Increasing digital adoption, evolving behavioral patterns and new trends across industries are impacting customer preferences for consuming financial services like never before. With demand for faster gratification gaining prominence, technological advancements are facilitating the growth of instant loans as a more convenient option to access credit. Expedited financial assistance through more innovative lending solutions transforms the borrower experience and opens new horizons for businesses seeking opportunities and advancement.

From days to minutes: The evolution of lending

Traditional lending institutions, such as banks, have long been the go-to source for individuals seeking credit. However, the cumbersome application processes, stringent eligibility criteria, and extended approval times have often proved to be major deterrents for borrowers in need of urgent funds. Recognizing these shortcomings, fintech companies and alternative lenders have stepped in to fill the gap, leveraging technology to offer instant loan solutions.

Instant loans, also known as real-time loans, are designed to bridge the gap between traditional lending and modern needs. Unlike traditional loans, which can take days or even weeks for approval, instant loans offer funds within minutes of application, often through automated algorithms and data analysis. This streamlined process eliminates the need for extensive paperwork and manual reviews, making it perfect for individuals facing urgent financial needs.

Why instant loans?

1) Speed: One of the primary advantages of instant loans is their unparalleled speed. With minimal documentation requirements and automated approval processes, borrowers can receive funds in their accounts almost instantaneously. This speed enables them to address financial emergencies promptly.

2) Convenience at fingertips: Gone are the days of visiting banks or filling out endless paperwork. Instant loans allow borrowers to apply for funds from anywhere using a smartphone or computer, offering unparalleled convenience. The elimination of physical paperwork and in-person visits to banks or lending offices streamlines the entire borrowing experience.

3) Accessibility: Real-time digital lending solutions are often more inclusive and accessible than traditional loans, particularly for individuals with limited credit history or subprime credit scores. By leveraging alternative data sources and innovative underwriting models, lenders can cater to a broader spectrum of borrowers.

4) Flexibility to choose and customize: Instant loans come in various forms, including payday loans, installment loans, and lines of credit, offering borrowers the flexibility to choose the option that best suits their needs. Additionally, many lenders offer customizable repayment plans and loan terms, allowing borrowers to tailor their borrowing experience to their specific requirements.

5) Transparency and informed decision-making: Unlike traditional lending institutions that may have opaque fee structures and complex terms and conditions, many real-time lenders prioritize transparency and clarity. Borrowers can easily understand the costs associated with their loans, including interest rates, fees, and repayment schedules, empowering them to make informed financial decisions.

Why is the instant loan trend likely to pick up?

With the promise of quick approvals and seamless transactions, instant loans are not just a passing trend but a fundamental reimagining of financial services. The instant loan trend is likely to continue picking up momentum due to several key factors:

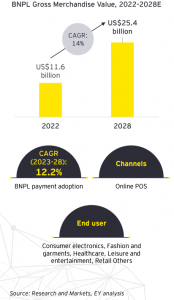

1) Changing Consumer Expectations: In today’s fast-paced digital world, consumers expect instant gratification and convenience in all aspects of their lives, including financial transactions. Buy-Now-Pay-Later schemes have been a case in point so far, facilitating purchases without the worry of immediate payment. Instant loans cater to similar consumer expectations by providing quick access to funds without the delays associated with traditional lending processes.

2) Technological Advancements: Advances in technology, particularly in the fields of artificial intelligence, machine learning, and data analytics, have enabled lenders to automate the loan approval process and assess borrowers’ creditworthiness in real time. These technological innovations have significantly reduced the time and effort required to apply for and receive loans, making instant loans more appealing to consumers.

3) Increasing Demand for Financial Inclusion: Traditional lending institutions often have strict eligibility criteria that exclude many individuals, particularly those with limited credit history or lower credit scores. Instant loans, with their reliance on alternative data sources and innovative underwriting models, have the potential to bridge this gap and provide access to credit for a wider range of borrowers, thereby promoting financial inclusion.

