Field debt collections deposits rely on a hub & spoke model for lodgement and realizations of cash collected by the agents. This field debt recovery process is to be steadily monitored and tracked for the lenders to seamlessly manage their collections inflow.

While this model for cash deposit by agents is viable for bigger financial institutions with a pan India presence, it can be a limitation for others. With growing adoption of digital banking and shrinking footprint of bank branches, cash deposits at branches is turning into a complex issue for collections agents.

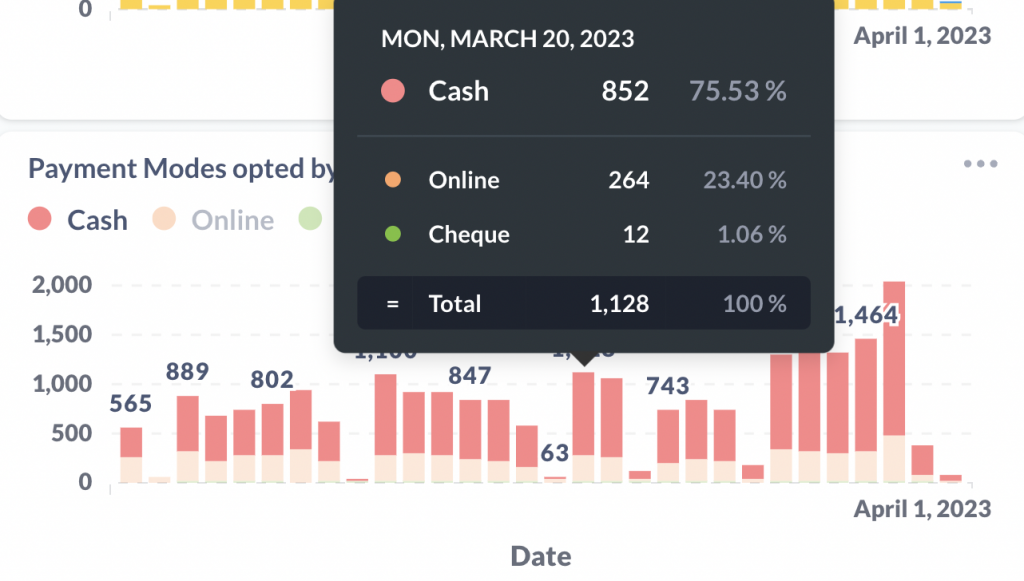

As per a study conducted by Credgenics, cash-based collections constitute more than fifty percent of the overall field collections transactions. An alternate deposit mechanism for faster realization of the collected payments is the need of the hour.

Chart 1: Payment Distribution reference from CG Platform

What are the challenges faced by field collection agents in depositing cash?

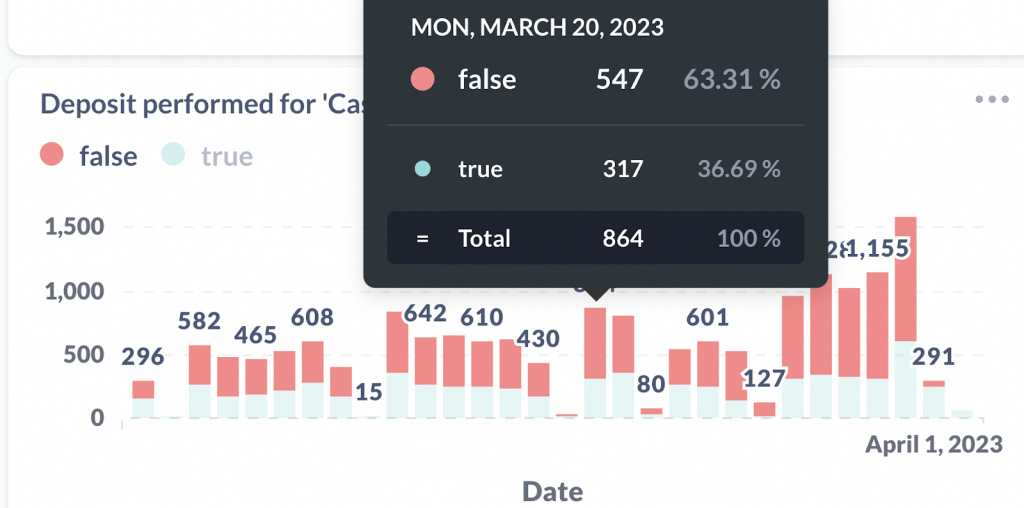

The hassle of searching for a lender’s branch to deposit the amount in remote areas and the risk of carrying cash in transit safely become a concern for the collections agents as well as the lenders. This may lead to missed / late cash deposits and impact the reconciliation process for smaller lenders. Additionally, the cumulative costs associated with multiple agents travelling long distances for making these deposits, the inability to track payments while agents are in transit and the delayed deposits add to this conundrum.

Chart 2: > 50% chances of missed deposits even in the recent months.

