can tailor their risk evaluation processes to different customer segments, adapting to the unique characteristics of various markets and industries.

4. Improved customer experience: The streamlined and data-driven risk assessment process enhances the overall customer experience. Faster loan approvals, personalized financial products, and more accurate risk pricing contribute to a positive relationship between financial institutions and their clients.

Conclusion

The integration of data-driven risk assessment in banks and NBFCs in India marks a transformative leap into a future where financial decision-making is more precise, proactive, and inclusive. Through advanced credit scoring models, banks are not only streamlining loan approvals but also broadening financial inclusion by recognizing creditworthiness through alternative data. The vigilant application of data analytics for fraud detection ensures the robust security of banking transactions, shielding both institutions and customers from evolving threats. Moreover, the proactive approach to operational risk management ensures the stability of banking operations, fostering resilience in the face of challenges. As Indian banks continue to embrace data-driven strategies, they pave the way for a more resilient, efficient, and customer-centric financial landscape, underscoring the pivotal role of data in shaping the future of banking in the country.

If you are looking to transform your debt collections strategy with the power of digital and data-powered insights, reach out to us to request an exploratory session at sales@credgenics.com or visit us at www.credgenics.com

FAQs:

1. How does data-driven risk assessment benefit banks and NBFCs in India?

Data-driven risk assessment empowers banks and NBFCs by enhancing the accuracy of credit scoring models, enabling more informed loan approvals, and expanding financial inclusion. It also plays a pivotal role in fraud detection, ensuring the security of transactions, and contributes to proactive operational risk management, ensuring the stability of banking operations.

2. What types of data are used in data-driven risk assessment in the Indian banking sector?

Banks and NBFCs leverage a diverse range of data, including traditional financial records, alternative data sources (such as social media and utility payments), and transactional data. This comprehensive dataset allows for a more holistic assessment of creditworthiness, fraud detection, and operational risk factors.

3. How does data-driven risk assessment contribute to financial inclusion in India?

By incorporating alternative data sources and advanced analytics, data-driven risk assessment helps banks reach individuals with limited or no traditional credit history. This inclusivity allows for more accurate credit assessments, enabling financial institutions to extend services to a broader spectrum of the population.

4. What role does machine learning play in data-driven risk assessment for banks and NBFCs?

Machine learning algorithms play a significant role in data-driven risk assessment by continuously learning from patterns and data. These algorithms are employed in credit scoring models for accurate predictions, fraud detection by identifying anomalies, and operational risk management by analyzing historical data to predict potential risks.

5. How do banks ensure the privacy and security of customer data in data-driven risk assessment?

Banks and NBFCs adhere to stringent data privacy and security measures to protect customer information. Compliance with regulatory standards, encryption protocols, and secure data storage practices are integral to maintaining the trust of customers and meeting legal requirements in safeguarding sensitive financial data.