India’s Non-Banking Financial Companies (NBFCs) have emerged as a core pillar of the rapidly expanding financial services ecosystem in India, playing a crucial role in credit inclusion and catering to diverse financial needs. As the industry expands, it needs to align with the dynamic landscape comprising evolving regulations, emerging technological advancements, and changing consumer demands. This blog explores the key trends and predictions shaping the future of NBFCs in India.

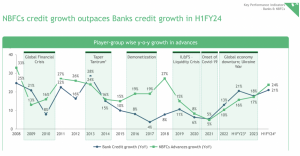

Source: Boston Consulting Group

The Rise of NBFCs (Non-banking Financial Companies)

Fueled by growing smartphone penetration and widespread internet access, NBFCs are offering faster, convenient and easily accessible financial services. These digital platforms provide seamless loan applications, faster processing, and personalized financial products, catering to the requirements and expectations of a tech-savvy population.

NBFCs are at the forefront of adopting emerging technologies like Artificial Intelligence (AI) and Machine Learning (ML) for automated credit scoring, fraud detection, and personalized recommendations. This allows for quicker loan approvals, improved risk management, and enhanced customer outreach.

What are the Driving Forces in the NBFC Industry?

1. Focus on Niche Segments and Underserved Markets

- Tailored Solutions: NBFCs are increasingly targeting underserved markets like micro, small and medium enterprises (MSMEs), rural populations, and women entrepreneurs. India boasts a robust MSME sector, with an estimated 633.9 lakh enterprises. Notably, micro-enterprises comprise the vast majority, accounting for over 99% (or 630.5 lakh) of the total number. This signifies the prevalence of small-scale businesses in the Indian economic ecosystem. This involves offering customized financial products that cater to the specific needs of these segments.

- Financial Inclusion: By reaching out to the unbanked and underbanked population, NBFCs are playing a vital role in promoting financial inclusion. This includes providing microloans, small business loans, and financial literacy initiatives.

2. Regulatory Landscape and Collaboration

- Evolving Regulations: The Reserve Bank of India (RBI) is actively shaping the NBFC sector through regulations focused on transparency, governance, and consumer protection. NBFCs will need to adapt to these evolving guidelines to ensure responsible practices and maintain regulatory compliance.

- Collaboration with Banks: Strategic partnerships with traditional banks can unlock new growth opportunities for NBFCs. This collaboration can leverage the strengths of both, with banks offering their extensive infrastructure and NBFCs specializing in niche areas.

3. Technological Advancements and Data Analytics

- Leveraging Big Data: NBFCs are increasingly using big data analytics to gain deeper insights into customer behavior, creditworthiness, and market trends. This data-driven approach allows for better product development, risk management, and customer segmentation.

- Cybersecurity and Data Privacy: As reliance on technology grows, cybersecurity and data privacy become paramount. NBFCs must invest in robust security measures and ensure compliance with data privacy regulations.

Predictions for the Future of NBFCs in India

A. Consolidation and Specialization: The NBFC space is likely to witness consolidation as smaller players merge or specialize in niche areas to compete effectively.

B. Focus on Customer Experience: Delivering a seamless and personalized customer experience will be critical for NBFCs to retain customers and attract new ones.

C. Open Banking: Open Banking initiatives fostering data sharing between financial institutions will create new opportunities for NBFCs to develop innovative financial products and services.

In Conclusion

The future of NBFCs in India is promising, with opportunities for growth driven by digitization, niche specialization, and focus on underserved markets. However, navigating the evolving regulatory landscape, embracing technology responsibly, and prioritizing customer experience will be crucial for success. By adapting to these trends and predictions, NBFCs can continue to play a significant role in the future of financial services in India.

If you are looking to transform your debt collections strategy with the power of digital and data-powered insights, reach out to us to request an exploratory session at sales@credgenics.com or visit us at www.credgenics.com.

FAQs:

1. What are the main factors driving the growth of NBFCs in India?

Several factors contribute to the projected growth of NBFCs in India. These include:

- Digitalization: Rise of Neo-banks offering convenient and accessible financial services through mobile apps.

- Focus on Underserved Markets: NBFCs cater to niche segments like MSMEs, rural populations, and women entrepreneurs.

- Technological Advancements: Adoption of AI and Machine Learning for faster loan approvals, improved risk management, and personalized offerings.

- Evolving Regulatory Landscape: RBI’s initiatives promote responsible lending practices and foster financial inclusion through NBFCs.

2. What challenges do NBFCs face in the future?

Despite the positive outlook, NBFCs face some challenges:

- Competition: increased competition from existing players and potential new entrants like fintech companies.

- Regulation: Adapting to evolving regulations and ensuring compliance with data privacy and consumer protection guidelines.

- Cybersecurity: Mitigating cybersecurity risks associated with increased reliance on technology.

- Consolidation: The NBFC space may witness consolidation, with smaller players merging or specializing to remain competitive.

3. How can NBFCs adapt and thrive in the future?

To thrive in the future, NBFCs can:

- Embrace Technology: Leveraging big data analytics for customer insights, risk assessment, and product development.

- Focus on Customer Experience: Providing a seamless and personalized customer journey to retain existing customers and attract new ones.

- Partner with Banks: Strategic collaborations with banks can unlock new growth opportunities by combining expertise and resources.

- Specialize and Innovate: Targeting niche segments effectively and developing innovative financial products to meet evolving customer needs.

4. What role will NBFCs play in India’s financial future?

NBFCs have the potential to play a significant role in India’s financial future by:

- Promoting Financial Inclusion: Reaching out to unbanked and underbanked populations to expand access to financial services.

- Supporting MSMEs: Providing tailored financial solutions to fuel the growth of small and medium enterprises.

- Driving Innovation: Encouraging innovation in the financial sector by offering new products and services.

- Enhancing Competition: Promoting healthy competition in the financial services market, leading to better rates and services for customers.