In India, Priority Sector Lending in banking pertains to the compulsory lending targets for priority sectors as established by the Reserve Bank of India (RBI) for banks and financial institutions. These targets are designed to guarantee that specific sectors of the economy receive essential credit and financial assistance, with the primary goal of fostering inclusive economic growth, mitigating regional disparities, and providing support to underprivileged segments of the population.

Master Directions by the Reserve Bank of India

Per the RBI’s revised Master Direction on Priority Sector Lending in October 2022, the central bank has recognized priority sectors, such as agriculture, MSMEs, export credit, education, housing, social infrastructure, renewable energy, and more, based on their substantial social and economic impact.

Under the PSL regulations, banks are mandated to apportion a designated portion of their total lending to these priority sectors. Presently, for both domestic commercial and foreign banks operating 20 branches or more, the comprehensive PSL target is established at 40% of their total adjusted net bank credit (ANBC) or Credit Equivalent of Off-Balance Sheet Exposures (CEOBE).

Regional rural banks and small finance banks, on the other hand, must meet a total PSL target amounting to 75% of either their adjusted net bank credit (ANBC) or Credit Equivalent of Off-Balance Sheet Exposures (CEOBE), whichever figure is higher.

Within this comprehensive PSL target, domestic commercial and foreign banks with 20 branches or more, regional rural banks, and small finance banks are entrusted with a specific goal of channeling 7.5% of their ANBC or CEOBE, whichever is greater, into micro-enterprises.

Banks fulfill their PSL obligations by disbursing loans, extending credit facilities, and providing a spectrum of financial products and services to individuals, entities, and businesses within the priority sectors. Alternatively, they can meet their targets by investing in eligible instruments like bonds issued by entities engaged in priority sector activities.

However, if banks are unable to meet their PSL targets, they are required to deposit the specified amount into the Rural Infrastructure Development Fund (RIDF), administered by NABARD, or other designated funds, such as those with NABARD, SIDBI, Mudra, National Housing Bank, among others, as determined by the RBI as per its master direction on PSL.

Priority Sector Lending in banking and the MSMEs

In July 2021, the government introduced an expansion of the MSME sector by encompassing retail and wholesale trades, extending the benefits to 2.5 crore traders within these categories, exempting them from PSL requirements.

According to the most recent monthly data released by the RBI, in May 2023, the MSME sector received a total of Rs 20.20 lakh crore in bank credit under PSL, constituting 14.5% of India’s entire non-food bank credit amounting to Rs 138.5 lakh crore. This marked a slight increase from April 2023 when Rs 19.84 lakh crore, equivalent to 14.3% of the total non-food bank credit of Rs 138.36 lakh crore, was channeled into the MSME sector. In May, Rs 16.17 lakh crore was allocated to micro and small enterprises, while medium-sized units received Rs 4.02 lakh crore.

Recent developments in PSL

- Bank deposits in rural funds to count as priority sector exposure:

In May 2023, it came to light that the government is exploring a potential overhaul of the priority sector lending (PSL) program to include bank deposits in the Rural Infrastructure Development Fund (RIDF) and similar funds as eligible contributions within the PSL framework.

The proposed adjustments are anticipated to offer banks greater flexibility in fulfilling their sector-specific PSL targets and unlocking capital for extending credit to economically vibrant sectors, thereby fostering overall economic growth.

Currently, the deposits made by banks in RIDF and similar funds are not recognized as a means to compensate for any shortfalls in meeting PSL targets, nor are they accounted for within the banks’ exposure in the corresponding PSL sub-categories. These investments, typically facilitated through institutions like NABARD, SIDBI, and MUDRA, are classified as part of ancillary services, other financial assistance to MSMEs, or housing.

Upon approval of the proposed changes, banks’ investments in eligible funds, aligned with their annual allocation, will be recognized as bank lending within the specific PSL sub-categories that correspond to the shortfall ratio for that particular year.