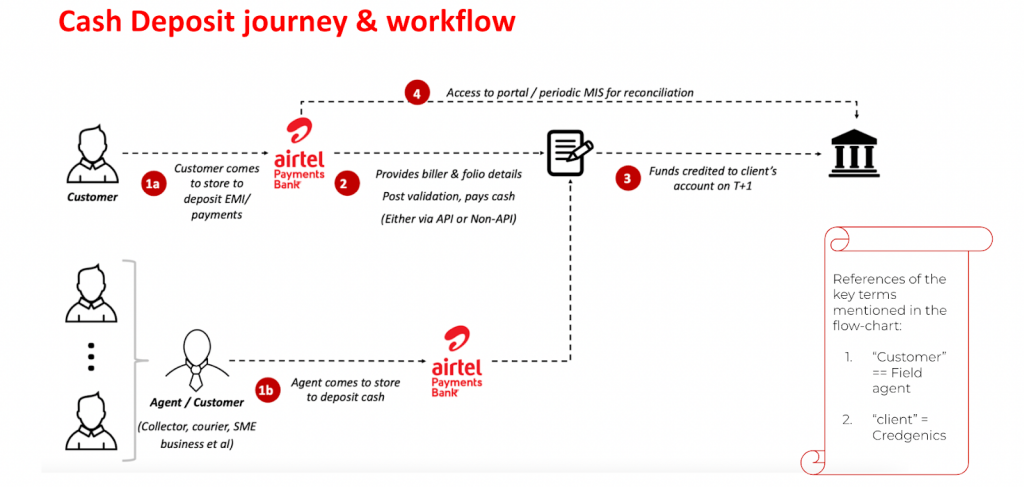

CG Collect enables cash management solutions for field debt collections

CG Collect field debt collections mobile app from Credgenics addresses the issue of cash deposit management associated with field debt collections. The field collection agents can make the deposits at the nearest Airtel store through the CG Collect FOS mobile app.This results in faster deposits, reduces instances of undeposited cash lying with the agents, and eases collections in smaller cities / towns / villages where cash continues to be a major mode for repayments. This also provides field agents with more flexibility to deposit the cash-in-hand at their nearby Airtel stores which are opened till late in most areas. Also Airtel stores are open on weekends, public holidays, which allows for easier deposits .

How does CG Collect cash drop capabilities benefit field agents and collections teams?

CG Collect has been integrated with the Airtel Payments Bank cash-drop services, which have the convenience of over 3,000 easily accessible Airtel stores, strategically located near agents location. Processing cash worth $500 million a month for 2,000-odd business-to-business (B2B) clients, Airtel covers upto 80% of the pincodes across India and have close to 300,000 active banking points depositing cash.

The integrated cash management services will reduce the challenge of managing physical cash and also mitigate the risk of cash in transit by digitizing the deposit part in the collections chain. Many large lenders lack payment integration reflecting delay in collections of a couple of days but with the new cash drop service feature, the collections will be reflected instantaneously.

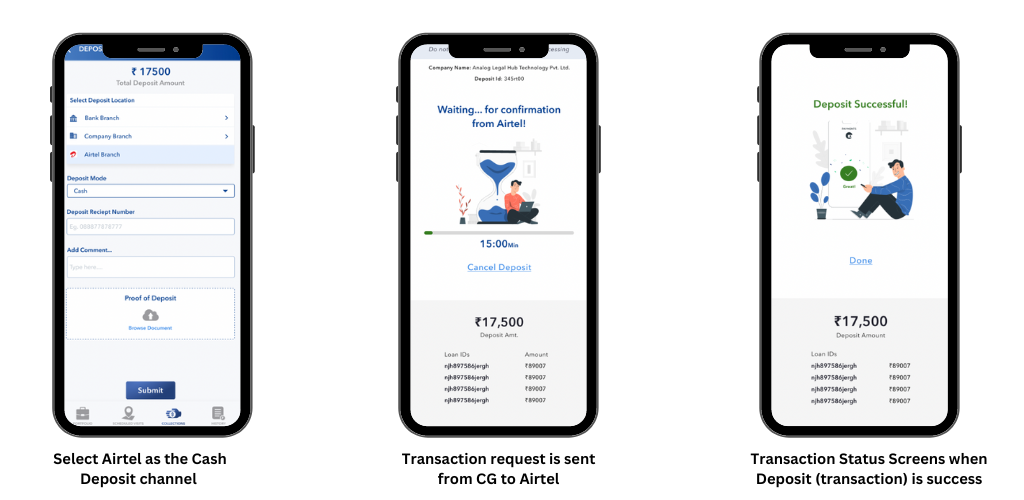

What does CG Collect cash drop service feature offer?

- Facility for CG Collect users (Field agents) to deposit cash in the nearby Airtel stores

- Merchant portal to track the previous transactions and their status

- Daily MIS for transaction and settlement information

CG Collect will accelerate collections deposits through its cash drop service feature

- Reduce cash transit cycle: Reduce the time between collections and deposit of cash payments by ~50%.

2. Increase cash recovered percentage: Reduce the probability of cases for cash lost in transit

3. Improve agent efficiency: Save time on agent travel and reduce operational costs for field collections

4. Secure field operations: Track the transaction status in real-time with no additional level of approvals needed while making deposits as these deposits are pre-verified by the supervisors

The cash drop service feature on CG Collect mobile app enables lenders and their field collections teams to deal with the leakages in collected payments, especially in rural areas, and ensure a steady flow of cash for operations. Agent productivity is increased when the agents do not need to worry about travelling long distances to make these deposits. They have better chances to fulfil their scheduled meetings and PTP, thus increasing collections.

Learn more about Credgenics’ CG Collect mobile app and how this field loan collections app is transforming collections with advances technologies and automation, bringing down cost of collections by 50% and improving collections by 30%.