Recently, The Reserve Bank of India Governor, Shaktikanta Das unveiled plans to introduce conversational payments on the Unified Payments Interface (UPI) using artificial intelligence (AI). This move will empower users to engage with AI-driven systems for seamless payment transactions.

As per the RBI’s official statement, this service will be accessible through UPI channels on both smartphones and feature phones, which will contribute to the further expansion of digital accessibility across India. Initially, this feature will be offered in Hindi and English, with plans for subsequent inclusion in additional Indian languages. The RBI has directed the National Payments Corporation of India (NPCI), the leading authority behind UPI, to initiate the implementation of conversational payments without delay. With robust action being taken in this regard, the journey towards a bright future of conversational payments in India seems to have begun.

What are conversational payments?

Conversational payments refer to a method of conducting financial transactions through a conversational interface, typically enabled by messaging apps or chatbots. This approach leverages the convenience and familiarity of natural language conversations to facilitate payments seamlessly. Conversational payments offer several advantages, including convenience, speed, and the ability to conduct financial transactions without leaving a messaging app. They can be particularly useful for peer-to-peer payments, bill payments, or e-commerce transactions. Additionally, chatbots can assist and answer questions related to payments, making the process more user-friendly. However, it’s essential to ensure the security and privacy of conversational payments, especially given the sensitive nature of financial transactions.

Benefits of Conversational Payments

- Enhanced customer experience: Conversational payments offer an intuitive and user-friendly experience, making banking and financial transactions more accessible to people with varying levels of digital literacy. As AI and machine learning continue to improve, chatbots and voice assistants will become even more adept at understanding and responding to user requests.

- Financial inclusion: India has been actively working towards financial inclusion, and conversational payments can play a pivotal role in this effort. By simplifying financial interactions, this technology can help individuals in remote or underserved areas access banking services more easily.

- Voice-activated transactions: With growing popularity of voice assistants such as Amazon’s Alexa and Google Assistant, voice-activated payments are likely to rise in prominence. Users will be able to initiate transactions by simply speaking to their connected devices, making financial transactions management more seamless, speedy and convenient.

- Integration with e-commerce: Conversational payments enhance the e-commerce experience by further simplifying the processes. They allow users to make purchases, track deliveries, and even handle returns and refunds through conversational interfaces.

- Cross-border transactions: With ease of conversational payments, cross-border transactions, and international remittances are likely to become more straightforward.

Conversational payments powered by UPI

In India, the relationship between UPI (Unified Payments Interface) and conversational payments is centered on enhancing the ease and accessibility of digital financial transactions. Conversational payments leverage natural language processing and chatbot technology to allow users to interact with a system or application through text or voice commands to initiate and complete financial transactions. Here’s how UPI and conversational payments are interconnected:

- Facilitating payments through conversations: Conversational payments enable users to perform financial transactions by simply conversing with a chatbot or a virtual assistant. They can instruct the system to send money, check account balances, pay bills, and perform other financial tasks using natural language. This makes the process more user-friendly and convenient.

- Integration with UPI: Many conversational payment solutions are integrated with UPI in India. UPI serves as the underlying payment infrastructure that facilitates the actual transfer of funds from one bank account to another. When a user initiates a transaction through a chatbot or voice assistant, the payment request is routed through UPI, which ensures the secure and efficient transfer of funds.

- Conversational banking: Conversational payments are often part of a broader trend known as conversational banking. This approach transforms the way customers interact with their banks and financial institutions. Users can inquire about their account details, initiate transfers, and even receive financial advice through conversations, all powered by UPI for the actual fund transfer.

- Convenience and accessibility: Conversational payments make financial services more accessible to a wide range of users, including those who may not be comfortable with traditional banking interfaces or those who prefer the convenience of voice commands or chat-based interactions. This inclusivity aligns with UPI’s goal of promoting digital financial inclusion in India.

- Innovative features: UPI continues to evolve with innovative features and services that enhance the capabilities of conversational payments. For example, UPI can support the integration of credit lines, enabling users to access credit seamlessly during a conversation with a chatbot or virtual assistant.

- Bill payments: Conversational payments often simplify bill payments. Users can instruct a chatbot to pay their utility bills, credit card bills, or other expenses, and UPI handles the actual payment processing.

