Securing a mortgage is a crucial step for individuals looking to purchase their dream home or invest in property. However, the traditional mortgage process often involves a myriad of paperwork, manual tasks, and lengthy approval timelines, leading to frustration for both borrowers and lenders alike. Fortunately, the advent of mortgage workflow automation has revolutionized the home financing landscape, offering a seamless and efficient experience for all parties involved.

Mortgage workflow automation involves the use of technology and digital tools to streamline the end-to-end mortgage process, from application submission to loan approval and closing. By automating repetitive tasks, minimizing manual interventions, and digitizing documentation, mortgage workflow automation accelerates the loan origination process, enhances accuracy, and improves the overall borrower experience.

Imagine:

- Applying online in minutes, ditching the endless forms and waiting lines.

- Uploading documents electronically, with automated verification, saves time.

- Getting pre-qualified instantly, knowing the budget, and moving forward with confidence.

- Seeing real-time updates on the application and staying informed every step of the way.

- Closing the deal digitally, avoiding unnecessary paperwork and delays.

What the numbers say

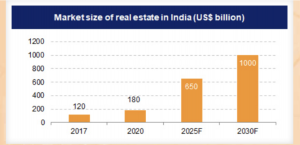

As per data released by the India Brand Equity Foundation, by 2040, the real estate market is projected to surge to Rs. 65,000 crore (US$ 9.30 billion), up from Rs. 12,000 crore (US$ 1.72 billion) in 2019. The Indian real estate sector is anticipated to attain a market size of US$ 1 trillion by 2030, a significant leap from US$ 200 billion in 2021, with a projected contribution of 13% to the country’s GDP by 2025. Notably, sectors such as retail, hospitality, and commercial real estate are experiencing substantial growth, catering to India’s burgeoning infrastructure requirements.

Projections indicate that India’s real estate sector is poised to expand to US$ 5.8 trillion by 2047, reflecting a considerable increase from its current share of 7.3% to 15.5% of the GDP.

In the fiscal year 2023, India’s residential property market witnessed unprecedented growth, with the value of home sales soaring to an all-time high of Rs. 3.47 lakh crore (US$ 42 billion), marking an impressive 48% year-on-year surge. Concurrently, the volume of sales exhibited a robust upward trajectory, registering a 36% increase with 379,095 units sold.

Source: IBEF

Given the projected expansion and to ensure it manifests without any complications, it is inevitable that technology will play a leading role. Home loan process automation can help make the projections a reality. Here’s how:

1) Online Application and Prequalification: Mortgage automation platforms offer borrowers the convenience of applying for a loan online, eliminating the need for paper-based applications. Through intuitive interfaces and intelligent form fields, borrowers can input their information securely and receive instant prequalification decisions based on predefined criteria.

2) Document Collection and Verification: Automation tools simplify the document collection process by enabling borrowers to upload required documents electronically. Advanced optical character recognition (OCR) technology extracts data from documents, automating the verification process and reducing the risk of errors. Lenders can quickly assess the completeness and authenticity of documents, expediting the underwriting process.

3) Credit Analysis and Risk Assessment: Mortgage automation systems integrate with credit bureaus and financial data sources to retrieve borrowers’ credit reports and assess their creditworthiness. Machine learning algorithms analyze credit histories, income statements, and debt-to-income ratios to generate risk scores and determine the borrower’s eligibility for a mortgage. This data-driven approach enhances decision-making accuracy and reduces the likelihood of manual errors.

4) Automated Underwriting and Approval: Automation platforms enable lenders to automate underwriting decisions based on predefined criteria and risk thresholds. By leveraging rule-based engines and decision algorithms, lenders can expedite loan approvals for qualified borrowers while mitigating the risk of default. Automated underwriting ensures consistency, transparency, and compliance with regulatory requirements throughout the approval process.

5) Electronic Closing and Settlement: Mortgage automation facilitates electronic closings, allowing borrowers to sign documents digitally and complete the transaction remotely. Electronic signatures, secure authentication methods, and blockchain technology ensure the integrity and legality of digital transactions, eliminating the need for physical presence and paper-based signings. Electronic settlements accelerate the closing process, reduce administrative overhead, and enhance convenience for borrowers.

Benefits of Mortgage Workflow Automation:

1) Accelerated Loan Processing: Automation reduces manual touchpoints and accelerates the mortgage origination process, enabling lenders to process applications faster and meet borrower expectations for quick approvals.

2) Enhanced Efficiency and Productivity: By automating repetitive tasks and data-intensive processes, mortgage automation platforms improve operational efficiency, reduce processing times, and enable lenders to handle higher loan volumes with existing resources.

3) Improved Accuracy and Compliance: Automation minimizes human errors, ensures data accuracy and enhances regulatory compliance throughout the mortgage lifecycle. Advanced validation checks and audit trails provide transparency and accountability, reducing the risk of non-compliance penalties.

