The Indian credit market is witnessing a remarkable surge, with both banks and non-banking financial companies (NBFCs) experiencing substantial loan growth in recent years. In 2023, the retail lending sector experienced a significant growth of 18% year-on-year, particularly driven by unsecured lending. According to the latest credit growth data by the Reserve Bank of India (RBI), personal loans saw remarkable growth at a rate of 22%.

As the Indian economy expands, the overall retail spending goes up and urban lifestyle expenses multiply, the need for loans is likely to keep rising. While the nature and amount for the loans may vary, it is important for customers to take an informed decision keeping their needs and future implications in perspective. Starting with the broad two categories – secured loans and unsecured loans, understanding the intricacies can enable customers to make the most suitable choice.

This blog post will look into the nuances of secured vs unsecured loans, shed light on their distinct characteristics, potential advantages and drawbacks.

Secured vs Unsecured Loans: A Quick Overview

Both secured and unsecured loans can be availed from banks, non-banking financial institutions and other online lenders. Depending on your situation, preference and financial objectives, you can choose a specific type of loan. The key distinction is that, in order to qualify for a secured loan, you must pledge an asset as collateral, which the lender may take control of if you are unable to repay the debt. An unsecured loan doesn’t require any collateral. Basically, collateral is an asset that you own – such as a car, house, investments or deposits in the bank – that backs up the debt. Secured loans need this collateral; unsecured ones don’t.

Recommended Read: Types of Unsecured Loans and How They are Flourishing in the Current Scenario

What’s the Difference Between Secured and Unsecured Loans?

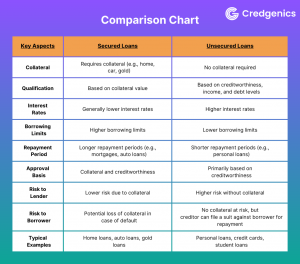

Secured loans have higher borrowing limits and lower interest rates because they are collateralized, whereas unsecured loans consider creditworthiness, income and debt levels etc. which usually translates into higher interest rates and lower borrowing limits. Here’s a tabular breakdown of the key differences between secured and unsecured loans:

Simply put, secured loans, such as home loans, auto loans, and gold loans, often come with lower interest rates, making them a more cost-effective choice over the long run. Here, collateral—such as a home or vehicle—acts as a safety net for lenders, allowing them to take possession of the asset if payments are not made. Furthermore, having collateral may help borrowers with less-than-perfect credit scores get approved for these loans.

On the other hand, unsecured loans, such as credit cards, personal loans, and education loans, do not require collateral. Instead, lenders evaluate the borrower’s creditworthiness, income, and existing debt levels to determine eligibility and interest rates. While unsecured loans pose no risk of asset loss, they often come with higher interest rates due to the increased risk for lenders. Qualifying for these loans can be more challenging, especially for those with limited credit histories or lower credit scores.

Recommended Read: Instant Loans: The Rise of Real-Time Lending Solutions

Things to Consider When Securing A Loan

Securing a secured or unsecured loan is dependent on your unique needs, circumstances and financial goals. When securing a loan, consider the following factors:

Collateral: If you don’t have a strong credit profile to qualify for an unsecured loan with a favorable interest rate, securing a loan with collateral may be a better option. In these situations, a secured loan can provide access to the necessary financing.

Loan Amount: Secured loans typically offer higher loan amounts with flexible tenures, like home loans up to 20 years. On the other hand, unsecured loans are ideal for smaller purchases such as electronics and furniture, which can be quickly repaid from your income.

Risk Tolerance: Review each loan option thoroughly for finer details, any upfront fees, penalties for late payments, or charges for early repayment.

Related Read: Understanding Retail Lending: A Beginner’s Guide

Final Thought

Ultimately, the loan that suits you best should fit well with your specific situation, financial objectives, and risk tolerance. It’s essential to carefully weigh the advantages and potential drawbacks of each loan option, ensuring that you make an informed decision that resonates with your unique needs.

FAQs:

Q1. What is a loan account number and why is it important for borrowers?

A loan account number is a unique identifier assigned to your specific loan agreement with the lender. It’s crucial for making payments, managing your account, and communicating with the lender regarding your loan. Providing your loan account number ensures accurate tracking and proper handling of your loan details.

Q2. Should I go for a secured or unsecured loan?

Choosing between a secured and unsecured loan depends on your circumstances and priorities. Secured loans offer lower interest rates but require valuable assets like your home or car as collateral. Unsecured loans don’t need collateral but often have higher interest rates due to the increased risk for lenders. The right choice depends on factors like your credit score, whether you have assets to use as collateral, and how comfortable you are with the potential consequences of defaulting on a secured loan.

Q3. Why is a good credit score important?

Having a good credit score (700 to 790) demonstrates to lenders that you are a responsible borrower and have a good track record of making payments on time. This makes you less of a risk in their eyes.

Q4. What should I consider before taking out a loan?

Have a clear repayment plan in mind. Only borrow what you truly need and can afford to pay back, considering the repayment time frame. Carefully research and compare options before committing to a loan.

Q5. Why are secured loans typically less costly than unsecured loans?

Secured loans are generally less expensive because the collateral (such as a house or car) reduces the lender’s risk. If the borrower defaults, the lender can seize the collateral to recover their losses, which allows them to offer lower interest rates on secured loans.

Q6: What are the advantages of an unsecured loan over a secured loan?

The main advantage of an unsecured loan is that you don’t have to put up any collateral, eliminating the risk of losing valuable assets if you can’t repay the loan. Unsecured loans also have a faster approval process with less documentation required.

2. https://www.investopedia.com/secured-vs-unsecured-loans-7558592#citation-1