In the lending industry, debt collections play a crucial role in ensuring the overall revenue and profitability of lenders. As the consumption of debt-based products continues to rise in India, the need to recover debts becomes increasingly important. However, traditional debt collection methods often face challenges such as manual processes, siloed operations, and language barriers, resulting in delayed loan recovery and reduced efficiency. To address these challenges, financial institutions are turning to automation and digitization to enhance debt collection efficiency and achieve operational effectiveness.

The growing need for automation in debt collections

According to recent reports, the gross NPA held by banks in India could fall by March 2024 to 4%. However, achieving this will require overcoming challenges posed by global economic sentiments. Also, the volatile economic scenario has put debt collections under the radar for lenders. This calls for a focus on strengthening debt collections processes, embracing automation and leveraging innovative capabilities.

Automation and digitization offer several benefits in debt collections. By leveraging data-driven insights and digital processes, financial institutions can effectively manage collections and boost their debt recovery rates. Automated debt collection platforms, such as the Credgenics debt collection platform, provide solutions that automate and streamline the entire collection process, from identifying defaulters to the final settlement of funds.

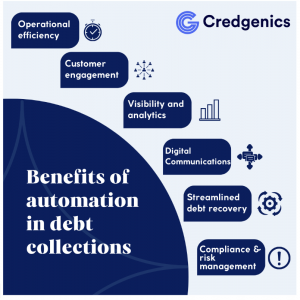

Benefits of automation in debt collections

Automation significantly improves both the recovery time and efficiency of the debt collection process. By implementing digital solutions, lenders can prioritize their efforts for maximum outcomes, fast-track processes, and gain real-time visibility. Let’s explore some key benefits of automation in debt collection:

1. Improved operational efficiency

Traditional debt collection methods rely on manual processes and human intervention, which can lead to inefficiencies and delays. Automation streamlines the entire collection process, eliminates the need for manual updates of payment activity and status. By automating usage of communication channels and integrating digital payment gateways, lenders can enhance operational efficiencies and reduce the time and effort required to recover debts.

2. Enhanced customer engagement

Automation enables personalized engagement with borrowers through AI-driven collection strategies. By leveraging data analytics and machine learning models, lenders can analyze borrower responses and tailor their collection strategies accordingly. This personalized approach improves customer engagement and increases the chances of successful debt recovery

3. Real-time visibility and analytics

Automation platforms provide dashboards and data analytics that offer a consolidated view of collections activities across different stages and channels. These dashboards enable lenders to assess the performance of collections campaigns and strategies, identify trends, and make data-driven strategy decisions. By leveraging real-time visibility and analytics, financial institutions can continuously optimize their collection efforts for maximum efficiency and results.

4. Efficient digital communications

Automated digital communication capabilities, such as interactive voice response systems, chatbots, and outbound calling, enable lenders to engage with borrowers across multiple channels. These tools facilitate timely and effective communication, allowing lenders to remind debtors of repayments, address queries, and offer assistance. By automating digital communications, lenders can improve the customer experience and increase the chances of successful debt recovery.

5. Streamlined debt recovery processes

Automation simplifies and streamlines debt recovery processes by removing manual effort in administrative and repetitive tasks thereby, reducing chances of human error. By automating research, documentation, and report reviewing, lenders can free up time for collectors to focus on more value added tasks. Additionally, automation can assist in determining more accurate settlement potential by analyzing comprehensive data pointers such as income, credit scores, past trends and net worth. This data-driven approach improves decision-making and increases the efficiency of debt recovery efforts.

6. Compliance and risk management

Automation helps financial institutions adhere to regulatory compliance requirements, policy controls, best practices in debt collections and reduce unforeseen legal complexities. By automating specific procedures and limiting reliance on human decision-making, lenders can ensure better compliance with regulations. This reduces the risk of negligence, oversight and liabilities while increasing productivity.