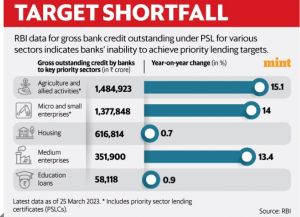

As per the RBI’s bank credit report, the outstanding gross bank credit under PSL as of March 24th comprises:

- ₹17.08 trillion for agriculture

- ₹15.70 trillion for micro and small enterprises

- ₹3.99 trillion for medium enterprises

- ₹6.21 trillion for housing

- ₹58,634 crore for education loans

- ₹4,656 crore for renewable energy

- ₹2,464 crore for social infrastructure

- ₹15,696 crore for export credit

- ₹59,659 crore for other sectors

- ₹14.41 trillion for weaker sections, which includes Priority Sector Lending Certificates (PSLCs)

- India considering electronic vehicles for priority sector lending:

The Indian finance ministry is contemplating the inclusion of electric vehicles within the Reserve Bank of India’s (RBI) priority sector framework, a step aimed at lowering the cost of raising funds, as revealed by a government official on Saturday. The suggestion originated in August 2023 from the power ministry, and if implemented, it has the potential to reduce the cost of financing for electric vehicles, thereby promoting their increased adoption.

This proposal aligns with a report co-authored by India’s policy think tank, Niti Aayog, in January 2022, which advocated for this concept.

Conclusion

Priority Sector Lending (PSL) in banking stands as a pivotal instrument in India’s financial landscape, driving inclusive growth, economic development, and social equity. It is not only a regulatory mandate but a mechanism that channels funds to the sectors that need it the most, ensuring access to credit for underprivileged sections and priority activities. The recent proposals and considerations, such as expanding PSL to include electric vehicles and reevaluating PSL norms, reflect the dynamism and adaptability of the Indian financial system. These potential changes underscore the ever-evolving nature of PSL to address the evolving needs of the economy.

As PSL continues to evolve, it is crucial for financial institutions, regulators, and policymakers to work in harmony, striking a balance between the need for robust financial practices and the imperatives of inclusive development. By fostering innovation, promoting responsible lending, and staying true to the core principles of PSL, India’s financial sector can further fortify its role in building a more equitable and prosperous future for all. The journey of Priority Sector Lending continues, and its impact will reverberate throughout India’s socio-economic landscape for years to come.

If you are looking to transform your debt collections strategy with the power of digital and data-powered insights, reach out to us to request an exploratory session at sales@credgenics.com or visit us at www.credgenics.com

FAQS:

1. What is Priority Sector Lending in banking?

Priority Sector Lending (PSL) in banking in India is a regulatory framework that mandates banks and financial institutions to allocate a specified portion of their lending to sectors crucial for the country’s socio-economic development. These sectors include agriculture, small and micro-enterprises, housing, education, and more. PSL is designed to ensure that credit is extended to underserved and economically vulnerable segments of the population, promoting financial inclusion, regional development, and inclusive growth. Compliance with PSL targets is essential for banks, and they are required to report their PSL activities regularly to the Reserve Bank of India (RBI) to support and monitor their efforts in contributing to the country’s economic and social well-being.

2. What are the benefits of fulfilling Priority Sector Lending targets for banks?

Banks that meet their PSL targets contribute to the broader objectives of financial inclusion, regional development, and social equity. Compliance with PSL requirements can lead to benefits such as reduced statutory reserve requirements, access to certain refinancing facilities, and a positive image in terms of responsible banking. It also supports the overall development of the economy by ensuring that credit flows to sectors essential for India’s growth and well-being.

3. How are the Priority Sector Lending (PSL) targets determined for banks in India?

PSL targets for banks are determined based on their total adjusted net bank credit (ANBC) or Credit Equivalent of Off-Balance Sheet Exposures (CEOBE). The specific targets vary for different sectors and sub-sectors within the PSL category. The Reserve Bank of India (RBI) periodically reviews and revises these targets to align with the changing economic and social priorities, and banks are expected to comply with the targets as set by the RBI.

If you are looking to transform your debt collections strategy with the power of digital and data-powered insights, reach out to us to request an exploratory session at sales@credgenics.com or visit us at www.credgenics.com