4) Rise of Fintech Companies and Alternative Lenders: The emergence of fintech companies and alternative lenders has disrupted the traditional banking sector by offering innovative financial products and services tailored to the needs of modern consumers. These companies are more agile and adaptable than traditional banks, allowing them to quickly adapt to changing market dynamics and capitalize on the growing demand for instant loans.

5) Economic Uncertainty and Financial Emergencies: Economic uncertainty, coupled with unexpected financial emergencies such as medical bills or car repairs, can create an urgent need for funds. Instant loans provide a convenient solution for individuals facing such situations, allowing them to access cash quickly without resorting to more expensive alternatives like credit cards or payday loans.

6) Regulatory Support and Adaptation: Regulatory frameworks governing the lending industry are evolving to accommodate the growing popularity of instant loans while ensuring consumer protection and responsible lending practices. As regulators become more familiar with the intricacies of real-time lending solutions, they are likely to provide clearer guidelines and support for the industry’s growth.

What the future holds for instant loans

As technology continues to advance and consumer preferences evolve, the future of instant loans looks promising. Innovations such as artificial intelligence, machine learning, and blockchain technology are poised to further enhance the speed, efficiency, and security of real-time lending solutions. Moreover, the regulatory frameworks governing the industry are likely to evolve to ensure consumer protection and foster responsible lending practices.

In conclusion, instant loans represent a shift in the lending landscape, offering borrowers unprecedented speed, convenience, and accessibility. While challenges persist, the continued innovation and evolution of real-time lending solutions hold immense promise for individuals and businesses seeking timely financial assistance. As the industry continues to mature, both borrowers and lenders need to embrace transparency, responsible lending practices, and technological advancements to unlock the full potential of instant loans in the digital age.

If you are looking to transform your debt collections strategy with the power of digital and data-powered insights, reach out to us to request an exploratory session at sales@credgenics.com or visit us at www.credgenics.com.

FAQs:

1) What are instant loans, and how do they work in India?

Instant loans, also known as quick or real-time loans, are financial products that provide borrowers with immediate access to funds. In India, these loans are typically offered by fintech companies and non-banking financial institutions (NBFCs) through online platforms. The application process is fast and streamlined, often requiring minimal documentation. Upon approval, funds are disbursed directly to the borrower’s bank account, usually within a few hours or even minutes.

2) What are the eligibility criteria for obtaining an instant loan in India?

The eligibility criteria for instant loans in India may vary depending on the lender and the type of loan being offered. However, common requirements typically include being a resident of India, being of legal age (usually 21 to 60 years old), having a stable source of income, and possessing a valid bank account and identity documents such as an Aadhaar card, PAN card, and proof of address.

3) How much can I borrow with an instant loan in India?

The loan amount you can borrow through an instant loan in India depends on various factors, including your income, creditworthiness, and the lender’s policies. In general, instant loans in India may range from a few thousand rupees to several lakhs. However, it’s essential to borrow only what you need and can comfortably repay to avoid falling into a cycle of debt.

4) What are the interest rates and repayment terms for instant loans in India?

Interest rates and repayment terms for instant loans in India can vary widely depending on the lender, the loan amount, and the borrower’s credit profile. While some lenders offer competitive interest rates, others may charge higher rates, especially for borrowers with lower credit scores. Repayment terms typically range from a few days to several months, with options for flexible installment plans.

5) Are instant loans in India safe and regulated?

Yes, instant loans in India are regulated by the Reserve Bank of India (RBI) and other relevant regulatory authorities. However, it’s essential to exercise caution and choose reputable lenders when applying for instant loans online. Before availing of any loan, carefully review the terms and conditions, including interest rates, fees, and repayment schedules, to ensure transparency and avoid falling victim to predatory lending practices. Additionally, only provide personal and financial information to licensed lenders and avoid sharing sensitive details on unsecured websites or with unauthorized individuals.