As the processes in finance evolve and are modernized, credit risk assessment is undergoing a change, largely driven by the capabilities of artificial intelligence (AI). Traditional credit scoring models, which rely on limited data and established credit history, are giving way to more sophisticated AI-driven methods. AI-based credit scoring is emerging as the future of credit risk assessment, offering numerous benefits in terms of accuracy, efficiency, and inclusivity.

AI-based credit scoring models offer a more intricate analysis of data, incorporating information that may seem unconventional or beyond the scope of traditional credit scoring models. AI can generate complex and comprehensive rules in contrast to the simplistic rules employed by traditional models, which frequently result in the rejection of creditworthy borrowers. Furthermore, self-learning credit scoring models can perpetually enhance their performance by assimilating new data—a characteristic absent in conventional credit scoring models.

The limitations of traditional credit scoring

Before diving into AI-based credit scoring, it’s essential to understand the shortcomings of traditional credit scoring systems. These systems primarily rely on historical data from credit bureaus. While they have been the industry standard for years, they come with several limitations:

- Limited data: Traditional credit scores are based on historical data related to a person’s credit usage, making them less effective for assessing individuals with little to no credit history or those with non-traditional financial backgrounds.

- Inflexibility: They do not consider other crucial data points like income, employment history, or current financial status.

- Slow response: Traditional credit assessments can be slow, causing delays in loan approvals, which can be problematic in today’s fast-paced financial environment.

- Vulnerable to bias: Traditional models can inadvertently perpetuate biases, as they may discriminate against individuals from certain demographic groups or those with unconventional financial history.

AI-based credit scoring: The evolution

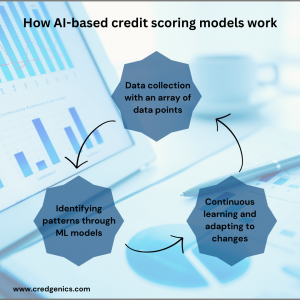

AI-based credit scoring represents a departure from these limitations by leveraging advanced algorithms, machine learning, and a vast array of data sources. Here’s how it works:

1. Data collection: A holistic approach

AI-based credit scoring systems take data collection to a whole new level. While traditional models typically rely on a limited set of credit-related data, AI systems cast a much wider net. They gather a comprehensive array of data points, including conventional credit history and transaction records, but they don’t stop there. These systems delve into a variety of unconventional sources, such as social media activity, online behavior, and even data from IoT (Internet of Things) devices, where applicable.

This holistic approach goes beyond what traditional models can offer. It allows a more in-depth examination of an individual’s financial situation. By tapping into unconventional data sources, AI can provide insights into a borrower’s financial habits, life events, and overall behavior, giving lenders a more complete picture. This added context is invaluable, especially when assessing those who may have limited or non-existent credit histories.

2. Machine learning: Uncovering hidden patterns

AI-based credit scoring models harness the power of machine learning, a subset of artificial intelligence that specializes in recognizing patterns and relationships within data. Unlike traditional models, which often rely on predefined rules and thresholds, AI models don’t make predetermined assumptions about what’s relevant.

Machine learning models dive into the vast pool of collected data, scrutinizing every detail. They can spot intricate, hidden correlations and patterns that might escape the human eye or simplistic rule-based models. This dynamic approach means that credit risk assessments are not limited to just a few basic parameters. Machine learning models can discern intricate connections between seemingly unrelated variables, thereby making more accurate predictions about an individual’s creditworthiness.

3. Continuous learning: Adapting to changing realities

One of the most compelling features of AI-based credit scoring is its capacity for continuous learning. Traditional credit scoring models are typically static; their rules and criteria remain largely fixed over time. In contrast, AI models are adaptive and can evolve in response to new data and changing financial landscapes.

This adaptability is crucial in today’s dynamic markets. Financial situations can change rapidly due to various factors like economic conditions, job market shifts, and personal life events. AI models, however, remain relevant and up-to-date by incorporating fresh data. As they process new information, they can adjust their assessments accordingly. This feature not only enhances the accuracy of credit risk predictions but also ensures that lenders are making informed decisions based on the most current data available.

Advantages of AI-based credit scoring

The transition to AI-based credit scoring is not just a technological upgrade; it’s a game-changer for credit risk assessment, offering several compelling advantages:

1. Increased accuracy: AI models are significantly more accurate in assessing credit risk, reducing the likelihood of false approvals or rejections. This accuracy benefits both lenders and borrowers.

2. Inclusivity: One of the most noteworthy advantages is the ability of AI to evaluate the creditworthiness of individuals with limited credit history or those from underserved communities. This fosters financial inclusion and widens access to credit for a broader spectrum of the population.

3. Speed and efficiency: AI-based systems can make instant credit decisions, greatly reducing the time and effort required for loan approvals. In a world where time is money, this efficiency is a game-changer for borrowers and lenders alike.

