The finance sector plays a pivotal role in shaping the global economy along with leaving a strong impact on the society and environment. As we confront the challenges of climate change, resource depletion, and social inequality, the need for financing sustainability focused initiatives has never been more critical. The urgency for environmental sustainability and the imperative to embrace a greener economy and ecosystem have led to this need in recent years, giving rise to green fintech. In India, where the financial services industry is a catalyst for economic development, green fintech is bound to play a crucial role in the market. This article unravels the impact that green fintech can enable in the Indian financial landscape, making it certain that a future defined by sustainability is possible only when all stakeholders understand and play their part.

Understanding green fintech

A relatively recent development, green fintech refers to the application of financial technology, including digital platforms, mobile banking, and artificial intelligence, to promote sustainable development, mitigate climate change, and support environmentally friendly practices. Green fintech aims to align financial services with environmental goals, making them more sustainable, efficient, and accessible.

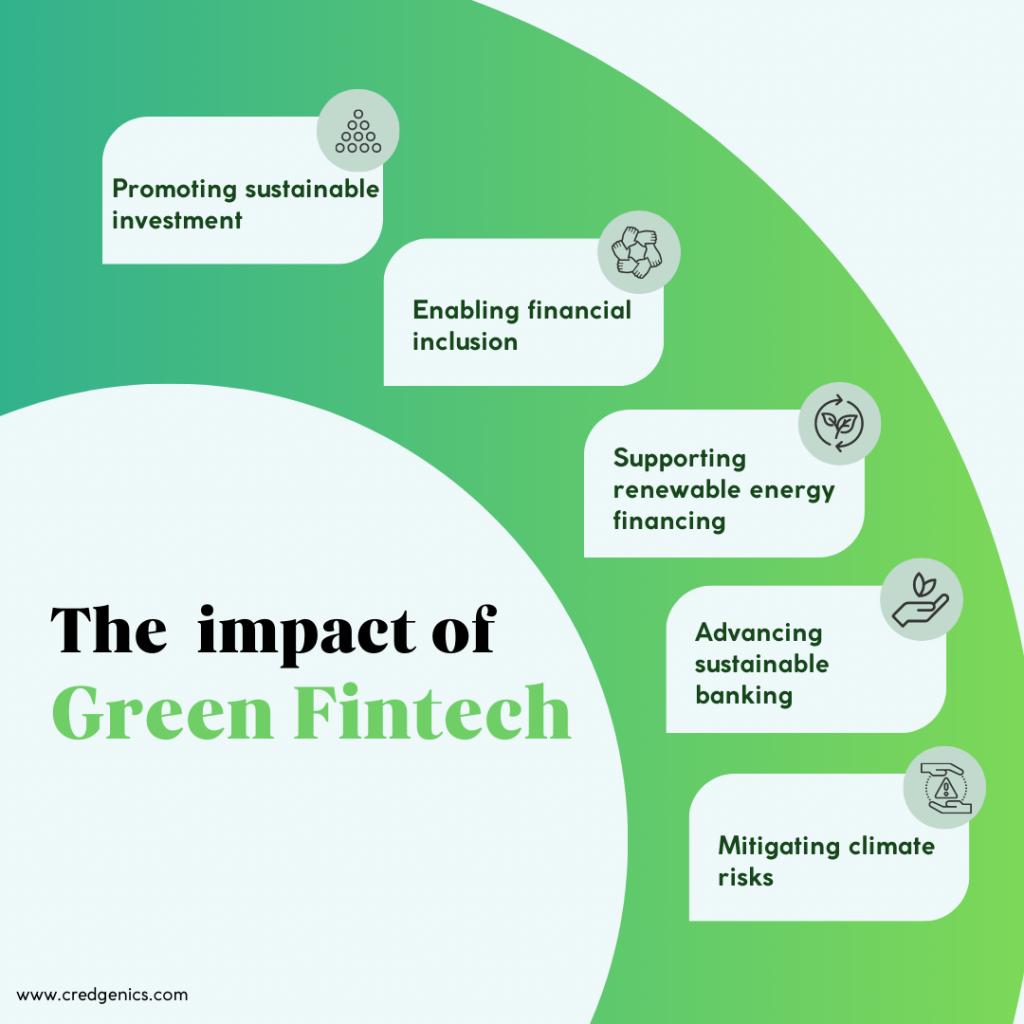

The impact of green fintech

The impact of green fintech on the financial market is beginning to transform how investments are made, empowering individuals and institutions to channel their capital towards environmentally friendly initiatives such as renewable energy projects and green bonds. A World Bank report acknowledges the contribution of India in this regard for launching the first green bond in early 2023 to raise $2 billion for projects associated with biodiversity conservation and environmental protection. Further, green fintech has also played a pivotal role in promoting financial inclusion by providing innovative digital solutions that extend financial services to underserved populations while integrating sustainable banking practices and climate risk assessment into decision-making processes.

