A key determinant of borrowing costs for both individuals and businesses in India’s lending ecosystem is the Prime Lending Rate (PLR). While the term Prime Lending Rate might not be widely known, its weight in the financial ecosystem is substantial, serving as a yardstick for interest rates attached to several loan products. Prime Lending Rate is a reference point for interest rates in the lending market. For example, when a person applies for a home loan, the interest rate that they are offered is tied to the current PLR. This rate essentially sets the baseline that different lending institutions use to determine their interest rates, affecting everything from home loans and personal loans to business loans.

What is Prime Lending Rate?

The prime rate, also known as the prime lending rate, represents the interest rate at which commercial banks extend loans and various financial products to customers with an acceptable credit rating. This rate is meant to make up for the risk that lenders bear while lending funds. When determining the prime rate, banks and other financial institutions carefully consider the fluctuations and volatility present in both the economy and market.

The prime lending rate is typically lower than the interest rate imposed on other borrowers who may pose a high risk of loan default. Factors such as the costs of funds, operational expenses, and a minimum margin to meet capital charge requirements play a pivotal role in establishing the prime lending rate.

While the prime rate may not directly impact a majority of consumers, it acts as a foundational benchmark for numerous customer and small business loans. In a significant development on July 1, 2010, the Base Rate scheme was introduced, replacing the Benchmark Prime Lending Rate. The Base Rate encompasses all components of the loan rate shared by borrowers. Banks are allowed to compute their actual lending rates using the Base Rate along with any other customer-specific charges deemed appropriate.

Under the Base Rate scheme, all loan categories, whether new or up for renewal, are obligated to be priced solely in terms of the Base Rate. This means that banks cannot lend at rates lower than the Base Rate. This framework ensures transparency and standardization in lending practices, contributing to a fair and consistent approach across the banking sector.

To give an example, let’s say the Reserve Bank of India (RBI) decides to decrease the repo rate, which is the rate at which banks borrow from the central bank. This adjustment has a ripple effect, causing a change in the Prime Lending Rate. As a result, individuals looking for home loans might find themselves eligible for lower interest rates, making borrowing more cost-effective.

In practical terms, the Prime Lending Rate is like a behind-the-scenes player in the financial system. Its influence isn’t just in banking strategies but also in the day-to-day financial decisions of regular people – affecting how affordable it is to buy a home or start a business. By exploring the nuances of the Prime Lending Rate, we get a clearer picture of how it quietly shapes the economic landscape for borrowers and lenders in India.

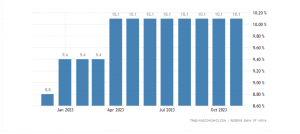

Prime Lending Rate in India (Trading Economics and RBI)

Prime Lending Rate in India (Trading Economics and RBI)

What are the factors influencing Prime Lending Rate

Repo Rate: The Reserve Bank of India (RBI) sets the repo rate, which is the rate at which banks borrow money from the central bank. Changes in the repo rate directly affect the cost of funds for banks. If the RBI raises the repo rate to control inflation, banks may increase their PLR to maintain profitability.

Cost of funds: Banks raise funds through various means, including deposits and borrowings. The cost associated with these funds influences the PLR. If the cost of funds increases, banks may adjust the PLR upward to ensure their lending operations remain financially viable.

Inflation and economic conditions: Inflation and the overall economic climate are critical factors. In times of high inflation, the RBI may adopt a tight monetary policy, leading to an increase in the repo rate and subsequently affecting the PLR. Economic conditions, including GDP growth and employment rates, also play a role in shaping the PLR.

Credit risk: Banks assess the credit risk associated with lending to different customers. The PLR reflects the perceived risk, with higher-risk borrowers facing higher interest rates. This differentiation allows banks to manage their exposure to credit risk while offering competitive rates to low-risk borrowers.

Significance of Prime Lending Rate in India

Influencing Loan Rates: For example, let’s say a Bank has a PLR of 8%. This means that the Bank considers 8% to be the baseline interest rate for its most creditworthy customers.

When determining interest rates for other customers, the Bank would add a margin to the PLR. A home loan might have an interest rate of PLR + 2%, resulting in a 10% interest rate for the borrower.

Impact on Borrowers and Businesses: For individuals, a lower PLR can mean more favorable loan terms, encouraging borrowing and spending. Conversely, a higher PLR may make borrowing more expensive.

For businesses, especially small and medium enterprises (SMEs), fluctuations in the PLR can significantly impact the cost of capital, influencing investment decisions and expansion plans.

Economic indicator: Changes in the PLR often reflect the RBI’s broader monetary policy stance. During economic downturns, the RBI may lower the repo rate to stimulate borrowing and spending, leading to a reduction in the PLR. Conversely, during periods of inflationary pressure, the RBI might raise rates to cool down the economy, resulting in an increased PLR.

Financial Market Dynamics: Investors and analysts closely watch changes in the PLR as it provides insights into the monetary policy stance and economic health. These changes can impact stock markets, bond yields, and overall investor sentiment.

Financial inclusion: The PLR plays a role in shaping financial inclusion by influencing the accessibility of credit. Policies that result in a lower PLR can make credit more affordable for a broader segment of the population, contributing to the government’s efforts to bring more individuals and businesses into the formal financial system.