4) Enhanced Customer Experience: Mortgage automation enhances the borrower experience by offering a seamless and user-friendly application process, real-time updates on application status, and faster loan approvals. Streamlined communication channels and self-service portals empower borrowers to track their progress and access support when needed.

5) Cost Savings and Competitive Advantage: By reducing manual labor, paper-based processes, and operational overhead, mortgage automation lowers processing costs, increases profitability, and enables lenders to offer competitive interest rates and fees to borrowers. Moreover, automation fosters innovation and differentiation, positioning lenders as industry leaders in the digital age.

Implementation Considerations

Successfully implementing mortgage workflow automation requires careful planning, collaboration, and investment in technology infrastructure. Lenders must evaluate their existing processes, identify automation opportunities, and select suitable technology partners that align with their business goals and regulatory requirements. Key considerations include data security, scalability, integration capabilities, user experience, and change management strategies. Training and upskilling employees to leverage automation tools effectively are also essential to ensure a smooth transition and maximize the benefits of mortgage workflow automation.

Challenges and Future Trends

While mortgage workflow automation offers numerous benefits, it also presents challenges related to data privacy, cybersecurity, regulatory compliance, and adoption barriers. Addressing these challenges requires ongoing investment in technology, robust risk management practices, and collaboration across the industry. Looking ahead, the future of mortgage automation is promising, with advancements in artificial intelligence, machine learning, and predictive analytics poised to further optimize the mortgage process. Innovations such as digital identity verification, blockchain-based smart contracts, and open banking APIs hold the potential to revolutionize home financing and create a more inclusive and accessible mortgage ecosystem for borrowers worldwide.

Mortgage workflow automation represents a marked shift in home financing, offering a transformative approach to mortgage origination, underwriting, and closing. By harnessing the power of technology, lenders can streamline processes, enhance efficiency, and deliver an exceptional borrower experience. As the mortgage industry continues to evolve, embracing automation will be paramount for lenders seeking to remain competitive, drive growth, and meet the evolving needs of borrowers in an increasingly digital world. With innovation and collaboration, mortgage automation will pave the way for a more efficient, transparent, and accessible home financing landscape, empowering individuals to achieve their homeownership dreams with confidence and convenience.

If you are looking to transform your debt collections strategy with the power of digital and data-powered insights, reach out to us to request an exploratory session at sales@credgenics.com or visit us at www.credgenics.com.

FAQs:

1) What is mortgage workflow automation, and how does it work?

Mortgage workflow automation involves the use of technology and digital tools to streamline the end-to-end mortgage process, from application submission to loan approval and closing. Automation tools leverage data analytics, machine learning, and artificial intelligence to automate repetitive tasks, minimize manual interventions, and accelerate the loan origination process. By digitizing documentation, validating borrower information, and automating underwriting decisions, mortgage workflow automation improves efficiency, accuracy, and transparency in the mortgage lending process.

2) What are the benefits of mortgage workflow automation for lenders?

Mortgage workflow automation offers numerous benefits for lenders, including accelerated loan processing, improved operational efficiency, reduced processing times, enhanced accuracy, and compliance with regulatory requirements. Automation tools streamline document collection, verification, and underwriting processes, enabling lenders to handle higher loan volumes with existing resources and offer a seamless borrower experience. By automating repetitive tasks and minimizing manual errors, mortgage workflow automation helps lenders reduce costs, increase profitability, and gain a competitive edge in the market.

3) How does mortgage workflow automation enhance the borrower experience?

For borrowers, mortgage workflow automation offers convenience, speed, and transparency throughout the loan application process. Digital application forms enable borrowers to apply for a mortgage online, upload required documents electronically, and receive instant pre-qualification decisions. Automation tools provide real-time updates on application status, prompt borrowers for any missing information, and guide them through each stage of the process. By reducing paperwork, streamlining communication, and expediting loan approvals, mortgage workflow automation improves the overall borrower experience and satisfaction.

4) Is mortgage workflow automation secure, and how does it protect borrower data?

Yes, mortgage workflow automation prioritizes data security and privacy to safeguard borrower information throughout the loan origination process. Automation platforms employ advanced encryption techniques, secure authentication methods, and robust cybersecurity measures to protect sensitive data from unauthorized access, breaches, and cyber threats. Compliance with industry regulations such as GDPR and HIPAA ensures that borrower data is handled responsibly and ethically. By implementing stringent security protocols and regular audits, mortgage workflow automation platforms ensure the confidentiality, integrity, and availability of borrower data at all times.

5) How can lenders integrate mortgage workflow automation into their existing processes?

Lenders can integrate mortgage workflow automation into their existing processes by partnering with technology providers that offer customizable solutions tailored to their specific needs and requirements. Automation platforms should seamlessly integrate with lenders’ existing systems, such as loan origination systems (LOS), customer relationship management (CRM) software, and document management systems. Training and upskilling employees on how to use automation tools effectively are essential to ensure a smooth transition and maximize the benefits of automation. Continuous monitoring, feedback, and optimization of automated workflows enable lenders to adapt to changing market dynamics and enhance their mortgage lending capabilities over time.