Some of the areas that green fintech has impacted are explained below.

Promoting sustainable investment

A significant aspect of green fintech is its role in promoting sustainable investments. Through digital platforms and fintech solutions, individuals and institutions can easily access and invest in green assets, such as renewable energy projects, green bonds, and socially responsible funds. These platforms provide transparent information on sustainable investments’ environmental impact and financial performance, enabling investors to make informed decisions and allocate their capital toward environmentally friendly initiatives.

Enabling financial inclusion

Green fintech in India is playing a crucial role in promoting financial inclusion. Fintech companies leverage digital technologies to offer innovative solutions, extending financial services to underserved populations, including rural communities and low-income individuals. Mobile banking and digital payment platforms have simplified access to financial services, reducing reliance on cash and improving financial literacy. This increased financial inclusion empowers individuals to participate in the green economy initiatives and make sustainable choices.

Supporting renewable energy financing

India has set ambitious renewable energy targets, and green fintech plays a pivotal role in supporting the financing of projects associated with them. Fintech platforms provide alternative lending models, crowdfunding mechanisms, and peer-to-peer lending platforms that facilitate easier access to capital for renewable energy initiatives. By directly connecting investors with clean energy projects, green fintech eliminates traditional barriers to financing and accelerates the deployment of renewable energy infrastructure across the country.

Advancing sustainable banking

Green fintech in India is reshaping the banking sector by driving sustainable practices. Banks are adopting digital platforms to streamline operations, reduce paper usage, and optimize resource utilization. Fintech solutions enable banks to offer green financial products, such as green loans and mortgages, which incentivizes environmentally friendly practices. These innovative financial products reward customers for adopting energy-efficient technologies or investing in sustainable infrastructure, fostering a greener economy.

Mitigating climate risk

Given the significant risks that climate change poses to financial stability, green fintech assists in assessing and mitigating climate-related risks. Fintech solutions powered by artificial intelligence and machine learning algorithms help financial institutions analyze and manage their exposure to climate risks. These tools provide insights into potential climate risks associated with investments, loans, and insurance portfolios. By integrating climate risk assessment into decision-making processes, financial institutions can better manage their assets and contribute to a more resilient financial system.

The future of green fintech

As India strives to build a low-carbon economy, the continued growth and adoption of green fintech will play a pivotal role in driving the country towards a sustainable and resilient financial system. Green fintech is transforming the Indian financial services space by promoting sustainable investment, enabling financial inclusion, supporting renewable energy financing, advancing sustainable banking, and mitigating climate risk. It presents a significant opportunity to align financial services with environmental objectives, creating a greener and more sustainable future.

FAQs:

1. What is green fintech, and why is it important?

Green fintech, also known as sustainable fintech, refers to integrating financial technology with environmental sustainability objectives. It plays a crucial role in addressing today’s pressing environmental challenges. Here are some reasons why green fintech is important:

- Environmental Impact: Green fintech enables the financial sector to contribute to mitigating climate change and reducing environmental degradation. It promotes financing environmentally friendly projects and businesses, such as renewable energy, energy efficiency, sustainable agriculture, and clean technologies.

- Risk Management: Climate change and environmental factors pose significant risks to the financial system. Green fintech provides tools and technologies to assess and manage these risks. Incorporating environmental data and analytics into financial decision-making processes, it enables better risk assessment, stress testing, and scenario analysis. This helps financial institutions and investors understand their exposure to climate-related risks, such as physical risks from extreme weather events and transition risks from policy changes and market shifts.

- Financial Innovation: Green fintech drives financial innovation by developing new products, services, and business models that align with sustainability goals. It also promotes the development of sustainable investment platforms, digital tools for measuring environmental impact, and blockchain-based solutions for transparency and traceability in supply chains.