Summing up

The movements of the Prime Lending Rate are not merely indicators of financial dynamics but drivers that shape the financial landscape for borrowers and lenders alike. A nuanced understanding of the Prime Lending Rate is essential for individuals navigating the credit market, businesses seeking funding, and policymakers crafting strategies for economic stability and growth. The PLR is more than just a number; it is a key to unlocking opportunities and fostering financial well-being for the diverse population of India.

If you are looking to transform your debt collections strategy with the power of digital and data-powered insights, reach out to us to request an exploratory session at sales@credgenics.com or visit us at www.credgenics.com

FAQs:

1. What is the Prime Lending Rate?

The prime lending rate is the interest rate that commercial banks charge their most creditworthy customers, typically large corporations or other financial institutions. It serves as a benchmark for setting interest rates on various loans and financial products throughout the economy. The prime lending rate is influenced by factors such as the central bank’s monetary policy, prevailing economic conditions, and the overall creditworthiness of borrowers. Changes in the prime lending rate can have a cascading effect on interest rates for a wide range of loans, impacting consumer borrowing costs, business investments, and the overall health of the financial system.

2. Who decides the Prime Lending Rate in India?

In India, the Prime Lending Rate (PLR) is not directly set by a specific authority. Rather, it is dependent on a number of variables, and commercial banks are free to choose their own PLRs in accordance with these variables. However, the Reserve Bank of India (RBI) plays a significant role in shaping the environment in which banks operate and, indirectly, the factors that influence the PLR.

Key factors that influence the Prime Lending Rate in India include:

- Repo Rate: The RBI sets the repo rate, which is the rate at which banks borrow money from the central bank. Changes in the repo rate have a direct impact on the cost of funds for banks. As the repo rate changes, banks may adjust their lending rates, including the PLR, to maintain profitability.

- Cost of Funds: The overall cost of funds for banks, which includes interest paid on deposits and other sources of funding, influences the PLR. If the cost of funds increases, banks may raise their PLR to ensure that lending remains financially viable.

- Economic Conditions: The broader economic conditions, such as inflation, GDP growth, and employment rates, also influence the PLR. The RBI, through its monetary policy, aims to create a stable economic environment, and changes in economic conditions can lead to adjustments in the PLR.

- Credit Risk: Banks assess the credit risk associated with lending to different customers. The creditworthiness of borrowers affects the interest rates offered, and this, in turn, can impact the PLR. Higher-risk borrowers may be charged higher interest rates.

While individual banks have the autonomy to set their PLRs, there is a certain level of coordination and alignment with the broader economic policies set by the RBI. The central bank’s policies, especially regarding the repo rate and overall economic management, have a cascading effect on the interest rate environment, including the Prime Lending Rate in India.

3. How is Prime Lending Rate determined?

A number of variables that together affect banks’ cost of funding and the overall state of the economy decide the Prime Lending Rate (PLR). One crucial determinant is the Reserve Bank of India’s (RBI) repo rate. The interest rate at which banks borrow money from the central bank is known as the repo rate, and it is determined by the RBI. Changes in the repo rate directly impact the cost of funds for commercial banks. If the RBI decides to increase the repo rate as a measure to control inflation, for instance, banks may subsequently raise their PLR to maintain profitability and cover the increased cost of borrowing from the central bank.

Additionally, the overall cost of funds for banks, including interest on deposits and other sources of funding, plays a pivotal role in setting the PLR. Banks consider economic indicators, such as inflation rates and the prevailing economic climate, in determining their PLR. Economic conditions influence the risk and return profile of lending, prompting adjustments to the PLR. Furthermore, the credit risk associated with borrowers is a critical factor. Banks assess the creditworthiness of customers, and the perceived risk is factored into the interest rates. Borrowers with higher credit risk may face a higher PLR, reflecting the increased risk to the lending institution. Overall, the interplay of these factors results in a dynamic determination of the Prime Lending Rate, shaping the landscape of interest rates for various loans in the financial market.

4. What is Prime Lending Rate affected by?

The prime lending rate is influenced by various factors, and its movement is typically tied to broader economic conditions and monetary policy. Here are some key factors that can affect the prime lending rate:

- Central Bank Policies: The central bank, such as the Federal Reserve in the United States, plays a crucial role in determining interest rates. Changes in the central bank’s monetary policy, such as adjustments to the federal funds rate, can impact the prime lending rate. Central banks often use interest rate changes as a tool to control inflation, stimulate economic growth, or manage other economic objectives.

- Economic Conditions: The overall health of the economy, including indicators like GDP growth, employment rates, and inflation, can influence the prime lending rate. During periods of economic expansion, central banks may raise interest rates to prevent overheating, while during economic downturns, they may lower rates to stimulate borrowing and spending.

- Credit worthiness of Borrowers: The prime lending rate is designed for the most creditworthy borrowers. Changes in the perceived credit risk of these borrowers, based on factors like their financial stability and credit histories, can influence the prime rate.

- Market Interest Rates: Movements in broader financial markets, including changes in yields on government bonds and other benchmark interest rates, can impact the prime lending rate. Banks consider these market rates when determining their own lending rates.

- Inflation Expectations: Expectations about future inflation can influence interest rates. If inflation is expected to rise, central banks may increase interest rates to maintain price stability, which can affect the prime lending rate.

- Global Economic Factors: Factors such as international economic conditions, trade dynamics, and geopolitical events can also have an impact on the prime lending rate, especially in economies with strong global ties.