The challenge of recovering Non-Performing Assets (NPAs) has long plagued Indian banks and other non-banking financial institutions, prompting the need for more efficient recovery channels. Lok Adalats, as an out-of-court settlement mechanism, is a viable solution, offering swift and cost-effective resolution for debt disputes. In recent years, Lok Adalats have gained prominence as an essential tool in pre-litigation debt recovery, supplementing traditional recovery channels like Debt Recovery Tribunals (DRTs) and the Securitization and Reconstruction of Financial Assets and Enforcement of Securities Interest (SARFAESI) Act. This article explores the significance of Lok Adalats in the context of debt recovery and highlights their effectiveness in addressing NPAs.

Overview of Debt Recovery Channels in India:

The Indian banking sector employs various debt recovery channels, including Lok Adalats, DRTs, the SARFAESI Act, and the Insolvency and Bankruptcy Code (IBC) 2016. While each channel serves a specific purpose, Lok Adalats stand out for its ability to facilitate amicable settlements outside the courtroom. With Lok Adalats, cases pending in court or at a pre-litigation stage can be resolved swiftly, minimizing legal complexities and costs, and ensuring a smooth experience for borrowers and lenders. We will cover the debt recovery channels below:

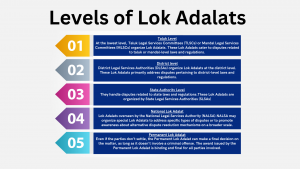

Lok Adalat: It offers an out-of-court settlement for recovery dues and serves as a dispute resolution mechanism. Cases pending in court or at a pre-litigation stage can be compromised or settled amicably through Lok Adalats. The RBI has decided that cases with a monetary value between ₹5 lakhs and ₹20 lakhs can be referred to Lok Adalat.

Fig. 1: Levels of Lok Adalat

Debt Recovery Tribunals (DRTs): DRTs facilitate the expeditious adjudication and recovery of debts owed to banks and financial institutions. Governed by the Recovery of Debts Due to Banks and Financial Institutions Act 1993, DRTs handle cases where the debt amount exceeds ₹20 lakhs.

SARFAESI Act: The Securitization and Reconstruction of Financial Assets and Enforcement of Securities Interest Act 2002 allows banks and financial institutions to auction residential or commercial properties of defaulters to recover loans without court involvement. The SARFAESI Act also empowers the RBI to license Asset Reconstruction Companies (ARCs) to take over stressed assets from banks and enforce security interests without court intervention. The act applies to cases where the security interest securing repayment of financial assets exceeds ₹1 lakh and the amount due is 20% or more of the principal amount and interest thereon, excluding agricultural land.

IBC 2016: The Insolvency and Bankruptcy Code is a bankruptcy law enacted in 2016 that provides a time-bound resolution scheme, requiring cases admitted to IBC proceedings to be resolved within 180 days.

Efficiency of Lok Adalats in Debt Recovery:

Lok Adalats have emerged as a preferred choice for debt recovery, owing to their efficiency and cost-effectiveness. In recent years, the number of cases referred to Lok Adalats has surged, indicating their growing significance in debt resolution. Despite the challenges posed by small-ticket loans, Lok Adalats have demonstrated commendable success rates, with stable recovery percentages over the years. This underscores the effectiveness of Lok Adalats as a viable alternative to traditional recovery channels.

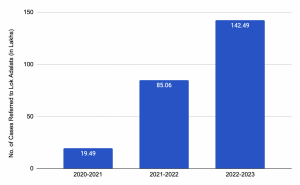

In 2021-22, the number of non-performing assets (NPAs) referred by banks to various recovery channels, including Lok Adalat and the Insolvency and Bankruptcy Code (IBC), increased fourfold over 2020-21, as per the Progress Report 2021-2022 released by RBI.

Among all channels, the number of stressed accounts reported to Lok Adalats by banks increased dramatically in 2021-22. This increase was primarily due to lakhs of small ticket loans referred for resolution to Lok Adalats.

As per the RBI Reports, in 2021-22, Lok Adalats saw a substantial 85,06,741 cases referred, involving an amount of Rs 1,19,006 crore. The recovery, however, stood at Rs 2,778 crore, constituting 2.3% of the referred amount. In 2022-23, the number of cases referred increased to 1,42,49,462, with an amount of Rs 1,88,527 crore. The amount to be recovered increased by 66.86 times from the previous year.