4. Reduced bias: While AI systems can inadvertently inherit biases from historical data, they can also be designed to be less discriminatory by minimizing the influence of factors like race, gender, or age. The potential for a more equitable financial system is one of the most promising aspects of AI-based credit scoring.

5. Fraud detection: Beyond just creditworthiness, AI can enhance fraud detection by identifying suspicious patterns and anomalies in financial behavior, protecting both lenders and borrowers from fraudulent activities.

The future of credit risk assessment

AI-based credit scoring is rapidly evolving and is poised to be a pivotal force in the future of credit risk assessment. As technology advances and more data sources become available, these models will become even more accurate and inclusive. The financial industry should embrace these changes while maintaining a strong commitment to ethical and responsible AI usage.

Consumers can look forward to faster and fairer credit decisions, while lenders can benefit from reduced risk and more efficient operations. However, all stakeholders must work together to address the challenges and concerns associated with AI-based credit scoring to ensure a more equitable and secure financial system for everyone. In this rapidly changing landscape, the responsible and ethical use of AI is crucial to ensuring that the future of credit risk assessment benefits all.

If you are looking to transform your debt collections strategy with the power of digital and data-powered insights, reach out to us to request an exploratory session at sales@credgenics.com or visit us at www.credgenics.com

FAQs?

1. What are the elements of an effective credit risk management process?

Credit risk management involves assessing, monitoring, and mitigating risks associated with lending. The process comprises key steps:

- Credit Assessment: Evaluating a borrower’s creditworthiness.

- Risk Decision: Approving or rejecting credit applications and setting terms.

- Credit Monitoring: Continuously tracking borrowers’ financial health.

- Risk Mitigation: Strategies to reduce credit risk, such as collateral or diversification.

- Portfolio Management: Balancing risk and return in the overall credit portfolio.

- Regulatory Compliance: Adhering to legal and regulatory requirements.

- Loss Recovery: Dealing with defaults, including debt recovery.

- Policy Development: Continuously refining credit policies and strategies.

- Reporting and Analysis: Regular assessment of credit risk metrics.

Credit risk management is essential for financial stability, minimizing losses, and ensuring responsible lending practices.

2. What is credit risk?

Credit risk, often referred to as default risk, is the risk that a borrower or debtor will fail to meet their financial obligations, such as repaying a loan or meeting other credit-related agreements. In essence, it’s the likelihood that a borrower will default on their debt, leading to financial losses for the lender or creditor.

Key factors contributing to credit risk include:

- Creditworthiness: The borrower’s ability and willingness to repay the debt. This is often assessed through credit scores, credit reports, and financial background checks.

- Economic Conditions: The overall economic health, including factors like unemployment rates, interest rates, and inflation, can influence a borrower’s ability to repay debt.

- Industry and business conditions: The financial well-being of the industry or sector to which the borrower belongs can impact their ability to meet financial obligations.

- Loan terms: The terms of the credit agreement, such as interest rates, repayment schedules, and the presence of collateral or guarantees, can affect credit risk.

- Credit diversification: Lenders often mitigate credit risk by diversifying their credit portfolios, spreading risk across different borrowers, industries, and asset types.

- Regulatory and legal factors: Government regulations, laws, and financial standards can impact credit risk, affecting how lenders assess and manage it.

Credit risk can be categorized into various levels, from low risk (e.g., high-quality borrowers with excellent credit histories) to high risk (e.g., borrowers with poor credit histories, unstable income, or significant financial distress). Lenders use credit risk assessment to evaluate the risk level associated with each borrower and determine the terms and conditions of credit, including interest rates and credit limits.

Managing credit risk is crucial for lenders to minimize potential losses. They employ various strategies, including setting credit policies, performing ongoing monitoring of borrowers, establishing loan loss reserves, and, in some cases, requiring collateral or guarantees to offset potential defaults.

3. How does AI-based credit scoring differ from traditional credit scoring models?

AI-based credit scoring differs from traditional models in several ways. Traditional credit scoring relies on historical data and is limited to information from credit bureaus. In contrast, AI-based models use advanced algorithms, machine learning, and a wider range of data sources, including non-traditional data like social media activity, to assess creditworthiness. AI models can uncover complex patterns and correlations in data, providing a more nuanced evaluation of a borrower’s risk. They are also adaptive and can continuously learn from new data, making them more responsive to changing financial situations.

4. Is AI-based credit scoring more accurate in predicting credit risk than traditional models?

AI-based credit scoring has shown significant potential for improving the accuracy of credit risk assessment. These models can consider a broader range of data, which allows for a more comprehensive evaluation of an individual’s financial situation. AI’s ability to identify hidden patterns and correlations in data often leads to more precise predictions. However, the effectiveness of AI-based models depends on the quality of the data they are trained on and the algorithms used. Continuous monitoring and adjustment are essential to ensure that the models remain accurate and free from bias.