- Market Opportunities: The shift towards sustainability presents significant market opportunities. Green fintech helps mobilize private capital towards sustainable investments, unlocking new markets and revenue streams. Additionally, it meets the growing demand from investors and consumers who prioritize sustainable investments and want to align their financial choices with their values.

- Regulatory Compliance: Governments and regulatory bodies are increasingly emphasizing sustainability and climate-related reporting and disclosure requirements. Green fintech assists financial institutions in meeting these compliance obligations efficiently. By promoting transparency and accountability, green fintech enhances the overall resilience and stability of the financial system.

2. How can green fintech help the environment?

Fintech can help the environment in several ways:

- Financing Sustainable Projects: Fintech platforms can facilitate financing environmentally friendly projects. By connecting investors with green initiatives, fintech enables the flow of capital towards sectors such as renewable energy, energy efficiency, sustainable agriculture, and waste management. This financial support accelerates the development and deploys sustainable solutions, helping address environmental challenges.

- Sustainable Investment Platforms: Fintech has paved the way for the creation of sustainable investment platforms. These platforms provide individuals and institutions with easy access to sustainable investment opportunities. They offer a range of options, such as green bonds, impact investing funds, and portfolios aligned with environmental, social, and governance (ESG) criteria. Fintech streamlines the process of researching, selecting, and investing in sustainable assets, making it more convenient and inclusive.

- Digital Payments and Paperless Transactions: Fintech promotes digital payments and paperless transactions, reducing the reliance on cash and physical documents. This transition to digital finance has environmental benefits by minimizing paper usage and the associated deforestation and reducing carbon emissions from transportation and logistics. It also improves efficiency and security in financial transactions.

- Financial Inclusion for Environmental Initiatives: Fintech can enhance financial inclusion by reaching underserved populations, particularly in developing regions with acute environmental challenges. By leveraging mobile banking, digital wallets, and microfinance solutions, fintech can provide access to financial services and capital for communities engaged in sustainable practices, such as small-scale farmers adopting climate-smart agriculture or rural entrepreneurs developing renewable energy projects.

- Data Analytics and Risk Assessment: Fintech incorporates advanced data analytics and artificial intelligence (AI) algorithms that can assess and manage environmental risks more effectively. Fintech platforms can provide financial institutions and investors insights about climate-related risks, such as flood-prone areas or carbon-intensive industries by analyzing environmental data, satellite imagery, weather patterns, and other relevant information. This helps make informed decisions, manage portfolios, and mitigate potential losses.

3. What are some examples of green fintech?

Green fintech refers to financial technology solutions that promote sustainability and environmental responsibility and support the transition to a low-carbon economy. Here are some examples of green fintech initiatives and solutions:

- Renewable Energy Financing: Fintech platforms are emerging to facilitate financing for renewable energy projects. These platforms connect investors with renewable energy developers, enabling individuals and institutions to invest directly in solar, wind, or other clean energy projects.

- Carbon Footprint Tracking and Offsetting: Fintech companies are developing applications and platforms that allow individuals and businesses to track their carbon footprint. These tools calculate emissions based on consumption patterns and offer suggestions for reducing carbon footprints.

- Sustainable Investments and ESG Analysis: Fintech platforms are providing tools and resources for sustainable investing. These platforms offer information and analysis on environmental, social, and governance (ESG) factors of investment options, allowing investors to make more informed decisions aligned with their sustainability goals.

- Green Loans and Microfinancing: Fintech companies are leveraging technology to streamline and simplify the process of accessing green loans and microfinancing for environmentally friendly initiatives. These platforms enable individuals, small businesses, and organizations to secure funding for green projects, such as energy-efficient upgrades, sustainable agriculture, or eco-friendly infrastructure development.

- Sustainable Supply Chain Finance: Fintech companies are using blockchain technology and smart contracts to create transparent and efficient supply chain finance solutions. These platforms enable businesses to access financing based on sustainable supply chain practices, such as fair trade, organic farming, or responsible sourcing. By incentivizing sustainable practices, these solutions promote environmental and social responsibility throughout the supply chain.

- Green Payment Solutions: Fintech companies are introducing eco-friendly payment solutions that reduce reliance on paper and plastic. Digital payment platforms, mobile wallets, and contactless payment technologies minimize the need for physical cards and receipts, reducing waste and carbon emissions associated with traditional payment methods.