- Security and authentication: UPI ensures the security and authentication of transactions initiated through conversational payments. Users typically need to authenticate their identity using methods like UPI PIN or biometric authentication to confirm transactions, maintaining the security of the process.

Current landscape in the Indian context

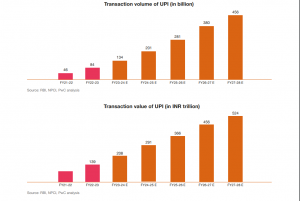

In the first quarter of FY 2023–24, UPI transaction volume reached 24.9 billion, and transaction value reached INR 39.7 trillion.

Source: RBI, NPCI, PwC Analysis

In October, digital payments in India continued their upward trajectory, with the Unified Payments Interface reaching a significant milestone by surpassing 1,100 crore transactions for the first time. According to data from the National Payments Corporation of India (NPCI), UPI recorded an impressive 1,141 crore transactions, amounting to a total value of INR 17.16 lakh crore.

Comparing this to the previous month, UPI transactions increased by 8% from the INR 1,056 crore recorded in September, and the transaction value grew by 8.6% from INR 15.8 lakh crore.

On an annual basis, UPI demonstrated remarkable growth, with a 55% increase in transaction volume and a 42% surge in transaction value. The NPCI, with its ambitious growth plans, aims to achieve 100 billion monthly transactions shortly. To support this goal, they recently unveiled a range of UPI innovations at the Global Fintech Fest 2023. These innovations include features like credit line access, NFC-based offline payment options such as UPI LITE X and Tap & Pay, as well as conversational payment solutions like Hello! UPI and BillPay Connect.

Conclusion

The evolution of digital payments in India over the last six to eight years has been truly exceptional, serving as a global benchmark for growth. This transformation has played a pivotal role in India’s shift from a cash-reliant economy to one that depends less on physical currency, with a notable prevalence of digital-first transactions in urban areas, spanning from metropolises to tier 1-4 cities and even extending into rural regions.

Looking ahead, digital payments are expected to make significant inroads into the Indian economy, reaching a wide spectrum of customer segments and introducing innovative applications while fortifying existing businesses. As per PwC analysis, it is projected that transaction volumes in retail digital payments, facilitated through various instruments, will witness a twofold increase by the fiscal year 2026-27.

With a focus on customer experience, financial inclusion, security, and technological advancements, innovative technology is set to play a pivotal role in shaping the future of conversational payments and digital finance in the country. As India continues its journey toward becoming a digitally empowered society, conversational payments are a significant step in that direction.

If you are looking to transform your debt collections strategy with the power of digital and data-powered insights, reach out to us to request an exploratory session at sales@credgenics.com or visit us at www.credgenics.com

FAQs:

1. What are conversational payments, and how do they work in India?

Conversational payments in India use chatbots or voice assistants to initiate and complete financial transactions through natural language commands. Users can instruct these systems to transfer funds, check account balances, pay bills, and perform various financial tasks, making transactions more accessible and user-friendly.

2. Which payment methods are commonly integrated with conversational payments in India?

Conversational payments in India are often integrated with the Unified Payments Interface (UPI), a popular real-time payment system. UPI serves as the backbone for secure fund transfers when users interact with chatbots or voice assistants to execute financial transactions.

3. Are conversational payments secure in India, and what authentication methods are employed?

The future of conversational payments in India will center around security. Users are typically required to authenticate their identity using methods such as UPI PIN, biometric authentication (fingerprint or facial recognition), or multi-factor authentication to confirm transactions. These measures ensure the safety of conversational payment interactions.

4. What are the key use cases for conversational payments in India?

Conversational payments in India serve a wide range of use cases, including sending money to contacts, checking account balances, paying utility bills, recharging mobile phone accounts, and even accessing credit lines. These applications make managing finances more convenient and accessible.

5. How do conversational payments contribute to financial inclusion in India?

Conversational payments play a significant role in promoting financial inclusion in India. They offer a user-friendly interface for individuals who may not be comfortable with traditional banking methods or digital apps. This inclusivity aligns with India’s goal of extending financial services to a broader population, including those in rural and underserved areas, heralding a brighter future for conversational payments in India.