Leveraging automation for debt collections

For maximizing loan recovery through automation, financial institutions can leverage various tools and solutions. Credgenics debt collections technology platform offers a comprehensive suite of automation features that streamline the entire collections process. Let’s explore some of the key features that can enhance debt collection efficiency:

1. Dashboard and data analytics

Debt collection platforms provide dashboards that offer a consolidated view of collections activities. These dashboards derive data from API-based integration with lenders’ loan management systems, providing insights into the stage of each delinquent case, recovered loan amounts, communication channels used, and the status of legal communications. Data analytics and machine learning models analyze this data to drive collection strategies and optimize decision-making.

2. Digital communications

Automated digital communication capabilities, such as outbound calling and chatbots, enable lenders to interact with borrowers across multiple channels. These tools facilitate timely and personalized communication, improve customer engagement, and increase the chances of successful debt recovery. To maintain professionalism and encourage client loyalty, automated cloud-based calling services—like those offered by Credgenics—ensure that calls are tracked and borrower numbers are masked.

3. Digital payments

Enabling digital payment capabilities simplifies and accelerates the debt recovery process. By integrating payment gateways with debt collection platforms, lenders can provide borrowers with secure and convenient digital payment options. This reduces the complexity of payment collection and improves the overall efficiency of debt recovery efforts. Platforms like Billzy offer complete visibility on loan repayments in real-time, simplifying transaction management for both lenders and borrowers.

4. Skip Tracing

Maintaining updated borrower information is crucial for effective debt collections. Skip-tracing tools automate the process of identifying and updating publicly available contact details, making it faster and more accurate. By leveraging borrower information provided to lending companies, skip tracing tools track down any missing contact details. This ensures that lenders can reestablish borrower connect and close long-standing loan accounts.

5. Digital Door-to-Door recovery

Digitizing field collections improves operational efficiencies, enhances team productivity, and transforms the customer experience. Credgenics’ CG Collect mobile app for field team enables lenders to digitize on-field loan collections, providing real-time visibility, eliminating cash transactions, and simplifying collection processes. These digital solutions improve the efficiency of door-to-door loan recoveries and enhance the overall effectiveness of debt collection efforts.

In conclusion, debt collection efficiency is crucial for the overall profitability and success of lenders. Automation and digitization offer significant benefits in streamlining collection processes, enhancing operational efficiencies, and improving customer engagement. By leveraging tools such as automated communications, data analytics, and digital payment capabilities, financial institutions can maximize loan recovery and optimize their debt collection efforts. Embracing automation in debt collections is key to staying competitive in the lending industry and ensuring long-term success.

For a deeper insight into digital debt collections, watch this detailed video by Kavan Desai from Credgenics.

If you are looking to transform your debt collections strategy with the power of digital and data-powered insights, reach out to us to request an exploratory session at sales@credgenics.com or visit us at www.credgenics.com.

FAQs

1) How does automation improve debt collection efficiency?

Automation enhances debt collection efficiency by streamlining and automating various stages of the collection process. Tasks such as payment reminders, follow-ups, and documentation can be automated, reducing manual effort, minimizing errors, and ensuring a more systematic and timely approach to debt recovery.

2) What role does technology play in debt collection automation?

Technology plays a crucial role in debt collection automation by offering advanced tools such as customer relationship management (CRM) systems, predictive analytics, and communication platforms. These technologies enable creditors to assess and predict payment behavior, automate communications, and maintain comprehensive records, ultimately optimizing the debt collection workflow.

3) How does automation contribute to a more personalized debt collection approach?

Automation allows for the customization of debt collection strategies based on individual debtor profiles. By leveraging data and analytics, automated systems can tailor communication schedules, outreach methods, and settlement options to suit the unique circumstances of each debtor. This personalized approach increases the likelihood of a successful debt recovery.

4) Can automation help in compliance with debt collection regulations?

Yes, automation aids in compliance by ensuring that debt collection practices adhere to relevant regulations and guidelines. Automated systems can be programmed to follow legal and ethical debt collection practices, including accurate record-keeping, verification of debts, and adherence to communication restrictions. This not only enhances efficiency but also reduces the risk of legal issues associated with debt collection.