Fig. 2: Cases Referred to Lok Adalats – A yearly comparison

Advantages of Lok Adalats for borrowers

By opting for Lok Adalats, borrowers can efficiently settle disputes at an early stage, avoiding prolonged legal battles and the associated costs. This proactive approach not only saves time and resources but also prevents borrowers from incurring excessive interest charges over time. Additionally, the collaborative nature of Lok Adalats encourages borrowers to actively participate in negotiations, leading to mutually beneficial settlement agreements. Ultimately, leveraging Lok Adalats enables borrowers to resolve issues promptly and cost-effectively, ensuring a smoother and more favorable resolution process for all parties involved.

Advantages of Lok Adalats for Lenders

Lok Adalats offer several advantages for lenders, including expedited dispute resolution and cost savings. By opting for Lok Adalats, lenders can efficiently resolve loan disputes outside of traditional court proceedings, saving both time and resources. This proactive approach not only minimizes the burden on the judicial system but also fosters stronger relationships between lenders and borrowers. Ultimately, leveraging Lok Adalats allows lenders to efficiently manage loan disputes, minimize legal expenses, and maintain positive borrower relationships, enhancing overall operational efficiency.

Credgenics’ Innovative Approach to Pre-Litigation Debt Recovery:

Credgenics, a pioneer in debt resolution technology, has introduced a groundbreaking initiative by launching loan dispute settlement services at the pre-litigation stage through Lok Adalats for BFSI customers across various loan segments, products, and Days Past Due.

Our offering provides a seamless avenue for resolving cases outside the courts, resulting in significant time and cost optimization during the resolution process. With real-time resolution capabilities, we empower lenders and borrowers to efficiently address disputes and reach amicable agreements. Furthermore, we’ve achieved :

- Over 86% of participants expressed willingness to settle cases at the pre-litigation stage.

- An impressive settlement ratio of up to 81% for low ticket-size loans

- An average settlement ratio ranging from 18% to 20%.

The solution offers the following benefits:

- Leverage high intent to settle cases outside the courts

- Reduce the cost of debt resolutions via settlements

- Avail real-time debt resolution capability

- Realize the high potential of cost optimization in resolutions

- Experience positive results in the resolution process

- Facilitate cooperation between institutional lenders and borrowers

By delivering a higher probability of resolution and fostering improved cooperation between lenders and borrowers, Credgenics is reshaping the landscape of debt resolution and enhancing outcomes for all stakeholders involved.

Conclusion:

In conclusion, Lok Adalats have emerged as a transformative channel for debt recovery, offering swift, cost-effective, and amicable solutions to NPAs in the pre-litigation stages. As Indian banks grapple with the challenge of NPAs, leveraging Lok Adalats’ efficiency and effectiveness is paramount. With innovative solutions like Credgenics’ loan dispute settlement services, the path to debt recovery becomes more streamlined and collaborative, ultimately benefiting lenders, borrowers, and the broader economy.

If you are looking to transform your debt collections strategy with the power of digital and data-powered insights, reach out to us to request an exploratory session at sales@credgenics.com or visit us at www.credgenics.com.

FAQs

1. What if a borrower receives notice from Lok Adalat and does not have money to repay the amount?

If a borrower does not have cash in hand but wants to repay in the near future, they can attend the Lok Adalat, submit a reply, and negotiate for a repayment period. If the lender agrees to your demand, they can then obtain the decree and repay the debt as per your revised repayment period.

2. What is the process of settling a loan under Lok Adalat?

- The borrower or lender initiates the resolution process by submitting the loan case to Lok Adalat.

- Mediation Session between the borrower and lender, aiming to achieve a mutually acceptable settlement, with a panel comprising of a judge, lawyer, and social worker from Lok Adalat conducting a mediation session

- The settlement agreement draft was prepared by Lok Adalat and then signed by both parties.

- The borrower fulfills the settlement agreement terms by making the agreed-upon payment to the lender.

- Once the settlement agreement is executed, Lok Adalat officially closes the case, marking the loan as settled. The settlement agreement reached in Lok Adalat holds legal validity and can be enforced in a court of law.

What are the RBI Guidelines on Lok Adalats?

3. The Reserve Bank of India (RBI) has issued guidelines regarding Lok Adalats to facilitate their effective functioning:

The Reserve Bank of India (RBI) has issued guidelines regarding Lok Adalats to facilitate their effective functioning:

- Banks can take up matters where outstanding exceed the ceiling of Rs. 20 lac, with Lok Adalats organized by the Debt Recovery Tribunals / Debt Recovery Appellate Tribunals.

- Banks are encouraged to use the forum of Lok Adalats for the recovery of personal loans, credit card loans, or housing loans with less than Rs.10 lakh, as suggested by the Honourable Supreme Court.

- All NPA accounts, both suit-filed and non-suit filed are in the “doubtful” and “loss” categories.