Over the past two decades, FinTech has rapidly evolved as one of the most dynamic segments in the financial services industry. Pioneering innovations within this space have not only shaped the current financial landscape but have also left a profound impact on an entire generation. The continuous stream of disruptive models has proven to be progressively game-changing, resulting in diverse fintech trends in India. Fueled by distinctive, customer-centric value propositions and collaborative business models, FinTechs have majorly impacted the financial services sector.

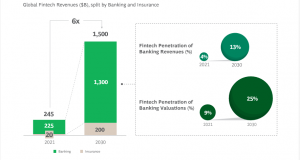

Aligned with global trends, the FinTech ecosystem has experienced remarkable technological strides and is anticipated to surge from $245 billion to $1.5 trillion by 2030. Projections indicate that the Asia-Pacific region will surpass the United States, claiming the top spot in the global FinTech market by the end of the decade. Leading this global FinTech race are countries like India, renowned for their cutting-edge FinTech innovations, substantial underbanked populations, and a burgeoning demographic of tech-savvy youth and middle-class individuals. As we approach 2024, it’s crucial to delve into the key technology trends that are poised to redefine the future of FinTech in India.

Source: Capital IQ and Boston Consulting Group

Market trends to watch out for in 2024

1. Greater momentum in embedded finance and Banking as a Service (BaaS):

BaaS and embedded finance are set to be instrumental in driving disintermediation and opening up novel avenues for growth. These trends will not only allow FinTechs to solidify existing partnerships but also enable them to forge new alliances within the financial services sector. Industries beyond traditional finance, such as e-commerce platforms, are increasingly embracing API-based business models to leverage the benefits of embedded finance. As a result, consumers and businesses can seamlessly access instant loans right at the point of checkout on these platforms. With the growing adoption of API-based models across diverse industries, FinTechs stand to broaden their user base as distributors, ultimately boosting profitability through specialization in niche market segments.

2. Central Bank Digital Currencies (CBDCs) take centerstage

Central Bank Digital Currencies (CBDCs) are gaining prominence as governments explore digital alternatives to traditional currencies. In 2024, several countries are expected to make significant strides in piloting and implementing CBDCs. These digital currencies could redefine the monetary landscape, offering faster and more efficient cross-border transactions while addressing concerns related to financial inclusivity and privacy.

3. Enhancing collaboration: Fintech-bank partnerships

Facing hurdles in obtaining banking licenses, fintechs are anticipated to strengthen their collaborations with banks to ensure long-term sustainability. Such partnerships will play a pivotal role in navigating the regulatory landscape until favorable opportunities for acquiring licenses become available.

4. Green fintech and sustainable investments

The growing emphasis on sustainability is making its mark on the fintech industry, giving rise to green fintech. In 2024, we expect an increased focus on sustainable investments, with fintech platforms pushing the integration of Environmental, Social, and Governance (ESG) criteria into their offerings. From green investment products to carbon footprint tracking, fintech is poised to contribute significantly to the global sustainability agenda.

Tech trends in 2024

1. Breakthroughs in lending technology: ONDC and Credit on UPI

The Open Network for Digital Commerce (ONDC) is poised to create pathways into the fintech realm, opening up prospects for startups specializing in lending technology. Simultaneously, the extension of UPI into credit functionalities has the potential to reshape the lending landscape, with possible outcomes including consolidation and rationalization.

2. Decentralized Finance (DeFi) evolution

Decentralized Finance, or DeFi, has been a driving force in the fintech sector, and its evolution is set to continue in 2024. DeFi platforms leverage blockchain technology to offer traditional financial services like lending, borrowing, and trading without the need for traditional intermediaries. As security and scalability concerns are addressed, we anticipate a surge in DeFi adoption, with new and improved protocols offering a broader array of financial services.

3. AI and Advanced Analytics for personalized finance

Artificial Intelligence (AI) and advanced analytics are becoming integral to fintech, enabling personalized and data-driven financial solutions. In 2024, we anticipate a significant uptick in AI-powered robo-advisors, offering tailored investment advice, and advanced analytics platforms that help users gain deeper insights into their financial behaviors. This trend not only enhances user experiences but also fosters more informed financial decision-making.

The fintech landscape in 2024 promises to be dynamic, driven by technological innovations, regulatory advancements, and changing consumer expectations. From decentralized finance reshaping the foundations of banking to embedded finance seamlessly integrating financial services into our daily lives, the fintech trends in India forecast a future where finance is more accessible, personalized, and sustainable. As we navigate this transformative era, staying abreast of these trends will be crucial for businesses, investors, and consumers alike.

If you are looking to transform your debt collections strategy with the power of digital and data powered insights, reach out to us to request an exploratory session at sales@credgenics.com or visit us at www.credgenics.com.

FAQs:

1. What are the key fintech trends in India that will reshape the landscape in 2024?

In 2024, India’s fintech landscape will witness transformative technological advancements. Key trends include the rise of decentralized finance (DeFi), the integration of artificial intelligence (AI) for personalized financial solutions, the expansion of blockchain applications, and the increased adoption of contactless payment technology.

2. How is India positioning itself in the global fintech race, and what factors contribute to its prominence?

India is emerging as a frontrunner in the global fintech race, propelled by cutting-edge innovation, a substantial underbanked population, and a growing demographic of tech-savvy individuals. Factors contributing to India’s prominence include a robust regulatory framework, collaborative fintech-bank partnerships, and a surge in digital adoption, especially in rural and semi-urban areas.

3. What role does Banking as a Service (BaaS) play in the evolving fintech ecosystem in India?

Banking as a Service (BaaS) is a pivotal trend shaping India’s fintech landscape in 2024. BaaS facilitates collaboration between fintech startups and traditional banks, unlocking new opportunities for innovative financial services. This model enhances accessibility, fosters financial inclusion, and allows fintechs to offer a broader array of services without the need for full-scale banking licenses.

4. How is the Indian fintech sector addressing cybersecurity concerns in the wake of increased digitization?

With the surge in digitization, cybersecurity will remain a top priority for the Indian fintech sector in 2024. Fintech companies are investing significantly in advanced cybersecurity measures, including biometric authentication, blockchain-based security, and AI-driven fraud detection, to ensure robust digital defenses and maintain user trust in an increasingly digital financial landscape.